Gold and silver unable to show strength

Let’s get started with our analysis of the markets under the prism of the Dow Theory

Stocks

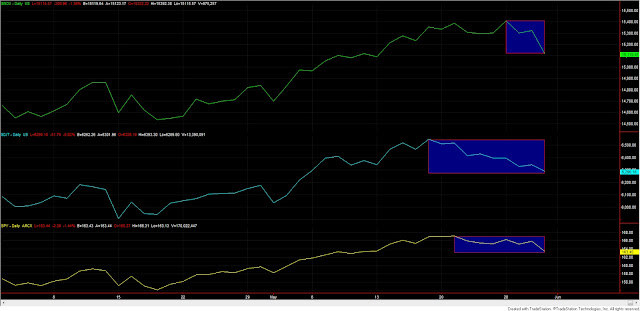

The SPY, Industrials and Transports closed down. While it is still too early to declare a secondary reaction in existence, we should keep our eyes glued on the charts. The Transports have been declining for 9 days. The Industrials and SPY for just 3 and 7 days. Thus, it is still too early to declare a secondary reaction since the last recorded highs. However, little by little we approach our 10 trading days requirement. Thus, and in spite of our “gut feeling,” we stick with the rules and keep classifying both the primary and secondary trend as bullish.

Here you have an updated chart. The blue rectangles signal market action since the last recorded highs.

|

| Still too early to declare a secondary reaction, but keep an eye on the blue rectangles |

Today’s volume was the highest seen since 04/15/2013. Furthermore, today’s volume was much higher than yesterday’s, which is bearish. To add insult to injury, today’s pivot low (see the chart below), was bearish as today’s volume clearly exceeded the volume seen at the preceding pivot low. Both pivots are highlighted with an ellipse, and both lows are connected with a red line. In my post of May 22, which you can find here, I stressed that the volume action seen on that day, negated any bullish volume reading. Thus, to recap, we have the following bearish volume signs:

1. Today’s bearish volume day within an overall pattern of bearish volume days in the last 3 days.

2. Today’s bearish pivot low.

3. Very bearish action on May 22.

|

| Volume is becoming bearish |

Therefore, the overall pattern of volume has become bearish. If we couple this bearish volume reading with the lack of confirmation of the last highs made by the Industrials on May 28 (more details here), we can conclude that the odds favor the development of a secondary reaction. Let’s see what happens.

Gold and Silver

GLD and SLV closed down. The primary and secondary trend remains bearish.

GDX and SIL, the gold and silver miners ETFs closed down. The primary and secondary trend remains bearish.

Yesterday, I wrote some comments concerning the relationship between the miners, gold and paper gold. You can read them here.

If I get some time, I plan to finish this weekend my study concerning the “classical/Rhea” Dow Theory record. You can find the first part of this study here.

Here you have the figures of the markets I monitor for today.

| Data for May 31, 2013 | |||

| DOW THEORY PRIMARY TREND MONITOR SPY | |||

| SPY | |||

| Bull market started | 11/15/2012 | 135.7 | |

| Bull market signaled | 01/02/2013 | 146.06 | |

| Last close | 05/31/2013 | 163.45 | |

| Current stop level: Bear mkt low | 135.7 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 11.91% | 20.45% | 7.63% | |

| Alternative Schannep’s stoploss: | |||

| Highest closing high | 05/21/2013 | 167.17 | |

| 16% stoploss from highest closing high | 140.42 | ||

| Max Pot Loss % | |||

| -3.86% | |||

| DOW THEORY PRIMARY TREND MONITOR GOLD (GLD) | |||

| GLD | |||

| Bull market started | 05/16/2012 | 149.46 | |

| Bull market signaled | 08/22/2012 | 160.54 | |

| Exit December 20 | 12/20/2012 | 161.16 | |

| Current stop level: Sec React low | 11/02/2012 | 162.6 | |

| Realized Loss % | Tot advance since start bull mkt | ||

| 0.39% | 7.83% | ||

| DOW THEORY PRIMARY TREND MONITOR SILVER (SLV) | |||

| SLV | |||

| Bull market started | 06/28/2012 | 25.63 | |

| Bull market signaled | 08/22/2012 | 28.92 | |

| Exit December 20 | 12/20/2012 | 29 | |

| Current stop level: Sec React low | 11/02/2012 | 29.95 | |

| Realized gain % | Tot advance since start bull mkt | ||

| 0.28% | 13.15% | ||

| DOW THEORY PRIMARY TREND MONITOR ETF SIL | |||

| SIL | |||

| Bull market started | 07/24/2012 | 17.08 | |

| Bull market signaled | 09/04/2012 | 21.83 | |

| Exit January 23 | 01/24/2013 | 21.69 | |

| Current stop level: Sec React low | 11/15/2012 | 21.87 | |

| Realized Loss % | Tot advance since start bull mkt | Max Pot Loss % | |

| -0.64% | 26.99% | 27.81% | |

| DOW THEORY PRIMARY TREND MONITOR ETF GDX | |||

| GDX | |||

| Bull market started | 05/16/2012 | 39.56 | |

| Bull market signaled | 09/04/2012 | 47.77 | |

| Exit January 23 | 01/24/2013 | 44.56 | |

| Current stop level: Sec React low | 12/05/2012 | 45.35 | |

| Realized Loss % | Tot advance since start bull mkt | Max Pot Loss % | |

| -6.72% | 12.64% | 20.75% | |

Sincerely,

The Dow Theorist