Primary bear market for stocks still in force until Transports confirm.

Let’s get started with our Dow Theory commentary for today.

Stocks

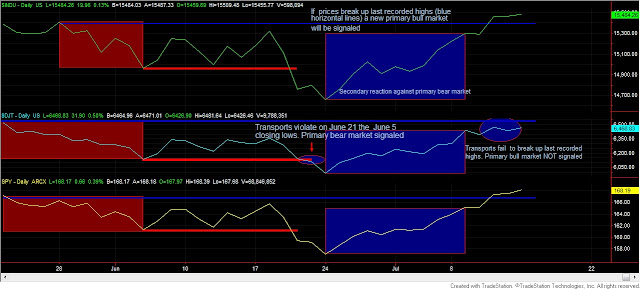

The SPY, Industrials, and Transports closed up. As you can see on the chart below, the Transports have not bettered the last recorded highs (blue horizontal line) yet, and, accordingly, as explained here, no primary bull market has been signaled. The ellipse highlights the lack of confirmation.

|

| Transports have hitherto not confirmed higher closing highs made by the Industrials (top) and SPY (bottom) |

The secondary trend is bullish, as has been explained here.

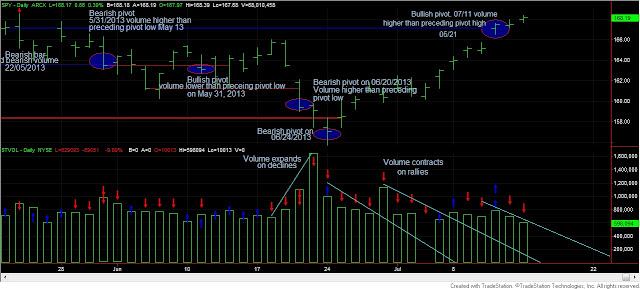

Friday’s volume was lower than Thursday’s, which was bearish, as Friday was an “up” day. Today’s volume was lower than Friday’s, which is also bearish. The overall pattern of volume is bearish, as:

1) There are more red arrows (bearish volume days) than blue arrows (bullish volume days), as you can see from the chart below.

2) Volume clearly recedes when prices stage a rally lasting some days (declining trend lines).

On the plus side, we have to note that three trading days ago, we had a bullish pivot (highlighted with an ellipse), as was explained here.

Gold and Silver

SLV and GLD closed up. The primary trend is bearish, as explained here and reconfirmed bearish here. However, the secondary trend remains bearish too.

GDX and SIL, the gold and silver miners ETFs closed up. The primary trend is bearish, as explained here and reconfirmed bearish here.

The secondary trend for GDX and SIL is bullish, as explained here.

Here you have the figures of the markets I monitor for today, which contain no changes, as we are flat.

| Data for July 15, 2013 | |||

| DOW THEORY PRIMARY TREND MONITOR SPY | |||

| SPY | |||

| Bull market started | 11/15/2012 | 135.7 | |

| Bull market signaled | 01/02/2013 | 146.06 | |

| Exit June 21 | 06/21/2013 | 159.07 | |

| Current stop level: Sec reaction lows | 161.27 | ||

| Realized gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 8.91% | 17.22% | None. | |

| DOW THEORY PRIMARY TREND MONITOR GOLD (GLD) | |||

| GLD | |||

| Bull market started | 05/16/2012 | 149.46 | |

| Bull market signaled | 08/22/2012 | 160.54 | |

| Exit December 20 | 12/20/2012 | 161.16 | |

| Current stop level: Sec React low | 11/02/2012 | 162.6 | |

| Realized Loss % | Tot advance since start bull mkt | ||

| 0.39% | 7.83% | ||

| DOW THEORY PRIMARY TREND MONITOR SILVER (SLV) | |||

| SLV | |||

| Bull market started | 06/28/2012 | 25.63 | |

| Bull market signaled | 08/22/2012 | 28.92 | |

| Exit December 20 | 12/20/2012 | 29 | |

| Current stop level: Sec React low | 11/02/2012 | 29.95 | |

| Realized gain % | Tot advance since start bull mkt | ||

| 0.28% | 13.15% | ||

| DOW THEORY PRIMARY TREND MONITOR ETF SIL | |||

| SIL | |||

| Bull market started | 07/24/2012 | 17.08 | |

| Bull market signaled | 09/04/2012 | 21.83 | |

| Exit January 23 | 01/24/2013 | 21.69 | |

| Current stop level: Sec React low | 11/15/2012 | 21.87 | |

| Realized Loss % | Tot advance since start bull mkt | Max Pot Loss % | |

| -0.64% | 26.99% | 27.81% | |

| DOW THEORY PRIMARY TREND MONITOR ETF GDX | |||

| GDX | |||

| Bull market started | 05/16/2012 | 39.56 | |

| Bull market signaled | 09/04/2012 | 47.77 | |

| Exit January 23 | 01/24/2013 | 44.56 | |

| Current stop level: Sec React low | 12/05/2012 | 45.35 | |

| Realized Loss % | Tot advance since start bull mkt | Max Pot Loss % | |

| -6.72% | 12.64% | 20.75% | |

Sincerely,

The Dow Theorist