Gold and silver still in primary trend

Let’s see what the Dow Theory has in store for us today. Today is going to be another short post on this blog. Now need to babble when there is scarcity of technical relevant events (at least as my eye can see).

The three stock indices I monitor, the Industrials, Transports and SPY closed up today. In spite of today’s advance, both the primary and secondary trend remain bearish.

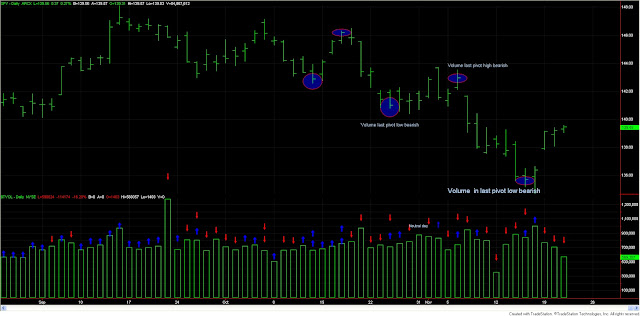

Volume was dramatically bearish today. As you can see in the chart below, volume contracted as the SPY moved up. Thus, we had another bearish volume day. You can see in the chart that the red arrows hold the upper hand. Furthermore, you can see that the rally that started four days ago off the lows has experienced declining volume. Certainly, volume is not confirming the new rally. Moreover, to make volume even more bearish, the last three pivots had bearish volume. So, even though, volume doesn’t make trends but merely qualifies them, clearly volume is giving us a bearish picture. At least short term (1-2 weeks ahead).

|

| Volume is not confirming the rally that started on 11/16/2012 |

Gold, silver and their respective ETFs (GDX, SIL) closed up today. Hitherto the entire precious metals’ universe is dodging a primary bear market signal. All of them remain stuck in a secondary reaction, but the primary trend remains bullish.

After last week’s storm of Dow Theory relevant events, now we are enjoying the calm. Will it last very long? Market action will tell.

Here you have the figures of the markets I monitor for today.

| Data for November 21, 2012 | |||

| DOW THEORY PRIMARY TREND MONITOR SPY | |||

| SPY | |||

| Bear market started | 09/14/2012 | 147.24 | |

| Bear market signaled | 11/16/2012 | 136.37 | |

| Last close | 11/21/2012 | 139.52 | |

| Current stop level: Bull market high | 147.24 | ||

| Price chg since bear mkt signaled | Tot decline since start bear mkt | Max Pot Loss % | |

| 2.31% | -5.24% | -7.38% | |

| DOW THEORY PRIMARY TREND MONITOR GOLD (GLD) | |||

| GLD | |||

| Bull market started | 05/16/2012 | 149.46 | |

| Bull market signaled | 08/22/2012 | 160.54 | |

| Last close | 11/21/2012 | 167.57 | |

| Current stop level: Bear mkt low | 149.46 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 4.38% | 12.12% | 7.41% | |

| DOW THEORY PRIMARY TREND MONITOR SILVER (SLV) | |||

| SLV | |||

| Bull market started | 06/28/2012 | 25.63 | |

| Bull market signaled | 08/22/2012 | 28.92 | |

| Last close | 11/21/2012 | 32.31 | |

| Current stop level: Bear mkt low | 25.63 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 11.72% | 26.06% | 12.84% | |

| DOW THEORY PRIMARY TREND MONITOR ETF SIL | |||

| SIL | |||

| Bull market started | 07/24/2012 | 17.08 | |

| Bull market signaled | 09/04/2012 | 21.83 | |

| Last close | 11/21/2012 | 22.92 | |

| Current stop level: Bear mkt low | 17.08 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 4.99% | 34.19% | 27.81% | |

| DOW THEORY PRIMARY TREND MONITOR ETF GDX | |||

| GDX | |||

| Bull market started | 05/16/2012 | 39.56 | |

| Bull market signaled | 09/04/2012 | 47.77 | |

| Last close | 11/21/2012 | 48.05 | |

| Current stop level: Bear mkt low | 39.56 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 0.59% | 21.46% | 20.75% | |

Sincerely,

The Dow Theorist.