The Transports finally confirm higher closing highs made by SPY and Industrials

With no more preambles, let’s get commenced with our Dow Theory commentary for today.

Stocks

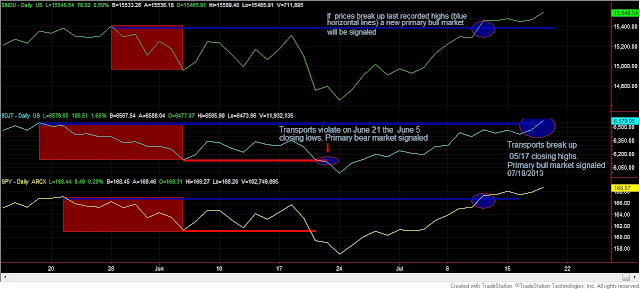

After some days lagging behind, the Transports finally managed to break above their 05/17/2013 closing highs, and thereby confirmed the Industrials and SPY’s prior breakout of 07/11/2013. A primary bull market has been signaled today.

While this is an unusual signal (namely, that the last recorded primary bull market highs get bettered straight away without the usual sequence: lows, secondary reaction against primary bear market, pullback and subsequent rally that betters the secondary reaction’s highs), it is a fully orthodox Dow Theory signal. As I explained here:

In case you are asking yourself whether such a breakup is “orthodox” according to the Dow Theory, I’ll tell you that “yes”; it is “orthodox” under Dow Theory, and Rhea, and Schannepexplicitly wrote about it, even though it is very infrequent. Since I have personally examined all the Dow Theory record, I can safely say that less than 10% of the primary bull market signals are flashed by this particular setup

The chart below says it all:

|

| The Transports (middle) finally bettered their last recorded highs (blue horizontal line): A primary bull market has been signaled according to the Dow Theory |

You can read more about this quite unusual signal here.

So, the Dow Theory signaled the existence of a primary bull market. Of course, this bull market was in existence, since the last recorded lows (06/24), and we should reclassify what currently passed as a secondary reaction, as a primary bull market swing. However, as with any market timing device, it is not possible to call in real time the very top or bottom of any movement.

Personally, I feel the market is heavily overbought and overextended, and I wouldn’t be surprised to see the market retreat swiftly. Rhea was well aware that after making higher highs, markets tend to enter into a secondary reaction. However, we really don’t know. What we do know is that the primary trend is bullish.

Where lays our Dow Theory stop? It lays at the last recorded primary bear market lows (06/24/2013), that is 7.52% below current the close of the SPY at 168.87. This is a quite narrow stop, which offers a good reward/risk ratio for the current long position.

I hope to get some time to write either tomorrow or next weekend about the new primary bull market, and what it means for investors. I’ll attempt to provide some valuable statistics. Readers of this blog, stay tuned!

The SPY, Transports, and Industrials closed up. The primary trend is bullish, and the secondary trend is bullish, as we have just explained.

Today’s volume was slightly higher than yesterday’s, which is bullish, as higher prices were joined by stronger volume. The overall pattern of volume remains bearish.

Gold and Silver

SLV and GLD closed up. The primary trend is bearish, as explained here and reconfirmed bearish here. Furthermore, the secondary trend remains bearish too.

GDX and SIL, the gold and silver miners ETFs closed down. The primary trend is bearish, as explained here and reconfirmed bearish here.

The secondary trend for GDX and SIL is bullish, as explained here.

Here you have the figures of the markets I monitor for today. Today there are changes, as we the primary trend for stocks turned bullish, which suggest a commitment on the long side.

| Data for July 18, 2013 | |||

| DOW THEORY PRIMARY TREND MONITOR SPY | |||

| SPY | |||

| Bull market started | 06/24/2013 | 157.06 | |

| Bull market signaled | 07/18/2013 | 168.87 | |

| Last close | 07/18/2013 | 168.87 | |

| Current stop level: Bear mkt low | 157.06 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 0.00% | 7.52% | 7.52% | |

Sincerely,

The Dow Theorist