Compiling data since the late 1800’s and a proprietary database from 1953, we have developed one of the most accurate market timing systems in existence.

We are a two-generation family-run company that specializes in delivering market timing indicators to assist serious investors achieve personal financial success. Leveraging over a century of experience, our subscribers enjoy the benefit of knowing when it is an appropriate time to be 100% invested, 50/50, and when to stay out!

We believe that with accurate, objective market-timing advice, you do not have to lose what you have saved for, and you can participate in the gains that the market gives.

TheDowTheory.com is the premier stock market major-trend timing Newsletter with documented and verified long term records which set the standard for market timing.

Take a look around, and please accept our invitation to join our growing list of subscribers.

We have developed a monthly newsletter for our subscribers that delivers years of objective research and results to your inbox.

Our subscribers knew when to buy-in in 2002 and when to sell out in November of 2007 and then re-buy in February and March of 2009 and stay fully invested for most of the market’s run into 2018. At that time we warned of an upcoming Bear market which did occur briefly at the end of 2018, and again in early 2020 targeted a stock market top.

After that Bear market we returned to fully invested in early April 2020 and have stayed that way into late 2021 as we looked again for the next Bear market to come along.

We invite you to look around our site and decide for yourself if your investments deserve to have the same advantage that our subscribers enjoy.

Schannep’s book is definitely a great one and makes a wonderful job in presenting an updated version of the Dow Theory while respecting its essentials. It is written from a real investor to the real investor. It is a no-nonsense book.

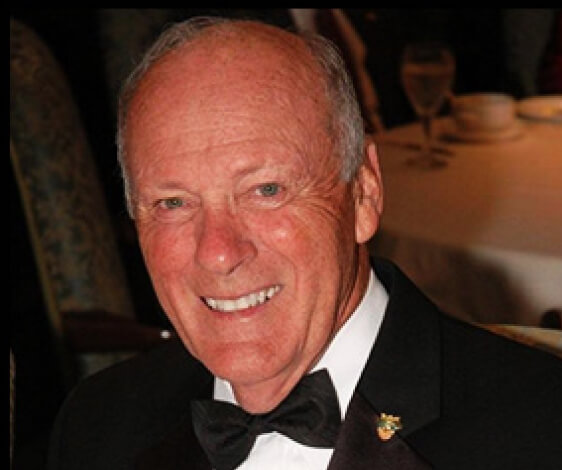

Founder & Editor Emeritus

I am a 1956 graduate of the U.S. Military Academy at West Point. For 4 years I was a jet instructor pilot and academic instructor in the Air Force. From 1961 until 1968 I was a stockbroker with Dean Witter (now Morgan Stanley) in Phoenix. I opened and managed the Dean Witter Tucson offices from 1968 until retiring as Senior Vice President in charge of southern Arizona offices in 1984. My dearest wife Helen passed away from pancreatic cancer in 2014. She and I had four children, eight grand-children, and seven great-grand-children, and I live in Tucson and Pinetop, Arizona. I was president of the Lions Club, the West Point Society, the Big Brothers, and other professional organizations. I was on the Executive Committee of the Tucson Chamber of Commerce, the Arizona state chairman of the National Association of Security Dealers (NASD – now FINRA) Fair Practices Committee, and an Allied member of the New York Stock Exchange (NYSE).

I’ve had a serious interest in market timing for many years, starting with The Dow Theory over 55 years ago. My father-in-law had known Robert Rhea, the great Dow Theorist of the 1930’s and author of the definitive work on the subject The Dow Theory. In 1962, I mimeographed (!) my first market timing letter to my clients (Subscribers can access “From The Archives” in the Subscribers area). In 1969, I initially developed a stock market major trend timing indicator which over the next several years I further developed and improved. I went from making the necessary calculations on my slide rule and adding machine to my first personal computer over thirty years ago.

Back in 1977, I began writing a personal correspondence to my fellow managers, my stockbrokers and some other colleagues about my advanced market timing indicator, and my expectations for the stock market. That became the “Schannep Timing Indicator Quarterly Letter” which I continued in my retirement. The day before the market low in 1982 I wrote a memo to the brokers in my office that “The values are here and the markets will turn”.

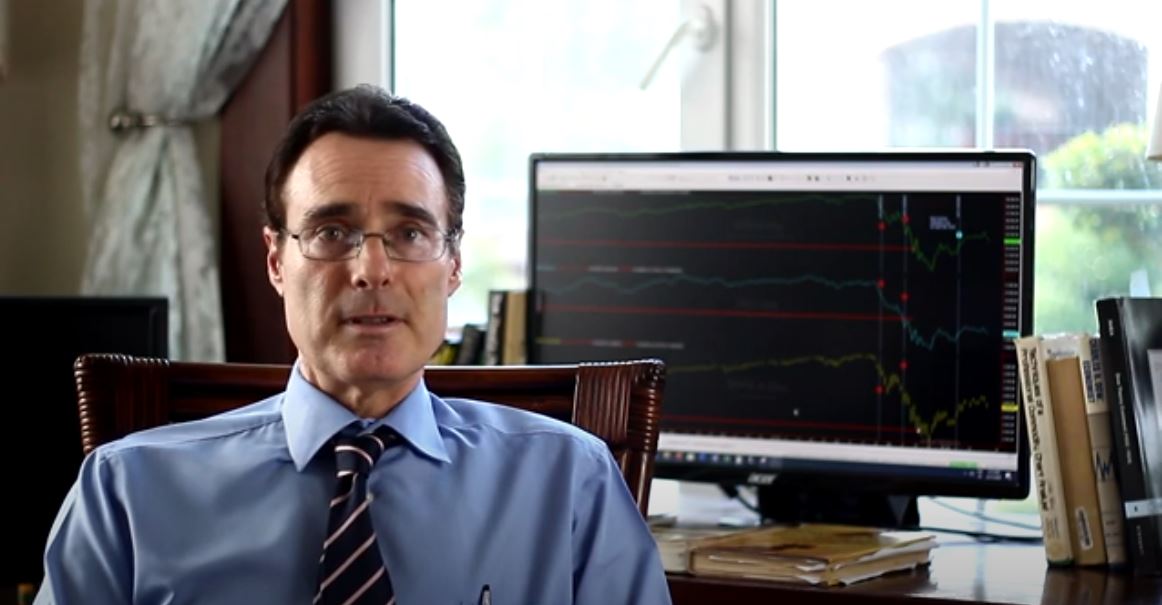

Editor-in-Chief

My background is quite uncommon.

Lawyer by trade since the early 1990s, I became an investor by necessity. I needed to invest the savings derived from my profession, and I wasn’t very excited about placing my money at the local bank. My gut feeling told me it was riskier to let my money sit in the bank than to be an intelligent investor. However, to be a smart investor, I had to educate myself. Not an easy feat.

My first contact with the investment world was in 1992. At that time, a Spanish bank was on the verge of bankruptcy. Their shares declined sharply. I thought that eventually, the Central Bank was not going to let it go down and that a larger bank would take it over. So I bought a quite sizeable amount of shares (in relation to my net worth at that time; something which I wouldn’t do nowadays). As I suspected, the failing bank was taken over, and some three years later, my investment had multiplied by five when I sold out.

Since then, I was piqued by the stock market, and I began making sporadic investments and reading more and more books about finance. By the year 2000, I bought Hamilton’s “The Stock Market Barometer” and, more importantly, Rhea’s “The Dow Theory.” While I found both books interesting, I didn’t have an epiphany, so I continued dabbling with other investment methods more geared towards becoming a trader. To this end, by the end of 2002, my family and I moved to the Dominican Republic so that I could trade in the same time zone as New York. Since then, my large family and I have happily lived there.

The 2000-2002 bear market got me mostly out of stocks, and I had the luck that my small portfolio was not hurt so badly, so I could even make on average capital gains when I sold out by the end of 2002 upon my moving to my new host country. However, it was more luck than skill, as most of my investment decisions were fundamentally based, and I was no Warren Buffet.

While not always successful, as a consequence of my investment decisions, my capital grew, and I built a nest-egg. Intellectual affinity directed me to invest a large part of my assets in an investment fund by the mid-2000s. From being a client, I ended up being a director of the managing company of the fund. It was a valuable experience, as I could see the “practical” side of the investment world and made me become friends with really talented people. The more I learned, the more interested I was in technical analysis, which prompted me to become an entirely technical trader.

Since 2006 and following the recommendation of a colleague in the investment arena, I began to re-read Charles Dow Editorials, Hamilton, Rhea, and Richard Russell. Something was intriguing in the Dow Theory. While still not proficient, the Dow Theory helped me avoid unscathed the horrible 2008-2009 bear market, which intensified my desire to master the theory.

The real turn-around for longer-term investing came in 2012 when I read Schannep’s “The Dow Theory for the 21st Century”. This was the epiphany. Suddenly all the pieces of the puzzle fell into place. Schannep had accomplished what even Rhea could not: I could see the immediate practical application of the Dow Theory. I was so inspired and convinced after having read his book at least five times that I became a Subscriber, and I started a blog in which I analyzed the stock market (and precious metals and interest rates) under the prism of what I call “Schannep’s Dow Theory.” This blog (dowtheoryinvestment.com) continues to this date and serves to cement further my knowledge and full confidence in the Dow Theory.

The culmination of my blogging and “hands-on” experience has been my joining as contributing editor at Schannep’s service “thedowtheory.com.” I do hope I can make a meaningful contribution.

Read Manuel’s August 7th, 2021 Interview with Alessio Rastani of LeadingTrader.com »