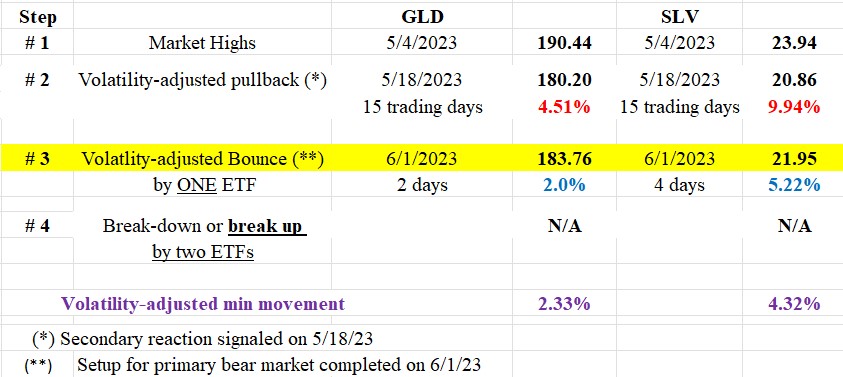

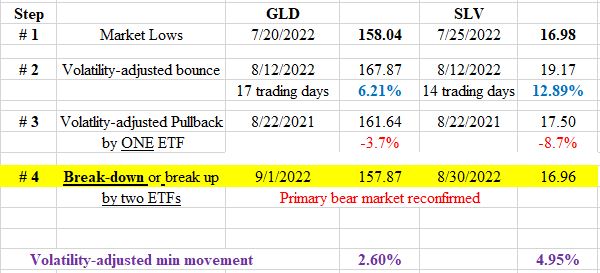

Dow Theory Update for June 3: Setup for a primary bear market signal for GLD and SLV completed on 6/1/23

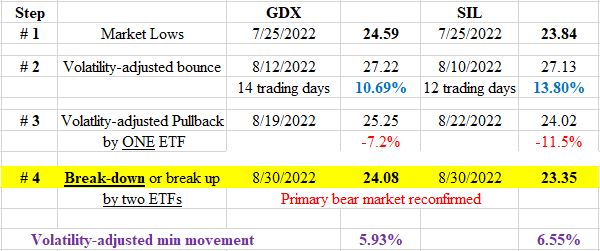

I am writing before the close of 6/3/23. So readers, beware, things may change. Executive Summary: 1. The primary trend for gold and silver is bullish, the secondary one is bearish, and the setup for a potential primary bear market signal was completed on 6/1/23. The primary trend for gold and silver ETF miners (GDX […]