Whenever a 1st Buy signal of any of 1) Capitulation, 2) the Dow Theory for the 21st Century, or 3) the Schannep Timing Indicator (until 10/31/22. Starting 11/1/22 Blay Timing Indicator), buy to 50% invested; if another Indicator gets a finalizing Buy go to fully invested, i.e. add another 50%. If the 2nd Buy is a capitulation or an incremental Buy then add just another 25%, adding the final 25% when another finalized Buy signal occurs. If a Buy is reversed in time by the same type signal then return to the position held excluding that Buy, i.e. if 50%/(25%) was bought then sell that 50%/(25%).

Whenever a 1st Sell Indicator occurs sell 1/2 or 50%, upon a 2nd sell out 100%.

Bold Italicized percentage is 1st Buy or Sell, underlined percentage completes 100%.

Dates shown are dates of signals. [Here is a tweak for possibly getting better execution prices: ‘Action’ dates can be days later, most likely is the Schannep Timing Indicator when Monetary component figures are released. In the case of a sell, ‘wait and watch’ if there are intervening ‘obvious’ UP days and hold off to enter the sell order until the first ‘obvious’ DOWN day to execute; (may require waiting until the last minutes of the trading day). For Buy signals the opposite procedure. Does NOT apply to Capitulation Buys.]

I use equal amounts of Diamonds (DIA), Spiders (SPY), the equal-weighted S&P (RSP) and Nasdaq100 (QQQ, more explanations about including the Nasdaq HERE), so as to participate fully in the market’s advances/declines, however the results shown are from using the Dow Jones Industrial Average only. Results shown include dividends received and interest earned on 3 month Treasuries as received quarterly. Market levels are for the Dow Jones Industrial Average. When Bull/Bear markets become “official” both the DJIA and the S&P500 levels are shown.

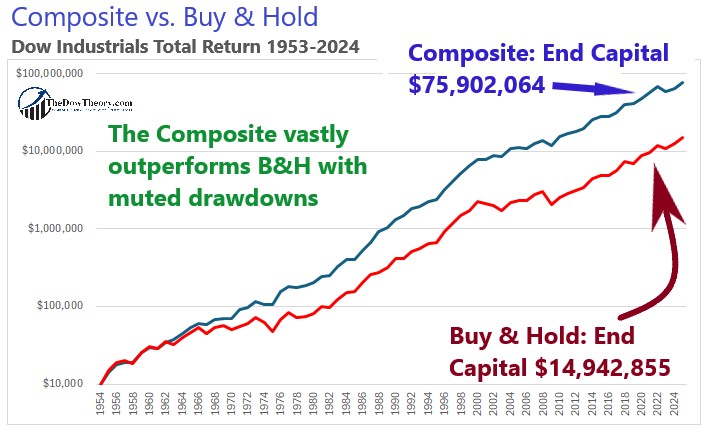

The Dow Theory for the 21st Century is used in place of the original/traditional Dow Theory. As it was only spelled out with the publication of Jack Schannep’s book in 2008, these results are from backtesting for the most part. The chart below illustrates the strong outperformance of our Composite indicator versus a Buy and Hold strategy from the end of 1953 to 2024, showcasing significantly smaller drawdowns and demonstrating the potential results if the indicator’s rules had been explicitly followed with available data throughout this timeframe.

The above performance chart was produced for illustration purposes only based on a hypothetical $10,000 investment amount and should not be used as the basis for making investment decisions. The chart is based on the annual rate of return calculation gross of any fees.

And the table below gives you the details of all trades and their performace:

| Buy Signal Type Date/Level Capitulation | % | Buy or Sell Date/Level The Dow Theory for the 21st Century | % | Buy or Sell Date/Level Schannep Timing | % | Buy or Sell Date/Level Definition of "Official" Bull or Bear met | % | COMPOSITE Indicator Signal | Start 12/31/53 $10,000 |

|---|---|---|---|---|---|---|---|---|---|

| 9/14/53 mkt lows 255.49 | |||||||||

| Year-end 12/31/53 @280.90 | $10,000 | ||||||||

| B-1/25/54@290.40 | 50 | $10,007 | |||||||

| B-4/1/54@306.27 | 50 | Bull-4/1/54 @306.27 (S&P@27.17 ) | < Fully Invested at 100% | Average Buy 298.33 | $10,338 | ||||

| Year-end 12/30/54 @404.39 | $14,108 | ||||||||

| Year-end 12/30/55 @488.40 | $17,732 | ||||||||

| 4/6/56 Bull Mkt High: | 521.05 | ||||||||

| S-8/20/56@511.24 | 50 | $19,066 | |||||||

| Year-end 12/30/56 @499.97 | $19,099 | ||||||||

| S-2/5/57@469.96 | 50 | < to 100% 'cash' | Average Sell 490.60 | $18.603 | |||||

| Bear-10/17/57 @436.87 (S&P@40.65) | n/a | ||||||||

| 10/22/57 Bear Mkt Low: | 419.79 | ||||||||

| Year-end 12/31/57 @435.69 | 19,134 | ||||||||

| B-4/21/58@450.72 | 50 | $19,222 | |||||||

| B-5/5/58@461.12 | 50 | < Fully Invested at 100% | Average Buy 455.92 | $19,464 | |||||

| Bull-7/25/58 @501.76 (S&P@46.97) | n/a | ||||||||

| Year-end 12/31/58 @583.65 | $25,259 | ||||||||

| S-11/12/59@644.26 | 50 | $28,607 | |||||||

| Year-end 12/31/59 @679.36 | $29,525 | ||||||||

| S-2/16/60@611.33 | 50 | No Bear market | < to 100% 'cash' | Average Sell 627.80 | $28,173 | ||||

| Year-end 12/30/60 @615.89 | $28,824 | ||||||||

| B-1/3/61@610.25 | 50 | $28,829 | |||||||

| B-3/6/61@674.46 | 50 | < Fully Invested at 100% | Average Buy 642.35 | $30,485 | |||||

| 12/13/61 Bull Mkt High | 734.91 | ||||||||

| Year-end 12/29/61@731.14 | $33,843 | ||||||||

| S-4/12/62@685.67 | 50 | $32,029 | |||||||

| S-5/10/62@647.23 | 50 | < to 100% 'cash' | Average Sell 666.45 | $31,209 | |||||

| Bear-5/25/62 @611.88 (S&P@59.47) | n/a | ||||||||

| B-6/22/62@539.19 | 50 | B-6/22/62@539.19 | n/a | B-6/22/62@539.19 | n/a | $31,306 | |||

| 6/26/62 Bear Mkt Low: | 535.76 | ||||||||

| B-7/18/62@571.24 | 25 | $32,308 | |||||||

| B-7/31/62@597.93 | 25 | < Fully Invested at 100% | Average Buy 561.88 | $33,482 | |||||

| B-11/14/62@630.48 | n/a | ||||||||

| Bull-11/29/62 @652.61 (S&P@62.41) | n/a | ||||||||

| Year-end 12/31/62@652.10 | $37,072 | ||||||||

| Year-end 12/31/63@762.95 | $44,755 | ||||||||

| Year-end 12/31/64@874,13 | $52,914 | ||||||||

| Year-end 12/31/65@969.26 | $60,567 | ||||||||

| 2/9/66 Bull Mkt High: | 995.15 | ||||||||

| Capitulation | % | The Dow Theory | % | Schannep Indicator | % | Official Bull or Bear | % | COMPOSITE | Value |

| S-5/2/66@931.95 | 50 | $58,838 | |||||||

| S-5/9/66@886.80 | 50 | < to 100% 'cash' | Average Sell 909.37 | $57,455 | |||||

| S-Bear market definition met | n/a | Bear-8/22/66@792.03 (S&P@78.24) | n/a | ||||||

| 10/7/66 Bear Mkt Low: | 744.32 | ||||||||

| B-12/13/66@816.70 | 50 | $59,103 | |||||||

| B-12/27/66@792.20 | 50 | < Fully Invested at 100% | Average Buy 804.45 | $58,315 | |||||

| Year-end 12/30/66@785.69 | $57,853 | ||||||||

| Bull-4/24/67@887.53 (S&P@92.62) | n/a | ||||||||

| S-11/2/67@864.85 | 50 | $65,514 | |||||||

| Year-end 12/31/67@905.11 | $67,457 | ||||||||

| S-1/22/68@871.71 | 50 | < to 100% 'cash' | Average Sell 868.28 | $66,384 | |||||

| B-4/11/68@905.69 | 50 | No Bear market | $67,081 | ||||||

| B-9/24/68@938.28 | 50 | < Fully Invested at 100% | Average Buy 921.99 | $69,584 | |||||

| 12/3/68 Bull Mkt High: | 985.21 | ||||||||

| Year-end 12/31/68@943.75 | $70,588 | ||||||||

| S-2/20/69@916.65 | 50 | $68,876 | |||||||

| S-3/7/69@911.18 | 50 | < to 100% 'cash' | Average Sell 913.92 | $68,800 | |||||

| Bear-7/28/69 @ 806.23 (S&P@90.21) | n/a | ||||||||

| B-10/16/69@838.77 | 50 | $71,439 | |||||||

| Year-end 12/31/69@800.36 | $70,616 | ||||||||

| S-1/26/70@768.88 | 50 | No Bull market | < to 100% 'cash' | $69,490 | |||||

| B-5/25/70@641.36 | 50 | B-5/25/70@641.36 | n/a | B-5/25/70@641.36 | n/a | $70,980 | |||

| 5/26/70 Bear Mkt Low: | 631.16 | ||||||||

| B-6/10/70@694.35 | 25 | ||||||||

| B-8/21/70@745.41 | 25 | B-8/24/70@759.58 | n/a | < Fully Invested at 100% | Average Buy 680.61 | $74,084 | |||

| Bull-9/4/70@771.15 (S&P@82.83) | $78,883 | ||||||||

| Year-end 12/31/70@838.92 | $90,014 | ||||||||

| S-7/28/71@872.01 | 50 | No Bear market | $95,390 | ||||||

| B-9/7/71 @916.47 | 50 | < Fully Invested at 100% | $98,271 | ||||||

| Year-end 12/31/71@890.20 | $96,534 | ||||||||

| Year-end 12/29/72@1,020.02 | $114,097 | ||||||||

| 1/11/73 Bull Mkt High: | 1,051.70 | ||||||||

| Capitulation | % | The Dow Theory | % | Schannep Indicator | % | Official Bull or Bear | % | COMPOSITE | Value |

| S-2/23/73@959.89 | 50 | $107,921 | |||||||

| S-2/26/73@953.79 | 50 | < to 100% 'cash' | Average Sell 956.84 | $107,617 | |||||

| Bear-8/21/73@857.84 (S&P@100.89) | n/a | ||||||||

| B-10/22/73@960.57 | 50 | No Bull Market | $112,422 | ||||||

| S-11/20/73@844.90 | 50 | < to 100% 'cash' | $106,139 | ||||||

| Year-end 12/29/73@850.86 | $106,982 | ||||||||

| B-8/23/74@686.80 | 50 | B-8/23/74@686.80 | n/a | B-8/23/74@686.80 | n/a | $112,160 | |||

| B-9/30/74@607.87 | 25 | B-9/30/74@607.87 | n/a | B-9/30/74@607.87 | n/a | $106,442 | |||

| B-10/21/74@669.82 | 25 | < Fully Invested at 100% | Average Buy 662.82 | $114,941 | |||||

| B-11/4/74@657.23 | n/a | ||||||||

| 12/6/74 Bear Mkt Low: | 577.6 | ||||||||

| Year-end 12/29/74@616.24 | $106,978 | ||||||||

| Bull-1/28/75@687.34 (S&P@77.26) | |||||||||

| Year-end 12/29/75@852.41 | $154,698 | ||||||||

| 9/21/76 Bull Mkt High: | 1,014.79 | ||||||||

| S-11/9/76@930.77 | 50 | $174,369 | |||||||

| Year-end 12/29/76@1004.65 | $182,360 | ||||||||

| S-10/31/77@818.35 | 50 | < to 100% 'cash' | Average Sell 874.56 | $172,175 | |||||

| Year-end 12/29/77@831.17 | $173,825 | ||||||||

| Bear-1/10/78@781.53 (S&P@90.17) | n/a | ||||||||

| 2/28/78 Bear Mkt Low: | 742.12 | ||||||||

| B-4/17/78@810.12 | 50 | $176,915 | |||||||

| B-6/5/78@863.83 | 50 | < Fully Invested at 100% | Average Buy 836.98 | $184,168 | |||||

| Bull-8/3/78@886.87 (S&P@103.51) | n/a | ||||||||

| Capitulation | The Dow Theory | % | Schannep Indicator | % | Official Bull or Bear | % | COMPOSITE | Value | |

| S-10/17/78@866.34 | 50 | $188,189 | |||||||

| S-10/26/78@821.12 | 50 | < to 100% 'cash' | Average Sell 843.73 | $183,588 | |||||

| Year-end 12/29/78@805.01 | $186,171 | ||||||||

| B-1/4/79@826.14 | 50 | $186,386 | |||||||

| Year-end 12/31/79@838.74 | $201,952 | ||||||||

| 4/21/80 Mkt Low: | 759.13 | ||||||||

| B-6/11/80@872.70 | 50 | < Fully Invested at 100% | Average Buy 849.42 | $213,535 | |||||

| Year-end 12/31/80@963.99 | $242,955 | ||||||||

| 4/27/81 Bull Mkt High: | 1,024.05 | ||||||||

| S-7/2/81@959.19 | 50 | $248,265 | |||||||

| S-8/31/81@881.47 | 50 | < to 100% 'cash' | Average Sell 920.33 | $242,134 | |||||

| Bear-9/24/81 @845.69 (115.01) | n/a | ||||||||

| Year-end 12/31/81@875.00 | $251,371 | ||||||||

| 8/12/82 Bear Mkt Low: | 776.92 | ||||||||

| B-8/20/82@869.28 | 50 | $268,924 | |||||||

| B-8/23/82@891.17 | 50 | < Fully Invested at 100% | Average Buy 880.22 | $272,493 | |||||

| B-Bull-9/3/82 @925.13 (S&P@122.68) | n/a | ||||||||

| Year-end 12/31/82@1,046.54 | $326,814 | ||||||||

| S-7/29/83@1199.21 | 50 | $384,507 | |||||||

| B-10/7/83@1272.15 | 50 | < Fully Invested at 100% | $400,960 | ||||||

| Year-end 12/30/83@1,258.64 | $400,611 | ||||||||

| S-1/25/84@1231.88 | 50 | $393,293 | |||||||

| S-2/22/84@1134.21 | 50 | < to 100% 'cash' | Average Sell 1,183.04 | $379,630 | |||||

| B-8/3/84@1202.96 | 50 | No Bear Market | $394,909 | ||||||

| B-8/21/84@1239.73 | 50 | < Fully Invested at 100% | Average Buy 1,221.34 | $402,326 | |||||

| Year-end 12/31/84@1,211.57 | $399,788 | ||||||||

| Year-end 12/31/85@1,546.67 | $532,491 | ||||||||

| Year-end 12/31/86@1,895.95 | $675,705 | ||||||||

| 8/25/87 Bull Mkt High: | 2,722.42 | ||||||||

| S-10/12/87@2471.44 | 50 | $899,819 | |||||||

| S-10/16/87@ 2246.74 due to Bear Definition met | 50 | < to 100% 'cash' | Average Sell 2,359.09 | $859,357 | |||||

| Bear-10/16/87 @2246.74 (S&P@282.70) | |||||||||

| Capitulation | % | The Dow Theory | % | Schannep Indicator | % | Official Bull or Bear | % | COMPOSITE | Value |

| B-10/19/87@1738.74 | 50 | B-10/19/87@1738.74 | n/a | B-10/19/87@1738.74 | n/a | 10/19/87 Bear Mkt Low: | 1,738.74 | $859,751 | |

| B-12/3/87@1776.53 | 25 | B-12/3/87@1776.53 | n/a | B-12/3/87@1776.53 | n/a | $873,985 | |||

| Year-end 12/31/87@1,938.83 | $936,694 | ||||||||

| B-2/19/88@2014.58 | 25 | < Fully Invested at 100% | Average Buy 1,817.15 | $968,317 | |||||

| B-2/29/88@ 2071.62 due to Bull definition met | n/a | Bull-2/29/88 @2071.62 (S&P@267.82) | n/a | ||||||

| S-8/10/88@2034.14 | 50 | $995,176 | |||||||

| B-10/7/88@2150.25 | 50 | < Fully Invested at 100% | $1,031,680 | ||||||

| Year-end 12/30/88@2,168.57 | $1,049,054 | ||||||||

| S-10/13/89@2569.26 | 50 | No Bear market | $1,276,237 | ||||||

| Year-end 12/31/89@2,753.20 | $1,336,940 | ||||||||

| B-3/2/90@2660.36 | 50 | < Fully Invested at 100% | $1,327,228 | ||||||

| 7/16/90 Bull Mkt High: | 2,999.75 | ||||||||

| S-8/2/90@2864.60 | 50 | $1,451,887 | |||||||

| B-8/23/90@2483.42 | Stay at 50% | B-8/23/90@ 2483.42 This Capitulation Buy reaffirms the 50% invested position and offsets the Bear definition | n/a | B-8/23/90@ 2483.42 S-8/23/90@ 2483.42 due to Bear definition being met, reduce to 50% invested as capitulation was occurring | n/a n/a | Bear-8/23/90 @2483.42 (S&P@307.06) | n/a | ||

| 10/11/90 Bear Mkt Low: | 2,365.10 | ||||||||

| B-10/26/90@2436.14 | 25 | $1,360,643 | |||||||

| B-11/12/90@2540.35 | 25 | < Fully Invested at 100% | $1,407,265 | ||||||

| Year-end 12/31/90@2,633.66 | $1,466,592 | ||||||||

| B-1/25/91@2659.41 | n/a | Bull-2/6/91@2830.94 (S&P@358.07) | n/a | ||||||

| Year-end 12/31/91@3,168.83 | $1,820,133 | ||||||||

| Year-end 12/31/92@3,301.11 | $1,951,478 | ||||||||

| Year-end 12/31/93@3,754.09 | $2,281,725 | ||||||||

| S-6/20/94@3741.90 | 50 | No Bear Market | $2,301,751 | ||||||

| Year-end 12/3/94@3,834.44 | $2,374,739 | ||||||||

| B-2/22/95@3973.05 | 50 | < Fully Invested at 100% | $2,431,749 | ||||||

| Year-end 12/29/95@5,117.12 | $3,194,102 | ||||||||

| Year-end 12/31/96@6,448.27 | $4,108,987 | ||||||||

| Year-end 12/31/97@7,908.25 | $5,123,738 | ||||||||

| 7/17/98 Bull Mkt High: | 9,337.97 | ||||||||

| S-8/4/98@8487.31 | 50 | $5,551,390 | |||||||

| S-8/27/98@8165.99 | 50 | < to 100% 'cash' | Average Sell 8,326.65 | $5,457,453 | |||||

| Bear-8/31/98 @7539.07 (S&P@957.28) | n/a | ||||||||

| Capitulation | % | The Dow Theory | % | Schannep Indicator | % | Official Bull or Bear | % | COMPOSITE | Value |

| B-8/31/98@7539.07 | 50 | B-8/31/98@7539.07 | n/a | B-8/31/98@7539.07 | n/a | 8/31/98 Bear Mkt Low: | 7,539.07 | $5,460,221 | |

| B-9/10/98@7615.54 | 25 | $5,492,709 | |||||||

| B-9/14/98@7945.35 | 25 | < Fully Invested at 100% | Average Buy 7,659.75 | $5,672,629 | |||||

| B-11/5/98@8915.47 | n/a | ||||||||

| Bull-11/6/98 @8975.46 (S&P@1141.01) | n/a | ||||||||

| Year-end 12/31/98@9,181.43 | $6,587,555 | ||||||||

| S-8/30/99@10914.14 | 50 | $7,911,514 | |||||||

| S-9/23/99@10318.59 | 50 | No Bear Market | < to 100% 'cash' | Average Sell 10,616.37 | $7,711,294 | ||||

| B-12/3/99@11286.18 | 50 | $7,782,522 | |||||||

| Year-end 12/31/99@11,497.12 | $7,874,161 | ||||||||

| 1/14/00 Bull Mkt high: | 11,722.98 | ||||||||

| Year-end 12/29/00@10,786.85 | $7,906,828 | ||||||||

| S-3/16/01@ 9823.41 due to Bear definition being met | 50 | S-Bear-3/16/01 @9823.41 (S&P@1150.53) | < to 100% 'cash' | $7,605,300 | |||||

| B-9/20/01@8376.21 | 50 | B-9/20/01@8376.21 | n/a | B-9/20/01@8376.21 | n/a | $7,739,026 | |||

| 9/21/01 Bear Mkt low: | 8,235.81 | ||||||||

| B-10/30/01@9121.98 | 25 | $8,100,952 | |||||||

| B-11/6/01@9591.12 | 25 | < Fully Invested at 100% | Average Buy 8,866.38 | $8,416,498 | |||||

| B-11/19/01@9976.46 due to Bull definition being met | n/a | Bull-11/19/01 @9976.46 (S&P500@1151.06) | n/a | ||||||

| Year-end 12/31/01@10,021.50 | $8,819,695 | ||||||||

| 3/19/02 Bull Mkt High: | 10,635.25 | ||||||||

| S-6/3/02@9709.79 | 50 | $8,610,924 | |||||||

| S-7/3/02@9054.97 | 50 | < to 100% 'cash' | Average Sell 9,382.38 | $8,332,393 | |||||

| Bear-7/10/02 @8813.50 (S&P@920.47) | n/a | ||||||||

| B-7/19/02@8019.26 | 50 | B-7/19/02@8019.26 | n/a | B-7/19/02@8019.26 | n/a | $8,338,311 | |||

| B-8/2/02@8313.13 | 25 | $8,497,121 | |||||||

| B-8/14/02@8743.31 | 25 | < Fully Invested at 100% | Average Buy 8,273.74 | $8,832,567 | |||||

| S-9/17/02@8207.55 | 50 | $8,308,187 | |||||||

| Capitulation | % | The Dow Theory | % | Schannep Indicator | % | Official Bull or Bear | % | COMPOSITE | Value |

| B-10/9/02@7286.27 | 25 | B-10/9/02@ 7286.27 This capitulation Buy is "another" Indicator so add 25% | n/a | B-10/9/02@7286.27 | n/a | 10/9/02 Bear Mkt low: | 7,286.27 | $7,850,230 | |

| B-11/5/02@8678.27 | 25 | < Fully Invested at 100% | $8,987,700 | ||||||

| B-11/8/02@8571.60 | n/a | ||||||||

| B=11/21/02@8845.13 | n/a | ||||||||

| Bull-11/21/02 @8845.15 (S&P500@933.76) | n/a | ||||||||

| Year-end 12/31/02@8,341.63 | $8,669,595 | ||||||||

| S-1/24/03@8131.01 | 50 | $84,628.863 | |||||||

| B-4/22/03@8484.99 | 50 | No Bear Market | < Fully Invested at 100% | $8,682,077 | |||||

| Year-end 12/31/03@10,453.92 | $10,853,833 | ||||||||

| S-5/10/04@9990.02 | 50 | $10,446,118 | |||||||

| S-8/5/04 @9963.03 | 50 | < to 100% 'cash' | Average Sell 9,976.53 | $10,471,760 | |||||

| B-11/3/04@10137.05 | 50 | No Bear Market | $10,513,929 | ||||||

| B-11/22/04 @10489.42 | 50 | < Fully Invested at 100% | Average Buy 10,,313.24 | $10,707,920 | |||||

| Year-end 12/31/04@10,783.01 | $11,032,139 | ||||||||

| S-4/14/05@10278.75 | 50 | $10,583,046 | |||||||

| B-11/18/05@ 10766.33 | 50 | < Fully Invested at 100% | $11,013,382 | ||||||

| Year-end 12/30/05@10,717.50 | $10,994,414 | ||||||||

| S-7/12/06@11013.18 | 50 | No Bear Market | $11,429,717 | ||||||

| B-10/12/06@ 11947.70 | 50 | < Fully Invested at 100% | $12,015,774 | ||||||

| Year-end 12/29/06@12,463.15 | $12,590,913 | ||||||||

| S-8/14/07@13028.92 | 50 | $13,335,079 | |||||||

| 10/9/07 Bull Mkt High: | 14,164.53 | ||||||||

| Year-end 12/31/07@13,264.82 | $13,601,240 | ||||||||

| S-1/15/08@12501.11 | 50 | < to 100% 'cash' | Average Sell: 12.765.02 | $13,220,768 | |||||

| Bear-3/7/08 @11893.69 (S&P500@1293.37) | n/a | ||||||||

| B-4/18/08@12849.36 | 50 | No Bull market | $13,282,605 | ||||||

| S-7/2/08@11215.51 | 50 | < to 100% 'cash' | $12,489,173 | ||||||

| B-10/7/08@9447.11 | 50 | B-10/7/08@9447.11 | n/a | B-10/7/08@9447.11 | n/a | $12,534,241 | |||

| B-11/5/08@9139.27 | 25 | $12,345,603 | |||||||

| B-11/12/08@8282.66 | Stay @ 75 awaiting finalizing Dow Theory Buy | B-11/12/08@8282.66 | n/a | B-11/12/08@8282.66 | n/a | $11,483,159 | |||

| S-11/19/08@ 7997.28 Mkt low on all three, Hold at 75% from capitulation Buys | < Holding 75% from Capitulation Buys | ||||||||

| 11/20/08 Bear Mkt Low: | 7,552.29 | ||||||||

| B-12/11/08@8565.09 | n/a | ||||||||

| Year-end 12/31/08@8,776.39 | $12,032,941 |

||||||||

| B-1/2/09@9034.69 due to Bull definition being met | 25 | Bull-1/2/09@ 9034.69 (S&P500@931.80) | < Fully invested at 100% | Average Buy: 8,975.93 (First In, First Out) | $12,299,560 | ||||

| 1/2/09 Bull Mkt High: | 9,034.69 | ||||||||

| Capitulation | % | The Dow Theory | % | Schannep Indicator | % | Official Bull or Bear | % | COMPOSITE | Value |

| S-1/14/09@8200.14 | 50 | $11,178,706 | |||||||

| S-2/19/09@ 7465.95 due to Bear definition being met | 50 | Bear-2/19/09 @7465.95 (S&P500@778.94) | to 100% cash | Average Sell: 7,833.05 | $10,700,263 | ||||

| B-2/23/09@7114.78 | 50 | B-2/23/09@7114.78 | n/a | B-2/23/09@7114.78 | n/a | $10,700,499 | |||

| 3/9/09 Bear Mkt Low: | 6,547.05 | ||||||||

| B-3/20/09@7278.38 | 25 | $10,838,954 | |||||||

| B-3/23/09@7775.86 | 25 | B-3/26/09@ 7924.56 Definition of Bull Mkt met | n/a | Bull-3/26/09 @7924.56 (S&P500@832.86) | < Fully invested at 100% | Average Buy: 7,320.95 | $11,397,370 | ||

| Year-end 12/31/09@10,428.05 | $15,662,871 | ||||||||

| S-6/4/10@9931.97 | 50 | No Bear market | $15,092,403 | ||||||

| B-6/15/10@ 10404.77 broke above previous highs | 50 | < Fully Invested at 100% | $15,458,216 | ||||||

| S-6/30/10@ 9774.02 broke below previous lows | 50 | $14,537,661 | |||||||

| B-8/2/10@10674.38 broke above prev highs | 50 | < Fully Invested at 100% | $15,227,255 | ||||||

| Year-end 12/31/10@11,577.51 | $16,701,669 | ||||||||

| 4/29/11 Bull Mkt High: | 12,810.54 | ||||||||

| S-8/2/11@11866.62 | 50 | $17,409,802 | |||||||

| B-8/8/11@10809.85 | 25 - wait at 75% for finalized Dow Theory signal to go to 100% | B-8/8/11@ 10809.85 | n/a | B-8/8/11@10809.85 | n/a | $16,625,165 | |||

| S-8/10/11@10719.94 | 25, retain 50% due to capitulation | S-8/10/11@ 10719.94 due to Bear definition | n/a | Bear-8/10/11 @10719.94 (S&P500@1120.76) | n/a | $16,523,395 | |||

| B-8/18/11@10990.58 | 25 | $16.,737,224 | |||||||

| B-8/29/11@11539.25 | 25 | < Fully Invested at 100% | $17,374,932 | ||||||

| S-10/3/11@ 10655.30 break to new lows, hold 50% | 50 | 10/3//11 Bear Mkt Low: | 10,655.3 | $16,087,948 | |||||

| B-10/10/11@ 11433.18 | 50 | < Fully Invested at 100% | $16,679,754 | ||||||

| B-10/27/11@ 12208.55 | n/a | ||||||||

| Year-end 12/30/11@12,217.56 | $17,933,124 | ||||||||

| Bull-1/20/12 @12720.48 (S&P500@1315.38) | n/a | ||||||||

| Year-end 12/31/12@13,104.14 | $19,769,142 | ||||||||

| Year-end 12/31/13@16,576.66 | $25,623,362 | ||||||||

| Year-end 12/31/14@17,823.07 | $28,184,558 | ||||||||

| S-8/21/15@16459.75 | 50 | $26,442,640 | |||||||

| B-10/7/15@16912.29 | 50 | < Fully Invested at 100% | $26,849,054 | ||||||

| S-12/11/15@ 17265.21 | 50 | $27,528,894 | |||||||

| Year-end 12/31/15@17,425.03 | $27,675,482 | ||||||||

| B-7/8/16@18146.73 | 50 | < Fully Invested at 100% | $28,455,124 | ||||||

| Year-end 12/30/16@19,762.60 | $31,391,018 | ||||||||

| Year-end 12/29/17@24,719.22 | $40,215,368 | ||||||||

| S-4/23/2018@ 24448.69 | 50 | $40,045,412 | |||||||

| B-9/20/2018@ 26656.98 | 50 | < Fully Invested at 100% | $42,203,232 | ||||||

| 10/3/2018 Bull Mkt High: | 26,828.39 | ||||||||

| S-11/16/2018@ 25413.22 | 50 | $40,387,160 | |||||||

| S-11/23/2018@ 24285.95 | 50 | < to 100% 'cash' | Average Sell: 24,849.59 | $39,510,052 | |||||

| Bear-12/21/18 @22445.37 (S&P500@2416.62) | |||||||||

| Capitulation | The Dow Theory | Schannep Indicator | Official Bull or Bear | COMPOSITE | Value | ||||

| B-12/24/18 @ 21792.20 | 50 | B-12/24/18 @ 21792.20 | n/a | B-12/24/18 @ 21792.20 | n/a | 12/24/2018 Bear Mkt Low: | 21,782.20 | ||

| Year-end 12/31/18@23,327.46 | $41,003,072 | ||||||||

| B- 2/19/19@25891.31 | 50 | < Fully Invested at 100% | Average Buy: 23,841.76 | $43,386,900 | |||||

| Bull-3/1/19 @26026.32 (S&P500@2803.69) | |||||||||

| S-8/14/2019@ 25479.42 | 50 | $43,221,380 | |||||||

| B-8/30/2019@ 26403.28 | 50 | < Fully Invested at 100% | $44,048,976 | ||||||

| Year-end 12/31/2019@ 28,538.44 | $48,026,980 | ||||||||

| 2/12/2020 Bull Mkt Highs: | 29,551.42 | ||||||||

| S-2/25/2020@ 27081.36 | 50 | $45,774,724 | |||||||

| B-3/9/20@23851.02 | 25 added by this capitulation to 50 already from Schannep Timing Indicator Buy | B-3/9/20@23851.02 S-3/9/2020 @23851.02 | n/a n/a | B-3/9/20@23851.02 S-3/9/2020 @23851.02 | n/a n/a | Bear-3/9/20 @23,851.02 (S&P500@2,746.55) and Capitulation offset | Offsetting Hold 50% | $43,072,168 | |

| 3/23/2020 Bear Mkt Lows: | 18,591.93 | ||||||||

| B-4/6/2020@ 22679.99 | 25 | B-4/6/2020@ 22679.99 | n/a | Bull-4/6/2020 @22,679.99 (S&P500@2,663.68) < Fully Invested | < Fully Invested at 100% | $41,556,640 | |||

| Year-end 12/31/2020@ 30,606.48 | $56,996,460 | ||||||||

| Year-end 12/31/2021 @36,338.30 | $68,937,216 |

||||||||

| 1/4/2022 Bull Mkt high: | 36,799.65 | ||||||||

| S-2/22/2022 @33596.61 | 50 | $ 63,904,404 |

|||||||

| S-4/11/2022@34,308.08 | 50 | < to 100% 'cash' | Average Sell: 33,952.345 | $ 64,673,880 |

|||||

| Bear-6/13/22 @30516.64 (S&P500 @3749.63) | |||||||||

| 6/17/22-Market low | 29,888.78 | ||||||||

| B-8/10/2022 @33309.51 | 50 | $65,006,200 | |||||||

| B-8/12/2022@33,761.05 | 50 | < Fully invested at 100% | Average Buy 33,535.28 | $65,455,056 | |||||

| S-9/15/2022 @30961.82 | 50 | $60,152,428 | |||||||

| S-9/30/2022 @28725.51 | 50 | < to 100% 'cash' | Average Sell: 29,843.67 | $58,036,216 | |||||

| 9/30/22-Market low | 28,725.51 | ||||||||

| B-11/10/2022 @33715.37 | 50 | $58,298,472 | |||||||

| Year-end 12/30/2022 @33,147.25 | $58,041,076 | ||||||||

| Capitulation | The Dow Theory for the 21st Century | Blay Timing Indicator | Buy or Sell Date/Level Definition of "Official" Bull or Bear met | COMPOSITE Indicator Signal | VALUE | ||||

| B-4/20/23 @33,786.62 | 50 | < Fully invested at 100% | Average Buy: 33,750.99 | $59,198,632 | |||||

| Bull -6/13/23 @34,212.12 (S&P500 @4,369.00) | |||||||||

| S-10/20/2023 @33,127.28 | 50 | $58,676,628 | |||||||

| B-12/1/2023 @36,245.50 | 50 | < Fully invested at 100% | $61,699,152 | ||||||

| Year-end 12/29/2023 @37,689.54 | $64,269,508 | ||||||||

| S-1/4/24 @37440.34 | 50 | $63,863,636 | |||||||

| B-1/17/24 @37,266.67 | 50 | < Fully invested at 100% | $63,797,772 | ||||||

| Year-end @42,544.22 | $75,902,064 | ||||||||

| S-3/4/2025 @42520.99 | 50 | $74,332,176 | |||||||

| Capitulation | Cap. neutralizes BTI SELL Composite remains at 50% invested | S-4/7/25 @37965.60 | |||||||

| B-6/3/25 @42197.79 | 50 | "< Fully invested at 100%" | $74,666,408 | ||||||

NOTE: This is a 13.41% compound annual increase since 12/31/53 to 12/31/24 (71 years) v. a 11.08% gain for Buy & Hold over the same period.

My thanks to Tom Halgren, a subscriber with a sharp eye for detail, for finding numerous typos/errors/mistakes in the previously shown results. He and I believe this/his recalculation is as true and correct as is possible to construct.

The results following full (100%) BUY signals are:

| BUY: | Average | 3 Months later: | 6 Months later: | 9 Months later: | One Year later: | To Next full SELL: | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | Adj'd level | Level | Gain | Level | Gain | Level | Gain | Level | Gain | Date | Level | Gain |

| 1/25/1954 | 287.19 | 296.4 | 3.2% | 343.48 | 19.6% | 356.34 | 24.10% | 397 | 38.20% | 2/5/1957 | 490.6 | 70.8% |

| 5/5/1958 | 455.92 | 506.95 | 11.2% | 550.68 | 20.8% | 586.12 | 28.60% | 625.9 | 37.30% | 2/16/1960 | 627.8 | 37.7% |

| 2/20/1961 | 654 | 705.96 | 7.9% | 723.54 | 10.6% | 730.09 | 11.60% | 717.55 | 9.70% | 5/10/1962 | 666.45 | 1.9% |

| 7/31/1962 | 568.56 | 589.77 | 3.7% | 589.77 | 3.7% | 682.8 | 20.10% | 695.4 | 22.30% | 5/6/1966 | 917.39 | 61.4% |

| 12/27/1966 | 804.45 | 873.72 | 8.6% | 869.39 | 8.1% | 933.14 | 16.00% | 894.94 | 11.20% | 1/22/1968 | 868.28 | 7.9% |

| 9/24/1968 | 921.99 | 952.32 | 3.3% | 913.92 | -0.9% | 3/7/1969 | 913.92 | -0.9% | ||||

| 8/21/1970 | 722.92 | 761.57 | 5.3% | 878.56 | 21.5% | 921.87 | 27.50% | 880.91 | 21.90% | 2/26/1973 | 935.55 | 29.4% |

| 10/21/1974 | 702.73 | 641.9 | -8.7% | 815.86 | 16.1% | 854.74 | 21.60% | 846.82 | 20.50% | 10/31/1977 | 874.56 | 24.5% |

| 6/5/1978 | 836.98 | 886.61 | 5.9% | 843.73 | 0.8% | 10/26/1978 | 843.73 | 0.8% | ||||

| 6/11/1980 | 687.25 | 941.3 | 37.0% | 908.45 | 32.2% | 967.67 | 40.80% | 1007.42 | 46.60% | 8/31/1981 | 920.33 | 33.9% |

| 9/3/1982 | 908.15 | 1031.36 | 13.6% | 1138.06 | 25.3% | 1213.04 | 33.60% | 1215.45 | 33.80% | 2/22/1984 | 1188.55 | 30.9% |

| 8/9/1984 | 1241.94 | 1218.97 | -1.8% | 1289.97 | 3.9% | 1260.27 | 1.50% | 1320.79 | 6.30% | 10/16/1987 | 2329.72 | 87.6% |

| 1/5/1988 | 1821.38 | 1997.51 | 9.7% | 2158.61 | 18.5% | 2106.51 | 15.70% | 2190.54 | 20.30% | 8/23/1990 | 2553.12 | 40.2% |

| 11/12/1990 | 2511.89 | 2874.75 | 14.4% | 2920.17 | 16.3% | 3001.34 | 19.50% | 3054.11 | 21.60% | 8/27/1998 | 8168.44 | 225.2% |

| 9/14/1998 | 7742.21 | 8695.6 | 12.3% | 9876.35 | 27.6% | 10490.51 | 35.50% | 10910.33 | 40.90% | 9/23/1999 | 10616.37 | 37.1% |

| 6/11/2001 | 9565.81 | 9382.38 | -1.9% | 7/3/2001 | 9382.38 | -1.9% | ||||||

| 8/14/2002 | 8381.29 | 8542.13 | 1.9% | 7908.79 | -5.6% | 8647.82 | 3.20% | 9310.56 | 11.10% | 8/5/2004 | 9547.27 | 13.9% |

| 11/22/2004 | 10313.24 | 10611.2 | 2.9% | 10471.91 | 1.5% | 10569.89 | 2.50% | 10871.43 | 5.40% | 1/15/2008 | 12223.44 | 18.5% |

| 12/8/2008 | 9381.47 | 7733.4 | -17.6% | 2/19/2009 | 7733.4 | -17.6% | ||||||

| 3/23/2009 | 7445.32 | 8322.91 | 11.8% | 9748.55 | 30.9% | 10466.44 | 40.60% | 10888.83 | 46.30% | 8/10/2011 | 10825.74 | 45.4% |

| 8/29/2011 | 11539.25 | 11555.63 | 0.4% | 12952.07 | 12.5% | 12441.58 | 8.10% | 14107.48 | 13.90% | 4/23/2018 | 24448.69 | 124.3% |

| 9/20/2018 | 26656.98 | 24998.64 | -6.2% | 11/16/2018 | 25413.22 | -6.2% | ||||||

| 2/19/19 | 2589131 | 25763.99 | -0.5% | 26135.79 | 0.9% | 27934.02 | 7.9% | 29348.03 | 13.4% | 3/9/2020 | 23851.02 | -7.9% |

| 4/6/20 | 22679.99 | 26287.03 | 15.9% | 27772.76 | 22.4% | 30829.40 | 35.9% | 33430.24 | 47.4% | 4/11/2022 | 34,308.08 | 51.27% |

| 8/12/22 | 33,535.28 | 29,843.67 | -11.0% | 9/30/2022 | 29,843.67 | -11.0% | ||||||

| 4/20/23 | 33,750.99 | 35,225.18 | 4.36% | 33,127.28 | -1.84% | 37,863.80 | 12.18% | 39,986.4 | 12.55% | N/A | N/A | |

| Average: | 4.83% | 12.95% | 20.32% | 24.03% | 35.89% | |||||||

| Median: | 4.03% | 14.30% | 19.80% | 21.05% | 29.4% |

With the invaluable help of Subscriber Tom Halgren, I constructed the Composite (based on the DJIA total return) starting on 12/29/78. Its signals have been derived from using the DT21C and the Blay Timing Indicator (BTI)

| DATE | % INVESTED | Dow Industr. | Start Equity | % annual |

|---|---|---|---|---|

| 12/29/78 | 50 | 805.01 | 1.00 | |

| 12/31/79 | 100 | 838.74 | 1.09 | 8.70% |

| 12/31/80 | 100 | 963.99 | 1.32 | 21.55% |

| 12/31/81 | 50 | 874.99 | 1.43 | 8.15% |

| 12/31/82 | 100 | 1046.54 | 1.78 | 24.84% |

| 12/30/83 | 100 | 1258.64 | 2.19 | 22.58% |

| 12/31/84 | 100 | 1211.57 | 2.25 | 3.04% |

| 12/31/85 | 100 | 1546.67 | 3.00 | 33.19% |

| 12/31/86 | 100 | 1895.95 | 3.81 | 26.90% |

| 12/31/87 | 50 | 1938.83 | 5.77 | 51.48% |

| 12/30/88 | 100 | 2168.57 | 6.40 | 11.01% |

| 12/29/89 | 50 | 2753.20 | 8.16 | 27.44% |

| 12/31/90 | 100 | 2633.66 | 9.23 | 13.14% |

| 12/31/91 | 100 | 3168.83 | 11.46 | 24.13% |

| 12/31/92 | 100 | 3301.11 | 12.29 | 7.22% |

| 12/31/93 | 100 | 3754.09 | 14.37 | 16.92% |

| 12/30/94 | 100 | 3834.44 | 15.06 | 4.80% |

| 12/29/95 | 100 | 5117.12 | 20.57 | 36.60% |

| 12/31/96 | 100 | 6448.27 | 26.46 | 28.64% |

| 12/31/97 | 100 | 7908.24 | 32.99 | 24.70% |

| 12/31/98 | 100 | 9181.43 | 41.98 | 27.23% |

| 12/31/99 | 50 | 11497.12 | 50.06 | 19.24% |

| 12/29/00 | 0 | 10786.85 | 49.14 | -1.82% |

| 12/31/01 | 100 | 10021.50 | 57.54 | 17.09% |

| 12/31/02 | 100 | 8341.63 | 56.67 | -1.52% |

| 12/31/03 | 100 | 10453.92 | 73.77 | 30.17% |

| 12/31/04 | 100 | 10783.01 | 76.96 | 4.33% |

| 12/30/05 | 100 | 10717.50 | 76.70 | -0.34% |

| 12/29/06 | 100 | 12463.15 | 91.13 | 18.81% |

| 12/31/07 | 0 | 13264.82 | 97.35 | 6.83% |

| 12/31/08 | 75 | 8776.39 | 89.98 | -7.57% |

| 12/31/09 | 100 | 10428.05 | 117.13 | 30.16% |

| 12/31/10 | 100 | 11577.51 | 125.65 | 7.28% |

| 12/30/11 | 100 | 12217.56 | 137.74 | 9.62% |

| 12/31/12 | 100 | 13104.14 | 151.84 | 10.24% |

| 12/31/13 | 100 | 16576.66 | 196.81 | 29.61% |

| 12/31/14 | 100 | 17823.07 | 209.74 | 6.57% |

| 12/31/15 | 0 | 17425.03 | 194.86 | -7.10% |

| 12/30/16 | 100 | 19762.60 | 212.36 | 8.98% |

| 12/29/17 | 100 | 24719.22 | 272.06 | 28.11% |

| 12/31/18 | 50 | 23327.46 | 288.18 | 5.93% |

| 12/31/19 | 100 | 28538.44 | 334.71 | 16.15% |

| 12/31/20 | 100 | 30606.48 | 414.34 | 23.79% |

| 12/31/21 | 100 | 36338.30 | 501.15 | 20.95% |

| 12/30/22 | 50 | 33147.25 | 445.93 | -11.02% |

| 12/29/23 | 100 | 37689.54 | 493.78 | 10.73% |

| 12/31/24 | 100 | 43,544.22 | 583.15 | 18.10% |

| Ave. Annual | 15.56% | |||

| CAGR Annual | 14.84% |

NOTE: This is a 14.84% compound annual increase since 12/28/78 to 12/31/24 v. a 12.21% gain for Buy & Hold over the same period.