Gold and silver at crossroads.

US stocks

The Industrials, Transports and SPY closed up. In spite of today’s strong close, no index managed to make a higher high.

The primary trend was reconfirmed as bullish on October 17th and November 13th, for the reasons given here and here.

Today’s volume was lower than yesterday’s. This is bearish, as higher prices were not met by stronger volume. I’d label volume as bearish.

Gold and Silver

SLV and GLD closed timidly up. For the reasons I explained here, and more recently here, I feel the primary trend remains bearish. HereI analyzed the primary bear market signal given on December 20, 2012. The primary trend was reconfirmed bearish, as explained here. The secondary trend is bullish (secondary reaction against the primary bearish trend), as explained here.

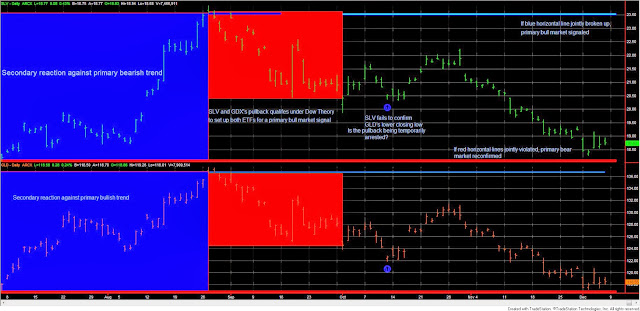

Here, I explained that GLD and SLV set up for a primary bull market signal. However, a setup is not the same as the “real thing,” namely the primary bull market; thus, many “setups” do not materialize and until the secondary reaction closing highs are jointly broken up, no primary bull market will be signaled. However, such set up will be nullified if GLD and SLV jointly violate the last recorded primary bear market lows, as I explained here. I see a very delicate technical picture for both SLV and GLD. If the reconfirmation of the primary bear market is to be avoided, both ETFs should start rallying now. Failure to escape “danger zone” right now, increases the odds for a dramatic decline. Here you have the charts that say it all:

|

| SLV and GLD remain too close to “danger zone” (primary bear market lows-red horizontal lines) |

As to the gold and silver miners ETFs, SIL closed up, and GDX closed down. The primary trend is bearish, as was profusely explained here and here. Likewise, the secondary trend is bearish.

All in all, the last shoe to drop for the precious metals sector would be GLD and SLV reconfirming the ongoing primary bear market. Until this happens, the secondary trend is bullish, and this is the only “bullishness” to be found in this beleaguered sector.

Here you have the figures for the SPY which represents the only market with a suggested open long position:

| Data for December 6, 2013 | |||

| DOW THEORY PRIMARY TREND MONITOR SPY | |||

| SPY | |||

| Bull market started | 06/24/2013 | 157.06 | |

| Bull market signaled | 07/18/2013 | 168.87 | |

| Last close | 12/06/2013 | 180.94 | |

| Current stop level: Secondary reaction low | 165.48 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 7.15% | 15.20% | 2.05% | |

Sincerely,

The Dow Theorist