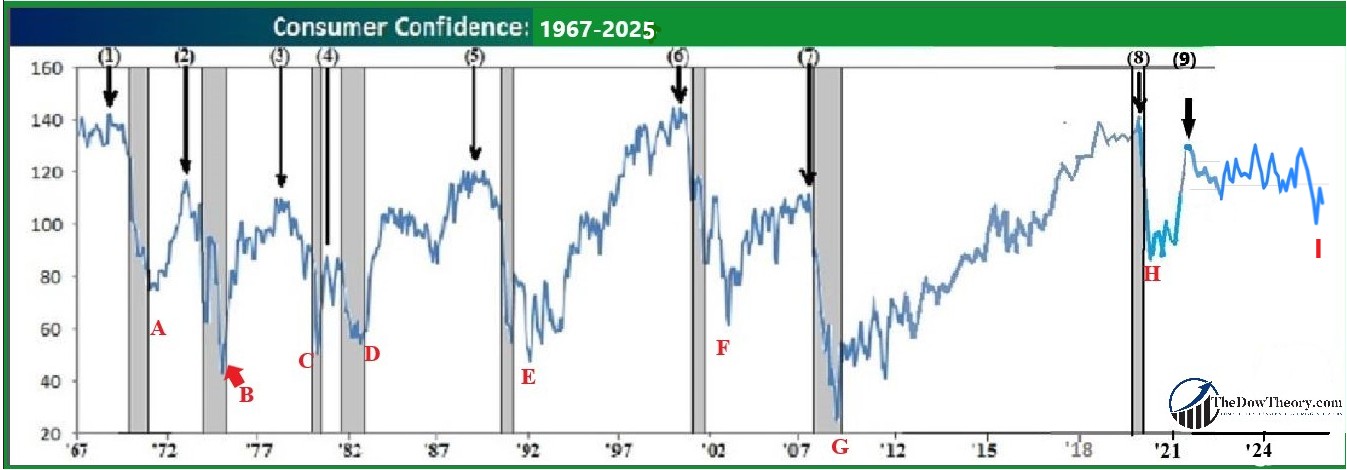

Consumer confidence is important because 2/3rds of the American economy is impacted by the consumer. The Conference Board’s monthly index measuring the economic outlook of 5,000 households is considered a predictor of future spending, and hence economic growth. It’s actual record in that regard is suspect, at best, however what is of more interest to investors is its relationship to the stock market. Since the Index was created in 1967, it has fluctuated between 43 and 145, with 1985=100, seasonally adjusted. The data is available in various places, one source is at https://www.investing.com/economic-calendar/cb-consumer-confidence-48. Until the year 2000, the previous all-time high was in October of 1968 at 142.3. The Bull market as measured by the Dow Jones topped out five weeks later on December 3rd of 1968 at 985 before dropping 36% over the next 18 months to 631. A recession started the next December of 1969. From the all-time high in 2000 the market began an immediate 30% bear market with a recession starting 14 months later just as the bear market ended, NOT an unusual occurrence. The all-time low on the index was in December of 1974 at 43.2 and the Bear market bottomed that month on December 6thof 1974 at 577 before rising 75% over the next 21 months. A five-year economic expansion began three months later in March of 1975. It would appear that the stock market has an important bearing on consumer’s confidence levels, it is highest near market highs, and lowest near market lows. Can you believe the Conference Board’s director of consumer research has said ‘that stocks don’t play a big role in consumer confidence’ (Dow Jones Newswires 12/28/99)? Much has been written about the effects of fear and greed on the stock market, and indeed, investor’s (read consumer’s) confidence is similarly affected. So just how good is the relationship between high confidence (greed?) and Bull market tops, and low confidence (fear?) and Bear market bottoms? Let’s look at the Peaks and Valleys (separated by at least 32½ points) of Consumer confidence over the last 56 years, and their relationship to the stock market’s Highs and Lows, and the economy’s ups and downs:

| Consumer Confidence | Lead-time to Bull mkt high | Bull Market Highs | Confidence Peak Lead-time to recession | Recessions |

|---|---|---|---|---|

| Highs | ||||

| Peaks: | in months: | Date and Level: | in months: | Start: |

| 1) 10/68 @ 142.3 | 2 | 12/68 @ 985 | 13 | 1/69 |

| 2) 12/72 @ 116.1 | 1 | 1/73 @ 1,052 | 11 | 11/73 |

| 3) 4/78 @ 109.9 | 5 | 9/78 @ 908 | 21 | 1/80 |

| 4) 11/80 @ 87.2 | 5 | 4/81 @ 1,024 | 8 | 7/81 |

| 5) 2/89 @120.7 | 17 | 7/90 @ 3,000 | 16 | 7/90 |

| 6) 1&5/00 @144.7* | 0 | 1/00 @ 11,723 | 10 | 3/01 |

| 7) 7/07 @ 112..6 | 3 | 10/07 @ 14,164 | 5 | 12/07 |

| 8) 7/19 @ 138.5 | 7 | 2/20 @ 29,551 | 7 | 2/20 |

| 9) 6/21 @ 128.9 | 6.5 | 1/22 @ 36799.65 | 6 (*) | 1/22 (*) |

| 5.2 mos. Median: 5 mos. | Average: 11.25 mos. Median: 10.5 mos. | |||

| (*) In Q1 and Q2 of 2022, GDP contracted by -1.6% and -0.6%, respectively. Although not officially labeled as a "recession," it is undeniable that the CCI led to the onset of a severe bear market and the subsequent GDP contraction that followed. |

* All-time high

The monthly report comes out on the last Tuesday of the month during the month that is covered, with any revision made the following month. While a peak (or valley) is not definitive until later, the fact that it is not surpassed in subsequent months is a clue of its reversal. To wait for the full 32 ½ point drop is to wait until the recession has already started. There were no other such peaks meeting the definition in the above timeframe, including none ahead of the 9/76-2/78, 8/87-10/87, or 7/98-8/98 Bear markets. Interestingly, those three Bear markets were the only ones since the Index was started that were not followed by recessions. When the Index has peaked, in all cases to date, a Bear market and recession have followed. Bear markets usually ‘forecast’ recessions, the Index peaking always has!

| Consumer Confidence | Lead(Lag) to Bear lows | Bear Market Lows | Confidence Valley Lead(Lag) to start econ. expansion. | Start of Economic |

|---|---|---|---|---|

| Valleys: | in months: | Date and Level: | in months: | Expansion: |

| A) 4/71 @ 75.2 | -11 | 5/70 @ 631 | -5 | Nov-70 |

| B) 12/74 @ 43.2 | 0 | 12/74 @ 578 | 3 | 3/75 |

| C) 5/80 @ 50.1 | -1 | 4/80 @ 759 | 2 | 7/80 |

| D) 10/82 @ 54.3 | -2 | 8/82 @ 777 | 1 | Nov-82 |

| E) 2/92 @ 47.3 | -16 | 10/90 @ 2365 | -11 | 3/91 |

| F) 3/03 @ 61.4 | -5 | 10/02 @ 7286 | -16 | 11/01 |

| G) 2/09 @ 25.3** | 1 | 3/09 @ 6547 | 5 | 7/09 |

| H) 4/20 @ 85.7 | -1 | 3/20 @ 18592 | 0 | 4/20 |

| J) 4/25 @ 85.7(to date **) | 0 | 4/25 @ 37965.60 | N/A | N/A |

| Average: | (3.9) mo.Lag | Average: | (2.3) mo.Lag | |

| (**) Since the CCI has not rallied by at least 32 1/2 points, the 4/25 date is considered a "tentative" bottom. |

**All-time low

Did someone say it is always darkest just before the dawn? Investors actually stay in a funk until after the Bear market had ended and a new Bull market was already underway. All of the above valleys involved recessions, with three occurring during recessions and two after the recessions had ended. There were no other valleys meeting the definition. Another interesting fact derived from the data is that it only takes 2.3 years on average to drop from a peak’s high to the next valley’s low, but it takes almost twice as long, some 4 years on average, to rise from a valley’s low to the next peak’s high. Can you say ‘funk’? These timeframes are obviously consistent with the average bear market lasting just 1.4 years and the average bull market lasting 2.75 years.

The University of Michigan’s Consumer Sentiment is a very similar index whose results closely approximate, but are not the same as that of the Conference Board. It’s advantage, however, is that it is released approximately 2 weeks earlier each month than the Conference Board’s release. It and the “Small Business Optimism Index” which is also released monthly can be guides to confidence. While confidence in general has been a good indicator for nearly 50 years, since the Conference Board’s Consumer Confidence Index became available in 1967 it has been an excellent forecasting tool.

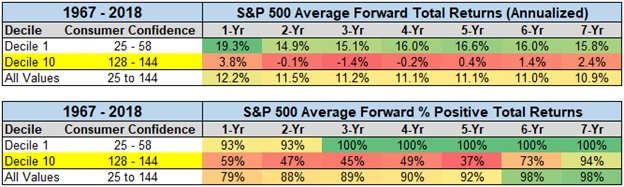

The following is from an article in MarketWatch (9/25/2018) “Why stock investors should be wary of consumer confidence at an 18-year high”, that breaks down the consumer confidence level into deciles, with the highest of the 10 being when the value is from 128 to 144 as it was in October of 2018 at 137.9. The forward years’ returns are shown as being negative 3 of the following 4 years with the percentage of positive returns calculated in the second chart. This a very small sampling and I can’t vouch for its accuracy or significance, nevertheless, this would seem to show that the future after Confidence peaks is not too rosy, to say the least. That makes sense as those returns follow the Bull market highs that we know are coming. If accurate, this backs up what I have written years ago in this Special Report.  >The BOTTOM LINE: Consumers confidence typically rises during Bull markets (often called the ‘wealth effect’) and reaches a peak some 4 to 5 months on average before the stock market peaks, and a recession follows 12 months on average after that. The Index peaks at an average level of 119.2, with 87.2 being the lowest peak (which was inside the ‘double dip’ recessions of 1080 and 1982). Conversely, consumers become less confident and concern turns to fear (the ‘poor’ effect?) even after the Bear market has ended and a new Bull market begun, signaling the start of an economic expansion. The index valleys at an average level of 52.8, with 75.2 being the highest valley. The Consumer Confidence Index is published monthly for all the world to see, but it’s important to know that it is a far better gauge of when the stock market and the economy will change rather than what they will continue to do. Actually it’s tops lead at stock market tops, much as volume tops and an inverted yield curve precede market tops (see Special Reports: “There’s something about …. Volume” and “There’s something about…the Yield Curve“), but it typically languishes beyond Bear market bottoms. In January, 2000 it was at a new all-time record high (and matched in May), and then fell off. Obviously that invited one to watch that a peak was forming, and to watch out for the results that would follow. In 2003 the valley (F) caused by the terrorism high alert, war in Iraq, etc, etc, typically occurred months after the stock market’s low. The peak (7) in 2007 which became official in February 2008 confirmed the October 2007 stock market peak and December 2007 recession start, both events were widely debated at the time. In 2009 the new all-time low (G) signaled an end to the recession that most economists and gurus felt was “no where in sight”.

>The BOTTOM LINE: Consumers confidence typically rises during Bull markets (often called the ‘wealth effect’) and reaches a peak some 4 to 5 months on average before the stock market peaks, and a recession follows 12 months on average after that. The Index peaks at an average level of 119.2, with 87.2 being the lowest peak (which was inside the ‘double dip’ recessions of 1080 and 1982). Conversely, consumers become less confident and concern turns to fear (the ‘poor’ effect?) even after the Bear market has ended and a new Bull market begun, signaling the start of an economic expansion. The index valleys at an average level of 52.8, with 75.2 being the highest valley. The Consumer Confidence Index is published monthly for all the world to see, but it’s important to know that it is a far better gauge of when the stock market and the economy will change rather than what they will continue to do. Actually it’s tops lead at stock market tops, much as volume tops and an inverted yield curve precede market tops (see Special Reports: “There’s something about …. Volume” and “There’s something about…the Yield Curve“), but it typically languishes beyond Bear market bottoms. In January, 2000 it was at a new all-time record high (and matched in May), and then fell off. Obviously that invited one to watch that a peak was forming, and to watch out for the results that would follow. In 2003 the valley (F) caused by the terrorism high alert, war in Iraq, etc, etc, typically occurred months after the stock market’s low. The peak (7) in 2007 which became official in February 2008 confirmed the October 2007 stock market peak and December 2007 recession start, both events were widely debated at the time. In 2009 the new all-time low (G) signaled an end to the recession that most economists and gurus felt was “no where in sight”.