Executive summary:

- The gold and silver (GLD & SLV) have been under a secondary reaction since 7/18/23.

- The current secondary reaction notwithstanding, the primary trend for gold and silver remains bearish.

General Remarks:

In this post, I thoroughly explained the rationale behind my use of two alternative definitions to appraise secondary reactions.

GOLD AND SILVER

A) Market situation if one appraises secondary reactions not bound by the three weeks dogma.

I explained HERE that gold and silver have been in a primary bear market since 6/21/23.

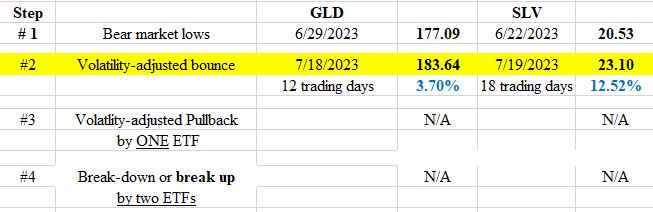

On 6/22/23, SLV reached a temporary bottom, while GLD did the same on 6/29/23. Following these lows, a rally ensued until 6/22/23 (SLV, 18 days) and 6/20/23 (GLD, 12 days), satisfying the time requirement for a secondary reaction. In terms of extent, as demonstrated in the table below, both ETFs significantly exceeded the Volatility-Adjusted Minimum Movement (for further explanations about VAMM, here). Altogether, the conditions for a secondary reaction have been met.

Now, we are confronted with three potential outcomes:

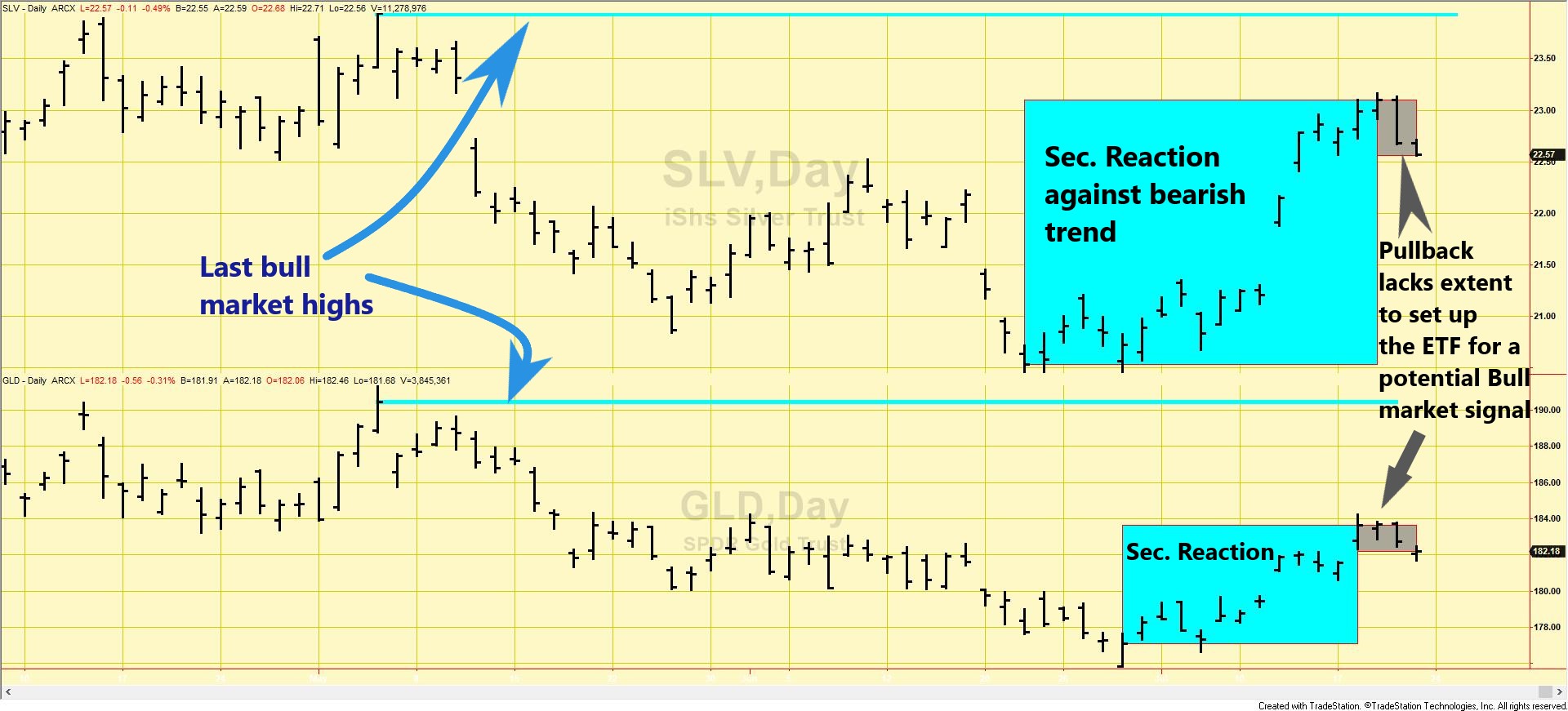

a) Once the ongoing pullback surpasses the Volatility-Adjusted Minimum Movement (VAMM) – you can find more information about VAMM here– the conditions for a new primary bull market would be fulfilled.

b) If the pullback does not reach the VAMM, and both ETFs continue to climb higher, breaking above the last recorded market highs (GLD: 5/4/23 @ 190.44 and SLV: 23.94), a primary bull market would also be signaled. This alternative signal has been extensively discussed in the past (examples HERE & HERE).

c) If both ETFs drop below the closing lows of 6/29 (GLD) and 6/22/23 (SLV), the primary bear market would be reconfirmed, and the current secondary reaction would come to an end.

The charts below aid in visualizing the present situation. The blue horizontal lines highlight the peaks of the last recorded bull market (letter “b” above). A confirmed breakthrough of these lines would signal a new primary bull market. On the right side of the charts, the blue rectangles represent the current secondary reaction, while the grey rectangles depict a pullback that did not meet the extent requirement to establish the ETFs for a primary bull market.

B) Market situation if one sticks to the traditional interpretation demanding at least three weeks of movement to declare a secondary reaction.

As I explained HERE, the primary trend was signaled as bearish on 6/21/23.

The latest rally has not persisted for a minimum of 15 confirmed trading days, leading to the absence of a secondary reaction.

Consequently, both the primary and secondary trends remain bearish.

Sincerely,

Manuel Blay

Editor of thedowtheory.com