Many have tried to improve on the Dow Theory’s results and failed, however I have made changes that do, indeed, improve those results. Robert Rhea in his The Dow Theory wrote in 1932 the “the usefulness of the Dow Theory improves with age. Certainly a more comprehensive study of the subject is possible with a 35-year record before us than when Dow worked with the figures of only a few years, while those who use it 20 years from now will have a greater advantage than we now enjoy.” And now over 85 years later, we have an even greater advantage.

In my book Dow Theory for the 21st Century, Technical Indicators for Improving Your Investment Results, I illustrate several improvements within the framework of Charles Dow’s original thoughts and premises that would have increased the performance of the traditional “Dow’s Theory” over the last 60+ years. The first improvement I added was to begin buying during “capitulation”, a word Charles Dow never uttered but he clearly alluded to with his discussion of the final phase of bear markets when he described “distress selling of sound securities, regardless of their value…..” Robert Rhea described it as “a semi-panic collapse (and) it is wise to cover short position and even perhaps make commitments for long account”. There have only been 15 occasions over the past 60+ years when Capitulation, as we measure and identify it, has occurred and each time a Dow Theory Buy signal has followed, about 4 months later, on average. I say “we” here because one of my sons, Bart, has assisted me in the past on this Market Letter. One half of those 15 times occurred within a day or two of the Bear market lows – four were on THE day of the lows. The average was 14 days and 4.6% above the lows; the median was within 3 days and 2% of the lows.

The second enhancement was also an original Charles Dow idea: that a secondary reaction lasts “from ten days to sixty days” (Wall Street Journal, January 4th, 1902) rather than the widely accepted “from three weeks to as many months”. Things DO happen faster in the 21st century. This was the thesis of Alvin Toffler’s Future Shock, as well as a premise in my more recent book. By using Capitulation as the time to start buying and shortening the timeframe for the steps of the Dow Theory to occur, the result is a signal within a month and a half average of Capitulation, and at a 5% better/lower average entry level than the traditional Dow Theory.

Another advancement was not available in Charles Dow’s day; that is adding the broader Standard & Poors 500 Index, in addition to Dow’s own Industrial Average and the Railroad/ Transportation Average. The definition of bull and bear markets is also involved: Charles Dow only had 5 years to work with his 2 indices and concluded that a bull market, or bear market was “the great move covered from four to six years”. He actually thought that a complete market cycle would last 10 years, with 5 years in a bull market and 5 years in a bear market. We’ve had 115 more years of historic data than Dow had and now know that Bull markets have averaged less than three years, and Bear markets less than a year and a half. Dow’s expectation was fulfilled, however, 100 years after his death when the 2002-07 bull market lasted exactly 5 years to the day. My own definition is, indeed, specific: A minimum +19% advance, or a minimum 16% decline, on both the Dow Jones Industrials and the S&P500. These percentages are reciprocal numbers of each other, unlike the often used plus or minus 20%. When Bull markets meet the +19% threshold they then go on some 93% of the time to at least a +29% gain. When Bear markets drop 16% they then go on some 69% of the time to at least a -24% decline. It should be remembered that Dow’s Theory was a barometer to predict the future course of business activity. A recession follows my definition of a -16% decline some 67% of the time. Using the standard -20% figure missed three recessions that the -16% definition captured. I use the attainment of my definition of bear market as a “stop-loss” point for completing a Sell signal, or the definition of bull market as a “stop-buy” in the case of a Buy signal, when such signals had not already been completed by our interpretation of the Dow Theory for the 21st Century.

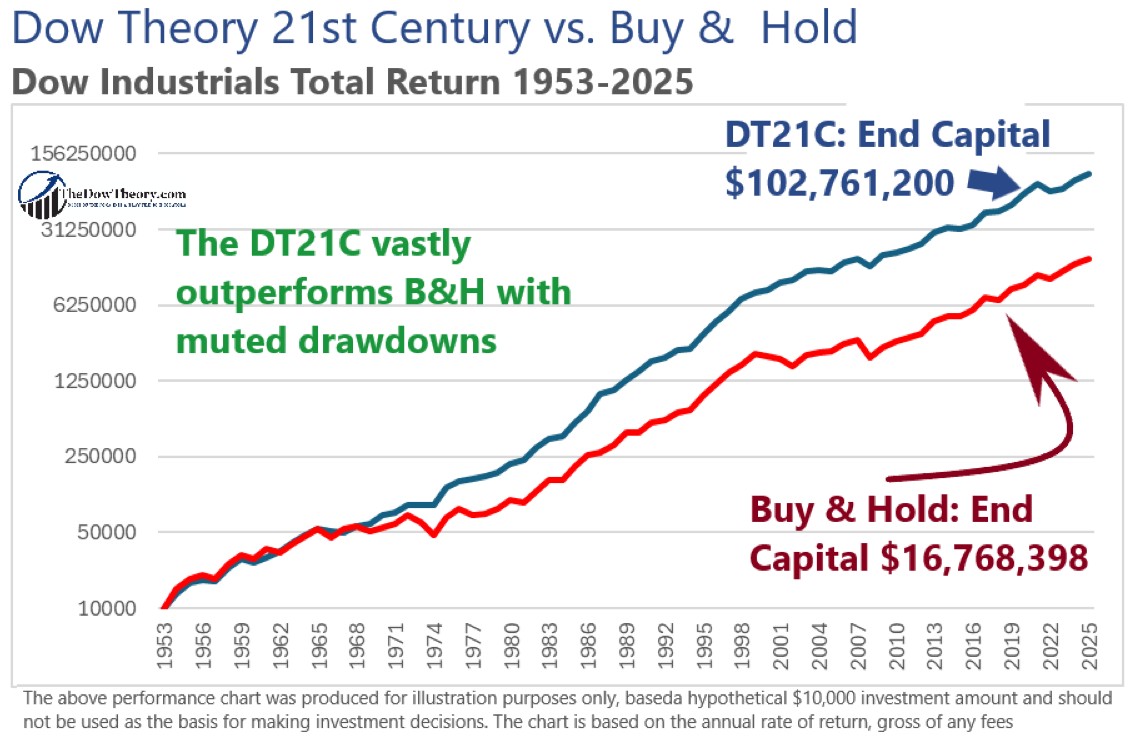

You can view the Record of the Dow Theory For The 21st Century below, however the current and Complete table is available for Subscribers only. Results shown include dividends received and interest earned on 3 month Treasuries as received quarterly. Market levels are for the Dow Jones Industrial Average. When Bull/Bear markets become “official” both the DJIA and the S&P500 levels are shown. FYI, the results over the last 72 years have shown a 13.69% annual gain for this Indicator vrs. a 10.86% annual gain for Buy & Hold. The chart below helps you visualize the outperformance and drawdown reduction from the end of 1953 to 12/31/2025:

While most trades were taken in real life, the results are hypothetical and are NOT an indicator of future results and do NOT represent returns that any investor attained

The “traditional” Dow Theory is “better” than most trend following systems, but the Dow Theory for the 21st Century (DT21C) is “best” and even “better” than the Traditional Dow Theory. Learn why with hard data in this article “Face Off: Schannep vs Classical Dow Theory – A Data-Driven Comparison“

Do you want to continue reading?

Do you want to see all trades taken, all rules spelled out, more valuable statistics and be informed when the DT21C signals a new trend?

Become a Subscriber, and you’ll have access to the full Special Report.

Additionally, your subscription will give you a wealth of information (i.e., access to our Letters since 1962 and their accompanying trade recommendations, the power of the consumer confidence report as a timing device, the special report about the yield curve, how to calculate profit objectives that work, trend assessment for gold, silver and their ETF miners -GDX & SIL- and much more). More importantly, you’ll be punctually updated through our email service of any change in the trends for US stock indexes. Not accidentally, our Newsletter has consistently been ranked among the top investments Letters.

| Signal | Results $10,000 becomes | Date | Dow Jones Industrials | %Change | Status | Date | Dow Jones Transports | %Change | Date | S&P500 | %Change |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 9/14/1953 | 255.49 | Mkt lows | 9/14/1953 | 90.56 | 9/14/1953 | 22.71 | |||||

| $10,000 | 12/31/1953 | 280.9 | Year-end level | ||||||||

| BUY 100% | $10,026 | 4/1/1954 | 306.27 | 19.90% | Definition of Bull mkt met | 4/1/1954 | 102.07 | 9.20% | 4/1/1954 | 27.17 | 19.60% |

| $13,682 | 12/31/1954 | 404.31 | Year-end level | ||||||||

| $17,196 | 12/30/1955 | 488.4 | Year-end level | ||||||||

| 4/6/1956 | 521.05 | Bull Market Highs/Not | 5/9/1956 | 181.23 | 3/20/1956 | 48.87 | |||||

| 28-May | 468.81 | 10.00% | Pullback | 28-May | 161.6 | 10.80% | 28-May | 44.1 | 9.80% | ||

| 2-Aug | 520.95 | 11.10% | Bounce/Bull Mkt High | 25-Jul | 171.37 | 6.00% | 2-Aug | 49.74 | 12.80% | ||

| $18,364 | 12/31/1956 | 499.47 | Year-end level | ||||||||

| SELL 100% | $17,358 | 2/5/1957 | 469.96 | Breakdown | 22-Aug | 161.28 | 2/5/1957 | 43.89 | |||

| 10/22/1957 | 419.79 | Bear Market Lows | 12/24/1957 | 95.67 | 17-Dec | 39.42 | |||||

| $17,852 | 12/31/1957 | 435.69 | Year-end level | ||||||||

| 2/4/1958 | 458.65 | 9.30% | Bounce | 2/4/1958 | 111.16 | 16.20% | 2/4/1958 | 42.46 | 7.70% | ||

| 25-Feb | 436.89 | 4.70% | Pullback | 7-Apr | 100.67 | 9.40% | 25-Feb | 40.61 | 4.40% | ||

| BUY 100% | $17,934 | 4/21/1958 | 450.72 | Breakup | 21-Apr | 111.6 | 11-Mar | 42.51 | |||

| $23,849 | 12/31/1958 | 583.65 | Year-end level | ||||||||

| 8/3/1959 | 678.1 | Mkt highs | 7/8/1959 | 173.56 | 8/3/1959 | 60.71 | |||||

| 22-Sep | 616.45 | 9.10% | Pullback | 17-Nov | 146.63 | 15.50% | 22-Sep | 55.14 | 9.20% | ||

| $28,592 | 12/31/1959 | 679.36 | Year-end level | ||||||||

| 1/5/1960 | 685.47 | 11.20% | New high/Bounce | 1/5/1960 | 160.43 | 9.40% | 1/5/1960 | 60.39 | 9.50% | ||

| SELL 100% | $25,838 | 2/16/1960 | 611.33 | Breakdown | 3-Mar | 142.98 | 16-Feb | 54.73 | |||

| 25-Oct | 566.05 | Mkt lows | 29-Sep | 123.37 | 25-Oct | 52.3 | |||||

| $26,436 | 12/30/1960 | 615.89 | Year-end level | ||||||||

| BUY 100% | $26,544 | 3/6/1961 | 674.46 | 19.1.% | Definition of Bull market met | 3/6/1961 | 144.71 | 17.30% | 2/2/1961 | 62.3 | 19.10% |

| 13-Feb | 637.14 | 2.50% | Pullback | 13-Feb | 139.69 | 3.60% | 24-Apr | 64.4 | 3.40% | ||

| 2/20/1961 | 653.65 | Breakup | 23-Feb | 144.91 | 20-Feb | 62.36 | |||||

| 12/13/1961 | 734.91 | Bull Market Highs | 11-Oct | 152.92 | 12-Dec | 72.64 | |||||

| $29,468 | 12/29/1961 | 731.14 | Year-end level | ||||||||

| 1/29/1962 | 689.92 | 6.10% | Pullback | 20-Dec | 140.66 | 8.00% | 1/29/1962 | 67.9 | 6.50% | ||

| 15-Mar | 723.54 | 4.90% | Bounce | 2/2/1962 | 149.83 | 6.50% | 15-Mar | 71.06 | 4.70% | ||

| SELL 100% | $27,888 | 4/12/1962 | 685.67 | Breakdown | 26-Apr | 140.28 | 12-Apr | 67.71 | |||

| Capitulation BUY 50% | $28,032 | 22-Jun | 539.19 | 22-Jun | 116.05 | 22-Jun | 52.68 | ||||

| 6/26/1962 | 535.76 | Bear Market Lows | 25-Jun | 115.89 | 26-Jun | 52.32 | |||||

| 12-Jul | 590.27 | 10.20% | Bounce | 16-Jul | 125.49 | 8.30% | 12-Jul | 58.03 | 10.90% | ||

| BUY to 75% | $28,929 | 7/18/1962 | 571.24 | 3.20% | 3% Pullback* was low for DJIA and S&P and newer low for DJT | 18-Jul 8-Aug | 122.58 119.28 | 2.3% 4.9% | 18-Jul | 56.2 | 3.20% |

| 7/30/1962 | 591.44 | Breakup | 27-Aug | 125.16 | 31-Jul | 58.23 | |||||

| BUY to 100% | $29,980 | 7/31/1962 | 597.93 | ||||||||

| $33,195 | 12/31/1962 | 652.1 | Year-end level | ||||||||

| $40,074 | 12/31/1963 | 762.95 | Year-end level | ||||||||

| $47,380 | 12/31/1964 | 874.13 | Year-end level | ||||||||

| $54,233 | 12/31/1965 | 969.26 | Year-end level | ||||||||

| 2/9/1966 | 995.15 | Bull Market Highs | 2/15/1966 | 271.72 | 2/9/1966 | 94.06 | |||||

| 15-Mar | 911.08 | 8.40% | Pullback | 15-Mar | 243.6 | 10.30% | 15-Mar | 87.35 | 7.10% | ||

| 21-Apr | 954.73 | 4.80% | Bounce | 20-Apr | 265.97 | 9.20% | 21-Apr | 92.42 | 5.20% | ||

| SELL 100% | $50,172 | 5/9/1966 | 886.8 | Breakdown | 5-May | 240.96 | 9-May | 86.32 | |||

| 10/7/1966 | 744.32 | Bear Market Lows | 7-Oct | 184.34 | 7-Oct | 73.2 | |||||

| 16-Nov | 820.87 | 10.30% | Bounce | 16-Nov | 208.79 | 13.30% | 16-Nov | 82.37 | 12.50% | ||

| 2-Dec | 789.47 | 3.80% | Pullback | 22-Nov | 199.54 | 4.40% | 22-Nov | 79.67 | 3.30% | ||

| BUY 100% | $51,611 | 12/13/1966 | 816.7 | Breakup | 13-Dec | 208.82 | 12-Dec | 83 | |||

| $49,738 | 12/30/1966 | 785.69 | Year-end level | ||||||||

| 8/9/1967 | 926.72 | Mkt highs | 8/4/1967 | 274.49 | 8/4/1967 | 95.83 | |||||

| 30-Aug | 893.72 | 3.60% | Pullback | 22-Aug | 256.06 | 6.70% | 27-Aug | 92.64 | 3.30% | ||

| 25-Sep | 943.08 | 5.50% | New high/Bounce | 18-Sep | 265.11 | 3.50% | 25-Sep | 97.59 | 5.30% | ||

| SELL 100% | $56,325 | 11/2/1967 | 864.85 | Breakdown | 10-Oct | 254.59 | 2-Nov | 92.34 | |||

| $56,728 | 12/29/1967 | 905.11 | Year-end level | ||||||||

| 3/21/1968 | 825.13 | Mkt lows | 3/5/1968 | 214.58 | 3/3/1968 | 87.72 | |||||

| 15-Jul | 923.72 | 11.90% | Bounce | 8-Jul | 269.61 | 25.60% | 11-Jul | 102.39 | 16.70% | ||

| 9-Aug | 869.65 | 5.90% | Pullback | 9-Aug | 245.76 | 8.80% | 2-Aug | 96.63 | 5.60% | ||

| 9-Sep | 924.98 | Breakup | 1-Oct | 270.24 | 24-Sep | 102.59 | |||||

| BUY 100% | $58,843 | 9/24/1968 | 938.28 | ||||||||

| 12/3/1968 | 985.21 | Bull Market Highs | 1-Dec | 279.48 | 29-Nov | 108.37 | |||||

| $59,692 | 12/31/1968 | 943.75 | Year-end level | ||||||||

| 1/8/1969 | 921.25 | 6.50% | Pullback | 1/13/1969 | 260.04 | 7.00% | 1/13/1969 | 100.4 | 7.40% | ||

| 13-Feb | 952.7 | 3.40% | Bounce/new high | 7-Feb | 279.88 | 7.60% | 13-Feb | 103.71 | 3.30% | ||

| SELL 100% | $58,245 | 2/20/1969 | 916.65 | Breakdown | 25-Feb | 257.07 | 20-Feb | 99.79 | |||

| 29-Jul | 801.96 | Mkt lows | 30-Jul | 193.19 | 29-Jul | 89.48 | |||||

| 2-Sep | 837.78 | 4.50% | Bounce | 22-Aug | 202.02 | 4.60% | 22-Aug | 95.92 | 7.20% | ||

| 8-Sep | 811.84 | 3.10% | Pullback | 9-Oct | 194.72 | 3.60% | 8-Oct | 92.67 | 3.40% | ||

| BUY 100% | $60,624 | 10/16/1969 | 838.77 | Breakup | 27-Oct | 202.37 | 16-Oct | 96.37 | |||

| 10-Nov | 863.05 | Mkt highs | 28-Oct | 202.45 | 10-Nov | 98.33 | |||||

| 17-Dec | 769.93 | 10.80% | Pullback | 16-Dec | 169.43 | 16.30% | 17-Dec | 89.2 | 9.30% | ||

| $58.35 | 12/31/1969 | 800.36 | Year-end level | ||||||||

| 1/5/1970 | 811.31 | 5.40% | Bounce | 1/5/1970 | 183.31 | 8.20% | 1/5/1970 | 93.46 | 4.80% | ||

| SELL 100% | $56,217 | 1/26/1970 | 768.88 | Breakdown | 26-Jan | 168.98 | 23-Jan | 89.07 | |||

| Capitulation BUY 50% | $57,422 | 25-May | 641.36 | 25-May | 133.87 | 25-May | 70.25 | ||||

| 5/26/1970 | 631.16 | Bear Market Lows | 26-May | 131.53 | 26-May | 69.23 | |||||

| 3-Jun | 713.86 | 13.10% | Bounce | 3-Jun | 146.98 | 11.70% | 3-Jun | 78.52 | 13.40% | ||

| BUY to 75% | $59,933 | 6/10/70 << 7-Jul | 694.35 669.36 | 2.7% 6.2% | 3% Pullback* and Full Pullback/new low | 10-Jun 7-Jul | 141.44 116.69 | 3.8% 20.6% | 10-Jun 7-Jul | 75.48 71.23 | 3.9% 9.3% |

| 16-Jul | 723.44 | Breakup | 28-Sep | 148.21 | 21-Aug | 79.24 | |||||

| BUY to 100% | $63,815 | 8/21/1970 | 745.41 | ||||||||

| $72,820 | 12/31/1970 | 838.92 | Year-end level | ||||||||

| 4/28/1971 | 950.82 | Mkt highs | 4/28/1971 | 232.79 | 4/28/1971 | 104.77 | |||||

| 28-Jun | 873.1 | 8.20% | Pullback | 28-Jun | 208.89 | 10.30% | 22-Jun | 97.59 | 6.90% | ||

| 12-Jul | 903.4 | 3.50% | Bounce | 12-Jul | 220.21 | 5.40% | 12-Jul | 100.82 | 3.30% | ||

| SELL 100% | $77,169 | 7/28/1971 | 872.01 | Breakdown | 28-Jul | 208.06 | 28-Jul | 97.07 | |||

| 10-Aug | 839.59 | Mkt lows | 4-Aug | 203.61 | 9-Aug | 93.53 | |||||

| BUY 100% | $77,586 | 9/7/1971 | 916.47 | Break above previous Secondary Bounce High on all three | 16-Aug | 225.22 | 7-Sep | 101.15 | |||

| $76,215 | 12/31/1971 | 890.2 | Year-end level | ||||||||

| $90,082 | 12/29/1972 | 1020.02 | Year-end level | ||||||||

| 1/11/1973 | 1051.7 | Bull Market Highs | 12/11/1972 | 240.41 | 1/11/1973 | 120.24 | |||||

| 8-Feb | 967.19 | 8.00% | Pullback | 8-Feb | 202.1 | 15.90% | 8-Feb | 113.16 | 5.90% | ||

| 13-Feb | 996.79 | 3.10% | Bounce | 12-Feb | 207.13 | 2.50% | 13-Feb | 116.78 | 3.20% | ||

| SELL 100% | $84,689 | 2/26/1973 | 953.79 | Breakdown | 21-Feb | 201.21 | 26-Feb | 112.19 | |||

| $89,673 | 12/31/1973 | 850.86 | Year-end level | ||||||||

| Capitulation BUY 50% | $94,014 | 8/23/1974 | 686.8 | 8/23/1974 | 143.07 | 8/23/1974 | 71.55 | ||||

| Capitulation BUY to 75% | $89,221 | 30-Sep | 607.87 | 30-Sep | 128.48 | 30-Sep | 63.54 | ||||

| 4-Oct | 584.56 | Bear Mkt Lows/Not | 3-Oct | 125.93 | 3-Oct | 62.28 | |||||

| 14-Oct | 673.5 | 15.20% | Bounce | 14-Oct | 150.65 | 19.60% | 14-Oct | 72.74 | 16.80% | ||

| 16-Oct | 642.29 | 4.60% | 3% Pullback* was full Pullback low on all | 16-Oct | 145 | 3.70% | 16-Oct | 70.33 | 3.30% | ||

| BUY to 100% | $96,345 | 10/21/1974 | 669.82 | Breakup | 21-Oct | 152.43 | 21-Oct | 73.5 | |||

| 12/6/1974 | 577.6 | Bear Mkt Low/Not | 16-Dec | 138.31 | 6-Dec | 65.01 | |||||

| $89,670 | 12/31/1974 | 616.24 | Year-end level | ||||||||

| $129,669 | 12/31/1975 | 852.41 | Year-end level | ||||||||

| 9/21/1976 | 1014.79 | Bull Market Highs | 7/14/1976 | 231.27 | 9/21/1976 | 107.83 | |||||

| 12-Oct | 932.35 | 8.10% | Pullback | 12-Oct | 203.85 | 11.90% | 22-Oct | 99.96 | 7.30% | ||

| 1-Nov | 966.09 | 3.60% | Bounce/high | 5/18/1977 | 246.64 | 21.00% | 1-Nov | 103.1 | 3.10% | ||

| SELL 100% | $146,158 | 11/9/1976 | 930.77 | Breakdown | 10/24/1977 | 201.74 | 8-Nov | 99.6 | |||

| $147,095 | 12/29/1976 | 1004.65 | Year-end level | ||||||||

| $154,586 | 12/30/1977 | 831.17 | Year-end level | ||||||||

| 2/28/1978 | 742.12 | Bear Market Lows | 3/9/1978 | 199.31 | 3/6/1978 | 86.9 | |||||

| 17-May | 858.37 | 15.60% | Bounce | 22-May | 231.3 | 16.10% | 17-May | 99.6 | 14.60% | ||

| 26-May | 831.69 | 3.10% | Pullback | 26-May | 223.7 | 3.30% | 26-May | 96.58 | 3.00% | ||

| BUY 100% | $158,634 | 6/5/1978 | 863.83 | Breakup | 6-Jun | 231.35 | 5-Jun | 99.95 | |||

| 9/11/1978 | 907.74 | Bull Market Highs | 8-Sep | 261.49 | 12-Sep | 106.99 | |||||

| 20-Sep | 857.16 | 5.60% | Pullback | 22-Sep | 241.58 | 7.60% | 27-Sep | 101.66 | 5.00% | ||

| 11-Oct | 901.42 | 5.20% | Bounce | 12-Oct | 250.15 | 3.50% | 11-Oct | 105.39 | 3.70% | ||

| SELL 100% | $162,098 | 10/17/1978 | 866.34 | Breakdown | 17-Oct | 237.44 | 17-Oct | 101.26 | |||

| 14-Nov | 785.26 | Bear Mkt lows/Not | 14-Nov | 205.49 | 14-Nov | 92.49 | |||||

| 6-Dec | 821.9 | 4.70% | Bounce | 6-Dec | 218.2 | 6.20% | 6-Dec | 97.49 | 5.40% | ||

| 18-Dec | 787.51 | 4.20% | Pullback/Bear Low | 20-Dec | 203.45 | 6.80% | 18-Dec | 93.44 | 4.20% | ||

| $164,702 | 12/29/1978 | 805.01 | Year-end level | ||||||||

| BUY 100% | $164,892 | 1/4/1979 | 826.14 | Breakup | 1/15/1979 | 218.79 | 26-Dec | 97.52 | |||

| $176,746 | 12/31/1979 | 838.74 | Year-end level | ||||||||

| 4/21/1980 | 759.13 | Bear Market Lows/Not | 3/27/1980 | 98.22 | |||||||

| $214,718 | 12/31/1980 | 963.99 | Year-end level | ||||||||

| 4/27/1981 | 1024.05 | Bull Market Highs | 4/16/1981 | 447.38 | 3/25/1981 | 137.11 | |||||

| 11-May | 963.44 | 5.90% | Pullback | 11-May | 410.28 | 8.30% | 11-May | 129.71 | 5.40% | ||

| 15-Jun | 1011.99 | 5.00% | Bounce | 1-Jun | 430.92 | 5.00% | 27-May | 133.77 | 3.10% | ||

| SELL 100% | $219,409 | 7/2/1981 | 959.19 | Breakdown | 2-Jul | 409.6 | 2-Jul | 128.64 | |||

| $232,828 | 12/31/1981 | 874.99 | Year-end level | ||||||||

| 6/18/1982 | 788.62 | Mkt Low | 6/21/1982 | 303.73 | 21-Jun | 107.2 | |||||

| 7/20/1982 | 833.42 | 5.70% | Bounce | 12-Jul | 323.43 | 6.50% | 7/20/1982 | 111.54 | 4.00% | ||

| Failed Secondary Reaction | 8/6/1982 | 784.33 | Breakdown | 8/5/1982 | 301.33 | ` | 8/4/1982 | 106.14 | |||

| 8/12/1982 | 776.92 | Bear Market Lows | 8/12/1982 | 292.12 | 8/12/1982 | 102.42 | |||||

| BUY 100% | $249,086 | 8/20/1982 | 869.28 | Break above previous Secondary Bounce High on all three | 8/20/1982 | 324.03 | 8/20/1982 | 113.02 | |||

| $306,381 | 12/31/1982 | 1046.54 | Year-end level | ||||||||

| 6/22/1983 | 1245.69 | Mkt High | 6/27/1983 | 590.63 | 6/22/1983 | 170.99 | |||||

| 18-Jul | 1189.91 | 4.50% | Pullback | 18-Jul | 556.48 | 5.80% | 18-Jul | 163.95 | 4.10% | ||

| 26-Jul | 1243.68 | 4.50% | Bounce | 26-Jul | 586.69 | 2.30% | 26-Jul | 170.35 | 3.90% | ||

| SELL 100% | $360,467 | 7/29/1983 | 1199.21 | Breakdown | 29-Jul | 550.76 | 29-Jul | 162.58 | |||

| 9-Aug | 1168.26 | Mkt Lows | 25-Aug | 524.41 | 8-Aug | 159.18 | |||||

| BUY 100% | $366,268 | 10/7/1983 | 1272.15 | Break above previous Secondary Bounce | 20-Sep | 590.03 | 7-Oct | 170.8 | |||

| 10-Oct | 1284.65 | Mkt High | 24-Oct | 593.29 | 10-Oct | 172.65 | |||||

| 7-Nov | 1214.84 | 5.40% | Pullback | 28-Oct | 576.61 | 2.80% | 8-Nov | 161.76 | 6.30% | ||

| 29-Nov | 1287.19 | 5.90% | Bounce/Newer Highs | 22-Nov | 612.57 | 6.20% | 29-Nov | 167.91 | 3.80% | ||

| $365,949 | 12/30/1983 | 1258.64 | Year-end level | ||||||||

| SELL 100% | $359,265 | 1/25/1984 | 1231.88 | Breakdown | 25-Jan | 573 | 25-Jan | 161.67 | |||

| 5-Apr | 1130.55 | Mkt lows | 6-Apr | 484.16 | 23-Feb | 154.29 | |||||

| 2-May | 1186.56 | 4.90% | Bounce | 2-May | 517.08 | 6.80% | 2-May | 161.9 | 4.90% | ||

| 24-Jul | 1086.57 | 9.10% | Pullback/Newer Lows | 25-Jul | 444.03 | 14.10% | 24-Jul | 147.82 | 9.10% | ||

| BUY 100% | $376,168 | 8/3/1984 | 1202.96 | Breakup | 3-Aug | 525.66 | 3-Aug | 162.35 | |||

| $386,042 | 12/31/1984 | 1211.57 | Year-end level | ||||||||

| 7/19/1985 | 1359.54 | Mkt Highs | 7/17/1985 | 702.6 | 7/17/1985 | 195.64 | |||||

| 20-Sep | 1297.93 | 4.50% | Pullback | 9/30 | 640.56 | 8.80% | 25-Sep | 180.66 | 7.60% | ||

| Newer High No SELL | 11-Nov | 1431.88 | 10.30% | Newer Highs | 4-Dec | 702.62 | 9.70% | 11-Nov | 197.28 | 9.20% | |

| $514,181 | 12/31/1985 | 1546.67 | Year-end level | ||||||||

| $652,471 | 12/31/1986 | 1895.95 | Year-end level | ||||||||

| 8/25/1987 | 2722.42 | Bull Market Highs | 8/14/1987 | 1101.16 | 8/25/1987 | 336.77 | |||||

| 21-Sep | 2492.82 | 8.40% | Pullback | 21-Sep | 1005.8 | 8.70% | 21-Sep | 310.54 | 7.80% | ||

| 2-Oct | 2640.99 | 5.90% | Bounce | 2-Oct | 1064.41 | 5.80% | 5-Oct | 328.08 | 5.60% | ||

| 9-Oct | 2482.21 | Breakdown | 15-Oct | 980.24 | 12-Oct | 309.39 | |||||

| SELL 100% | $868,879 | 10/12/1987 | 2471.44 | ||||||||

| Capitulation BUY 50% | $869,808 | 10/19/1987 | 1738.74 | Bear Markt Lows/Not | 26-Oct | 674.01 | 19-Oct | 224.84 | |||

| Capitulation BUY to 75% | $884,209 | 3-Dec | 1776.53 | Bear Market Low/Not | 3-Dec | 673.57 | 3-Dec | 225.21 | |||

| $947,651 | 12/31/1987 | 1938.83 | Year-end level | ||||||||

| 1/7/1988 | 2051.89 | 15.30% | Bounce | 1/7/1988 | 789.43 | 17.10% | 1/7/1988 | 261.07 | 16.10% | ||

| 1/20 | 1879.14 | 8.40% | 3% Pullback* and full pullbacks shown | 1/11 1/20 | 741.57 | 6.10% | 20-Jan | 242.63 | 7.10% | ||

| BUY to 100% | $980,660 | 2/19/1988 | 2014.59 | Breakup | 2/16/1988 | 791.14 | 2/19/1988 | 261.61 | |||

| 7/5/1988 | 2158.61 | Mkt High | 7/5/1988 | 908.45 | 7/5/1988 | 275.81 | |||||

| 7/27/1988 | 2053.7 | 4.90% | Pullback | 7/27/1988 | 855.73 | 5.80% | 7/27/1988 | 262.5 | 4.80% | ||

| 8/3/1988 | 2134.07 | 3.90% | Bounce | 8/3/1988 | 891.58 | 4.20% | 8/3/1988 | 272.97 | 4.00% | ||

| SELL 100% | $1.006,816 | 8/10/1988 | 2034.14 | Breakdown | 8/10/1988 | 848.57 | 8/10/1988 | 261.89 | |||

| 8/23/1988 | 1989.33 | Mkt Lows | 8/23/1988 | 831.34 | 8/22/1988 | 256.97 | |||||

| BUY 100% | $1/017,364 | 10/7/1988 | 2150.25 | Break above previous Secondary Bounce High on all three | 9/21/1988 | 892.77 | 10/7/1988 | 278.07 | |||

| $1,034,496 | 12/30/1988 | 2168.57 | Year-end level | ||||||||

| 9/1/1989 | 2752.09 | Mkt Highs | 9/5/1989 | 1532.01 | 9/1/1989 | 353.73 | |||||

| 25-Sep | 2659.19 | 3.40% | Pullback | 26-Sep | 1424.96 | 7.00% | 14-Sep | 343.16 | 3.00% | ||

| 9-Oct | 2791.41 | 5.00% | New high/Bounce | 9-Oct | 1518.49 | 6.60% | 9-Oct | 359.8 | 4.80% | ||

| SELL 100% | $1,258,527 | 10/13/1989 | 2569.26 | Breakdown | 13-Oct | 1406.29 | 13-Oct | 333.62 | |||

| $1,277,732 | 12/29/1989 | 2753.2 | Year-end level | ||||||||

| 1/30/1990 | 2543.24 | Mkt lows | 1/30/1990 | 1031.83 | 1/30/1990 | 322.98 | |||||

| 15-Feb | 2649.55 | 4.20% | Bounce | 9-Feb | 1088.19 | 5.40% | 15-Feb | 334.88 | 3.70% | ||

| 23-Feb | 2564.19 | 3.20% | Pullback | 20-Feb | 1067.92 | 1.90% | 23-Feb | 324.14 | 3.20% | ||

| BUY 100% | $1,293,606 | 3/2/1990 | 2660.36 | Breakup | 26-Feb | 1099.4 | 2-Mar | 335.54 | |||

| 15-Jun | 2935.89 | Mkt High/Bull Mkt High | 6-Jun | 1212.77 | 4-Jun | 367.4 | |||||

| 26-Jun | 2842.33 | 3.20% | Pullback | 5-Jul | 1131.02 | 6.70% | 26-Jun | 352.06 | 4.20% | ||

| 7/16/1990 | 2999.75 | 5.50% | Bull Market Highs/Bounce | 16-Jul | 1189.6 | 5.20% | 16-Jul | 368.95 | 5.20% | ||

| SELL100% | $1,415,108 | 8/2/1990 | 2864.6 | Breakdown | 30-Jul | 1125 | 2-Aug | 351.41 | |||

| Capitulation BUY 50% | $1,420,837 | 23-Aug | 2483.42 | 23-Aug | 861.31 | 23-Aug | 307.06 | ||||

| 10/11/1990 | 2365.1 | Bear Market Lows | 17-Oct | 821.93 | 11-Oct | 295.46 | |||||

| 19-Oct | 2520.79 | 6.60% | Bounce | 22-Oct | 883.69 | 7.70% | 22-Oct | 314.76 | 6.50% | ||

| BUY to 75% | $1,420,427 | 10/26/1990 << 10/29 | 2436.14 2430.20 | 3.5% 3.6% | 3% Pullback* and Full Pullback shown | 10/26 10/39 | 837.09 822.30 | 5.3% 6.9% | 10/26/90 10/29 | 304.71 301.88 | 3.2% 4.1% |

| BUY 100% | $1,469,097 | 11/12/1990 | 2540.35 | Breakup | 5-Dec | 903.67 | 12-Nov | 319.48 | |||

| $1,531,030 | 12/31/1990 | 2633.66 | Year-end level | ||||||||

| $1,900,106 | 12/31/1991 | 3168.83 | Year-end level | ||||||||

| $2,037,221 | 12/31/1992 | 3301.11 | Year-end level | ||||||||

| $2,381,978 | 12/31/1993 | 3754.09 | Year-end level | ||||||||

| $2,496,341 | 12/30/1994 | 3834.44 | Year-end level | ||||||||

| $3,409,931 | 12/29/1995 | 5117.12 | Year-end level | ||||||||

| $4,386,634 | 12/31/1996 | 6448.27 | Year-end level | ||||||||

| $5,469,954 | 12/31/1997 | 7908.25 | Year-end level | ||||||||

| 5/13/1998 | 9211.84 | Mkt High/Bull High | 4/16/1998 | 3686.02 | 4/22/1998 | 1130.54 | |||||

| 15-Jun | 8627.93 | 6.30% | Pullback | 2-Jun | 3259.3 | 11.60% | 15-Jun | 1077.01 | 4.70% | ||

| 7/17/1998 | 9337.97 | 8.20% | Bull Highs/Bounce | 14-Jul | 3618.73 | 11.00% | 17-Jul | 1184.75 | 10.00% | ||

| SELL 100% | $5,926,503 | 8/4/1998 | 8487.31 | Breakdown | 29-Jul | 3244.93 | 4-Aug | 1072.12 | |||

| Capitulation BUY 50% | $5,946,824 | 31-Aug | 7539.07 | Bear Market Lows | 4-Sep | 2616.75 | 31-Aug | 957.28 | |||

| 8-Sep | 8020.78 | 6.40% | Bounce | 8-Sep | 2749.3 | 5.10% | 8-Sep | 1023.46 | 6.90% | ||

| BUY to 75% | $5,982,207 | 10-Sep | 7615.54 | 5.10% | 3% Pullback* was full pullback on all three | 10-Sep | 2631.51 | 4.30% | 10-Sep | 980.19 | 4.20% |

| BUY to 100% | $6,178,162 | 9/14/1998 | 7945.35 | Breakup | 14-Sep | 2805.14 | 14-Sep | 1029.72 | |||

| $7,174,625 | 12/31/1998 | 9181.43 | Year-end level | ||||||||

| 5/13/1999 | 11107.19 | Mkt Highs/Bull High | 5/12/1999 | 3783.5 | 5/13/1999 | 1367.56 | |||||

| 27-May | 10466.93 | 5.80% | Pullback | 25-Jun | 3316.11 | 12.40% | 27-May | 1281.41 | 6.30% | ||

| 16-Jul | 11209.84 | 7.10% | Mkt Highs/Bounce | 2-Jul | 3515.99 | 6.00% | 16-Jul | 1418.78 | 10.70% | ||

| 2-Aug | 10645.96 | Pullback/New Low | 11-Aug | 3130.53 | 10-Aug | 1281.43 | |||||

| 25-Aug | 11326.04 | Mkt High/Bounce | 25-Aug | 3309.25 | 25-Aug | 1381.79 | |||||

| SELL100% | $8,155,537 | 9/23/1999 | 10318.59 | Break 1st Pullback | 23-Sep | 2895.98 | 23-Sep | 1280.41 | |||

| $8,261,425 | 12/31/1999 | 11497.12 | Year-end level | ||||||||

| 1/14/2000 | 11722.98 | Bull Market Highs/Not | 16-Nov | 3099.67 | 3/24/2000 | 1527.46 | |||||

| $8,723,813 | 12/29/2000 | 10786.85 | Year-end level | ||||||||

| Capitulation BUY 50% | $8,963,459 | 9/20/2001 | 8376.21 | 9/20/2001 | 2033.86 | 9/20/2001 | 984.54 | ||||

| 9/21/2001 | 8235.81 | Bear Market Lows | 20-Sep | 2033.86 | 21-Sep | 965.8 | |||||

| 26-Oct | 9545.17 | 15.90% | Bounce | 11-Oct | 2314.8 | 13.80% | 29-Oct | 1104.61 | 14.40% | ||

| BUY to 75% | $9,382,647 | 10.30/2001<< 10/31/2001 | 9121.98 9075.14 | 4.4% 4.8% | 3% Pullback* and full Pullback lows shown | 30-Oct 31-Oct | 2195.26 2195.84 | 5.2% 5.2% | 30-Oct 31-Oct | 1059.79 1059.78 | 4.0% 4.1% |

| BUY to 100% | $9,748,118 | 11/6/2001 | 9591.12 | Breakup | 8-Nov | 2320.98 | 6-Nov | 1118.86 | |||

| $10,215,106 | 12/31/2001 | 10021.5 | Year-end level | ||||||||

| 3/19/2002 | 10635.25 | Bull Market Highs | 3/4/2002 | 3049.96 | 3/19/2002 | 1170.29 | |||||

| 6-May | 9808.04 | 7.80% | Pullback | 10-May | 2643.1 | 13.30% | 7-May | 1049.49 | 10.30% | ||

| 17-May | 10353.08 | 5.60% | Bounce | 17-May | 2798.36 | 5.90% | 17-May | 1106.59 | 5.40% | ||

| SELL100% | $9,973,305 | 6/3/2002 | 9709.79 | Breakdown | 25-Jun | 2627.92 | 3-Jun | 1040.68 | |||

| Capitulation BUY 50% | $9,993,773 | 19-Jul | 8019.26 | 19-Jul | 2332.18 | 19-Jul | 847.75 | ||||

| 23-Jul | 7702.34 | Mkt Lows | 23-Jul | 2160.35 | 23-Jul | 797.7 | |||||

| 31-Jul | 8736.59 | 13.40% | Bounce | 30-Jul | 2389.51 | 10.60% | 31-Jul | 911.62 | 14.30% | ||

| BUY to 75% | $10,184,114 | 2-Aug << 5-Aug | 8313.13 8043.63 | 4.8% 7.9% | 3% Pullback* and full Pullback lows shown | 2-Aug 5-Aug | 2202.03 2132.27 | 7.8% 10.7% | 2-Aug 3-Aug | 864.24 834.60 | 5.2% 8.4% |

| BUY to 100% | $10,586,158 | 8/14/2002 | 8743.31 | Breakup | 21-Aug | 2432.21 | 14-Aug | 919.62 | |||

| 22-Aug | 9053.64 | Mkt highs | 22-Aug | 2463.96 | 22-Aug | 962.7 | |||||

| 5-Sep | 8283.7 | 8.50% | Pullback | 5-Sep | 2204.26 | 10.50% | 3-Sep | 878.02 | 8.80% | ||

| 10-Sep | 8602.61 | 3.80% | Bounce | 11-Sep | 2297.32 | 4.20% | 10-Sep | 909.58 | 3.60% | ||

| SELL 100% | $9,957,669 | 9/17/2002 | 8207.55 | Breakdown | 16-Sep | 2203.69. | 17-Sep | 873.52 | |||

| Capitulation BUY 50% | $9,966,270 | 10/9/2002 | 7286.27 | Bear Market Lows | 9-Oct | 2013.02 | 9-Oct | 776.76 | |||

| 6-Nov | 8771.01 | 20.40% | Bounce | 6-Nov | 2413.71 | 19.90% | 6-Nov | 923.76 | 18.90% | ||

| BUY to 75% | $10,837,135 | 11/8/2002 << 11/11 | 8537.13 8358.95 | 2.7% 4.7% | 3% Pullback* and full Pullbacks shown | 11/8 11/26 | 2346.88 2268.35 | 2.7% 6.0% | 11/8 11/11 | 894.74 876.10 | 3.1% 5.2% |

| BUY to 100% | $11,138,278 | 11/21/2002 | 8845.13 | Breakup | 21-Nov | 2328.78 | 21-Nov | 933.76 | |||

| 27-Nov | 8931.68 | Mkt highs | 27-Nov | 2371.82 | 27-Nov | 938.87 | |||||

| 27-Dec | 8303.78 | 7.00% | Pullback | 27-Dec | 2291.66 | 27-Dec | 875.4 | 6.80% | |||

| $10,531,010 | 12/31/2002 | 8341.63 | Year-end level | ||||||||

| 1/14/2003 | 8842.62 | 6.50% | Bounce/New high | 1/6/2003 | 2421.71 | 6.70% | 1/14/2003 | 931.66 | 6.40% | ||

| SELL 100% | $10,279,879 | 1/24/2003 | 8131.01 | Breakdown | 21-Jan | 2281.23 | 24-Jan | 861.4 | |||

| 11-Mar | 7524.06 | Mkt low/Bear low | 11-Mar | 1942.19 | 11-Mar | 800.73 | |||||

| 21-Mar | 8521.97 | 13.30% | Bounce | 21-Mar | 2263.49 | 16.50% | 25-Mar | 895.79 | 11.90% | ||

| 31-Mar | 7992.13 | 6.20% | Pullback | 31-Mar | 2131.21 | 5.80% | 31-Mar | 846.18 | 5.30% | ||

| BUY 100% | $10,307,279 | 4/22/2003 | 8484.99 | Breakup | 15-Apr | 2316,62 | 22-Apr | 911.37 | |||

| $12,885,565 | 12/31/2003 | 10453.92 | Year-end level | ||||||||

| 2/11/2004 | 10737.7 | Mkt highs | 1/22/2004 | 3080.32 | 2/11/2004 | 1157.76 | |||||

| 24-Mar | 10048.23 | 6.40% | Pullback | 22-Mar | 2750.8 | 10.70% | 24-Mar | 1091.19 | 5.70% | ||

| 6-Apr | 10570.81 | 5.20% | Bounce | 22-Apr | 3006.76 | 9.30% | 5-Apr | 1150.57 | 5.40% | ||

| SELL 100% | $12,401,528 | 5/10/2004 | 9990.02 | Breakdown | none | 10-May | 1087.12 | ||||

| 12-Aug | 9814.59 | Mkt Lows | 6-Aug | 2966.08 | 12-Aug | 1063.23 | |||||

| 14-Sep | 10318.16 | 5.10% | Bounce | 6-Oct | 3388.72 | 14.30% | 6-Oct | 1142.05 | 7.40% | ||

| 25-Oct | 9749.49 | 5.50% | New low/Pullback | 13-Oct | 3282.43 | 3.10% | 25-Jan | 1094.8 | 4.10% | ||

| BUY 100% | $12,487,392 | 11/3/2004 | 10137.05 | Breakup | 21-Oct | 3431.69 | 3-Nov | 1143.2 | |||

| 12/28/2004 | 10854.54 | Mkt highs | 12/28/2004 | 3811.62 | 12/30/2004 | 1213.55 | |||||

| $13,326,409 | 12/31/2004 | 10783.01 | Year-end level | ||||||||

| 1/24/2005 | 10368.61 | 4.50% | Pullback | 24-Jan | 3454.78 | 9.30% | 24-Jan | 1163.75 | 4.10% | ||

| 4-Mar | 10940.56 | 5.50% | Bounce/Newer Highs | 7-Mar | 3872.17 | 12.10% | 2-Mar | 1225.31 | 5.30% | ||

| SELL 100% | $12,783,923 | 4/14/2005 | 10278.75 | Breakdown | 14-Apr | 3441.3 | 14-Apr | 1162.05 | |||

| 20-Apr | 10012.36 | Mkt lows | 15-Apr | 3382.89 | 20-Apr | 1137.6 | |||||

| 29-Jul | 10640.91 | 6.30% | Bounce | 28-Jul | 3817.06 | 12.80% | 3-Aug | 1245.04 | 9.40% | ||

| 13-Oct | 10216.59 | 4.00% | Pullback | 20-Sep | 3581.45 | 6.20% | 13-Oct | 1176.84 | 6.80% | ||

| BUY 100% | $13,027,787 | 11/18/2005 | 10766.33 | Breakup | 1-Nov | 3840.04 | 18-Nov | 1248.27 | |||

| $13,005,349 | 12/30/2005 | 10717.5 | Year-end level | ||||||||

| $15,452,112 | 12/29/2006 | 12463.15 | Year-end level | ||||||||

| 7/19/07 | 14000.41 | Mkt highs/Bull High | 7/19/07 | 5446.49 | 7/19/2007 | 1553.08 | |||||

| 3-Aug | 13181.91 | 5.60% | Pullback | 3-Aug | 4873.81 | 10.50% | 3-Aug | 1433.06 | 7.70% | ||

| 8-Aug | 13657.86 | 3.60% | Bounce | 8-Aug | 5079.39 | 4.20% | 8-Aug | 1497.49 | 4.50% | ||

| SELL 100% | $16,365,382 | 8/14/2007 | 13028.92 | Breakdown | 8/14/2007 | 4850.25 | 8/14/2007 | 1426.54 | |||

| 10/9/2007 | 14164.53 | Bull Market Highs/Not | 5-Oct | 4997.17 | 10/9/2007 | 1565.15 | |||||

| $16,587,535 | 12/31/2007 | 13264.82 | Year-end level | ||||||||

| 3/10/2008 | 11740.15 | Mkt Lows | 1/17/2008 | 4140.29 | 3/10/2008 | 1273.37 | |||||

| 1-Apr | 12654.36 | 7.80% | Bounce | 3-Apr | 4999.93 | 16.50% | 7-Apr | 1372.54 | 7.50% | ||

| 14-Apr | 12302.06 | 2.80% | Pullback | 9-Apr | 4803.1 | 3.90% | 14-Apr | 1328.32 | 3.20% | ||

| BUY 100% | $16,677,342 | 4/18/2008 | 12849.36 | Breakup | 16-Apr | 5073.41 | 18-Apr | 1390.33 | |||

| 2-May | 13058.2 | Mkt highs | 5-Jun | 5492.95 | 19-May | 1426.63 | |||||

| SELL 100% Break below last Secondary pullback all 3 therefore SELL 100% | $14,631,283 | 7/2/2008 | 11215.51 | Pullback below last Secondary low therefore SELL | 2-Jul | 4653.13 | 2-Jul | 1261.52 | |||

| Capitulation BUY 50% | $14,684,080 | 7-Oct | 9447.11 | 7-Oct | 3898.15 | 7-Oct | 996.23 | ||||

| 27-Oct | 8175.77 | Mkt Lows | 27-Oct | 3364.98 | 27-Oct | 848.92 | |||||

| 4-Nov | 9625.26 | 17.70% | Bounce | 4-Nov | 4071.81 | 21.00% | 4-Nov | 1005.75 | 18.50% | ||

| BUY to 75% | $14,463,088 | 11/5/2008 | 9139.27 | 5.00% | 3% Pullback* continued through Capitulation below | 6-Nov | 3605.56 | 11.50% | 6-Nov | 904.88 | 10.00% |

| Capitulation (no BUY) | 12-Nov | 8282.66 | 12-Nov | 3474.06 | 12-Nov | 852.3 | |||||

| Newer Lows so retain 75% attributal to capitulations | $13,110,693 | 11/19/2008 | 7997.28 | Newer Mkt Lows all three indices reverses partial Dow Theory Buy back to capitulation Buys | 19-Nov | 3141.52 | 19-Nov | 806.58 | |||

| 11/20/2008 | 7552.29 | Bear Market Lows | 20-Nov | 2988.99 | 20-Nov | 752.44 | |||||

| 8-Dec | 8934.18 | 18.3%% | Bounce | 12/8/2008 | 3589.63 | 20.10% | 12/8/2008 | 909.7 | 20.90% | ||

| $13,827,694 | 12/11/2008 << 12/23 | 8565.09 8419.49 | 4.1% 5.7% | 3% Pullback* Full Pullback as shown | 12/11 12/15 | 3251.73 3206.11 | 9.4% 10.7% | 12/11 12/23 | 873.59 863.16 | 3.9% 5.1% |

|

| $14,101,217 | 12/31/2008 | 8776.39 | Year-end level | ||||||||

| BUY to 100% | $14,413.66 | 1/2/2009 | 9034.69 | Breakup and Bull Market Definition | 1/2/2009 | 3651.02 | 1/2/2009 | 931.8 | |||

| 1/2/2009 | 9034.69 | Bull Market Highs | 1/6/2009 | 3717.36 | 1/6/2009 | 934.69 | |||||

| SELL 100% | 13,100,153 | 1/14/2009 | 8200.14 | Breakdown below previous secondary lows | 14-Jan | 3121.31 | 14-Jan | 842.62 | |||

| Capitulation BUY 50% | $13,103,036 | 2/23/2009 | 7114.78 | 23-Feb | 2586.7 | 23-Feb | 743.33 | ||||

| 3/9/2009 | 6547.05 | Bear Market Lows | 9-Mar | 2146.89 | 9-Mar | 676.53 | |||||

| 18-Mar | 7486.58 | 14.40% | Bounce | 19-Mar | 2637.27 | 22.80% | 18-Mar | 794.35 | 17.40% | ||

| BUY to 75% | $13,272,578 | 3/20/2009 | 7278.38 | 2.80% | 3% Pullback* was low for all | 20-Mar | 2516.96 | 4.60% | 20-Mar | 768.54 | 3.20% |

| BUY to 100% | $13,956,372 | 3/23/2009 | 7775.86 | Breakup | 23-Mar | 2715.21 | 23-Mar | 822.92 | |||

| $18,179,584 | 12/31/2009 | 10428.05 | Year-end level | ||||||||

| 4/26/2010 | 11205.03 | Mkt highs | 5/3/2010 | 4806.01 | 4/23/2010 | 1217.28 | |||||

| 26-May | 9974.45 | 11.00% | Pullback | 20-May | 4160.51 | 13.40% | 26-May | 1067.96 | 12.30% | ||

| 3-Jun | 10255.28 | 2.80% | Bounce | 27-May | 4381.98 | 5.30% | 3-Jun | 1102.83 | 3.30% | ||

| SELL 100% | $18,481,030 | 6/4/2010 | 9931.97 | Breakdown | 4-Jun | 4157.17 | 4-Jun | 1064.88 | |||

| 7-Jun | 9816.49 | Mkt lows | 7-Jun | 4037.98 | 7-Jun | 1050.47 | |||||

| BUY 100% as market bounced above previous signals high | $18,481,848 | 6/15/2010 | 10404.77 | Bounce above previous signal Bounce highs | 15-Jun | 4467.25 | 15-Jun | 1115.23 | |||

| 18-Jun | 10450.64 | Mkt highs | 15-Jun | 4467.25 | 18-Jun | 1117.51 | |||||

| SELL 100% as market broke below previous lows | $17,381,264 | 6/30/2010 | 9774.02 | Breakdown below previous market lows | 30-Jun | 4007.84 | 29-Jun | 1041.24 | |||

| 2-Jul | 9686.48 | Mkt Lows | 6-Jul | 3906.23 | 2-Jul | 1022.5 | |||||

| BUY 100% as market broke above previous market highs | $17,383,656 | 8/2/2010 | 10674.38 | Breakup above market highs | 26-Jul | 4482.09 | 2-Aug | 1125.86 | |||

| $19,066,868 | 12/31/2010 | 11577.51 | Year-end level | ||||||||

| 4/29/2011 | 12810.49 | Bull Mkt Highs/Not | 5/10/2011 | 5527.5 | 29-Apr | 1363.61 | |||||

| 15-Jun | 11897.27 | 7.10% | Pullback | 10-Jun | 5060.59 | 8.40% | 15-Jun | 1265.42 | 7.20% | ||

| 21-Jul | 12724.41 | 7.00% | Bounce/Bull Mkt High | 7-Jul | 5618.25 | 11.00% | 7-Jul | 1353.22 | 6.90% | ||

| SELL 100% | $19,841,936 | 8/2/2011 | 11886.62 | Breakdown | 2-Aug | 4942.27 | 2-Aug | 1254.05 | |||

| Capitulation BUY 50% | $19,842,012 | 8/8/2011 | 10809.85 | Mkt lows | 8-Aug | 4221.6 | 8-Aug | 1119.46 | |||

| 15-Aug | 11482.9 | 7.10% | Bounce | 15-Aug | 4684.44 | 7.40% | 15-Aug | 1204.49 | 7.60% | ||

| BUY to 75% | $21,015,730 | 8/18/2011 << 8/19 | 10990.58 10817.65 | 4.3% 5.8% | 3% Pullback* and full Pullbacks shown | 18-Aug 19-Aug | 4299.55 4221.60 | 8.2% 9.9% | 18-Aug 19-Aug | 1140.65 1123.53 | 5.3% 6.7% |

| BUY to 100% | $20,778,352 | 8/29/2011 | 11539.25 | Breakup | n/a | 29-Aug | 1210.08 | ||||

| 31-Aug | 11613.53 | Mkt highs | 30-Aug | 4683.96 | 31-Aug | 1218.89 | |||||

| 22-Sep | 10733.83 | 7.80% | Pullback | 22-Sep | 4149.94 | 11.00% | 22-Sep | 1129.56 | 7.30% | ||

| 27-Sep | 11190.61 | 4.30% | Bounce | 27-Sep | 4380.27 | 5.60% | 27-Sep | 1175.38 | 4.10% | ||

| SELL 100% | $19,239,274 | 10/3/2011 | 10655.3 | Breakdown/Bear Mkt Lows | 3-Oct | 4038.73 | 3-Oct | 1099.23 | |||

| BUY 100% | $19,239,330 | 10/10/2011 | 11433.18 | Breakup above pre-sell highs by all indexes (Rule #5) | 6-Oct | 4422.35 | 10-Oct | 1194.89 | |||

| $20,685,036 | 12/30/2011 | 12217.56 | Year-end level | ||||||||

| 5/1/2012 | 13279.32 | Mkt High | 3-Feb | 5368.03 | 2-Apr | 1419.04 | |||||

| 18-May | 12369.38 | 9.10% | Pullback | 18-May | 4873.76 | 9,2% | 18-May | 1295.22 | 8.70% | ||

| NO SELL as Highs above previous Highs exceeded by all 3 | 6-Sep | 13292 | Newer Highs | 1/2/2013 | 5435.74 | 6-Sep | 1432.11 | 2.80% | |||

| 5-Oct | 13610.14 | Mkt Highs | 5-Jul | 5249.12 | 14-Sep | 1465.77 | |||||

| 15-Nov | 12542.38 | 7.80% | Pullback | 16-Nov | 4891.27 | 6.80% | 15-Nov | 1353.33 | 7.70% | ||

| 18-Dec | 13350.96 | 6.40% | Bounce | 20-Dec | 5357.81 | 9.50% | 18-Dec | 1446.79 | 6.90% | ||

| 28-Dec | 12938.11 | NO Breakdown | 28-Dec | 5220.98 | 2.20% | 28-Dec | 1402.43 | 3.10% | |||

| $22,802,792 | 12/31/2012 | 13104.14 | Year-end level | ||||||||

| NO SELL as above previous Secondary Highs exceeded by all 3 | 1/18/2013 | 13649.7 | New Highs above previous Secondary highs | 1/2/2013 | 5435.74 | 1/10/2013 | 1472.12 | ||||

| 21-May | 15409.39 | Mkt Highs | 17-May | 6549.16 | 21-May | 1669.16 | |||||

| 5-Jun | 14960.59 | 2.90% | Pullback | 5-Jun | 6138.36 | 6.30% | 5-Jun | 1608.9 | 3.60% | ||

| NO SELL as Highs above previous market highs exceeded by all 3 | 8/2/2013 | 15460.91 | Newer Mkt Highs on all 3 therefore NO SELL | 18-Jul | 6579.05 | 11-Jul | 1675.02 | ||||

| $29,555,366 | 12/31/2013 | 16576.66 | Year-end level | ||||||||

| 7/16/2014 | 17138.2 | Mkt Highs | 7/23/2014 | 8468.54 | 7/24/2014 | 1987.98 | |||||

| 7-Aug | 16368.27 | 4.50% | Pullback | 7-Aug | 7992.08 | 5.60% | 7-Aug | 1909.57 | 3.90% | ||

| 19-Sep | 17279.74 | 5.60% | Bounce | 18-Sep | 8676.19 | 8.60% | 18-Sep | 2011.38 | 5.30% | ||

| SELL 100% but Not acted on as shown in October 2014 Letter, actually overridden to our benefit here, BUT see March 2020 | 13-Oct | 16321.07 | Breakdown | 10-Oct | 7893.26 | 10-Oct | 1906.13 | ||||

| 16-Oct | 16117.24 | Mkt Lows | 13-Oct | 7717.69 | 15-Oct | 1862.49 | |||||

| BUY 100% but overridden and Not acted on as shown in October 2014 Letter | 31-Oct | 17390.52 | Breakup over previous Bounce Highs on all 3 indexes | 28-Oct | 8759.3 | 31-Oct | 2108.05 | ||||

| 12/26/2014 | 18053.71 | Mkt High | 12/29/2014 | 9217.44 | 12/29/2014 | 2090.57 | |||||

| $32,509,586 | 12/31/2014 | 17823.07 | Year-end level | ||||||||

| 1/15/2015 | 17320.71 | 4.10% | Pullback | 1/15/2015 | 8655.94 | 6.10% | 1/15/2015 | 1992.67 | 4.70% | ||

| 1/22/2015 | 17813.98 | 2.80% | Bounce | 1/22/2015 | 9143.52 | 5.60% | 1/22/2015 | 2063.15 | 3.50% | ||

| SELL 100% | $30,500,364 | 8/21/2015 | 16459.75 | Breakdown | 1/20/2015 | 8649.32 | 8/21/2015 | 1970.89 | |||

| 8/25/2015 | 15666.44 | New Lows | 8/25/2015 | 7466.97 | 8/25/2015 | 1867.61 | |||||

| 9/16/2015 | 16739.95 | 6.90% | Bounce | 9/17/2015 | 8215.44 | 10 | 9/16/2015 | 1995.31 | 6.90% | ||

| 9/28/2015 | 16001.89 | 4.40% | Pullback | 9/28/2015 | 7675.87 | 6.60% | 9/28/2015 | 1881.77 | 5.90% | ||

| BUY 100% | $30,502,670 | 10/7/2015 | 16912.29 | Breakup | 10/9/2015 | 8253.16 | 10/7/2015 | 1995.83 | |||

| 11/3/2015 | 17918.15 | New High | 10/23/2015 | 8295.58 | 11/3/2015 | 2109.79 | |||||

| 11/13/2015 | 17245.24 | 3.80% | Pullback | 11/16/2015 | 8010.27 | 3.40% | 11/13/2015 | 2023.04 | 4.10% | ||

| 12/1/2015 | 17888.35 | 3.70% | Bounce | 11/20/2015 | 8301.8 | 3.60% | 12/1/2015 | 2102.63 | 3.90% | ||

| SELL 100% | $31,275,024 | 12/11/2015 | 17265.21 | Breakdown | 12/11/2015 | 7624.64 | 12/11/2015 | 2012.37 | |||

| $31,276,054 | 12/31/2015 | 17425.03 | Year-end level | ||||||||

| 2/11/2016 | 15660.18 | New Lows | 2/11/2016 | 6625.53 | 2/11/2016 | 1829.08 | |||||

| 4/20/2016 | 18096.26 | 15.50% | Bounce | 4/20/2016 | 8109.19 | 22.40% | 8-Jun | 2119.12 | 15.90% | ||

| 6/27/2016 | 17140.24 | 9.00% | Pullback | 6/27/2016 | 7093.4 | 12.50% | 6/27/2016 | 2000.53 | 5.60% | ||

| BUY 100% | $31,285,614 | 7/8/2016 | 18146.73 | Breakup/BUY | 10/5/2016 | 8138.01 | 7/8/2016 | 2129.9 | |||

| 8/15/2016 | 18636.05 | Mkt High | 8-Sep | 8078.6 | 15-Aug | 2190.15 | |||||

| 11/4/2016 | 17888.28 | 4.00% | Pullback | 14-Sep | 7755.4 | 4.00% | 4-Nov | 2085.17 | 4.80% | ||

| NO SELL as newer market highs exceeded by all 3 | 11/10/2016 | 18807.87 | Newer Mkt Highs on all 3 therefore NO SELL | 7-Nov | 8330.36 | 21-Nov | 2198.18 | ||||

| $34,513,468 | 12/30/2016 | 19762.6 | Year-end level | ||||||||

| $44,215,564 | 12/29/2017 | 24719.22 | Year-end level |