The Epitome of Synergy

I believe that the Dow Theory and my Blay Timing Indicator are the two premier stock market major trend timing indicators with documented and verified long term records which set the standard for market timing. At the same time I have been concerned that both are sometimes slow in determining a change in the market’s trend. Obviously, no indicator can pick market tops and bottoms precisely, and none have come closer on a consistent basis than these two, yet, there is always room for improvement. By combining the two plus adding some other tried and true indicators, I believe that real synergism has been attained. Synergy: “The interaction of two or more agents or forces so that their combined effect is greater than the sum of their individual effects“.

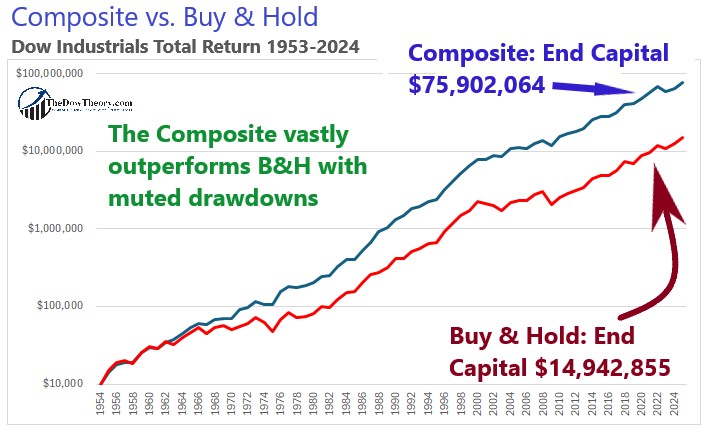

The chart below helps you visualize the strong outperformance of the Composite v. Buy and Hold while experiencing significantly smaller drawdowns from the end of 1953 to 2024:

While many trades were taken in real life, the results are hypothetical and are NOT an indicator of future results and do NOT represent returns that any investor attained

Long time readers know that I have referred to certain “pre-Buy conditions” since 1976, and have informally incorporated them with my Indicator in a successful effort to improve upon its results. The most continuously successful such Indicator has been Capitulation. When bear markets end in an identifiable capitulation that is clearly the time to start buying. It is usually the first indication of a turn in the tide, followed later by the Dow Theory and/or the Schannep Timing Indicator, and finally the definition of a Bull market is met. As you will see, I buy 50% into the market when capitulation occurs and wait for confirmation from one of the other indicators to complete to 100% invested. The definition is typically the last Indicator to come into play and one is usually fully invested by that time, but if not then that is the time to get fully invested. ‘Spiders’ (SPY-Standard & Poor’s Depositary Receipts), ‘Diamonds’ (DIA-Dow Jones Index Shares), and the i-Shares for the S&P equal-weighted Index (RSP) are the investment vehicles we use in our real-money Model Portfolio. Since, September 2022 we included QQQ (Nasdaq 100). Finally, the definition of Bull and Bear markets even has a place. After all, if the odds of markets going significantly farther after meeting the definition are as good as we have determined, they should figure into the Buy or Sell decision. Putting it all together in a Combined Indicator has resulted in the best if all worlds, a COMPOSITE Timing Indicator that performs in total better than an average of the individual parts. The 71 year record shows a total annual average increase of 13.41%, considerably better than the results of buying and holding which were 11.08%. FYI, 13.41% means a doubling of one’s investment in 5.5 years, quadrupling in just 11 years, and on and on.

This is probably an appropriate time to point out that the historical record which follows is not a completely ‘live’ record for the following reasons: The statistics I use in the Schannep Timing Indicator were not available until 1968. Money market funds which are used whenever a Sell signal is in effect were not invented until 1972. The first index fund was not introduced until 1976, and I was not able to produce daily calculations used in the ‘capitulation’ and the Schannep Timing Indicators until 1984. Finally, the vehicles that I suggest you use, the Exchange Traded Funds (ETFs) ‘Spiders’(SPY), ‘Diamonds’(DIA), and the (RSP) were not available until 1993, 1998 and 2004 respectively. While I believe the calculations are correct, it is probably prudent to disclaim perfection, the overall result is impressive in any event. This COMPOSITE Timing Indicator has not existed in its current form throughout the full timeframe, however its components have. The underlying Dow Theory was first postulated over 100 years ago and my own Schannep Timing Indicator first formulated over 40 years ago. The COMPOSITE Timing Indicator is formally incorporated from the various components that were uncovered over the previous many years. I use the ETFs but you may choose other Index funds or mutual funds with similar results, and if individual stocks or funds will magnify the positive results, please feel free to go with them. As you know, beating the stock market is an ongoing Battle for Investment Survival, to use the name of an excellent book on the subject with that title. While this COMPOSITE Timing Indicator is the end result of the culmination of a lifetime of work with the stock market, there may yet be room for improvement. After all, anything having to do with timing the stock market has to be considered a ‘work in progress’. As a subscriber to this Letter and website, you are entitled to the best I can offer, and I feel that the COMPOSITE Timing Indicator is just that.

Specific Details of the Composite Timing Indicator

When any one of the four possible Buy, or one of the three possible Sell, indicators occur, they should be followed to the extent of committing one-half of the intended commitment, either to investing or selling, as the case may be.

The first of the Buy signals is the ‘Capitulation’ Indicator. Different technicians use various indicators from Puts and Calls to New Lows as a Percentage of Issues Traded to determine capitulation. I use short-term oscillators on the three major market indices which when they reach specific levels are an indication of capitulation. Such levels have only been attained on fourteen occasions during the last 50 years. This indicator has appeared on average within 5.2% of the market lows in the Bear market years of 1962, 1970, 1974, 1987, 1990, 1998, 2001, 2002, 2008, 2009, 2011, 2018 and 2020. On four occasions there was a double capitulation during the same bear market bottoming process, and when that happens you can count that as a second Buy signal and increase your commitment to the market (see below). As you know from the discussion of Capitulation, it can only occur at or near Bear market lows and does not occur at or near Bull market highs, so is not also a Sell Indicator.

The second and third such signals can also be Sell indicators, they are the Dow Theory and the Schannep Timing Indicator (until 2022, thereafter the Blay Timing Indicator). In the Complete Record that follows I have used the original Dow Theory during the 20th Century part of the record but the “Dow Theory for the 21st Century” since then.

The fourth signal is when the markets reach the ‘Definition’ of a Bull or Bear markets, therefore it too can be a Sell indicator as well. When a +19% move up from the lows as measured by the Dow Jones AND the S&P 500 Index has occurred it has been followed 95% of the time by a further upmove to +29%, and 50% of the time by a move to +80%. When the market has dropped -16%, the ‘definition’ of a Bear market, it has then gone on 82% of the time to drop to -21%, and nearly 50% of the time (10 of 22 times) has gone to at least -35%. Since all Bull and Bear markets meeting the ‘definition’ have progressed further and been joined belatedly by the Dow Theory or the Schannep Timing Indicator, if not already ‘on board’, this Indicator should be used to complete to 100% IN or OUT of the market.

ON THE 1ST BUY OR SELL Signal go to 50% invested. When any of the above follow you should increase your commitment from 50% to 100% ‘in’ or ‘out’ of the market. The one exception would be a second Capitulation, at which time only an additional 25% is added. Whenever the allocation changes, the position should be rebalanced to fit the percentage indicated. As exceptional as this Indicator has been, we do not want to base this Composite Indicator’s signals on just one underlying type of signal. Therefore, it would take one of the second, third, or fourth type signals shown above to complete the position to 100%.

I hope the above is clear, but if not I suggest you look through the complete record which follows with an eye to following specific actions taken during any of the various signals. Dividends received and interest earned on 3 month Treasuries are added in as received quarterly. My thanks to Tom Halgren, a subscriber with a sharp eye for detail, for finding numerous typos/errors/mistakes in the previously shown results. He and I believe this/his recalculation is as true and correct as is possible to construct.

Do you want to continue reading?

Do you want to see all trades taken, all rules spelled out, more valuable statistics and be informed when the Composite triggers the next Buy/Sell signal?

Do you want to be alerted when a new signal has been triggered?

Become a Subscriber, and you’ll have access to the full Special Report, and access to our Letter and email alerts.

Additionally, your subscription will give you a wealth of information (i.e., access to our Letters since 1962 and their accompanying trade recommendations, the power of the consumer confidence report as a timing device, the special report about the yield curve, how to calculate profit objectives that work, trend assessment for gold, silver and their ETF miners -GDX & SIL- and much more). More importantly, you’ll be punctually updated through our email service of any change in the trends for US stock indexes. Not accidentally, our Newsletter has consistently been ranked among the top investments Letters.