Gold and silver up.

Let’s see what the Dow Theory has in store for us in this blog today.

Stocks

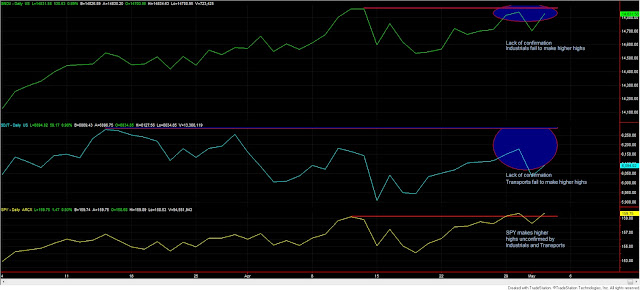

The SPY, Industrials and Transports closed up. Once again, the SPY has made a higher high whereas the Industrials, and the Transports are unable to confirm. According to the Dow Theory, the longer the lack of confirmation persists, the more likely we are seeing distribution. The chart below illustrates the lack of confirmation (Industrials and Transports fail to exceed the horizontal red lines, whereas SPY, at the bottom of the chart, clearly has broken out three days. Under Dow Theory for the primary trend to be reconfirmed, it is necessary that either the Industrials or the Transports (or both) make higher highs.

|

| The Industrials (top) and Transports (middle) fail to confirm the SPY (bottom of the chart) |

The primary and secondary trend remains bullish.

Today’s volume was lower than yesterday’s, which has a bearish connotation, as higher prices were not joined by increasing volume. The overall pattern of volume suggests distribution (which in turn increases the odds for a secondary reaction). By the way, Richard Russell of the Dow Theory Letters, has detected a worrisome increase of distribution days.

Gold and silver

GLD lost inventory, as we are accustomed to.

GLD and SLV closed up. I’d rather have seen a down day in order to witness the completion of a primary bull market setup, which requires a pullback of at least 3% for gold and ca. 6% for silver followed by a rebound exceeding the last recorded secondary highs (04/29/2013 for SLV, and 04/30/2013 for GLD). In the meantime, the primary trend is bearish and the secondary trend is BULLISH, as explained here.

GDX and SIL, the gold and silver miners ETF, closed down. The miners seem unable to even change the secondary trend from bearish to bullish, and, hence, both the primary and secondary trend is bearish.

Here you have the figures of the markets I monitor for today:

| Data for May 2, 2013 | |||

| DOW THEORY PRIMARY TREND MONITOR SPY | |||

| SPY | |||

| Bull market started | 11/15/2012 | 135.7 | |

| Bull market signaled | 01/02/2013 | 146.06 | |

| Last close | 05/02/2013 | 159.75 | |

| Current stop level: Bear mkt low | 135.7 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 9.37% | 17.72% | 7.63% | |

| DOW THEORY PRIMARY TREND MONITOR GOLD (GLD) | |||

| GLD | |||

| Bull market started | 05/16/2012 | 149.46 | |

| Bull market signaled | 08/22/2012 | 160.54 | |

| Exit December 20 | 12/20/2012 | 161.16 | |

| Current stop level: Sec React low | 11/02/2012 | 162.6 | |

| Realized Loss % | Tot advance since start bull mkt | ||

| 0.39% | 7.83% | ||

| DOW THEORY PRIMARY TREND MONITOR SILVER (SLV) | |||

| SLV | |||

| Bull market started | 06/28/2012 | 25.63 | |

| Bull market signaled | 08/22/2012 | 28.92 | |

| Exit December 20 | 12/20/2012 | 29 | |

| Current stop level: Sec React low | 11/02/2012 | 29.95 | |

| Realized gain % | Tot advance since start bull mkt | ||

| 0.28% | 13.15% | ||

| DOW THEORY PRIMARY TREND MONITOR ETF SIL | |||

| SIL | |||

| Bull market started | 07/24/2012 | 17.08 | |

| Bull market signaled | 09/04/2012 | 21.83 | |

| Exit January 23 | 01/24/2013 | 21.69 | |

| Current stop level: Sec React low | 11/15/2012 | 21.87 | |

| Realized Loss % | Tot advance since start bull mkt | Max Pot Loss % | |

| -0.64% | 26.99% | 27.81% | |

| DOW THEORY PRIMARY TREND MONITOR ETF GDX | |||

| GDX | |||

| Bull market started | 05/16/2012 | 39.56 | |

| Bull market signaled | 09/04/2012 | 47.77 | |

| Exit January 23 | 01/24/2013 | 44.56 | |

| Current stop level: Sec React low | 12/05/2012 | 45.35 | |

| Realized Loss % | Tot advance since start bull mkt | Max Pot Loss % | |

| -6.72% | 12.64% | 20.75% | |

Sincerely,

The Dow Theorist.