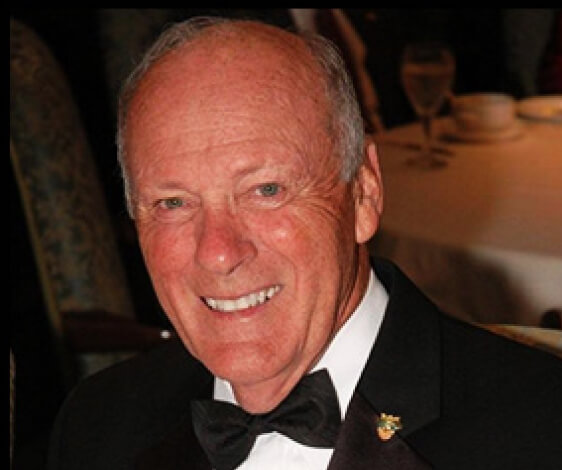

I am a 1956 graduate of the U.S. Military Academy at West Point. For 4 years I was a jet instructor pilot and academic instructor in the Air Force. From 1961 until 1968 I was a stockbroker with Dean Witter (now Morgan Stanley) in Phoenix. I opened and managed the Dean Witter Tucson offices from 1968 until retiring as Senior Vice President in charge of southern Arizona offices in 1984. My dearest wife Helen passed away from pancreatic cancer in 2014. She and I had four children, eight grand-children, and seven great-grand-children, and I live in Tucson and Pinetop, Arizona. I was president of the Lions Club, the West Point Society, the Big Brothers, and other professional organizations. I was on the Executive Committee of the Tucson Chamber of Commerce, the Arizona state chairman of the National Association of Security Dealers (NASD – now FINRA) Fair Practices Committee, and an Allied member of the New York Stock Exchange (NYSE).

I’ve had a serious interest in market timing for many years, starting with The Dow Theory over 55 years ago. My father-in-law had known Robert Rhea, the great Dow Theorist of the 1930’s and author of the definitive work on the subject The Dow Theory. In 1962, I mimeographed (!) my first market timing letter to my clients (Subscribers can access “From The Archives” in the Subscribers area). In 1969, I initially developed a stock market major trend timing indicator which over the next several years I further developed and improved. I went from making the necessary calculations on my slide rule and adding machine to my first personal computer over thirty years ago.

Back in 1977, I began writing a personal correspondence to my fellow managers, my stockbrokers and some other colleagues about my advanced market timing indicator, and my expectations for the stock market. That became the “Schannep Timing Indicator Quarterly Letter” which I continued in my retirement. The day before the market low in 1982 I wrote a memo to the brokers in my office that “The values are here and the markets will turn”.