Gold and silver up

GLD inventory conundrum explained?

Richard Russell of the “Dow Theory Letters” has recently said that “China is looking at the gold ETFs as an opportunity to collect huge hoards of gold in one fell swoop. Beneath the quiet and dull action of gold, a fierce battle among the accumulators is going on”. Is China buying GLD shares and redeeming them in order to get the inventory, that is the gold bullion? It seems Russell thinks so.

By the way, yesterday GLD didn’t lose any inventory.

Stocks

The SPY, Industrials and Transports closed down. The primary and secondary trend is bullish according the the Dow Theory.

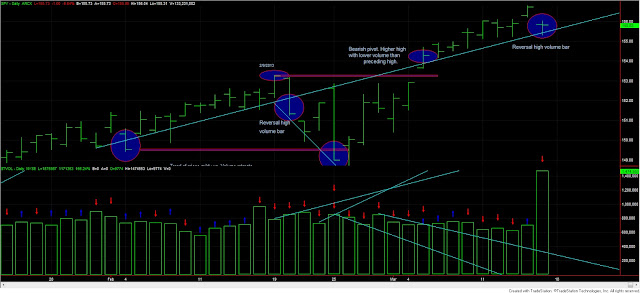

Today we had a monster volume day, which clearly exceeded yesterday’s. Since prices went down, it has a bearish connotation. Please look at the chart below, and you will see that today was a bearish volume reversal bar. Normally, such bars have follow-up, so the odds increase for lower prices ahead. Thus, volume remains bearish for the reasons I gave here.

|

| Today’s monster volume shows that selling pressure is rising |

Gold and silver

GDX and SLV closed up. The primary and secondary trend remains bearish.

GDX and SIL closed up. The primary and secondary trend remains bearish.

Here you have the figures of the markets I follow for today:

| Data for March 15, 2013 | |||

| DOW THEORY PRIMARY TREND MONITOR SPY | |||

| SPY | |||

| Bull market started | 11/15/2012 | 135.7 | |

| Bull market signaled | 01/02/2013 | 146.1 | |

| Last close | 03/15/2013 | 155.8 | |

| Current stop level: Bear mkt low | 135.7 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 6.69% | 14.83% | 7.63% | |

| DOW THEORY PRIMARY TREND MONITOR GOLD (GLD) | |||

| GLD | |||

| Bull market started | 05/16/2012 | 149.5 | |

| Bull market signaled | 08/22/2012 | 160.5 | |

| Exit December 20 | 12/20/2012 | 161.2 | |

| Current stop level: Sec React low | 11/02/2012 | 162.6 | |

| Realized Loss % | Tot advance since start bull mkt | ||

| 0.39% | 7.83% | ||

| DOW THEORY PRIMARY TREND MONITOR SILVER (SLV) | |||

| SLV | |||

| Bull market started | 06/28/2012 | 25.63 | |

| Bull market signaled | 08/22/2012 | 28.92 | |

| Exit December 20 | 12/20/2012 | 29 | |

| Current stop level: Sec React low | 11/02/2012 | 29.95 | |

| Realized gain % | Tot advance since start bull mkt | ||

| 0.28% | 13.15% | ||

| DOW THEORY PRIMARY TREND MONITOR ETF SIL | |||

| SIL | |||

| Bull market started | 07/24/2012 | 17.08 | |

| Bull market signaled | 09/04/2012 | 21.83 | |

| Exit January 23 | 01/24/2013 | 21.69 | |

| Current stop level: Sec React low | 11/15/2012 | 21.87 | |

| Realized Loss % | Tot advance since start bull mkt | Max Pot Loss % | |

| -0.64% | 26.99% | 27.81% | |

| DOW THEORY PRIMARY TREND MONITOR ETF GDX | |||

| GDX | |||

| Bull market started | 05/16/2012 | 39.56 | |

| Bull market signaled | 09/04/2012 | 47.77 | |

| Exit January 23 | 01/24/2013 | 44.56 | |

| Current stop level: Sec React low | 12/05/2012 | 45.35 | |

| Realized Loss % | Tot advance since start bull mkt | Max Pot Loss % | |

| -6.72% | 12.64% | 20.75% | |

Sincerely,

The Dow Theorist