Gold and silver at crossroads

Stocks

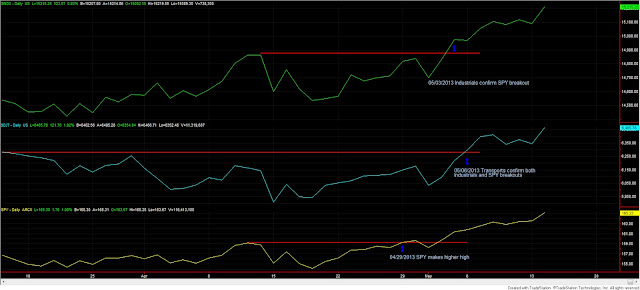

The SPY, Industrials and Transports made higher highs (see chart below). Such higher highs re-confirm the primary bull market in stocks. The primary and secondary trend remains bullish.

|

| Be it QE, be it inflation ahead, be it who knows what…higher highs confirm the primary bull market |

Today’s volume was higher than yesterday’s, which makes it a bullish volume day. The overall pattern of volume is neutral.

Gold and Silver

GLD and SLV closed down. Accordingly, the pullback whose study was made in this Dow Theory blog here continues. This further clarifies the existence of the setup for either a primary bull market or a re-confirmation of the primary bear market. Gold and silver are at crossroads now. Either they break above the secondary reaction highs thereby flashing a primary bull market signal, or violate the 04/15/2013 lows, thereby re-confirming the primary bear market. It is a really interesting technical formation.

In the meantime, the primary trend is bearish and the secondary trend is bullish.

GDX and SIL, the gold and silver miners, closed down. The primary and secondary trend remains bearish.

Here you have the figures of the markets I monitor for today.

| Data for May 14, 2013 | |||

| DOW THEORY PRIMARY TREND MONITOR SPY | |||

| SPY | |||

| Bull market started | 11/15/2012 | 135.7 | |

| Bull market signaled | 01/02/2013 | 146.06 | |

| Last close | 05/14/2013 | 165.23 | |

| Current stop level: Bear mkt low | 135.7 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 13.12% | 21.76% | 7.63% | |

| DOW THEORY PRIMARY TREND MONITOR GOLD (GLD) | |||

| GLD | |||

| Bull market started | 05/16/2012 | 149.46 | |

| Bull market signaled | 08/22/2012 | 160.54 | |

| Exit December 20 | 12/20/2012 | 161.16 | |

| Current stop level: Sec React low | 11/02/2012 | 162.6 | |

| Realized Loss % | Tot advance since start bull mkt | ||

| 0.39% | 7.83% | ||

| DOW THEORY PRIMARY TREND MONITOR SILVER (SLV) | |||

| SLV | |||

| Bull market started | 06/28/2012 | 25.63 | |

| Bull market signaled | 08/22/2012 | 28.92 | |

| Exit December 20 | 12/20/2012 | 29 | |

| Current stop level: Sec React low | 11/02/2012 | 29.95 | |

| Realized gain % | Tot advance since start bull mkt | ||

| 0.28% | 13.15% | ||

| DOW THEORY PRIMARY TREND MONITOR ETF SIL | |||

| SIL | |||

| Bull market started | 07/24/2012 | 17.08 | |

| Bull market signaled | 09/04/2012 | 21.83 | |

| Exit January 23 | 01/24/2013 | 21.69 | |

| Current stop level: Sec React low | 11/15/2012 | 21.87 | |

| Realized Loss % | Tot advance since start bull mkt | Max Pot Loss % | |

| -0.64% | 26.99% | 27.81% | |

| DOW THEORY PRIMARY TREND MONITOR ETF GDX | |||

| GDX | |||

| Bull market started | 05/16/2012 | 39.56 | |

| Bull market signaled | 09/04/2012 | 47.77 | |

| Exit January 23 | 01/24/2013 | 44.56 | |

| Current stop level: Sec React low | 12/05/2012 | 45.35 | |

| Realized Loss % | Tot advance since start bull mkt | Max Pot Loss % | |

| -6.72% | 12.64% | 20.75% | |

Sincerely,

The Dow Theorist