Gold and silver just about to signal primary bear market signal

Today has been an interesting day for those that analyze the markets under the Dow Theory.

The SPY, the Industrials and the Transports closed firmly up. The Transports by closing at 5310.75 clearly broke above the 06/19/2012 high of 5250.54.

However, the SPY and the Industrials, while being within short distance of the 09/14/2012 (SPY) and 10/05/2012 (Industrials) highs have refused to confirm the breakout of the Transports. Under Dow Theory, a movement not confirmed by at least one index is to be disregarded. Furthermore, if the non confirmation of the breakout were to persist in would have a bearish reading.

If either the SPY or the Industrials (or both) confirm the breakout of the Transports, the Dow Theory would be flashing a primary bull market. Such primary bull market signal is not frequent as it entails an uncorrected rally from the primary bear market lows. Such patter, albeit infrequent, is clearly part and parcel of the Dow Theory, and it was recorded by Rhea in his writings. You can fin more about the current setup in yesterday’s Dow Theory update which you can find here.

All in all: The primary trend remains bearish (although this can change quickly) and the secondary trend bullish.

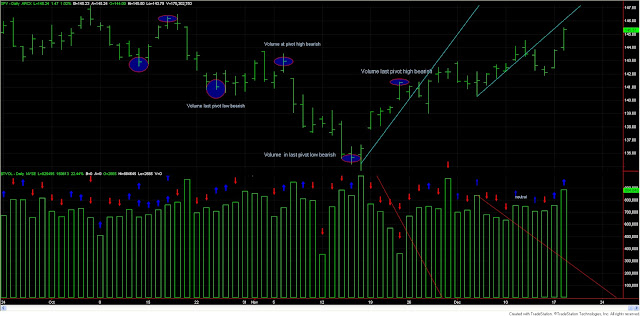

Volume was higher than yesterday’s and since it was an up day, it has a bullish connotation. Volume is becoming neutral. I insist the volume does not make trends but merely qualify them. In other words, I’d say that 90% of our trends are made by sheer price action. Volume serves to merely “fine tune” 10% of the trends made by price action. Or to put it otherwise: If you take 100 trends with confirming volume and 100 trends without confirming volume, the trends with confirming volume are 5% more likely to sport higher price. However, this does not mean that trends without supporting volume are going to fail. They are merely 5% less likely to continue its ascent. This is why volume, while important is always of secondary importance.

Here you have an updated chart:

|

| Volume is turning less bearish. More blue arrows in the last few days |

Today was a dramatic day in gold and silver. GLD (gold) violated its Nov 2 secondary reaction lows. Silver (SLV), however, while very weak, refused to violate its Nov 2 lows. So we got today in the precious metals a mirror image of that which is happening in stocks. We have had new lows unconfirmed. When or if silver violates its Nov 2 lows, we will get a confirmed primary bear market signal.

Here you have an updated chart:

|

| GLD violated its Nov 2. SLV refused to do so. |

SIL and GDX, the silver and gold ETF miners, closed down today. Technically, nothing has change, albeit both metals are very close to breaking the last recorded lows of Nov 15. The primary trend remains bullish and the secondary trend bearish.

And what about the vital BLV/GLD (long-term bond/gold term bond/gold) ratio? As you know, I keep a close eye to this ratio for the reasons explained here and here.

Well, the ratio is still refusing the announce Armaggedon (which accounts for gold’s weakness). However, technically something important has happened. More about such a ratio tomorrow in a special issue in this Dow Theory blog.

Here you have the figures of the markets I monitor for today:

| Data for December 18, 2012 | |||

| DOW THEORY PRIMARY TREND MONITOR SPY | |||

| SPY | |||

| Bear market started | 09/14/2012 | 147.24 | |

| Bear market signaled | 11/16/2012 | 136.37 | |

| Last close | 12/18/2012 | 145.37 | |

| Current stop level: Bull market high | 147.24 | ||

| Price chg since bear mkt signaled | Tot decline since start bear mkt | Max Pot Loss % | |

| 6.60% | -1.27% | -7.38% | |

| DOW THEORY PRIMARY TREND MONITOR GOLD (GLD) | |||

| GLD | |||

| Bull market started | 05/16/2012 | 149.46 | |

| Bull market signaled | 08/22/2012 | 160.54 | |

| Last close | 12/18/2012 | 162.08 | |

| Current stop level: Sec React low | 11/02/2012 | 162.6 | |

| Unrlzd gain % | Tot advance since start bull mkt | Min Pot Gain % | |

| 0.96% | 8.44% | 1.28% | |

| DOW THEORY PRIMARY TREND MONITOR SILVER (SLV) | |||

| SLV | |||

| Bull market started | 06/28/2012 | 25.63 | |

| Bull market signaled | 08/22/2012 | 28.92 | |

| Last close | 12/18/2012 | 30.65 | |

| Current stop level: Sec React low | 11/02/2012 | 29.95 | |

| Unrlzd gain % | Tot advance since start bull mkt | Min Pot Gain % | |

| 5.98% | 19.59% | 3.56% | |

| DOW THEORY PRIMARY TREND MONITOR ETF SIL | |||

| SIL | |||

| Bull market started | 07/24/2012 | 17.08 | |

| Bull market signaled | 09/04/2012 | 21.83 | |

| Last close | 12/18/2012 | 22.74 | |

| Current stop level: Bear mkt low | 17.08 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 4.17% | 33.14% | 27.81% | |

| DOW THEORY PRIMARY TREND MONITOR ETF GDX | |||

| GDX | |||

| Bull market started | 05/16/2012 | 39.56 | |

| Bull market signaled | 09/04/2012 | 47.77 | |

| Last close | 12/18/2012 | 45.75 | |

| Current stop level: Bear mkt low | 39.56 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| -4.23% | 15.65% | 20.75% | |

Sincerely,

The Dow Theorist