However, SIL and GDX’ trend remains bearish

Today has been a relevant day when we examine the markets under the prism of the Dow Theory.

Stocks

The SPY, Transportors, and Industrials closed down.

Today’s volume was lower than Friday’s. Since overall the stocks market was “down”, contracting volume has a bullish connotation.

Gold and Silver

SLV and GLD closed down. The primary trend is bearish, as explained hereand reconfirmed bearish here. The secondary trend is bullish (secondary reaction against the primary bearish trend), as explained here.

SIL closed up, and GDX closed down.

The secondary trend for GDX and SIL is bullish, as explained here.

The ongoing pullback for GDX has setup the GDX and SIL charts for a primary bull market setup under the Dow Theory.

Please mind that a setup for a primary bull market is not the same as the “very” primary bull market signal.

Readers of this Dow Theory blog know that the sequence for an ordinary primary bull market signal require: (a) secondary reaction against the primary bear market; (b) qualifying pullback, and (c) both indices breakup the secondary reaction highs.

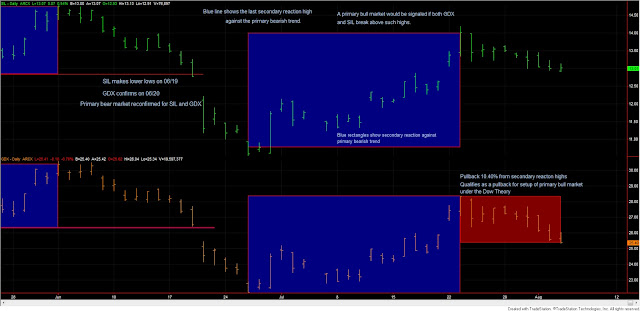

If you look at the chart below you will find:

a) We have had a secondary reaction, as shown by the blue rectangles.

b) GDX has retraced -10.40% from its 07/23 closing highs. As I calculated here, the minimum movement for GDX under the Dow Theory to be meaningful amounts to ca. 7.75%. Thus, the current pullback exceeds the “noise” threshold, and sets up GDX and SIL for a primary bull market signal.

|

| The red rectangle shows the ongoing pullback in GDX. SIL and GDX have setup for a primary bull market signal |

Here you have more details as to the current pullback:

| GDX | Date | SIL |

Date | |||

| Sec Reac High | 28.35 | 7/23/2013 | Sec Reac High | 14.01 | 7/23/2013 | |

| Pullback | 25.4 | 8/05/2013 | Pullback | 13 | 8/02/2013 | |

| Pctg pullback | -0.10406 | Pctg pullback | -0.07209 |

On the other hand, SIL’s pullback doesn’t reach the minum volatlity threshold to be meaningful under the Dow Theory.

Please mind that the pullback need not occur on both indices. As I wrote here:

Rhea wrote that the principle of confirmation becomes more important the longer the time frame. In other words, a primary bull market signal is meaningless without confirmation. The same basically applies to secondary reactions. However, when it comes to rallies (or small pullbacks in bear markets) which I would label “tertiary movement,” some Dow Theorists are lukewarm with the principle of confirmation.

Here are two quotes from Hamilton (contained in Rhea’s master book “The Dow Theory”) which are illustrative:

“…Dow’s theory….stipulates for a confirmation of one average by the other. This constantly occurs at the inceptions of a primary movement, but is anything but consistently present when the market turns for a secondary swing”

“This illustration serves to emphasize the fact that while the two averages may vary in strength they will not materially vary in direction, especially in a major movement. Throughout all the years in which both averages have been kept this rule has proved entirely dependable. It is not only true of the major swings of the market but it is approximately true of the secondary reactions and rallies. It would not be true of the daily fluctuation (…)”

So from the two quotes we can deduct that a rally may be considered in itself without requiring confirmation. While this is not carved in stone and confirmation is always welcome, when we talk of a tertiary movement, we can be a little less demanding with the principle of confirmation. Please mind that one of the quotes even questions the inflexible application of the principle of confirmation to secondary reactions. As far as I know contemporary Dow Theorists like Russell, and Schannep have not gone that far and require confirmation for secondary reactions. So do I.

All in all, GDX and SIL have setup for a primary bull market signal, should the secondary highs (upper boundary of the blue rectangle) be broken up.

Now the miners, and by implication paper gold and silver are at crossroads. If the pullback continues and both SIL and GDX break the last recorded primary bear market lows (lower boundary of the blue rectangle), the primary bear market will be reconfirmed. If, on the other hand, the upper boundary is broken up a primary bull market will be signaled. This is a moment of truth.

Here you have the figures for the SPY, which represents the only market with a suggested open long position.

| Data for August 5, 2013 | |||

| DOW THEORY PRIMARY TREND MONITOR SPY | |||

| SPY | |||

| Bull market started | 06/24/2013 | 157.06 | |

| Bull market signaled | 07/18/2013 | 168.87 | |

| Last close | 08/05/2013 | 170.7 | |

| Current stop level: Bear mkt low | 157.06 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 1.08% | 8.68% | 7.52% | |

Sincerely,

The Dow Theorist