Distribution days continue to pile up.

Let’s get started with our Dow Theory commentary in this blog for today.

Special note on gold

GLD lost yesterday (Feb 28) a 3.91 tonnes of gold (0.947%). Thus, inventories have been declining for 8 days in a row. Accordingly, inventories have declined from 1322.97 tons to 1254.49 tonnes, that is 68.48 tonnes or 4.88%.

If my readings of the GLD inventory spreadsheet are correct never before was such an uninterrupted spell of “pukes.”

I have written extensively about the bullishness of such an event (contrary to conventional wisdom), as you can find hereand here.

Stocks

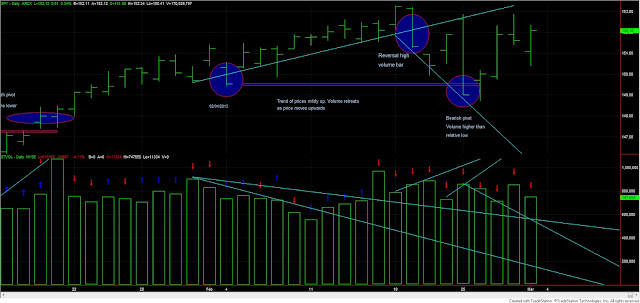

The SPY and Industrials closed up. The Transports closed down. The Industrials made a higher high bettering the highs made on February 27. However, such higher highs remain unconfirmed. Such lack of confirmations, together with our bearish volume readings, increase the odds for a secondary reaction. However, it is too early to tell.

Today’s volume was lower than yesterday’s. Since the SPY, Nasdaq and Industrials closed up it was a bullish day. However, bullish action unconfirmed by expanding volume has a bearish connotation. That today was another bearish volume day. Thus, today we had the ninth bearish volume day in a row. Here you have an updated chart:

|

| So many distribution days (red arrows) seem increases the odds for a reversal (secondary reaction) |

Gold and silver.

SLV closed up. GLD closed down. The primary and secondary trend remains bearish.

As to the miners ETFs, GDX and SIL, both closed down and made lower lows. Such confirmed lower lows confirm the primary bear market, and it is certainly not bullish. Here you have an updated chart depicting a clear bear market.

|

| A clear bear market in the mining stocks. Today, once again, the primary bear market has been re-confirmed |

If I find enough time, I plan to post a new piece concerning the average duration and average gain of bull markets according to the classical Dow Theory. The conclusions arising from this future article are really valuable for any investor. This post is the result of some comments left by the New Low Observer (NLO) in my Seeking Alpha blog.

Here you have the figures of the markets I monitor for today:

| Data for March 1, 2013 | |||

| DOW THEORY PRIMARY TREND MONITOR SPY | |||

| SPY | |||

| Bull market started | 11/15/2012 | 135.7 | |

| Bull market signaled | 01/02/2013 | 146.06 | |

| Last close | 01/03/2013 | 152.11 | |

| Current stop level: Bear mkt low | 135.7 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 4.14% | 12.09% | 7.63% | |

| DOW THEORY PRIMARY TREND MONITOR GOLD (GLD) | |||

| GLD | |||

| Bull market started | 05/16/2012 | 149.46 | |

| Bull market signaled | 08/22/2012 | 160.54 | |

| Exit December 20 | 12/20/2012 | 161.16 | |

| Current stop level: Sec React low | 11/02/2012 | 162.6 | |

| Realized Loss % | Tot advance since start bull mkt | ||

| 0.39% | 7.83% | ||

| DOW THEORY PRIMARY TREND MONITOR SILVER (SLV) | |||

| SLV | |||

| Bull market started | 06/28/2012 | 25.63 | |

| Bull market signaled | 08/22/2012 | 28.92 | |

| Exit December 20 | 12/20/2012 | 29 | |

| Current stop level: Sec React low | 11/02/2012 | 29.95 | |

| Realized gain % | Tot advance since start bull mkt | ||

| 0.28% | 13.15% | ||

| DOW THEORY PRIMARY TREND MONITOR ETF SIL | |||

| SIL | |||

| Bull market started | 07/24/2012 | 17.08 | |

| Bull market signaled | 09/04/2012 | 21.83 | |

| Exit January 23 | 01/24/2013 | 21.69 | |

| Current stop level: Sec React low | 11/15/2012 | 21.87 | |

| Realized Loss % | Tot advance since start bull mkt | Max Pot Loss % | |

| -0.64% | 26.99% | 27.81% | |

| DOW THEORY PRIMARY TREND MONITOR ETF GDX | |||

| GDX | |||

| Bull market started | 05/16/2012 | 39.56 | |

| Bull market signaled | 09/04/2012 | 47.77 | |

| Exit January 23 | 01/24/2013 | 44.56 | |

| Current stop level: Sec React low | 12/05/2012 | 45.35 | |

| Realized Loss % | Tot advance since start bull mkt | Max Pot Loss % | |

| -6.72% | 12.64% | 20.75% | |

Sincerely,

The Dow Theorist.