Primary and secondary trends unchanged

Next weekend, I will post the next issue in the saga “Face off: Schannep versus “classical” Dow Theory”, whose first part can be found here.

Let’s examine the markets under the prism of the Dow Theory

Stocks

The SPY, Industrials and Transports closed down.

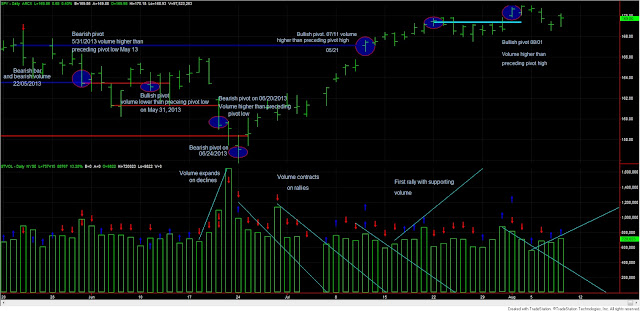

Today’s volume was higher than yesterday’s. Since stocks closed up, expanding volume has a bullish connotation. While volume readings are always more subjective than price readings (especially when price readings are anchored in the Dow Theory), and after weighting yesterday’s and today’s action, I’d say that volume is turning bullish. We have had two consecutive bullish volume days, and the last breakup of 08/01 was a bullish pivot, as was explained here.

Furthermore, albeit with not the text-book clearness I’d like to see, volume seems to expand on rallies and contract on pullbacks, which tends to be bullish.

Here you have an updated chart:

|

| Volume seems to be turning modestly bullish |

Gold and Silver

SLV and GLD gapped and closed up. The primary trend is bearish, as explained here and reconfirmed bearish here. The secondary trend is bullish (secondary reaction against the primary bearish trend), as explained here.

SIL closed and GDX closed up.

The secondary trend for GDX and SIL is bullish, as explained here.

Here you have the figures for the SPY, which represents the only market with a suggested open long position.

| Data for August 8, 2013 | |||

| DOW THEORY PRIMARY TREND MONITOR SPY | |||

| SPY | |||

| Bull market started | 06/24/2013 | 157.06 | |

| Bull market signaled | 07/18/2013 | 168.87 | |

| Last close | 08/08/2013 | 169.8 | |

| Current stop level: Bear mkt low | 157.06 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 0.55% | 8.11% | 7.52% | |

Sincerely,

The Dow Theorist