Investors’ pivot from bearish to bullish was too sudden

The bear market is not over, according to a contrarian analysis of stock market timer sentiment.

That’s for two contrarian-related reasons. First, since the mid-June low, stock market timers have been eager to turn bullish, and that is more typical of bear market rallies than the beginnings of a new bull market. Second, the stock market’s mid-June bottom was not accompanied by anything close to the capitulation that often accompanies a major bottom.

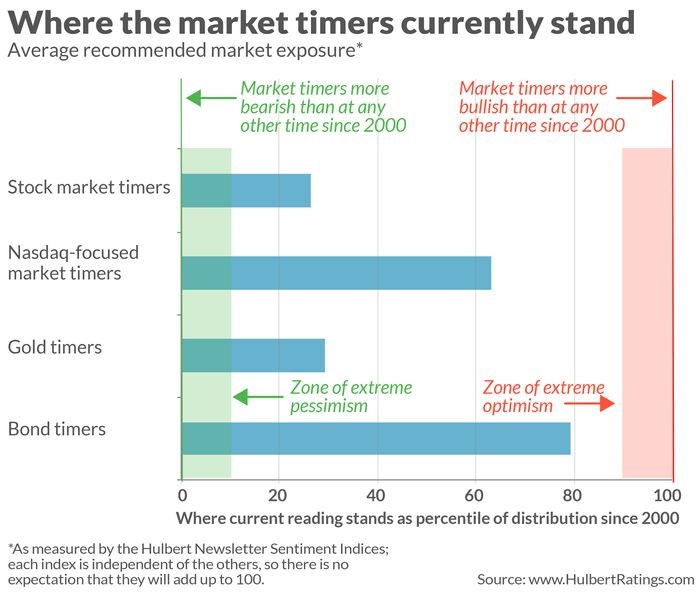

The accompanying chart, below, illustrates the speed with which many stock market timers have jumped on the bullish bandwagon. It plots the Hulbert Nasdaq Newsletter Sentiment Index (HNNSI), which is one of the two stock market sentiment indices that my firm calculates. It reflects the average recommended equity exposure level among a subset of short-term market timers who focus on the Nasdaq market in particular.

Notice that this average has spiked upward and is now within shouting distance of the highest decile of its historical distribution, indicating extreme levels of bullish optimism. It’s amazing that, in just six weeks, the mood has shifted so much and so quickly that we’re even talking about extreme levels of bullishness.

This is not what we typically see at the beginning of new bull markets. The usual pattern is for the rally off the bear market’s low to be initially met by skepticism rather than enthusiastic belief.

No capitulation at the June low

The second reason contrarians are suspicious of the market’s recent rally is that there was no sign of widespread capitulation at the mid-June low. Defined by Investopedia as the “surrender” that occurs “when a large enough proportion of investors simultaneously give up hopes of recouping recent losses, typically as the decline in prices gathers speed,” capitulation occurs at most, though not all, major bottoms.

Consider first the capitulation criterion that I have used in prior columns: The percentage of trading days over the trailing month in which both of my firm’s stock market sentiment indices are in their bottom deciles. Those bottom deciles indicate extreme levels of bearishness on the part of the timers, and staying there for more than a day or two indicates that the timers are stubbornly adhering to their bearishness — which, from a contrarian point of view, is a bullish omen.

On June 17, the day of what so far has been the bear market’s low, this metric stood at 33.3%, which was nowhere close to levels seen at past bear market bottoms. At the bottom of the 2007-2009 bear market, in March 2009, the comparable percentage was 81.0%.

If the current bear market is to follow the typical pattern, it won’t be over until capitulation occurs. And that could take a while, because the current level of this capitulation metric is 0%.

Other definitions of capitulation

It’s important to note that other analysts rely on different definitions of capitulation, as I indicated in a late-June column. While many of them reach largely similar conclusions, there are important differences.

One such analyst is Manuel Blay, editor of TheDowTheory.com, an advisory service founded by Jack Schannep. Their firm’s criteria for capitulation are proprietary and they change weekly. But in an email, Blay said that for this week, capitulation would require that at least two of the following three market averages close below their respective levels: Dow below 27,990; S&P 500 below 3,484; and the NYSE Composite below 13,156. Because each of these market benchmarks currently is well above its trigger level, capitulation is not likely to occur in the immediate future.

In an email, Schannep added that the absence of capitulation at the June low increases the likelihood that recent market strength is just a bear market rally. Though it’s possible for their market timing systems to generate a buy signal without capitulation, he thinks it’s unlikely given that “the last 10 bear markets have been signaled by” capitulation as their firm defines it.

Another analyst who’s been expecting capitulation is Sam Stovall, chief investment strategist at CFRA Research. He bases his definition of capitulation on a “15-day average of daily percent differences between intra-day highs and lows for the S&P 500.” Capitulation occurs “when spikes [are] well above two standard deviations.” Because the market at the June low didn’t satisfy his definition, Stovall says he’s been treating market strength since then as a bear market rally.

However, like Blay and Schannep, Stovall stressed that it’s possible that a bear market could end without capitulation. In an email, Stovall said that if the S&P 500 retraces 50% of its bear market decline, then he would conclude that the June lows are unlikely to be broken. That 50% retracement level is 4,232 — just 2% higher than where it currently stands (as of the market close Aug. 4).

What about market timers in other arenas?

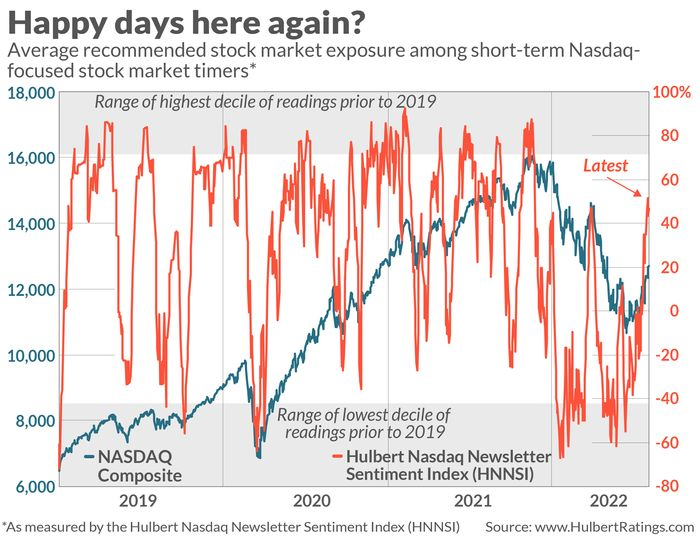

The Nasdaq market is just one of the arenas in which my firm tracks market timers’ average exposure levels. Three others are the broad U.S. stock market (focusing on benchmarks such as the S&P 500), the gold market, and the U.S. bond market (the aggregate investment grade bond market).

The chart below summarizes where the timers currently stand in all four arenas.