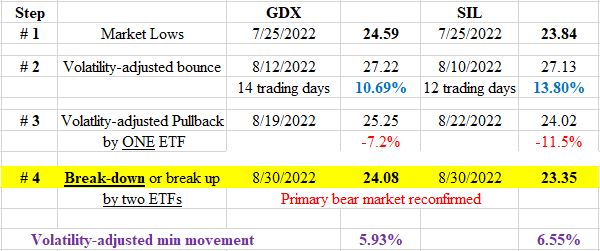

Dow Theory Update for September 3: Primary bear market for SIL and GDX reconfirmed on 8/30/22

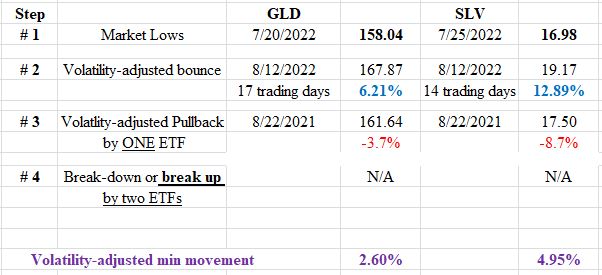

Primary bear market for GLD and SLV reconfirmed on 9/1/22. Very soon, I will pen a new post concerning GLD and SLV. The overall picture for precious metals is bearish. I don’t want to give names, but when I signaled a primary bear market, I was criticized. The perma-bulls had an arsenal of reasons for […]