Transports fail to rally

Let’s get started with our Dow Theory commentary for today:

The SPY and Industrials closed up. The Transports closed down. No index has been able to break above the most-recent highs. However, it is too early to declare the existence of a secondary reaction for the reasons explain on last Friday’s post on this Dow Theory blog.

Today’s volume was lower than Friday’s, which is bearish as higher prices were not confirmed by expanding volume. The overall pattern of volume is bearish.

Gold and Silver

GLD and SLV closed up. The primary and secondary trend remains bearish.

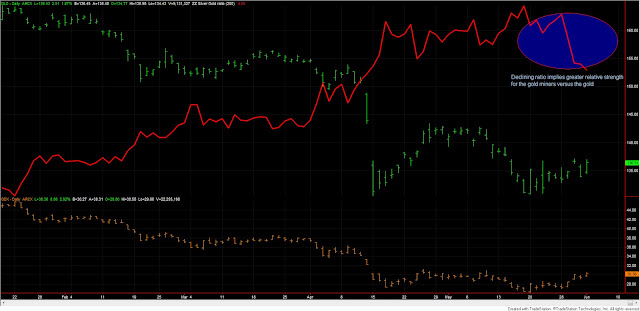

GDX and SIL the gold and silver miners ETFs, closed up. The miners are showing more relative strength than their respective precious metals of late. This might be indicative of an itermediate bottom for gold and silver. While not shown here, SIL is displaying greater relative strength than SLV as well. Here you have an updated chart for GDX/GDLratio chart. A declining red line (the ratio) implies that the miners are stronger than gold.

|

| While still to early to jump the gun, GDX greater relative strength favors GLD |

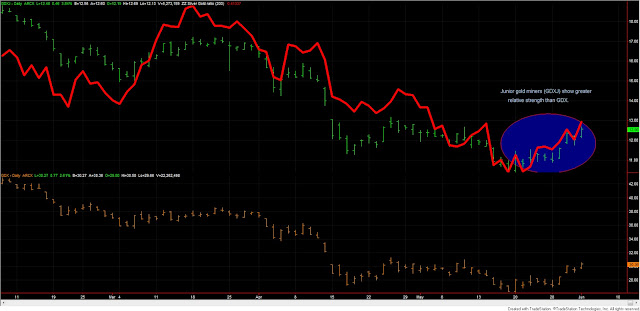

I also detected that GDXJ (the junior gold miners) is showing more relative strength than GDX (the senior gold miners), which might be indicative of a greater risk appetite and tends to be bullish for both the miners and the gold itself. Here you have the GDXJ/GDX ratio chart. An ascending red line (the ratio) implies that the junior miners are stronger than the seniors. Stronger juniors tend to be supportive of the whole gold-mining universe.

|

| Junior gold miners stronger than their senior peers, which is bullish for all gold miners and at the same time for gold |

However, I lend more credence to the very trend of prices (not that of ratios), and, until now, it is bearish for the entire precious metals’ universe. The primary and secondary trend for the miners remains bearish.

Here you have the figures of the markets I monitor for today:

| Data for June 3, 2013 | |||

| DOW THEORY PRIMARY TREND MONITOR SPY | |||

| SPY | |||

| Bull market started | 11/15/2012 | 135.7 | |

| Bull market signaled | 01/02/2013 | 146.06 | |

| Last close | 06/03/2013 | 164.35 | |

| Current stop level: Bear mkt low | 135.7 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 12.52% | 21.11% | 7.63% | |

| Alternative Schannep’s stoploss: | |||

| Highest closing high | 05/21/2013 | 167.17 | |

| 16% stoploss from highest closing high | 140.42 | ||

| Max Pot Loss % | |||

| -3.86% | |||

| DOW THEORY PRIMARY TREND MONITOR GOLD (GLD) | |||

| GLD | |||

| Bull market started | 05/16/2012 | 149.46 | |

| Bull market signaled | 08/22/2012 | 160.54 | |

| Exit December 20 | 12/20/2012 | 161.16 | |

| Current stop level: Sec React low | 11/02/2012 | 162.6 | |

| Realized Loss % | Tot advance since start bull mkt | ||

| 0.39% | 7.83% | ||

| DOW THEORY PRIMARY TREND MONITOR SILVER (SLV) | |||

| SLV | |||

| Bull market started | 06/28/2012 | 25.63 | |

| Bull market signaled | 08/22/2012 | 28.92 | |

| Exit December 20 | 12/20/2012 | 29 | |

| Current stop level: Sec React low | 11/02/2012 | 29.95 | |

| Realized gain % | Tot advance since start bull mkt | ||

| 0.28% | 13.15% | ||

| DOW THEORY PRIMARY TREND MONITOR ETF SIL | |||

| SIL | |||

| Bull market started | 07/24/2012 | 17.08 | |

| Bull market signaled | 09/04/2012 | 21.83 | |

| Exit January 23 | 01/24/2013 | 21.69 | |

| Current stop level: Sec React low | 11/15/2012 | 21.87 | |

| Realized Loss % | Tot advance since start bull mkt | Max Pot Loss % | |

| -0.64% | 26.99% | 27.81% | |

| DOW THEORY PRIMARY TREND MONITOR ETF GDX | |||

| GDX | |||

| Bull market started | 05/16/2012 | 39.56 | |

| Bull market signaled | 09/04/2012 | 47.77 | |

| Exit January 23 | 01/24/2013 | 44.56 | |

| Current stop level: Sec React low | 12/05/2012 | 45.35 | |

| Realized Loss % | Tot advance since start bull mkt | Max Pot Loss % | |

| -6.72% | 12.64% | 20.75% | |

Sincerely,

The Dow Theorist.