In spite of some today’s up close, precious metals remain in the grips of the bear

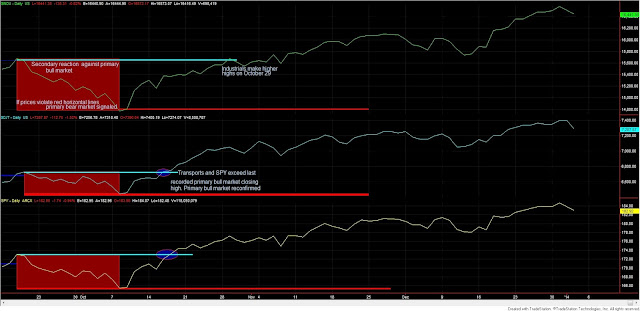

Tom Vician is a successful trend follower. His latest post in his “TrendFollowing Trader” blog alerts us that markets are severely overbought, both technically and in sentiment. Furthermore, he notes that the market laggards have recently outperformed the market. As he says “the detritus floats”, which is usually a bad omen. However, as a good trend follower, he waits for the actual signal and, in the meantime, acknowledges that the trend is up. Given his outstanding track record, it is worth to observe his thoughts. Personally, I feel the current run-up (or primary bull market leg) is due for a secondary correction, as you can see on the chart below; whether such a correction is to become a primary bear market, we cannot say; it is much too early. What is clear to me is that market sentiment is reaching extremes, as Zero Hedge reports here.

|

| Recent SPY action: A primary bull market. The last primary bull market swing might be aging |

US stocks

The SPY, Industrials and the Transports closed down and backed off from the most recent highs made last Tuesday highs.

The primary trend was reconfirmed as bullish on October 17th and November 13th, for the reasons given here and here.

Gold and Silver

SLV and GLD closed up. For the reasons I explained here, and more recently here, I feel the primary trend remains bearish. Here I analyzed the primary bear market signal given on December 20, 2012. The primary trend was reconfirmed bearish, as explained here. The secondary trend is bullish (secondary reaction against the primary bearish trend), as explained here.

As to the gold and silver miners ETFs, SIL, and GDX closed up. The primary trend is bearish, as was profusely explained here and here. Likewise, the secondary trend is bearish.

Later today, or tomorrow I will post a review of 2013 according to the Dow Theory. We will revisit all the Dow Theory-based market calls and how we have fared compared to buy and hold. It’ll be a real tour de force, as you will have before your eyes one full year of market action.

Here you have the figures for the SPY which represents the only market with a suggested open long position:

| Data for January 2, 2014 | |||

| DOW THEORY PRIMARY TREND MONITOR SPY | |||

| SPY | |||

| Bull market started | 06/24/2013 | 157.06 | |

| Bull market signaled | 07/18/2013 | 168.87 | |

| Last close | 01/02/2014 | 182.92 | |

| Current stop level: Secondary reaction low | 165.48 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 8.32% | 16.47% | 2.05% | |

Sincerely,

The Dow Theorist