Using over 100 years of research and 60 years of practice, we have perfected the interpretation of the Traditional Dow Theory.

Timing isn’t everything (Interpretation is!), but timing is one thing that can improve your investment results. We believe that Charles Dow’s observations of the swings of the stock market are more important than ever for protecting and growing your hard-earned investments.

Using over 100 years of research and 60 years of practice, we have perfected the interpretation of the Traditional Dow Theory. We have developed and added our own indicator, The Blay Timing Indicator, to accommodate recent changes in the market, such as the introduction of the S&P 500, and to add to the body of knowledge and predictability of the fundamentals of Market Timing.

We invite you to look around our site and decide for yourself if your investments deserve to have the same advantage that our subscribers enjoy.

A Consistently Top-Ranked Investment Letter!

Some Market letters successfully time the market, most do not! Two recent studies show which market letters do best – we are one of the “Top 2” highest performing Letters from 68 studied with over a 72% accuracy rating.

View Newsletter

The Acclaimed Book: Dow Theory for the 21st Century

Jack Schannep provides readers with a better understanding of the ingredients that make up the world of finance, specifically the American stock market, in order to help them achieve investment success.

Buy the Book

Meet Our Market Timing Experts

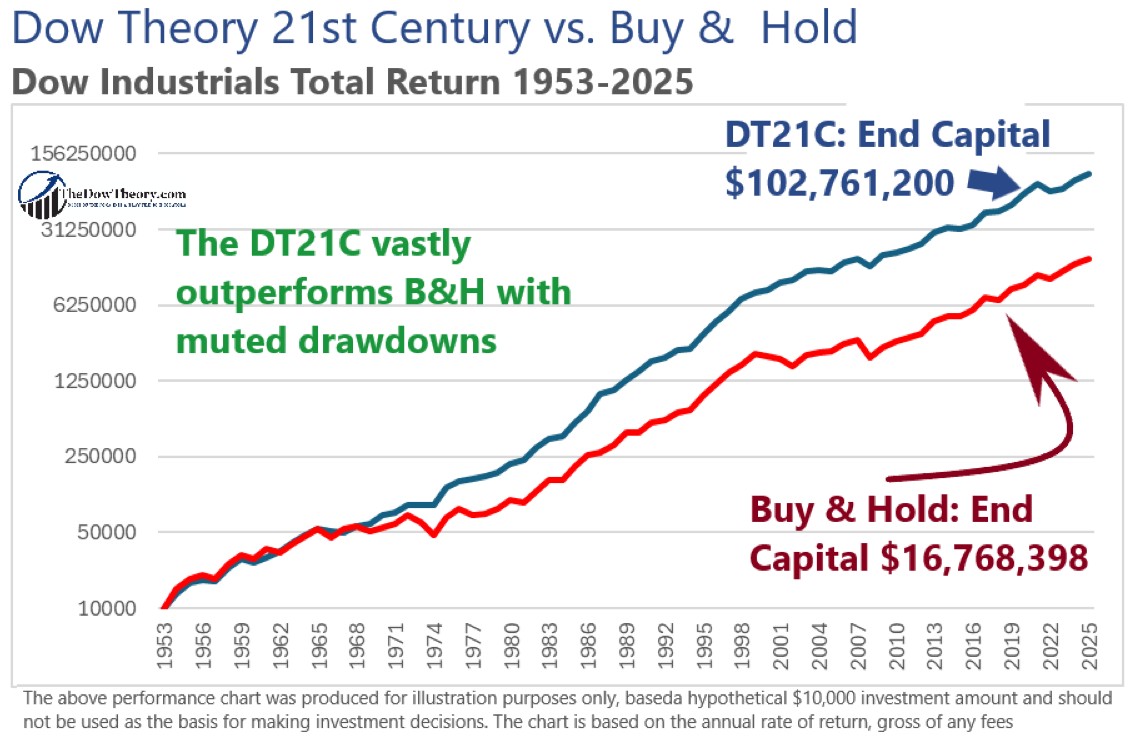

Our subscribers knew when to buy-in in 2002 and when to sell out in November of 2007 and then re-buy in February and March of 2009 and stay fully invested for most of the market’s run into 2018.

Meet the Experts

Many have tried to improve on the Dow Theory’s results and failed, however Jack Schannep made changes that do, indeed, improve those results. Robert Rhea in his The Dow Theory wrote in 1932 the “the usefulness of the Dow Theory improves with age.

Certainly a more comprehensive study of the subject is possible with a 35-year record before us than when Dow worked with the figures of only a few years, while those who use it 20 years from now will have a greater advantage than we now enjoy.” And now over 85 years later, we have an even greater advantage.

Two environments are constructive to higher stock prices and can be objectively measured, thereby lending themselves to be integrated into a timing indicator. The first one is the trend of margin debt. The second one is the relative strength of “aggressive” sectors (i.e., the S&P500) v. defensive sectors (i.e., Utilities). There is a high probability of higher prices when either is present.

I believe that the Dow Theory and my Blay Timing Indicator are the two premier stock market major trend timing indicators with documented and verified long term records which set the standard for market timing.