Precious metals: The moment of truth is near

Let’s get started with our Dow Theory commentary for today in this blog.

Will a correction be averted?

The “Big Picture” blog contains an interesting article that shows that too many writers (yours truly included) expect a secondary reaction and, thus, this shows that the selling has already occurred. Here you have the link.

My take on the article is neutral. As I have written several times (i.e. here and here), we don’t trade secondary reactions but avail ourselves of them in order to set our stops. Thus, I really don’t care. If a secondary reaction develops and the primary bull market reasserts itself afterwards, we will have higher trailing stops, which is a good thing for Dow Theory investors in order to lock in profits. The exact timing of the secondary reaction is irrelevant to those investing along the primary trend.

Go to thispost in this Dow Theory blog, and you will see the way we “use” and “abuse” corrections in order to set our stops.

Stocks

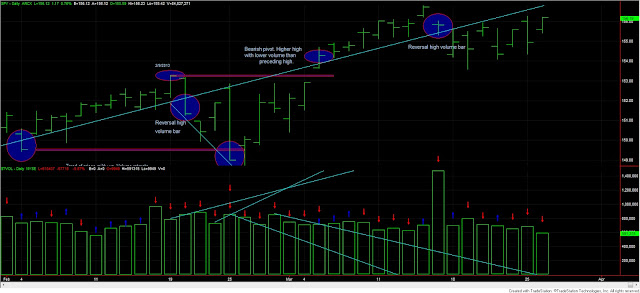

The SPY, Industrials and Transports closed up. Only the Industrials have managed to make higher highs. Such unconfirmed higher high implies that a secondary reaction may be forming. The primary and secondary trend remains bullish.

Today’s volume contracted dramatically. Higher prices were not met by expanding volume, which results in a bearish volume day. Bearish volume days are piling up, which suggest that distribution is taking place. Look at the chart and you will see the predominance of red arrows (bearish volume days).

|

| Volume is clearly bearish and suggest that this primary bull market leg is running out of steam |

Gold and silver

GLD, once again, didn’t either win or lose inventory yesterday.

GLD and SLV closed down. The primary and secondary trend remains bearish.

GDX closed down, and SIL closed up. The primary and secondary trend remains bearish.

Here you have the figures of the markets I monitor for today:

| Data for March 26, 2013 | |||

| DOW THEORY PRIMARY TREND MONITOR SPY | |||

| SPY | |||

| Bull market started | 11/15/2012 | 135.7 | |

| Bull market signaled | 01/02/2013 | 146.06 | |

| Last close | 03/26/2013 | 156.19 | |

| Current stop level: Bear mkt low | 135.7 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 6.94% | 15.10% | 7.63% | |

| DOW THEORY PRIMARY TREND MONITOR GOLD (GLD) | |||

| GLD | |||

| Bull market started | 05/16/2012 | 149.46 | |

| Bull market signaled | 08/22/2012 | 160.54 | |

| Exit December 20 | 12/20/2012 | 161.16 | |

| Current stop level: Sec React low | 11/02/2012 | 162.6 | |

| Realized Loss % | Tot advance since start bull mkt | ||

| 0.39% | 7.83% | ||

| DOW THEORY PRIMARY TREND MONITOR SILVER (SLV) | |||

| SLV | |||

| Bull market started | 06/28/2012 | 25.63 | |

| Bull market signaled | 08/22/2012 | 28.92 | |

| Exit December 20 | 12/20/2012 | 29 | |

| Current stop level: Sec React low | 11/02/2012 | 29.95 | |

| Realized gain % | Tot advance since start bull mkt | ||

| 0.28% | 13.15% | ||

| DOW THEORY PRIMARY TREND MONITOR ETF SIL | |||

| SIL | |||

| Bull market started | 07/24/2012 | 17.08 | |

| Bull market signaled | 09/04/2012 | 21.83 | |

| Exit January 23 | 01/24/2013 | 21.69 | |

| Current stop level: Sec React low | 11/15/2012 | 21.87 | |

| Realized Loss % | Tot advance since start bull mkt | Max Pot Loss % | |

| -0.64% | 26.99% | 27.81% | |

| DOW THEORY PRIMARY TREND MONITOR ETF GDX | |||

| GDX | |||

| Bull market started | 05/16/2012 | 39.56 | |

| Bull market signaled | 09/04/2012 | 47.77 | |

| Exit January 23 | 01/24/2013 | 44.56 | |

| Current stop level: Sec React low | 12/05/2012 | 45.35 | |

| Realized Loss % | Tot advance since start bull mkt | Max Pot Loss % | |

| -6.72% | 12.64% | 20.75% | |

Sincerely,

The Dow Theorist