Dow Theory’s Prescription for the Bond Debacle Dilemma

Due to the surge in interest rates, long-duration bonds have experienced a significant loss of value, amounting to a 50% drawdown. This substantial decline in the so-called safe haven asset class resembles the drawdowns seen in stock indexes, underscoring the fact that unexpected events occur. Investors sometimes harbor a false sense of security through simplistic strategies like buy and hold or the 60/40 portfolio.

So, let’s assess whether the Dow Theory (DT) has provided protection to bond investors throughout the bear market that commenced in August 2020.

To begin, we know that since the inception of TLT, the Dow Theory has consistently delivered strong results by outperforming buy and hold and mitigating drawdowns. In previous posts (found HERE, HERE, and HERE), I substantiated these results with robust data, illustrating the effectiveness of the DT when applied to TLT and EDV. I also demonstrated that the DT was much more effective at cutting drawdowns and achieving outperformance vs. buy and hold (BAH) than other trend-following systems. Therefore, my emphasis on the Dow Theory is not a trivial fixation but a thoroughly reasoned choice.

However, the research I linked to above concluded in March 2022. Therefore, we need to assess the developments from that date and, more crucially, evaluate how the DT has performed in safeguarding bond investors since the onset of the bear market on August 4, 2020. In essence, scrutinizing the most recent bear market offers an excellent “out of sample” test. Moreover, my prior research primarily took place during a thriving bond bull market. Given the substantial shift in the market environment, assessing how the DT performs when confronted with a significant bear market makes sense.

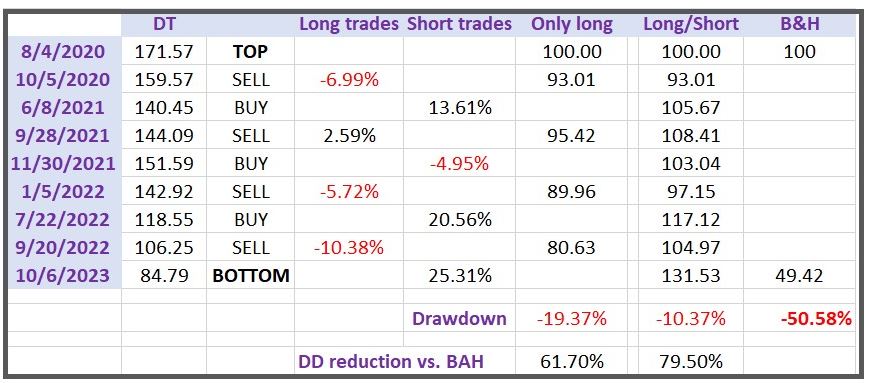

The following trades are the ones that I have publicly disclosed on my blog and in my monthly letter to subscribers. So, it is not a simulation but a compilation of the actual trades I discerned in real time.

The rules applied are as follows:

- I initiated the analysis at TLT’s market peak on 8/4/2020, beginning with an equity of $100 for both Buy and Hold (BAH) and the Dow Theory.

- The analysis concludes on 10/6/2023, marking the most recent bear market low.

- Dividends are not factored in for either BAH or the DT; the focus is on pure price action.

- For BAH, the calculations are straightforward: I consider the initial price of TLT and the final price.

- For the DT, two subsets are calculated. The first is the DT “only long,” which means that when a Sell signal is generated, the portfolio moves to cash. No interest accrual while in cash has been taken into account. The second subset is the DT “long/short,” in which the DT triggers a SELL, resulting in a short position. Conversely, when a BUY signal is given, the short position is covered, and the portfolio goes long. This approach maximizes the potential inherent in the Dow Theory. Like BAH, the DT commences at the top on 8/4/2020.

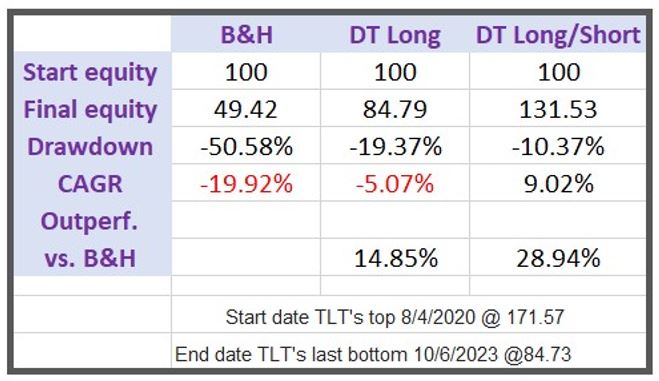

Now, let’s delve into the performance comparison, as shown in the Table below:

We can observe that Buy and Hold (BAH) yielded a negative Compound Annual Growth Rate (CAGR) of -19.92% with a substantial maximum drawdown of -50.50% (a clear example of capital destruction!). On the other hand, the Dow Theory’s “only long” approach, which shifts to cash when a Sell signal triggers, incurred considerably smaller losses, boasting a CAGR of -5.07% and a drawdown of only -19.73%. This means the drawdown was more than halved. In terms of outperformance, the Dow Theory outpaced BAH by an impressive 14.85% annually. Quite remarkable!

The right column shows the full and logical application of the DT, which entails going short. This strategy resulted in a significant CAGR increase to 9.02%, and the drawdown was minimized to -10.37%. Compared to BAH, the outperformance of the “long/short” Dow Theory skyrocketed to 28.04% annually. Do you recognize the distinction between a -19.92% annual loss and a 9.02% annual gain?

Such outperformance is not an anomaly; I have documented in my blog that the Dow Theory excels during market downturns. After all, if the market consistently rose in a straight line, trend followers would, at best, match the performance of Buy and Hold. Bear markets are the breeding ground for our outperformance and drawdown reduction. This is why trend following tests investors’ patience. When any market enjoys a sustained upward trajectory, trend following (including the Dow Theory) will, at best, keep pace with Buy and Hold. Market timing truly shines during challenging periods, which are inevitable. Patience is vital, but it is well rewarded.

The table below displays the breakdown of the DT trades, including the percentage gained or lost, as well as the percentage reduction in drawdown compared to BAH.

.

Conclusions:

- The Dow Theory is not, as many believe, a cult. When applied to stocks, it boasts a well-documented, third-party-validated track record spanning over 130 years.

- As elucidated in several posts (example HERE & HERE), the DT can also be applied to other markets (oil, precious metals, crypto, and bonds).

- The DT is in my opinion the most accurate trend following method. Why? HERE and HERE is the answer.

- The DT worked beautifully during the secular bond bull market but, more importantly, it has also shown great outperformance vs. BAH and drawdown reduction in the present huge bear market. Therefore, precisely when it is most needed, the Dow Theory has proven to be a protective shield for investors.

- Hence, multimarket application, documented track records, proven outperformance and drawdown reduction should boost our confidence in utilizing the DT in our investment strategy.

Sincerely,

Manuel Blay

Editor of thedowtheory.com