Unless there are major changes in the markets, I will post sparingly in the next few days. I wish the followers of this Dow Theory blog a merry Christmas.

US STOCKS

The primary and secondary trend is bearish, as explained here:

Here is an additional post concerning the likely decline to follow primary bear markets signals:

http://www.dowtheoryinvestment.com/2015/12/dow-theory-special-issue-additional.html

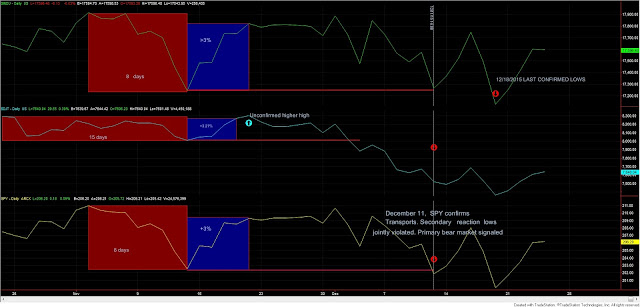

Following the primary bear market signal of Friday 11th December, stocks made lower confirmed lows on 12/18/2015. Hence, any secondary (bullish) reaction is to be counted starting from these last recorded lows. Hitherto, no secondary reaction has materialized yet. Here you have an updated chart:

|

| Snapshort of a primary bear market. No secondary reaction yet |

GOLD AND SILVER

The primary and secondary trend is bearish as explained here.

GOLD AND SILVER MINERS ETF

The primary trend remains bullish as explained here.

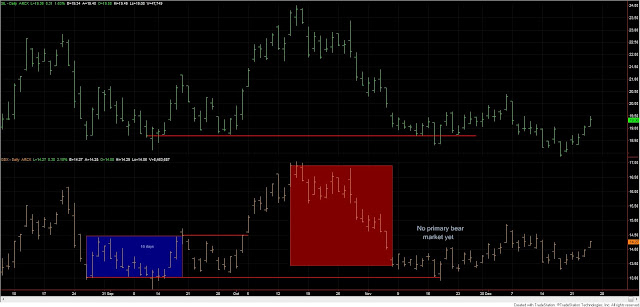

SIL has violated its 9/10/2015 closing low (last primary bear market low) unconfirmed by GDX. Both ETF miners are under a strong secondary reaction (displayed by the red rectangles on the chart below).

We have to wait for GDX to confirm. Until then we cannot declare a new primary bear market. The longer it takes for GDX to confirm, the better the odds for the primary bull market to survive. However, price action is king. Since mid-November GDX has refused to confirm. Here you have an updated chart.

|

| GDX (bottom) continues to refuse to confir. No primary bear market yet |

Sincerely,

The Dow Theorist