Precious metals fail to reverse bearish trends

Russell warns of excessive bullishness among investment advisors

In his last two Dow Theory Letters, Richard Russell has warned that bullish advisers clearly outnumber bearish advisers.

Normally, such excessive bullishness tends to beget at the very least a secondary reaction.

However, as readers of this Dow Theory blog are well aware, market action will have the last word. If a secondary reaction is coming we will soon know. In the meantime, we study diligently the markets.

Stocks

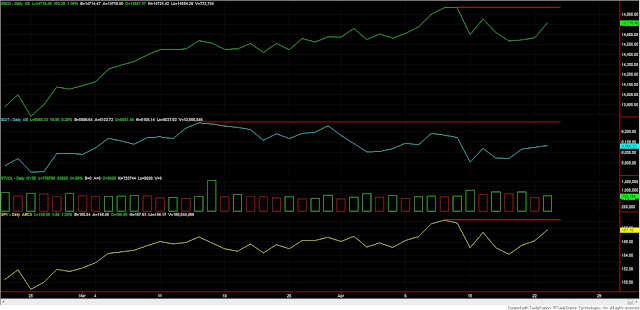

The SPY, Industrials and Transports closed up. However, in spite of recent price advances, no index has been able to better the last recorded highs as shown on the chart below (the horizontal red line shows the high-water mark). I am wondering whether the secondary reaction has turned bearish. I need further study which I hope to complete tomorrow in order to pronounce my verdict. The primary trend is bullish.

|

| Markets are failing to better the last recorded highs (horizontal red lines) |

Today’s volume was higher than yesterday’s, which is bullish. The overall pattern of volume remains bearish.

Gold and silver

Is GLD being bled to death? So it seems as inventory losses is gaining momentum. Here you can find the latest data:

GLD and SLV closed down. The primary and secondary trend remains bearish.

SIL and GDX, the gold and silver miners ETF, closed down. The primary and secondary trend remains bearish.

Here you have the figures of the markets I monitor for today:

| Data for April 23, 2013 | |||

| DOW THEORY PRIMARY TREND MONITOR SPY | |||

| SPY | |||

| Bull market started | 11/15/2012 | 135.7 | |

| Bull market signaled | 01/02/2013 | 146.06 | |

| Last close | 04/23/2013 | 157.78 | |

| Current stop level: Bear mkt low | 135.7 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 8.02% | 16.27% | 7.63% | |

| DOW THEORY PRIMARY TREND MONITOR GOLD (GLD) | |||

| GLD | |||

| Bull market started | 05/16/2012 | 149.46 | |

| Bull market signaled | 08/22/2012 | 160.54 | |

| Exit December 20 | 12/20/2012 | 161.16 | |

| Current stop level: Sec React low | 11/02/2012 | 162.6 | |

| Realized Loss % | Tot advance since start bull mkt | ||

| 0.39% | 7.83% | ||

| DOW THEORY PRIMARY TREND MONITOR SILVER (SLV) | |||

| SLV | |||

| Bull market started | 06/28/2012 | 25.63 | |

| Bull market signaled | 08/22/2012 | 28.92 | |

| Exit December 20 | 12/20/2012 | 29 | |

| Current stop level: Sec React low | 11/02/2012 | 29.95 | |

| Realized gain % | Tot advance since start bull mkt | ||

| 0.28% | 13.15% | ||

| DOW THEORY PRIMARY TREND MONITOR ETF SIL | |||

| SIL | |||

| Bull market started | 07/24/2012 | 17.08 | |

| Bull market signaled | 09/04/2012 | 21.83 | |

| Exit January 23 | 01/24/2013 | 21.69 | |

| Current stop level: Sec React low | 11/15/2012 | 21.87 | |

| Realized Loss % | Tot advance since start bull mkt | Max Pot Loss % | |

| -0.64% | 26.99% | 27.81% | |

| DOW THEORY PRIMARY TREND MONITOR ETF GDX | |||

| GDX | |||

| Bull market started | 05/16/2012 | 39.56 | |

| Bull market signaled | 09/04/2012 | 47.77 | |

| Exit January 23 | 01/24/2013 | 44.56 | |

| Current stop level: Sec React low | 12/05/2012 | 45.35 | |

| Realized Loss % | Tot advance since start bull mkt | Max Pot Loss % | |

| -6.72% | 12.64% | 20.75% | |

Sincerely,

The Dow Theorist