Result: No secondary reaction yet

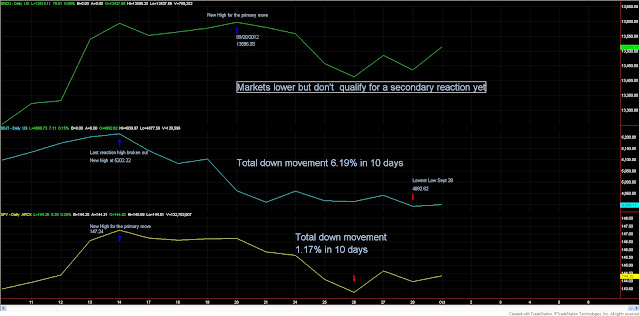

As I promised yesterday, here you have an updated chart of the Industrials, Transports and the SPY and the implication to be derived from a Dow Theory standpoint.

As you can see, only the Transports have fulfilled the requirements for a secondary reaction to exist. The Industrials haven’t even corrected for 10 trading days (since its last highs were made on 09/20/2012. And the SPY although it has corrected for more than 10 days, it hasn’t even reached the critical 3% threshold for a downward movement to qualify as a secondary reaction.

However, one of the main tenets of the Dow Theory is that any movement (i.e. a secondary reaction) to be valid must be confirmed by two indices. This is not the case as of this writing and hence we have to conclude that the very light downward movement doesn’t even qualify as a secondary reaction.

This has two implications for investors:

a) For latecomers the “sweet” entry point is not ready yet. If you don’t understand this sentence you should read this post “What should I do if I missed the Dow Theory bull signals for the SPY and GLD? Dow Theory’s second chance: The first secondary reaction” which you can find here

b) For those already “in” we still cannot raise our trailing stops which continue fixed at the June 4 bear market lows. More on how to place stops under Dow Theory here

Here the chart:

|

| Under Dow Theory only the Transports are experiencing secondary reaction unconfirmed by other indices |

Here the details as to the relevant figures to appraise the existence of a secondary reaction:

| SPY | ||||||

| Last primary leg primary movement up | ||||||

| LAST HIGH | 147.24 | 09/14/2012 | ||||

| PRIOR LOW | 128.1 | 06/04/2012 | ||||

| Amount primary | 0.14941452 | |||||

| movement | ||||||

| Correction until Sep 28, 2012. | ||||||

| LAST HIGH | 147.24 | 09/14/2012 | ||||

| Last low recorded | 143.97 | 09/28/2012 | ||||

| pullback down | -0.02220864 | doesn’t qualify as a correction | ||||

| total up leg | 19.14 | points | ||||

| total correct | 3.27 | points | ||||

| % secondary | ||||||

| corrected | 0.17084639 | far for retracing at least 1/3 of prior leg up | ||||

| Industrials | Warning: Industrials haven’t corrected for 10 days | |||||

| Last primary leg primary movement up | ||||||

| LAST HIGH | 13596.93 | 09/20/2012 | ||||

| PRIOR LOW | 12101.46 | 06/04/2012 | ||||

| Amount primary | 0.12357765 | |||||

| movement | ||||||

| Correction until Sep 28, 2012. | ||||||

| LAST HIGH | 13596.93 | 09/14/2012 | ||||

| Last low recorded | 13437.1 | 09/28/2012 | ||||

| pullback down | -0.01175486 | doesn’t qualify as a correction | ||||

| total upleg | 1495.47 | points | ||||

| total correct | 159.83 | points | ||||

| % secondary | ||||||

| corrected | 0.1068761 | far for retracing at least 1/3 of prior leg up | ||||

Transports |

|

|||||

| Last primary leg primary movement up | ||||||

| LAST HIGH | 5215.97 | 09/14/2012 | ||||

| PRIOR LOW | 4847.73 | 06/04/2012 | ||||

| Amount primary | 0.07596133 | |||||

| movement | ||||||

| Correction until Sep 28, 2012. | ||||||

| LAST HIGH | 5215.97 | 09/14/2012 | ||||

| Last low recorded | 4892.62 | 09/28/2012 | ||||

| pullback down | -0.0619923 | Qualifies as a correction | ||||

| total upleg | 368.24 | points | ||||

| total correct | 323.35 | points | ||||

| % secondary | ||||||

| corrected | 0.87809581 | It has retraced more than 1/3 qualifies as a correction | ||||

Sincerely,

The Dow Theorist