Category: Precious Metals

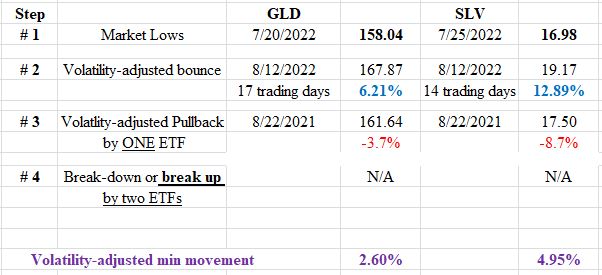

Dow Theory Update for August 24: Setup for a primary bull market completed for precious metals

posted on: August 24, 2022

Gold and Silver miners ETFs have also set up from a potential primary bull market signal GOLD AND SILVER A) Market situation if one appraises secondary reactions not bound by the three weeks dogma. As I explained here, the primary and secondary trend was signaled as bearish on 6/30/22. Following the 7/20/22 closing […]

Dow Theory Update for July 5: Bear market for gold and silver signaled on 6/30/2022

posted on: July 5, 2022

U.S. bonds are in a secondary reaction against the primary bear market. A post will follow soon. GOLD AND SILVER A) Market situation if one appraises secondary reactions not bound by the three weeks dogma. The primary trend was signaled as bullish on 11/11/21, as I explained here. In my June 16th, 2022, post I […]

Dow Theory Update for June 27: Primary bear market signaled for GDX & SIL on 6/23/22

posted on: June 27, 2022

Gold and Silver remain in a primary bull market GOLD AND SILVER MINERS ETFs A) Market situation if one appraises secondary reactions not bound by the three weeks dogma. In my 6/16/22 post, I explained that on 6/14/22, GDX had broken downside, its 5/12/22 secondary reaction low (pullback) unconfirmed by SIL. On 6/23/22, SIL confirmed […]

Dow Theory Update for June 16: Update on the trends for precious metals and their miners ETFs (GDX & SIL)

posted on: June 16, 2022

I am publishing this post before the close. Therefore, things might change. Readers, do your own homework GOLD AND SILVER A) Market situation if one appraises secondary reactions not bound by the three weeks dogma. The primary trend was signaled as bullish on 11/11/21, as I explained here. Despite the current pullback, the trend remains […]

Dow Theory Update for June 6: Setup for a potential primary bull market in U.S. bonds completed

posted on: June 6, 2022

Update on the trends for precious metals. US INTEREST RATES General Remarks: In this post, I provided a thorough explanation concerning the rationale behind my use of two alternative definitions to appraise secondary reactions. TLT is the iShares 20 years + Treasury bond ETF. More about it here IEF is […]

Dow Theory Update for May 26: Catching up with precious metals & their ETF miners

posted on: May 26, 2022

GOLD AND SILVER In this post, I provided a thorough explanation concerning the rationale behind my use of two alternative definitions to appraise secondary reactions. A) Market situation if one appraises secondary reactions not bound by the three weeks dogma. The primary trend was signaled as bullish on 11/11/21, as I explained […]

Dow Theory Update for May 13: All investing strategies need protection against bear markets. Three examples. Make no mistake about it.

posted on: May 13, 2022

A brief update on the trends for U.S.U.S. stocks, U.S. Bonds, and precious metals & their miners’ ETFs. The primary trends for gold & silver, SIL & GDX, and U.S. bond markets have not changed since I last reported. What is new since my last reporting is a nasty secondary reaction against the […]

Dow Theory Update for April 20: Update on the trends for precious metals and their ETF miners

posted on: April 20, 2022

The trend for US bonds remains bearish I am posting before the close, so things might change. Please do your homework. GOLD AND SILVER In this post, I provided a thorough explanation concerning the rationale behind my use of two alternative definitions to appraise secondary reactions. A) Market situation if one appraises secondary […]

Dow Theory Update for March 9th: Primary bull market signaled for gold and silver on 3/1/22 when one takes the “longer-term” interpretation of the Dow Theory.

posted on: March 9, 2022

The primary trend also bullish when one takes the “short-term” interpretation. GOLD AND SILVER In this post, I provided a thorough explanation concerning the rationale behind my use of two alternative definitions to appraise secondary reactions. A) Market situation if one appraises secondary reactions not bound by the three weeks dogma. […]

Dow Theory Update for January 8: Setup for a potential primary bear market in precious metals completed

posted on: January 8, 2022

Primary trend for US interest rates bearish GOLD AND SILVER In this post, I provided a thorough explanation concerning the rationale behind my use of two alternative definitions to appraise secondary reactions. A) Market situation if one appraises secondary reactions not bound by the three weeks dogma. The primary trend […]

Dow Theory Update for December 14: Precious metals under a secondary reaction against the primary bull market.

posted on: December 14, 2021

US bonds and US stock indexes remain in a primary bull market GOLD AND SILVER In this post, I provided a thorough explanation concerning the rationale behind my use of two alternative definitions to appraise secondary reactions. A) Market situation if one appraises secondary reactions not bound by the three weeks dogma. […]

Dow Theory Update for November 16: Recap of the Dow Theory outperformance across many markets

posted on: November 16, 2021

GLD/SLV, GDX/SIL, USO/XLE, TLT, and the Dow Industrials Is the Dow Theory only for US stock indexes? Does it work? Is it not a thing of the past? The Dow Theory works and outperformed Buy & Hold across many markets (energy, precious metals, and their ETF miners, US bonds, US stock indexes). Look at the […]

Back To Top