Supercharge Your Portfolio: Unleash the Power of DT21C and Relative Strength

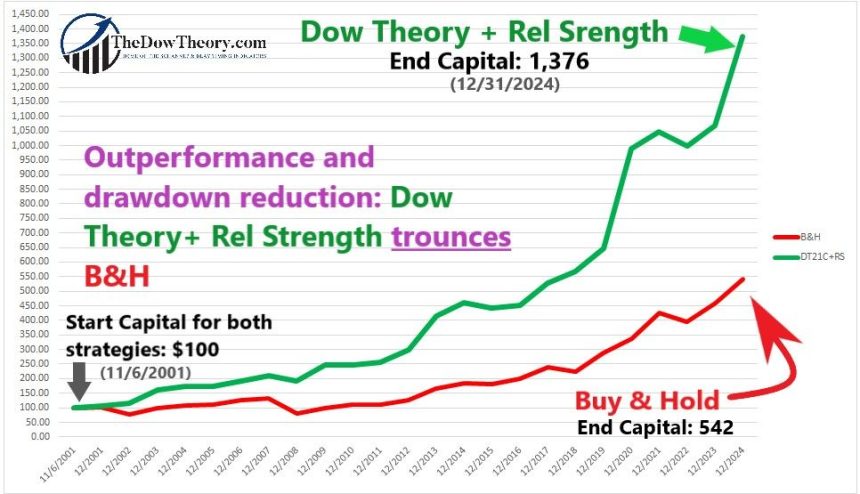

What happens when one mixes a great timing indicator like the Dow Theory for the 21st Century (DT21C) with a relative strength system? Answer: Even more outperformance and a better risk-reward profile v. Buy and Hold (B&H).

Relative Strength (RS) is based on the proven fact that assets (stocks, indexes, sectors, commodities, etc.) that have displayed strength relative to other peers should continue to be relatively stronger in the future. RS is not trend-following, as one relatively stronger asset may be falling, albeit less than its coequals. This is the weak point of RS investing. RS tends to outperform in Bull markets but gets decimated in Bear markets. For many RS systems, the risk-adjusted profile is not better than Buy & Hold due to large drawdowns during Bear markets.

What if we could get the upside of RS while getting rid of the downside? If we used RS only in Bull markets and exiting stocks during downturns, we would be getting the best of both worlds: Catching the RS’s outperformance in good times while avoiding the bad times.

We know that the DT21C is one of the best trend-following devices. This Dow Theory blog provided ample evidence of the net superiority of the DT21C over another trend following systems.

Thus, if we applied an RS strategy to equities only when the DT21C is in a BUY mode, we would have greater odds of achieving significant outperformance, as we’d have two sources of outperformance: the DT21C, and additionally, the one derived from the RS strategy.

However, there are many RS strategies. Some are good and robust. Some are not. After carefully researching the issue since 2015 and testing the waters with my own accounts, I came to one of the best, easy to trade, and most robust RS systems. The test starts on 11/06/01 and finishes on 12/31/21, ca. 21 ½ years. From 1/1/22, it has been traded “life” in my real-money portfolio, which I show in each Letter once I got the first “Buy” signal on 8/10/22. Take a look at the key charts and figures:

The results are hypothetical and are NOT an indicator of future results and do NOT represent returns that any investor attained

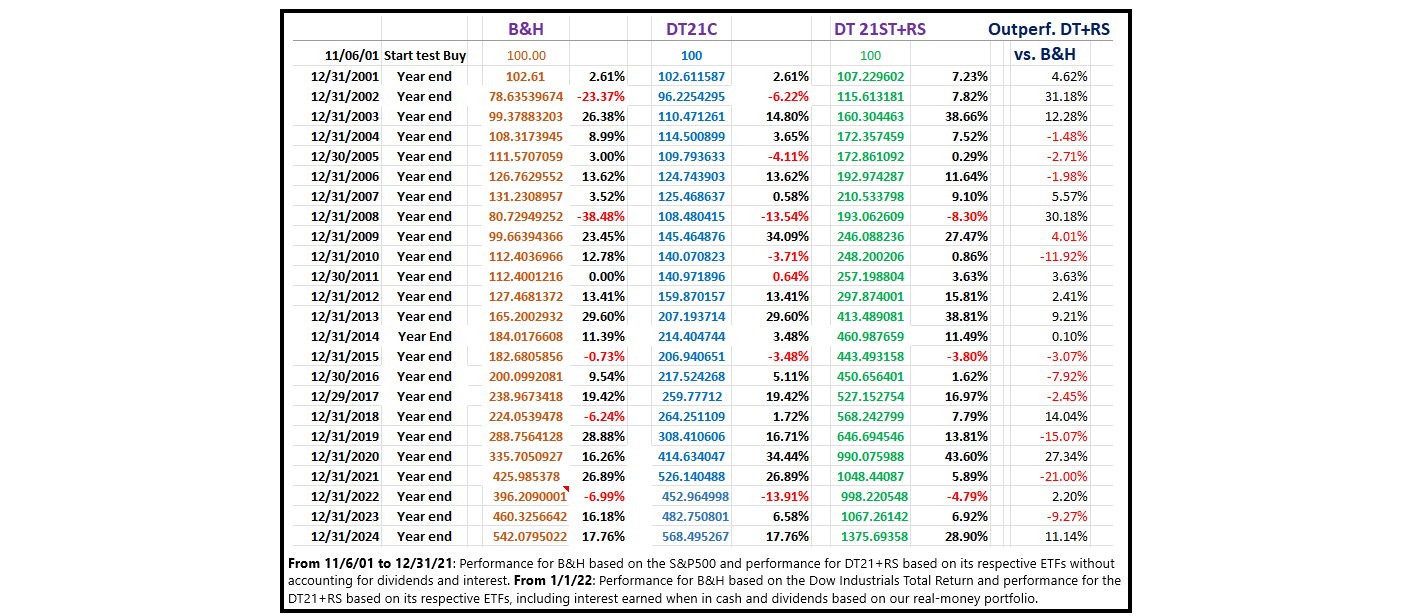

Below there is the performance breakdown for each year from 2001 to 2024:

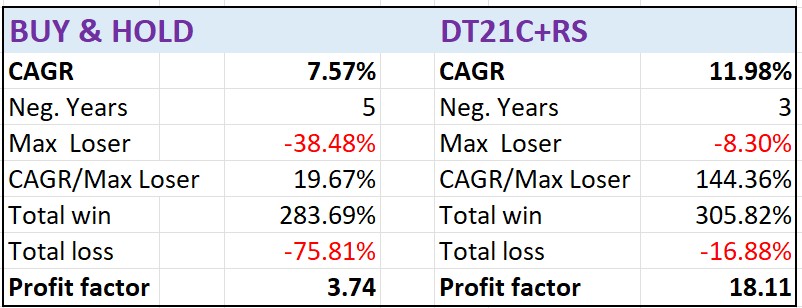

Key performance figures:

I calculated the profit factor (PF, total profits made divided by total losses, by computing the yearly percentage changes for each strategy and adding the total percentages of points won or lost each year. The DT21C+RS scored an astounding PF of 18.11, which means that we made much more than we lost and, more importantly, a high degree of accuracy at spotting trends. We can also observe that by using a good trend filter (the DT21C), we eliminate the drawback plaguing RS systems: huge drawdowns during bear markets. If you look at the “Total Loss” cells, you’ll see that the DT21C has a smaller total loss (as expected in good trend-following), but the DT21C+RS had an even more minuscule total loss of –8.30% percentage points over the last 24 years. In other words, by mixing RS with the DT21C, we increased performance but did not increase drawdowns. Given its propensity to significant drawdowns during bear markets, this is quite a feat when dealing with an RS strategy.

One approximation to a risk-adjusted performance measure is to divide the average annual performance by the maximum losing year. B&H scored 19.67, and the DT21C+RS system scored an exceptional 144.36, which implies that we are increasing performance and decreasing risk. If you divide 144.36 (DT21C+RS) by 19.67 (B&H), you obtain 7.34, which means that for each dollar risked, the DT21C+RS made $ 7.34 more than B&H.

The Compounded Annual Growth Rate (CAGR) is higher for the DT21C+RS vs. Buy & Hold.

The DT21C+RS system only had three modest negative years. B&H had five negative years. The worst annual performance was -38.48% for B&H, and an outstanding -8.30% for the DT21+RS. So, despite being a high relative strength strategy, we reduced drawdowns significantly thanks to the DT21C trend filter.

The correlation between the DT21C+RS and B&H is a modest 0.63. Thus, adding the RS element to the DT21C provides an additional layer of diversification. We are achieving more outperformance and decoupling ourselves from the vagaries of B&H.

Watch out! There is no holy grail in the markets, and we can’t always have the wind at our backs. While the DT21C+RS system significantly outperforms Buy & Hold (B&H) over the long term, it is important to prepare for psychological challenges during rough patches. In 21 years of testing and 3 years of trading, DT21C+RS outperformed B&H in 13 years but lagged behind in 11. This means there’s nearly a 45% chance of underperforming in any given year. Additionally, there were two instances of three consecutive years of underperformance. The silver lining? Underperformance doesn’t mean negative performance. Even in years when DT21C+RS fell short of B&H, it still delivered solid results, just not as robust as B&H’s. Patience and perspective are key to navigating these periods.

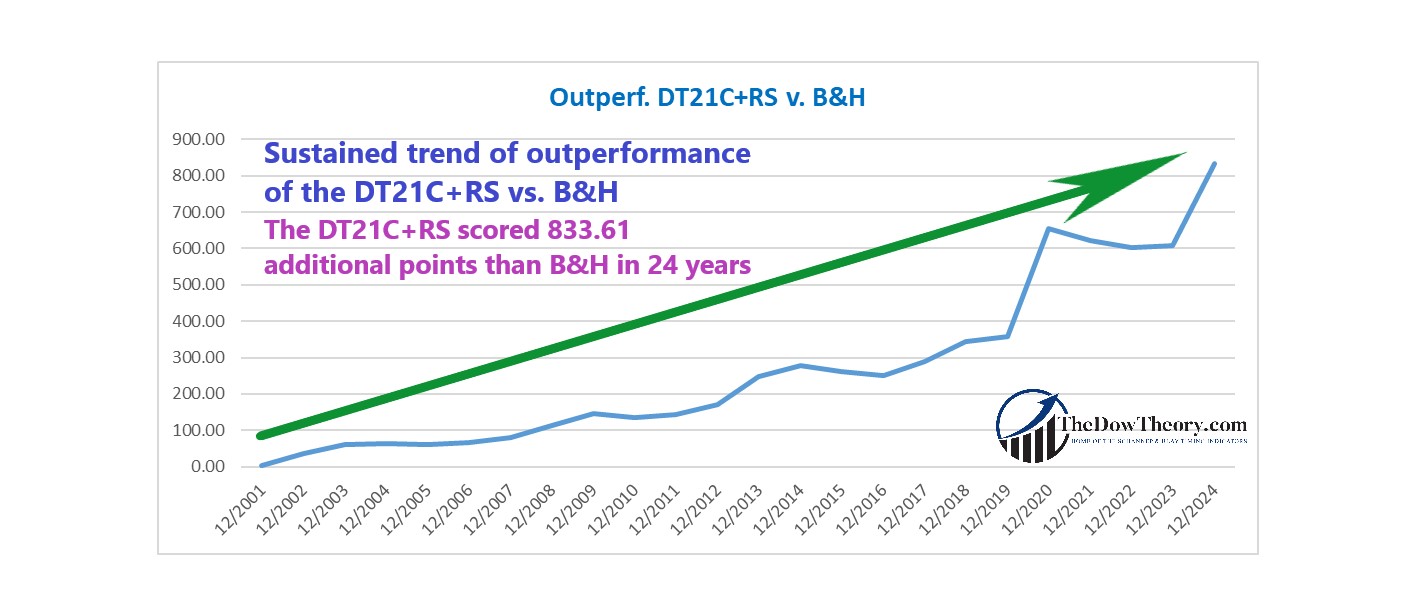

The chart below shows the cumulated outperformance of the DT21C+RS versus B&H: As you can see, the uptrend of outperformance is clear. Furthermore, you may observe that the periods of underperformance (blue line going down) are short-lived and moderate. In other words, the DT21C+RS will spend less time underperforming B&H than the DT21C or RS alone. This insight is vital as time underperforming B&H wears out the investor’s patience. The shorter we keep the time underperforming B&H, the more likely we will stick to our trend-following system in real life.

As you can see, the uptrend of outperformance is clear. Furthermore, you may observe that the periods of underperformance (blue line going down) are short-lived and moderate. In other words, the DT21C+RS will spend less time underperforming B&H than the DT21C or RS alone. This insight is vital as time underperforming B&H wears out the investor’s patience. The shorter we keep the time underperforming B&H, the more likely we will stick to our trend-following system in real life.

Well, now it’s time to open the black box and discuss the rules of our Relative Strength + DT21C strategy, namely:

- Selecting our universe (find the right assets to trade).

- How to select the highest relative strength assets.

- How to rank.

- Buy, Sell, and rotation rules.

- How do we avoid the risk of a crowded trade.

- Suggested alternatives to improve performance further.

……………………………… ………………………. …………………………………

Do you want to continue reading?

Do you want to know the rules of our top outperforming DT21C+Relative Strength system, and learn to trade it?

Become a Subscriber, and you’ll have access to the full Special Report. Furthermore, we will be informing our Subscribers of the trading candidates we will be selecting according to top performing strategy.

Moreover, your subscription will give you access to our Composite timing indicator which, since 1953, has consistently outperformed buy-and-hold while effectively keeping drawdowns at bay. You will also gain access to a wealth of information including our Letters since 1962 with accompanying trade recommendations, insights into the power of the consumer confidence report as a timing device, a special report on the yield curve, guidance on calculating effective profit objectives, trend assessments for gold, silver, and their ETF miners (GDX & SIL), and much more. Most importantly, you will receive timely updates via our email service regarding any changes in trends for US stock indexes. Not accidentally, our Newsletter has consistently been ranked among the top investments Letters.