Original posting December 2000

[AKA The “Unerring Unemployment” Indicator]

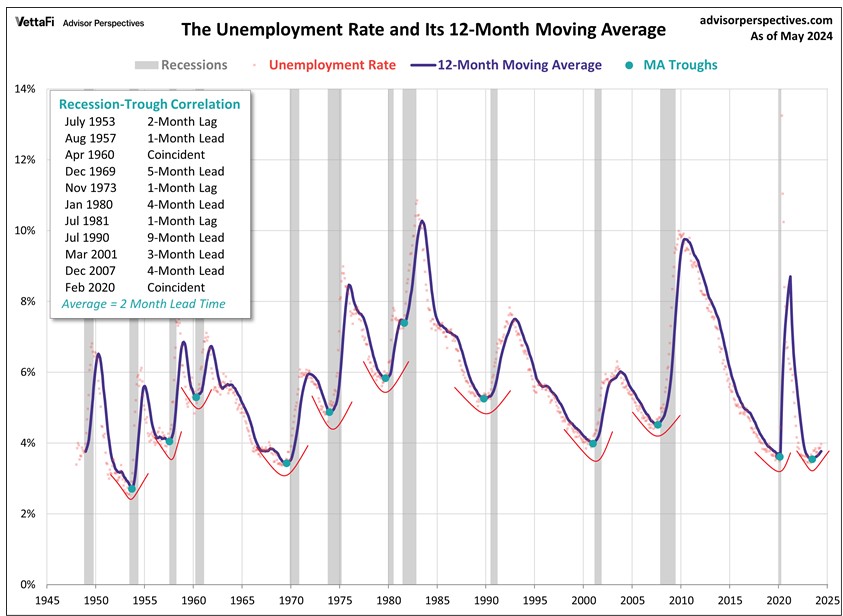

When the unemployment rate has upticked and looks like it is starting to rise, what are the implications? Not much if it only rises a tenth or two of a percent, but significant if it moves much further than that.

According to the press, minor moves could lead to a recession:

1) U.S. News & World Report (6/19/2000) described the needed rise as “more than three-tenths of a percent (0.30%) has led to a recession.”

2) Wall Street Journal (8/11/2000) stated that “the Federal Reserve has never been able to raise unemployment by more than that without causing a recession.”

If those reports had been correct, it would mean that rises above 0.30% would signal recessions. However, that was not always true because no recession followed a three or even four-tenth rise on numerous occasions (1951, 1956, 1963, 1967, 1976, 1986, 1995, and 2003). However, there IS a definite relationship between a rising unemployment rate, a recession, and a Bear market.

Therefore, having observed that some unemployment rates rose to 0.3% but did not reach 0.4% and that all 0.4% rises went on to 0.5% and higher, I determined the correct threshold to be 0.4%, as you will see below. Moves above 0.3% that don’t get to 0.4% don’t count toward our Indicator hitting a target.

There have been 13 occasions since 1948, when the Bureau of Labor Statistics data began on the seasonally adjusted civilian labor force unemployment rate, that the level has risen 4/10th of a percentage point (on a three-month moving average basis) from the cyclical low three-month average. On ALL of those occasions a recession was just starting, or was about to begin, and 9 of the 13 were accompanied by Bear markets. There have only been 13 times that the moving average rose 4/10ths, and 12 recessions in that timeframe, so this indicator caught them all (one extraneous signal was too early but confirmed by the following signal WITHIN that recession). The October 1959 signal was 6 months early for the coming April 1960 to February 1961 recession, and the August 1960 signal was given during that recession. Thus, the early signal was premature/in error and the second signal corrected it.

When the 3-month average rises 0.3% it usually goes higher, BUT not necessarily. There have been at least two occasions when it never attained 0.4% on a 3-month basis. However, on EVERY occasion that the 3-month moving average reached 0.4% it went on to exceed 0.5%, most times by a considerable amount. Therefore 0.4% is indeed the “magic number” in determining the status of recessions being confirmed. The National Bureau of Economic Research (NBER) has always confirmed the start of recessions many months after the fact, and is assumed to be correct, at least they are considered as “official. The underlying data can be found at the U.S. Bureau of Labor Statistics)

In 2000 the lowest three-month average of 3.9%, with each of September, October and November being at that level (actually November was initially reported as 4.0 so the average appeared to be 39.33). The record would indicate that if that was the low for the cycle and it rose to 4.33% as an average of a future three-month period, that a recession would occur and a bear market would probably also occur. It was particularly timely to be aware of this phenomenon because the Wall Street Journal (1/2/01) Forecasting Survey for 2001 showed the average estimate of 54 economists for unemployment for May of 2001 to be 4.4%! On 5/4/01, the April figure was reported as 4.5, which combined with February’s 4.2 and March’s 4.3 averaged 4.33%, up 4/10ths of a percent; hence, a recession was forecast! The Dow Jones level was 10,951. The first bear market low was 8,235 on 9/21/01. On 11/26/01 with the Dow Jones at 9982.75. the NBER, the official arbiter of determining the start and end of recessions, proclaimed the recession officially began in March of 2001 – but by that time, the recession was over! However, the recession’s end (11/01) was not reported “officially” until 7/17/03. By then, the next leg of the 2000-02 bear market had bottomed on October 9th, 2002, at 7286.27, and a bull market was well underway. In fact, by 7/17/03, when the NBER confirmed the recession was over, the market was up to 9050.82.

In 2008 a similar thing occurred. The lowest three-month average was 4.43% from late 2006 and October and November of 2007 had originally been reported as 4.7% each month. Then on January 4th, 2008 the Bureau of Labor Statistics reported a change for October 2007 to 4.8% and the number for December 2007 as 5.0%, therefore the October, November + December average became 4.83%, up 4/10ths of a percent, hence a recession was forecast! The Dow Jones level was 12,800.18.

Obviously, 4/10th is a larger percentage from 4.0 to 4.4 than it would be from 6.0 to 6.4. However the 4/10th continues to be the figure ‘that works’ regardless of the unemployment level. When the ‘4/10th point’ rise occurs, the market will usually already be in a bear market, so it is not a leading indicator but can still be useful to time the stock market. A further decline of 14.96% by the stock market has been the average of the 12 recessions even including the 3 times when no bear market resulted. A further decline of 19.37% was the average when a Bear market followed the recession alert (9 times). Only once has the 4/10th point signal preceded a recession (1959), all other times it has occurred inside the recession. Bear in mind that recessions are not usually identified by the National Bureau of Economic Research until 5 to 12 months after they start, so this 4/10th point indicator beats them to the punch every time.

The Rising Unemployment Rate “SELL” Indicator

A rise of +.4 (on a 3 mo. rolling ave. basis) in the Unemployment rate has resulted in Recessions all 13 times, and been accompanied by 9 Bear markets. Every time the 0.4% threshold was met, the stock market declined with a significant average drop of -14.96%.

| 3 mo. rolling | DowJones | Lags | Further | |||||

|---|---|---|---|---|---|---|---|---|

| Bull Mkt | DowJones | ave. +.4 rise | date of | Recession | Recession | Bear Mkt | DowJones | drop after .4 rise |

| High: | level: | "SELL" signal | release** | (months) | Start: | Low: | low level: | to lows |

| May-46 | 212.5 | Jan-49 | 177.92 | 2 lag | Nov-48 | Jun-49 | 161.6 | 9.20% |

| Jan-53* | 293.79 | Nov-53 | 282.71 | 4 lag | Jul-53 | Nov-53* | 273.88 | 3.10% |

| Apr-56 | 521.05 | Sep-57 | 461.7 | 1 lag | Aug-57 | Oct-57 | 419.79 | 9.10% |

| Jan-60* | 685.47 | Oct-59 | 650.92 | 6 lead | Apr-60 | Sept-60* | 569.08 | 8.97% |

| also | ||||||||

| Jan-60* | 685.47 | Aug-60 | 625.22 | 4 lag | Apr-60 | Oct-60* | 596.07 | 4.7%*** |

| Dec-68 | 985.21 | Feb-70 | 784.12 | 2 lag | Dec-69 | May-70 | 631.16 | 19.50% |

| Jan-73 | 1051.7 | Mar-74 | 847.54 | 4 lag | Nov-73 | Dec-74 | 577.6 | 31.80% |

| Sep-78 | 907.74 | Jan-80 | 881.48 | 0 | Jan-80 | March-80* | 759.98 | 13.78% |

| Apr-81 | 1024.05 | Nov-81 | 892,69 | 4 lag | Jul-81 | Aug-82 | 776.92 | 13.00% |

| Jul-90 | 2999.75 | Sep-90 | 2510.64 | 2 lag | Jul-90 | Oct-90 | 2365.1 | 6.80% |

| Jan-00 | 11,722.98 | Apr-01 | 10951.24 | 1 lag | Mar-01 | Sep-01 | 8235.81 | 24.79% |

| Oct-07 | 14,164.53 | Jan-08 | 12,743.18 | 1 lag | Dec-07 | Nov-08 | 7552.29 | 40.73% |

| Feb-20 | 29,551.42 | Apr-20 | 23,749.75 | 2 lag | Feb-20 | Mar-20 | 18,591.93 | 21.71% |

| Dec 12-24?? Not final yet | 45,014.04 | May-24 | 38,798.99 | ?? Not known yet | ?? Not known yet | ?? Not known yet | ?? Not known yet | ?? Not known yet |

| Ave: 1.58 mo. lag time | Ave. further drop: | 15.46% |

*Recent high and subsequent low if no actual Bear market (otherwise shown).

**First Friday of month following the month reported on.

***This 2nd Signal for same recession

It is obvious from the above that by the time of the 4/10% rise (on a rolling basis) the recession is probably already under way, but not yet identified as ‘official’ by the NBER. Twelve of the thirteen times this indicator lagged, or was coincident, with the start of the recession! Only once did it gave its “signal” early.

As further evidence of the importance of this 4/10th rise, the unemployment rate has gone on to rise one full percent from the low on each of the 13 times after such a rise occurred. Surprisingly, no bear market accompanied those full one percent rises in 1953 or 1960, but bear markets did a coincide with the other times. Even as the unemployment rate continued to rise as the recessions deepened, the stock market, as it usually does, began to anticipate the turn around in the economy, and turned up.