Gold and silver escape danger zone

Let’s get started with our Dow Theory commentary for today.

Stocks closed up today. However, according to the Dow Theory, both the primary trend and secondary trend remain bearish. If you are not acquainted with the stock market primary bear market signal, you should read my post on this blog “Dow Theory special issue: After the dust has settled. Weekend commentary to the Dow Theory primary bear market signal” which you can read here.

However, volume, again, refused to confirm the stock’s advance.

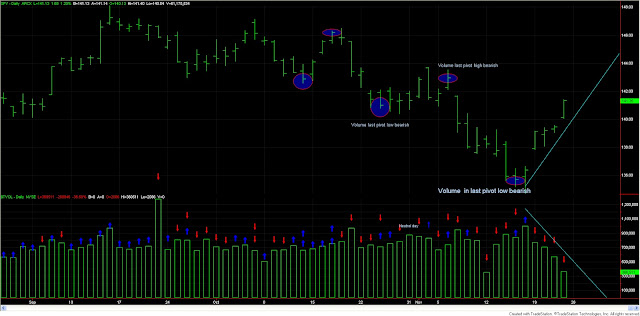

As you can see in the chart below today was a bearish volume day again. I know that today was a short trading day. However, what I see in the chart is that volume is not confirming market action. Red arrows and a down trendline confer a bearish inference.

|

| Volume bearish. Look at the diverging trends of price and volume |

Gold, silver and their respective miners ETFs closed up. Technically, nothing has changed according to the Dow Theory. The primary trend is bullish whereas the secondary trend is bearish.

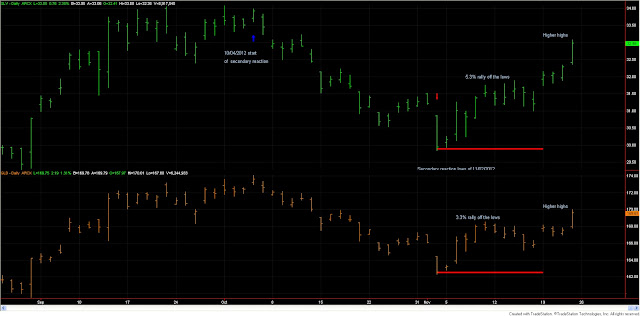

It is important to note that gold and silver seem to be escaping the “danger area” of the Nov 2 secondary lows. As you know, a joint violation by gold and silver of the Nov 2 lows would flash a primary bear market signal. Today’s action by making jointly new higher highs (although the highest highs have not been bettered yet), gold and silver are displaying strength.

Silver continues being the metal showing better relative strength.

Here you have an updated chart of GLD and SLV.

|

| Gold and silver seem are far from flashing a primary bear market signal |

Here you have the figures of the markets I monitor for today.

| Data for November 23, 2012 | |||

| DOW THEORY PRIMARY TREND MONITOR SPY | |||

| SPY | |||

| Bear market started | 09/14/2012 | 147.24 | |

| Bear market signaled | 11/16/2012 | 136.37 | |

| Last close | 11/23/2012 | 141.35 | |

| Current stop level: Bull market high | 147.24 | ||

| Price chg since bear mkt signaled | Tot decline since start bear mkt | Max Pot Loss % | |

| 3.65% | -4.00% | -7.38% | |

| DOW THEORY PRIMARY TREND MONITOR GOLD (GLD) | |||

| GLD | |||

| Bull market started | 05/16/2012 | 149.46 | |

| Bull market signaled | 08/22/2012 | 160.54 | |

| Last close | 11/23/2012 | 169.61 | |

| Current stop level: Bear mkt low | 149.46 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 5.65% | 13.48% | 7.41% | |

| DOW THEORY PRIMARY TREND MONITOR SILVER (SLV) | |||

| SLV | |||

| Bull market started | 06/28/2012 | 25.63 | |

| Bull market signaled | 08/22/2012 | 28.92 | |

| Last close | 11/23/2012 | 32.99 | |

| Current stop level: Bear mkt low | 25.63 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 14.07% | 28.72% | 12.84% | |

| DOW THEORY PRIMARY TREND MONITOR ETF SIL | |||

| SIL | |||

| Bull market started | 07/24/2012 | 17.08 | |

| Bull market signaled | 09/04/2012 | 21.83 | |

| Last close | 11/23/2012 | 23.38 | |

| Current stop level: Bear mkt low | 17.08 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 7.10% | 36.89% | 27.81% | |

| DOW THEORY PRIMARY TREND MONITOR ETF GDX | |||

| GDX | |||

| Bull market started | 05/16/2012 | 39.56 | |

| Bull market signaled | 09/04/2012 | 47.77 | |

| Last close | 11/23/2012 | 48.74 | |

| Current stop level: Bear mkt low | 39.56 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 2.03% | 23.21% | 20.75% | |

Sincerely,

The Dow Theorist.