Trade First, Ask Later

A prudent speculator never argues with the tape. Markets are never wrong, opinions often are.

Jesse Livermore

Overview: Now, eight months later into the party and with many percentage points and profits missed, analysts are emerging, claiming that a Dow Theory BUY was triggered in July. Lo and behold! You can verify this by searching for ‘Dow Theory July Buy’ on Google. The fact of the matter is that by early November 2022, our interpretation of the Dow Theory got us on board, and I hope you heeded the signal while most experts were predicting a horrible economy and a sagging stock market. Now we know that the stock market, as a leading indicator, was signaling that the economy was not heading toward a downturn. In fact, in the second quarter of 2023, GDP rose by 2.4% annually, pushing the specter of a recession further away. However, the sudden influx of analysts jumping on the ‘buy’ bandwagon so belatedly serves as a warning that the stock market is ripe for a pullback. I don’t anticipate a bear market but rather a correction.

The Rule of 7 is a valuable tool we use to establish targets for bull markets, and it has consistently proven to be accurate (example HERE). The chart below summarizes the Rule of 7 calculations, which are based on the S&P 500’s closing lows on 10/12/22 and the first rally that concluded on 10/28/22, resulting in a total difference of 324.03 points. The two first objectives have been handsomely reached, and the S&P500 is currently halfway to reaching its third target. However, it is worth noting that reaching the third target without experiencing a pullback is not typical. The chart also contains detailed calculations for the three price targets.

According to Jurrien Timmer (Director of Global Macro at Fidelity Investments) there is still room left for stocks to advance. In the Nifty-Fifty ninety-seventies and 2000’ dot.com bubbles “the bubble didn’t end until the valuation premium between the 50 largest stocks and the rest of the S&P 500 was close to 2x. We haven’t reached that extreme so far this year: today’s premium is only at 44%. So perhaps there is more room for the big growers to keep strutting their stuff. The question is whether they will pull the rest of the market higher with them (emphasis supplied).”

I think I have the answer to Jurrien’s question. In our June 1st Letter, I wrote that “the strong breadth in positive earnings revisions will likely lift many laggards higher”. Since June 1st, breadth has shown significant improvement.

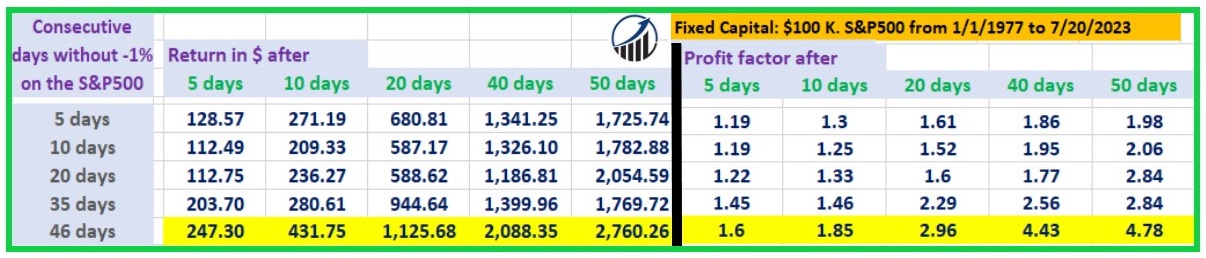

Bullish streaks: Much has been talked about the Dow Industrials’ longest winning streak since 1987. But there’s another bullish streak that’s received less attention and holds significant implications. On 7/31/23, the S&P notched up 46 consecutive days without a decline exceeding 1%, and I believed this was bullish. To test it further, I analyzed similar strings of 5, 10, 20, 35, and 46 days, measuring the average trade and profit factor at different exit points. The results are compelling – the longer 46-day streak led to higher profits and a better profit factor compared to shorter streaks. A strong streak like ours consistently delivered better profits, regardless of the exit day. Notice that the profit factor booms from exit day 20 onwards, suggesting some short-term weakness (or at the very least less strength) in the first days following the streak.

After the breather, another bullish factor is that institutions remain mostly bearish. John Auters, in his thought-provoking Bloomberg article (7/21/23), aptly titled “The Great Strategist Short Squeeze” reveals that “eighteen of the two dozen houses covered by Bloomberg’s regular survey expect the S&P to decline between now and the end of the year. If and when they capitulate, that will add to the upward pressure on the market (emphasis supplied)” He goes on to elaborate that the economic assumptions made by analysts were ultimately proven wrong, as positive economic surprises have been on the rise for several months, which leads me to say, “trade first, ask later.”

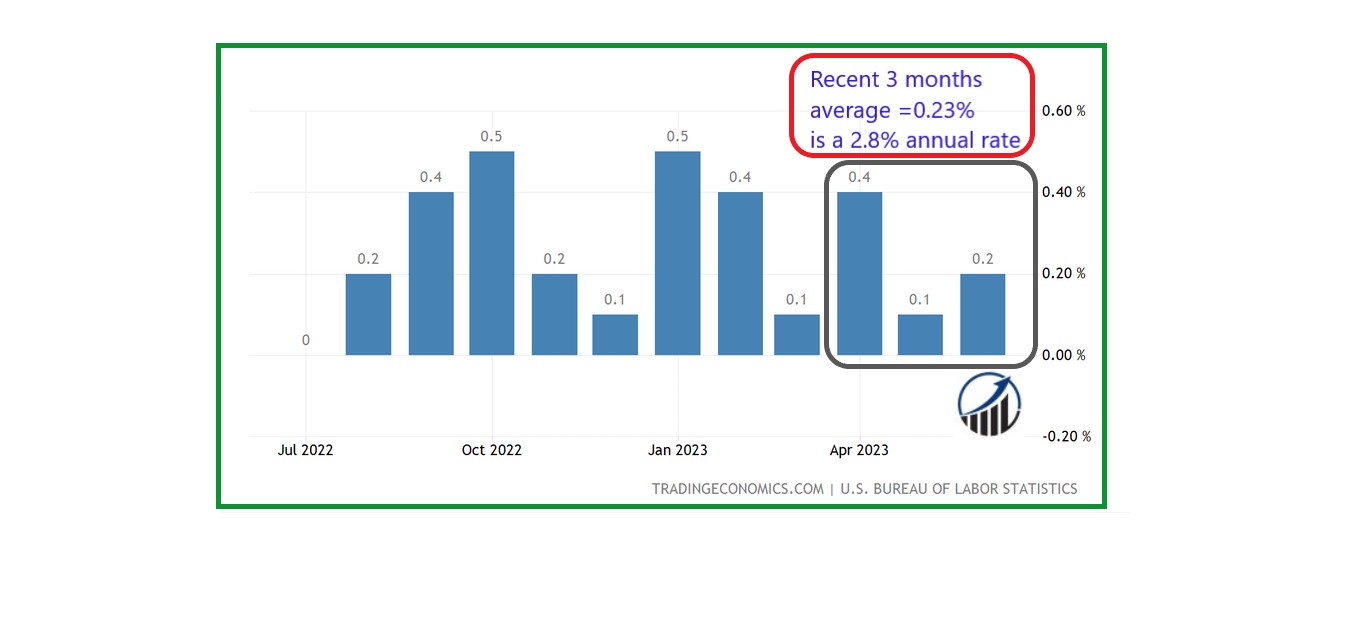

On inflation: High inflation can  negatively impact stocks. The most recent year-over-year print was lower than expected, registering at 3%. Personally, I prefer to assess inflation on a three-month basis, just as we did in our November 1st, 2022, Letter, where we stated that it had probably peaked – and it turns out we were correct. The average of the three most recent inflation readings is 0.23%, translating to an annual rate of 2.8%, as indicated in the right chart. It appears that the Federal Reserve is inching closer to reaching its 2% inflation goal. However, I remain skeptical that inflation has been completely subdued in the medium term (1-2 years). There is a possibility that inflation rear its ugly head in the coming months unless specific conditions are met, both endogenous and exogenous. The first two endogenous conditions involve the dollar halting its decline and curbing fiscal spending. The next two exogenous conditions pertain to China’s inflation and oil prices remaining low. Meeting all these conditions seems challenging.

negatively impact stocks. The most recent year-over-year print was lower than expected, registering at 3%. Personally, I prefer to assess inflation on a three-month basis, just as we did in our November 1st, 2022, Letter, where we stated that it had probably peaked – and it turns out we were correct. The average of the three most recent inflation readings is 0.23%, translating to an annual rate of 2.8%, as indicated in the right chart. It appears that the Federal Reserve is inching closer to reaching its 2% inflation goal. However, I remain skeptical that inflation has been completely subdued in the medium term (1-2 years). There is a possibility that inflation rear its ugly head in the coming months unless specific conditions are met, both endogenous and exogenous. The first two endogenous conditions involve the dollar halting its decline and curbing fiscal spending. The next two exogenous conditions pertain to China’s inflation and oil prices remaining low. Meeting all these conditions seems challenging.

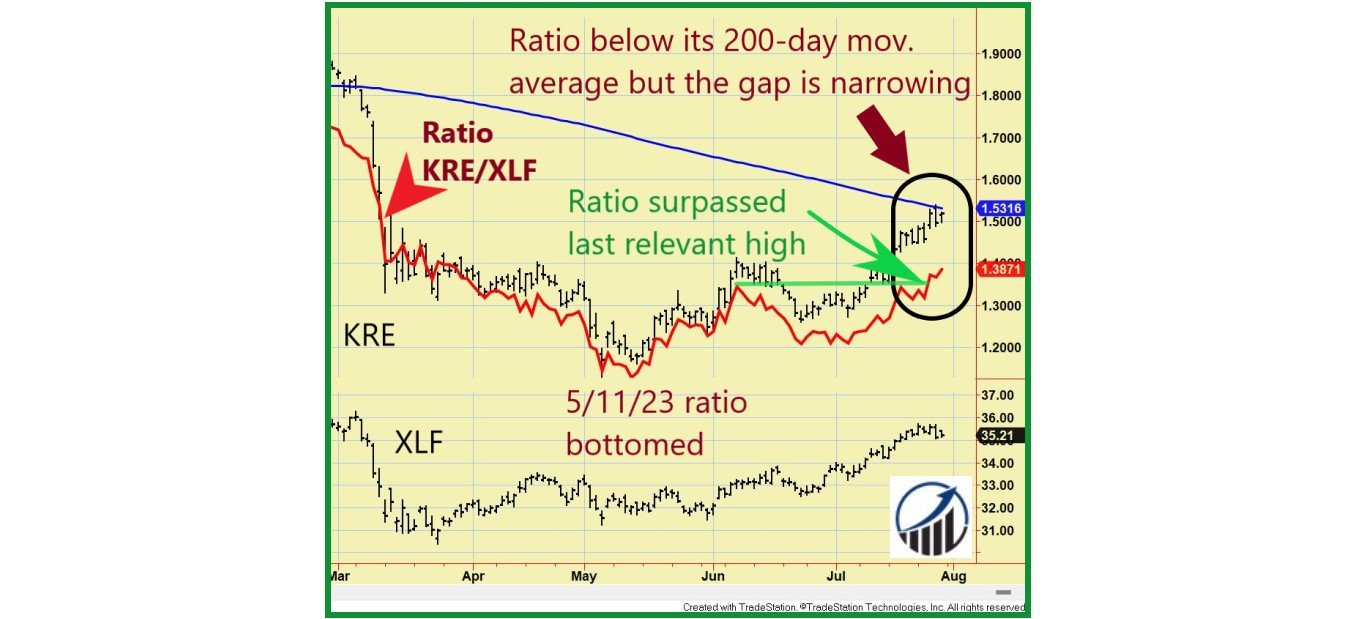

The left chart holds the key to deciphering what lies ahead. If the financial sector remains stable and the crisis has been effectively contained, credit will continue to flow, and keep the economy humming. The crisis left big banks unscathed and they are reporting good earnings and seem more immune to rising funding costs than their smaller peers. On 7/28/23, Heartland Tri-State bank went belly up and was taken over by Dream First Bank. The assets involved are minuscule: $139 million, which is close to a rounding error. Therefore, if the crisis has indeed passed, the ratio between smaller banks and larger ones should strengthen. The KRE (Regional Banks ETF)/XLF (Financial Sector ETF) ratio looks constructive. The ratio (red line) is getting closer to its 200-day moving average (blue line) and has broken topside its last relevant ratio highs (green horizontal line), suggesting a potential bottoming pattern. So, the market is sensing that the worst is over for smaller banks, especially as the Fed’s Financial Stress Index is hovering near its lows, and insider buying in this sector is strong.

The left chart holds the key to deciphering what lies ahead. If the financial sector remains stable and the crisis has been effectively contained, credit will continue to flow, and keep the economy humming. The crisis left big banks unscathed and they are reporting good earnings and seem more immune to rising funding costs than their smaller peers. On 7/28/23, Heartland Tri-State bank went belly up and was taken over by Dream First Bank. The assets involved are minuscule: $139 million, which is close to a rounding error. Therefore, if the crisis has indeed passed, the ratio between smaller banks and larger ones should strengthen. The KRE (Regional Banks ETF)/XLF (Financial Sector ETF) ratio looks constructive. The ratio (red line) is getting closer to its 200-day moving average (blue line) and has broken topside its last relevant ratio highs (green horizontal line), suggesting a potential bottoming pattern. So, the market is sensing that the worst is over for smaller banks, especially as the Fed’s Financial Stress Index is hovering near its lows, and insider buying in this sector is strong.

We are active on Linkedin. While I will never publish the “full picture” I give in these Letters, I post valuable tidbits of information, on Linkedin (i.e., discussions on the 60% stocks/40% bonds portfolio, insights into sector investing with the DT21C, etc.). You can follow me on Linkedin here: |

Clarification: All references below to days and prices refer to trading days and closing prices.

Now, let’s see what our Timing Indicators are doing:

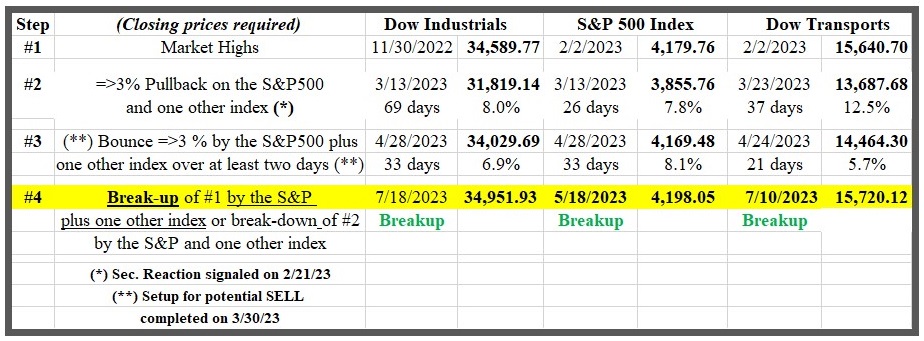

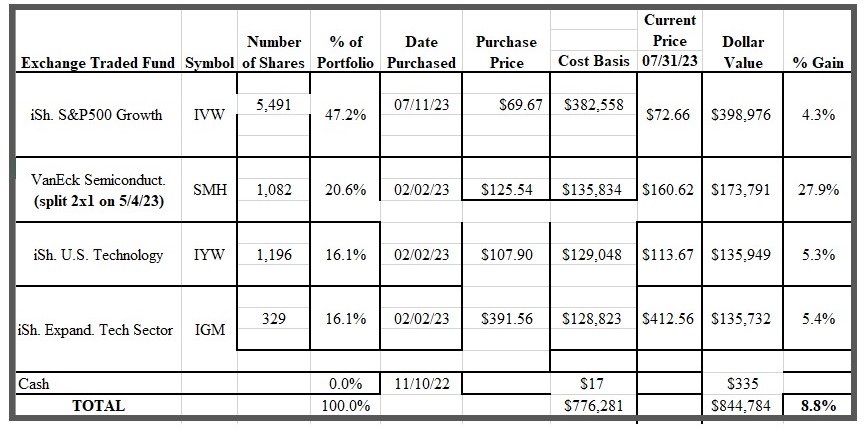

The DOW THEORY for the 21st Century (DT21C): This Indicator is GREEN (BUY) as of 11/10/22 at 33,715.37. The average annual gain for this Indicator since 1953 would have been 13.7% vs. 10.67% for Buy and Hold on 12/31/22. You can get all the explanations concerning the Buy signal with charts in our 11/10/22 email (reproduced in the Appendix to our December 1st, 2022 Letter). On 5/18/23 (Step #4), the S&P500 surpassed its 2/2/23 highs (Step #1). On 7/10/23 (Step #4), the Dow Transportation confirmed by pushing through its 2/2/23 highs (Step #1). This breakthrough reaffirmed the 11/10/22 BUY and effectively terminated the secondary reaction and eliminated the setup for a Sell signal. Adding to the positive developments, on 7/18/23, the Dow Industrials also experienced an upward breakthrough by surpassing its bull market highs from 11/30/22, which put the stock market “in the clear” after making higher highs and leaving behind the last bear market.

The Table below shows the relevant dates and price levels:

Until we get a higher one, our new stop loss becomes the lows of the last completed secondary reaction (Step #2, Rule 5, paragraph 2 of our Special Report). We now require all three Indexes to break down below the prices shown in Step #2 above to trigger a SELL. See our 7/11/23 email (reproduced in the Appendix below) for more details and an illustrative chart of the current situation.

We will check the markets and keep you appraised by email (and Discord for those who signed in) of any changes.

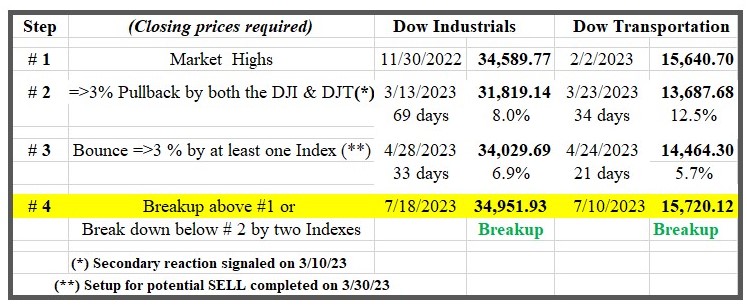

The Original Dow Theory: Charles Dow’s Theory is GREEN (“BUY”) as of 11/8/22 at 33,160.83. The average annual gain for this Indicator from 1953 through 12/31/2022 would have been 11.19% vs. 10.67% for Buy and Hold. More details about this BUY are in our December 1st 2022 Letter. The Dow Industrial made its last highs (Step #1 in the Table below) on 11/30/22 @34,589.77 and the Dow Transportation on 2/2/23 @ 15,640.70. After such highs, there was a pullback that qualifies as a secondary reaction (Step #2). Following the Step #2 lows, a bounce >=3% completed the setup for a potential SELL (Step #3). On 4/26/23, the Dow Transportation (DJT) took out (Step #4) its 3/23/23 pullback lows (Step #2), unconfirmed by the Dow Industrials. The principle of confirmation saved our skin, as the DJT’s breakdown was a fake out, and the Dow Transportation headed higher until it pushed through its 2/2/23 highs on 7/10/23. On 7/18/23, the Dow Industrials confirmed by breaking topside its 11/30/22 highs. This breakup is NOT a new Buy signal, as many have proclaimed, but simply a reaffirmation of the 11/8/22 BUY. A wrong interpretation of the original Dow Theory can lead to sub-par performance, as Jack documented some years ago HERE. In this post, I explained the right way to interpret the original Dow Theory.

The Table below contains all the price action that unfolded from 11/30/22 and 7/18/23.

The confirmed breakup above Step #1 (last recorded market highs) entails the following:

- The 11/8/22 BUY has been reaffirmed.

- The secondary reaction against the bullish trend (Step #2) has come to an end.

- As of now, the stop-loss should be maintained at the most recent pullback lows (Step #2) until we witness a new secondary reaction followed by a bounce.

We remind you that the “original” Dow Theory is not our main thrust in these Letters, as the DT21C is an even superior timing system. We just monitor the original Dow Theory.

Blay TIMING INDICATOR (BTI): This indicator is in GREEN (BUY) as of 4/20/23 at 33,786.62 (Dow Industrials). As with the DT21C, the BTI is long-term oriented. This proprietary market timing Indicator would have had an average annual increase since 12/29/1978 of 14.66% vs. 12.01% for Buy and Hold on 12/31/22. In June 2023 (released on 7/19/23), margin debt (MD) surged significantly by 5.75%, confirming its bullish trend. This rising trend of MD, combined with the excellent market health (with “aggressive” indexes like the S&P500 outperforming “defensive” indexes like utilities), keeps the BTI firmly in a BUY mode.

More about the BTI HERE. You may read the Q&A on the BTI HERE.

We will, of course, advise you by email should a change occur, as we have always done with the DT21C.

The COMPOSITE Timing Indicator: This is our primary major-trend timing Indicator which we follow in our real-money portfolio. It would have shown an average annual increase since 1953 of 13.38% vs. 10.67% for Buy and Hold on 12/31/22. It is in a GREEN mode after the 11/10/22 DT21C Buy signal at 33,715.37 and the 4/20/23 BTI BUY at 33,786.62 for an average price of 33,750.99. Our model portfolio shown below is now 100% invested.

Since November 1st, 2022, the Composite has been based on the DT21C and the BTI, which has replaced the Schannep Timing Indicator (STI). The rules of the Composite remain unchanged. Instead of deriving signals from the STI, we get them from the BTI. I uploaded the total return  record for the Composite based on the DT21C and the BTI. It scored a 14.87% compound annual increase from 12/28/78 to 12/31/22 vs. a 12.01% gain for Buy & Hold (DJIA Total return) over the same period. You may find it at the bottom of the Special Report (scroll down).

record for the Composite based on the DT21C and the BTI. It scored a 14.87% compound annual increase from 12/28/78 to 12/31/22 vs. a 12.01% gain for Buy & Hold (DJIA Total return) over the same period. You may find it at the bottom of the Special Report (scroll down).

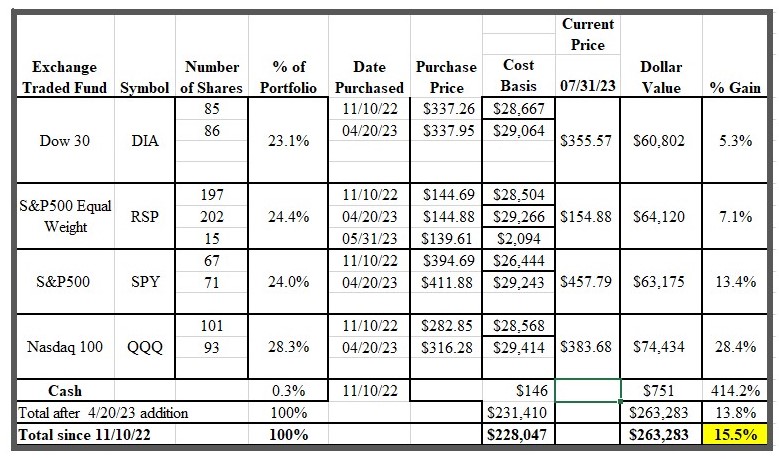

The table on the left, shows the status of my actual portfolio fully following the Composite Timing Indicator’s signals. I have added to the original mix (SPY, DIA, RSP) the QQQ (Nasdaq 100 ETF). Why did I include QQQ? For the reasons explained in our March 1st, 2022, Letter.

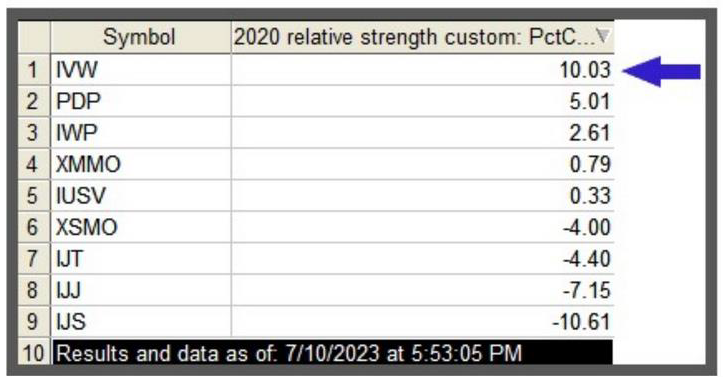

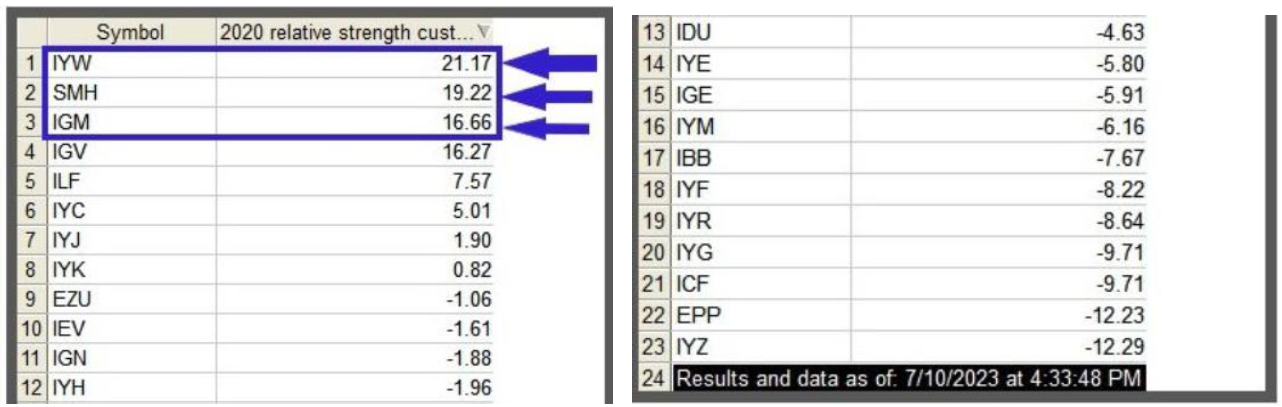

DT21C + Relative Strength Strategy. This strategy targets a significant outperformance v. Buy & Hold over the long run by having a good trend filter (the DT21C) coupled with high relative strength ETFs. Since 11/10/22 (DT21C BUY), our portfolio has been fully invested. Based on the close on 7/10/23, I re-ranked. On 7/11/23, I sold IJJ, EZU and EPP, while I kept SMH, and bought IVW, IYW and IGM. Although I executed the changes at the market open, it’s worth noting that restructuring the portfolio doesn’t require immediate action. For a more detailed explanation, you can find it in the email dated 7/11/23, reproduced in the Appendix below. The table provided below presents the status of my actual portfolio as of 7/31/23. More about the DT21C+RS HERE.

The BOTTOM LINE: July brought us an avalanche of good economic news: Consumer Confidence, consumer spending, GDP, U.S. durable goods orders all surged, while inflation dropped more than expected, and jobless claims decreased once again. It’s no surprise that the stock market had already factored in this positive news months ago and rallied. Nevertheless, the present market situation seems frothy, characterized by excessive bullishness, numerous price targets met, and an outside reversal bar on 7/27/23. These factors render the stock market susceptible to a correction once the stream of good news subsides.

And I feel the momentum of positive earnings surprises may slow down any moment now. The chart below depicts the Citigroup Economic Surprise Index for the both the USA and the world representing the sum of the difference between official economic results and forecasts. Presently, the U.S. index is above its recent and historical highs (not shown in the chart below), leaving it vulnerable to a reversion. Furthermore, the world index is declining, and the strong correlation between the two suggests an impending drop in the U.S. index, indicating fewer positive economic surprises. This, in turn, could trigger a correction in the stock market. Please note that I use the word “correction”, not “Bear market”. Presently, I do not anticipate a new Bear market for two reasons: Firstly, this Bull market is young, as it met the criteria for a Bull market on 6/13/23 (since 1949, all Bull markets reached at least 9 months of age after being signaled, except for the one in February 2009). Secondly, the technical landscape for the next few months remains constructive. Therefore, based on these factors, I do not anticipate a Bear market. As a result, we will continue riding the trend with our Composite at 100% long.

| The high number of positive economic surprises which were anticipated by the stock market serves as a reminder that we must exercise caution when making forecasts. Or, as this joke that I came across on Linkedin (7/24/23) goes:

Nurse: Sir, you have been in comma since Feb-22…Fed hiked the rates to 5.25% and there’s war in Europe. Patient: Oh, boy, I can’t wait to see how my puts are doing. In times of uncertainty, let’s prioritize price action and grant it the benefit of the doubt. As the saying goes, ‘shoot first, ask later.’ The market may be sensing something that eludes us, and the explanation might only become apparent when it’s too late to capitalize on it. As investors, it’s often the unknown unknowns that prove fatal. We should also always keep an eye on our time-tested Special Reports (Capitulation, Consumer Confidence, Unemployment, Rule of 7, etc.), as they help us discern the most likely course for the stock market. Our Composite Trend Indicator serves as the compass, while the Special Reports act as the barometer. ……………………………………………………………………………………………………… For longer-term results, see The Composite Timing Indicator, which we use for timing in our Portfolio versus Buy and Hold. FYI, over the last 69 years, Buy & Hold has grown at a 10.67% annual rate, whereas The Composite has grown at a 13.38% rate. The problem with showing this real-money Portfolio is that it represents only what Manuel is doing, which could be very different from others. Subscribers use this letter for Market Timing, which could include shorting, going long, and even utilizing leveraged investments that could double or triple – in either direction. These results have been monitored by several independent sources that track our performance, such as Hulbert Financial Digest, DowTheoryInvestments.com, CXO Advisory Group and TimerTrac.com.This Letter concentrates on the big picture, the trend of the major stock market indexes, which usually influences the price direction of most individual stocks. ……………………………………………………………………………………………………… Update for U.S. bonds, precious metals, and their ETF minersU.S. BONDS (TLT & IEF): The primary was signaled as bearish on 9/20/22, as was explained HERE. Following their respective 10/20/22 (@ 92.93 IEF) and 10/24/22 (@92.40 TLT) closing lows, a solid rally followed that qualifies as a secondary reaction against the still-existing primary bear market. On 12/9/22, the setup for a potential bull market signal was completed, as I explained HERE. On 1/12/23, IEF broke topside its 12/7/22 secondary reaction high @ 99.14, unconfirmed by TLT. Absent confirmation, no primary bull market has been signaled. Following the non-confirmation, bonds started to head south again (more HERE). Accordingly, the primary trend is bearish, and the secondary one (secondary reaction) is bullish. Gold (GLD) and Silver (SLV): The primary trend was signaled bearish on 6/21/23, as explained HERE. Then, on 7/18/23, after a rally, a secondary reaction was indicated (more details Then, on 7/18/23, after a rally, a secondary reaction was indicated (more details HERE). Consequently, the primary trend remains bearish, while the secondary trend is bullish. Gold and Silver miners’ ETFs (GDX & SIL): The primary trend for GDX and SIL turned bearish on 6/20/23. You may find an in-depth explanation HERE. Thus, the primary and secondary trend are bearish. These monthly updates on US Bonds, Gold, Silver, and their mining ETFs are meant to be a helpful overview of their status from a Dow Theory point of view. When events unfold after the monthly Letter is published it is incumbent on the reader to follow his/her own positions. In the future, we plan to follow these markets on a timelier basis, just as we currently do with the American stock market.

Manuel Blay for TheDowTheory.com Team

Please help keep an edge and reward our efforts by not forwarding or otherwise distributing this Letter. Its contents are for the exclusive use of each Subscriber. If you are reading this Letter without being a Subscriber, please sign up HERE. If you are an institution and want to make our Letter available to your clients, students, or personnel, you may contact us (subscribers@thedowtheory.com) for a special plan. If you find it useful, please give a referral. Thank you!

The Dow Theory is a form of technical analysis that relies on detecting trends in the stock market to determine an investment strategy. The same applies to the other Indicators. The detection of these trends may be interpreted differently by different analysts, and the opinions expressed on this website may not be shared by other individuals who apply the same principles of The Dow Theory. This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors and will be profitable or without the risk of loss or will equal the performance of the benchmark portfolio. Please consult your financial professional before investing to determine which investment(s) may be appropriate for you. All investments involve the risk of potential investment losses as well as the potential for investment gains. The performance of any portfolio or investment strategy should be viewed in the context of the broad market and prevailing economic conditions. References to markets, asset classes, and sectors generally reflect the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of any investment’s performance and does not reflect fees, expenses, or sales charges. All performance shown is historical, and there is no guarantee of future results. Past performance is not an indication of future returns. We are unaware of any readers’ personal circumstances, financial condition, risk tolerance, or goals and objectives, so nothing read here should be considered advice suitable for them. We assume no liability for any trade taken in pursuance of our email (Discord) notifications or this monthly Letter, even in the event of a typo or wrong interpretation of the market.

APPENDIX: Emails sent to Subscribers in July 2023Email sent on 7/11/2023: Email Title: Secondary reaction canceled on 7/10/23 & rotation in the DT21C+RS system Note: All references to days and prices refer to trading days and closing prices. Executive Summary:

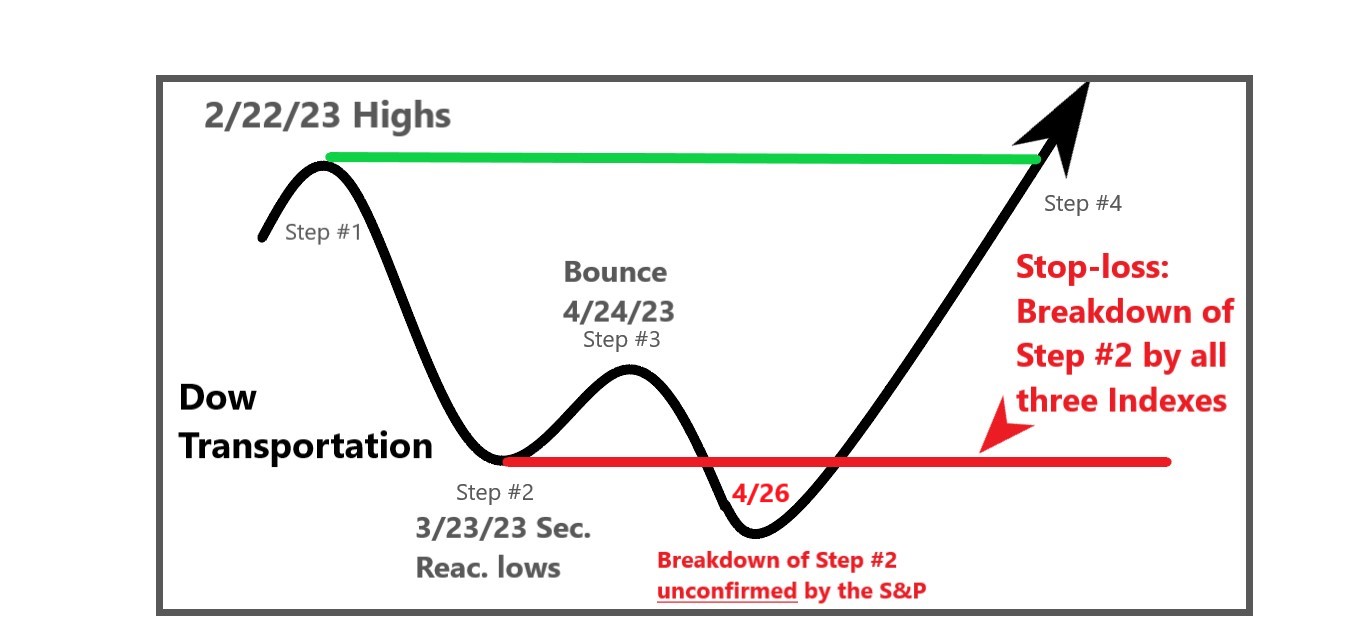

Dow Theory for the 21st Century (DT21C): In our July 1st Letter, we wrote: “A breakup by the Dow Industrials or Transportation of their market highs (Step #1) would confirm the S&P500’s breakup (Step #4, green, and green arrow in the chart below), cancel the setup for a potential SELL (step #3) and terminate the secondary reaction (Step #2).” Well, on 7/10/23, we got such a breakup (Step #4 in the Table below marked in yellow). The Dow Transportation closed above its 2/2/23 highs (Step #1 in the Table below) and confirmed the S&P500 breakup on 5/18/23. The Dow Industrials did not confirm, but we only need the S&P500 and one other Index to cancel the secondary reaction. |

Until we get a higher one, our new stop loss becomes the lows of the last completed secondary reaction (Step #2, Rule 5, paragraph 2 of our Special Report). We now require all three Indexes to break down below the prices shown in Step #2 above) to trigger a SELL. Having made a higher high, the Dow Transportation needs to pierce its secondary reaction lows (step #2) again.

The chart below highlights the most relevant price action of the Dow Transportation, which has been the critical Index this time:

Three brief remarks concerning the current technical situation when viewed through Dow Theory glasses:

- It took a good deal of time to confirm the 5/18/23 S&P500 breakup. According to Robert Rhea, the longer it takes for confirmation to occur, the less likely the probability is for higher prices. So, I would not be surprised to see some short-term weakness.

- The chart above shows the importance of the principle of confirmation. On 4/26/23, the Dow Transportation violated its 3/23/23 secondary reaction lows (Step #2) unconfirmed by the S&P500. So, according to the Dow Theory, the breakdown was suspect and did not result in a Sell signal.

- Contrary to common wisdom, the Dow Transportation does not lead the market (see the study in our October 1st, 2021 Letter), particularly when it pushes above recent highs, as we have seen this time when the first Index to break up was the S&P500.

More about the DT21C HERE.

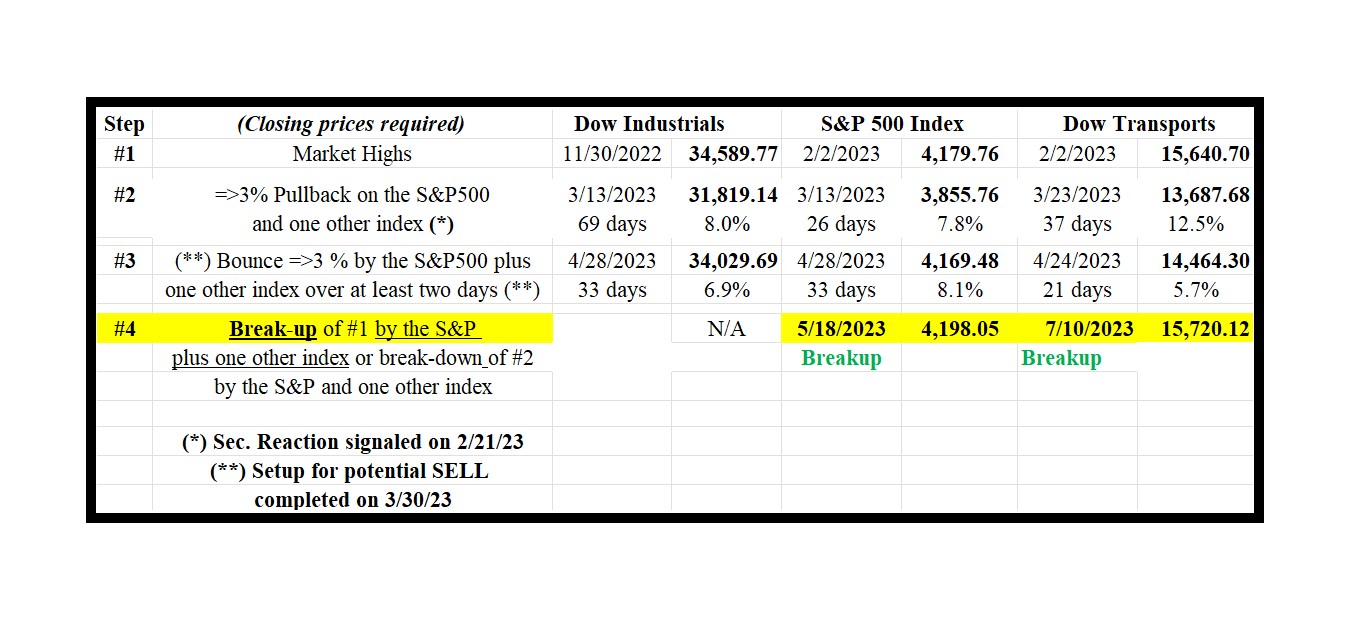

DT21C+Relative Strength Strategy:

Since 11/10/22 (DT21C BUY), our portfolio has been fully invested. We re-ranked and changed our holdings on 2/2/23 (see Appendix to our March 1st Letter). According to the rules spelled out in our Special Report (notably, points 1. b) and 5), upon the successful termination of a secondary reaction (higher highs), I re-rank at the close of the day of the breakup (7/10/23). The next day (7/11/23), I sell the ETFs that are no longer top-ranked and buy the strongest ones (preferably at the open).

As per such rules, our lookback period goes from 7/10/23 (day of the breakup) to 2/2/23 (the last highs before the onset of a secondary reaction).

As a reminder, when I start a new position, I invest 50% in the Style and 50% in the Sector portfolios. I, personally, don’t rebalance between the two portfolios until we get a SELL (last paragraph page 8 and first paragraph page 9 of the Special Report). However, those wanting to rebalance between the two portfolios may do so.

Below are the results of the new ranking:

Style:

The Style portfolio selects the top-ranked ETF (#1).

So, I will sell the current holding, IJJ, and Buy IVW.

Sectors:

The Sectors portfolio selects the top three ETFs.

So, I will sell the current holdings, EZU, and EPP, and I will buy IYW and IGM. I keep SMH, as it remains top-ranked (number #2). Accordingly, I will redistribute the proceeds obtained by selling EZU and EPP to buy equal dollar amounts of IYW and IGM.

So, I will reinvest the money in the “Style” portfolio in IVW. The money of the “Sector” portfolio will be divided into two equal amounts and equally invested in IYW and IGM.

In the August1st Letter, I will show the updated figures for the “style” and “sector” portfolios.

Blay Timing Indicator (BTI):

No changes. The BTI remains in a BUY mode. Market health (that is, “aggressive” Indexes like the S&P500 outperforming “defensive” Indexes like the utilities) remains good, and current prices are well above our current stop-loss, so a SELL is not on the horizon. More about the BTI HERE.

Composite Indicator:

The Composite is now 100% invested from the 11/10/22 DT21C BUY and the 4/20/23 BTI BUY. The Composite is far from a SELL from either the DT21C or the BTI, which would drop it to 50% invested. Of course, we will advise by email should any change occur. More about the Composite HERE.