It took a while for Ethereum to confirm Bitcoin, but it happened at last.

Let’s recap the technical landscape for Bitcoin.

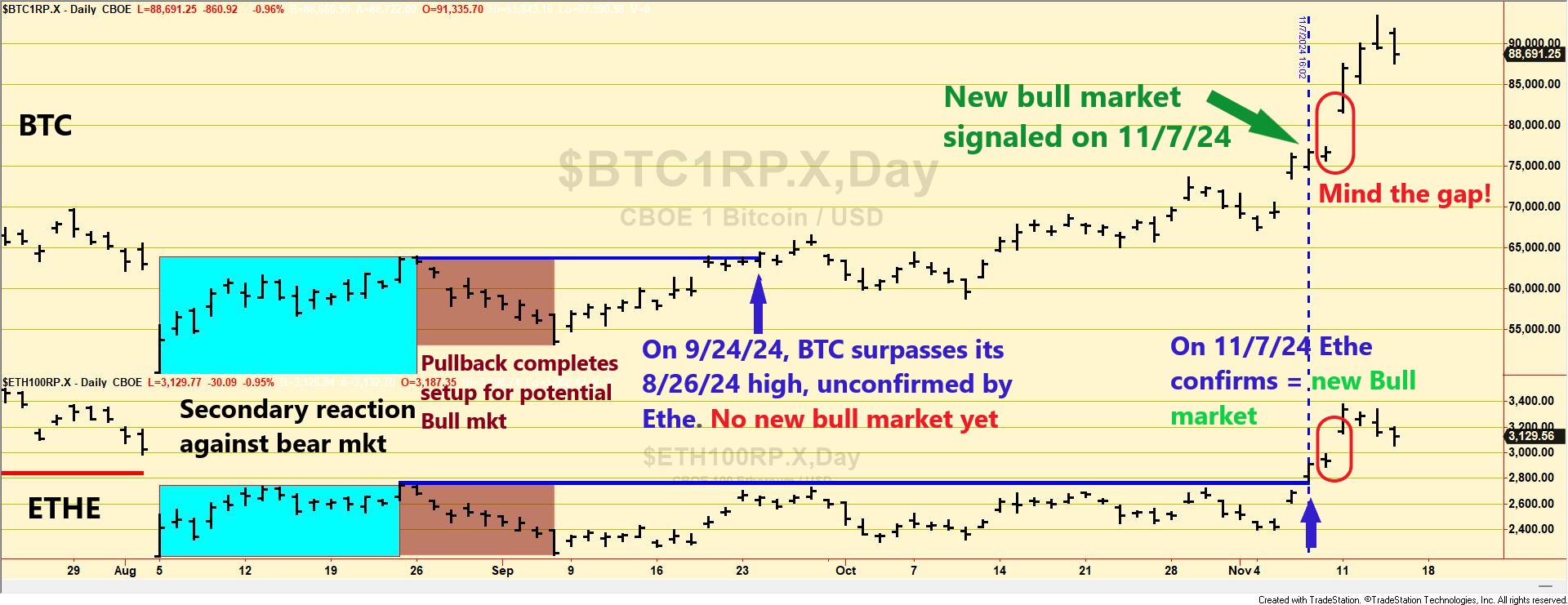

Bitcoin and Ethereum made their last bear market lows on 8/5/24. A rally followed such lows until 8/23/24 (Ethereum) and 8/26/24 (Bitcoin). Such a rally qualified as a secondary reaction against the bearish trend.

Both BTC and ETHE experienced a pullback until 9/6/24. The pullback, which lasted more than two days, had enough extent to set both cryptocurrencies up for a potential primary bull market.

On 9/24/24, BTC surpassed its 8/26/24 secondary reaction highs, but ETHE did not confirm. Absent confirmation from ETHE, no new bull market was signaled.

The awaited confirmation was given by ETHE when, on 11/7/24, it finally broke up its 8/23/24 secondary reaction highs, and according to the Dow Theory, a new bull market has been signaled.

The charts below highlight the most recent price action that led to the new bull market signal. The blue rectangles showcase the secondary (bullish) reaction against the then-existing bear market. The brown rectangles highlight the pullback that set up both cryptocurrencies for a potential bull market signal. The blue horizontal lines highlight the secondary reaction highs, which were the relevant price levels to be jointly surpassed for a new bull market.

So, the primary and secondary trends are now bullish.

As I write this post (11/14/24), Bitcoin is overbought, and I would not be surprised to see it receding from its current lofty levels to take a breather before resuming its ascent to higher highs. You may observe a huge gap in the chart, which I highlighted with a red oval. Gaps tend to get filled, so it would be normal price action if Bitcoin and Ethereum recede to fill the gap.

The Dow Theory nailed the bear market that started in mid-March 2024, and now it is back to bullish. Dow Theory signals don’t come around every day. When they do, smart money sits up and takes notice. Why? Because this isn’t just another fleeting market indicator. The Dow Theory boasts an impressive track record across diverse markets, making it the Swiss Army knife of financial forecasting, and it is much more accurate than other trend-following indicators such as moving averages. I provided the evidence HERE, HERE.

Sincerely,

Manuel Blay

Editor of thedowtheory.com