Stocks: Primary trend remains bullish. Secondary trend bearish.

So what did the stock market today? Mixed action.

The Transports which continue showing good relative strength closed up for the day. The Industrials closed barely up, and the SPY closed down.

Thus, the secondary trend remains bearish and until now, the decline has been so timid that not even the minimum Dow Theory threshold of 3% has been reached. So patience is demanded.

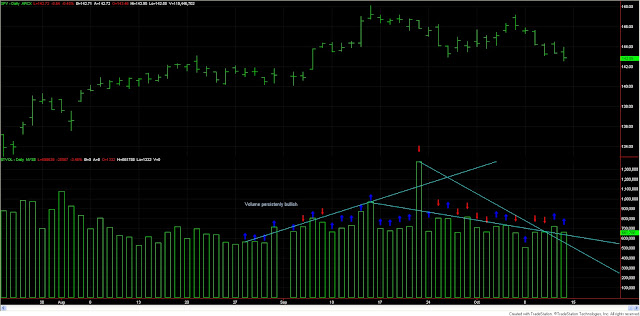

Today volume was bullish, since the SPY was clearly down and volume contracted. Volume indications remain mixed, with a slightly bearish bias short term. Again, you can see that volume supported the primary upward swing (volume increased together with prices) and has stagnated during this secondary reaction (hence confirming that the current pullback is nothing more than a secondary reaction and not the onset of a new bear market).

Here you have an updated chart of the volume patterns:

|

| Volume suggests that the current pullback is just a secondary reaction, not a new primary bear market |

As I wrote yesterday, and this is the subject for a future post, ca. 70% of the Dow Theory signals are profitable. If you couple this information with volume (which is saying that we are experiencing just a secondary reaction), we have to conclude that it is more logical to say that the primary bull market has still more time to live.

Doubters are encouraged to read my post:

“5 Reasons why I consider the stock market in a primary bull market” which you can read here

Such post remains fully fresh and valid.

The entire precious metals’ universe had a down day. In silver (SLV) and gold miners (GDX) minor technical damage was made as the 09/26/2012 lows were violated. Under Dow Theory such violation is likely to be deceptive as the new lows in silver were not confirmed by gold. By the same token, GDX new minor lows were not confirmed by SIL. Such law of confirmation forces me to say that the secondary trend of the precious metals’ universe (Gold/Silver and GDX/SIL) remain bullish. It goes without saying that the primary trend remains bullish as well.

Furthermore, as far as gold and silver are concerned, we have to bear in mind that on October 4, both metals jointly broke out previous highs. Under Dow Theory this was a very bullish event as it confirmed the primary trend and, additionally, “forced” us to “reset” the clock in order to count the minimum of 10 trading days for a secondary reaction to exist. For more details about the importance of such October 4 breakout, please read this post on this Dow Theory blog.

A final reason which confirms the primary trend in precious metals is the SIL/GDX ratio (red thick line in the chart) which continues solidly bullish (both primary and secondary movement). Normally, bullishness in this ratio reflect strength for the whole precious metals’ universe, since when prices decline, it is silver and its miners the first one to take a hit. Here you have an updated chart.

|

| Silver miners solidly bullish: Underlying strength for both gold and silver |

I will insist again that we are in the business of riding the primary trend. Outsmarting or second guessing secondary reactions is not our league, since we “use” them (i.e. in order to set our entry and exit points), but we don’t “trade” them. However, to satiate our restlessness, I allow myself to say that the technical action under Dow Theory seems to suggest that the yet to be born secondary reaction in the precious metals’ universe might be stopped in their tracks soon. October 4 was a clear warning of underlying strength, and today’s divergence seems to show that the timid pullback may be short-lived. While this may cheer up some of our readers, this would be bad news. We do need a secondary reaction, so I hope that at least this time the Dow Theory is wrong when it comes to forecasting the end of this pullback.

Conclusions: The primary trend for stocks continues bullish. The secondary trend is bearish but, until now, the retracement has been timid at best.

Gold, silver and their miners remain bullish in both the primary and secondary trend, and the odds favor a resumption of the upward movement, which, contrary to popular belief, would be bad news for Dow Theorists. If you don’t understand this statement, please read the following post in this Dow Theory blog: “Why Dow Theory matters: Outstanding Risk Reward Ratio thanks to the Dow Theory’s trailing stop” which you can fin here.

Later on this evening, I will publish the second part of the Special Dow Theory Issue concerning the “entrails” of this secondary reaction. In such post I will deal with the thorny issue of whether to buy indices or specific stocks.

Here you have the figures for today:

| Data for October 12, 2012 | |||

| DOW THEORY PRIMARY TREND MONITOR SPY | |||

| SPY | |||

| Bull market started | 06/04/2012 | 128.1 | |

| Bull market signaled | 06/29/2012 | 136.1 | |

| Last close | 10/12/2012 | 142.89 | |

| Current stop level: Bear mkt low | 128.1 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 4.99% | 11.55% | 6.25% | |

| DOW THEORY PRIMARY TREND MONITOR GOLD (GLD) | |||

| GLD | |||

| Bull market started | 05/16/2012 | 149.46 | |

| Bull market signaled | 08/22/2012 | 160.54 | |

| Last close | 10/12/2012 | 170.11 | |

| Current stop level: Bear mkt low | 149.46 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 5.96% | 13.82% | 7.41% | |

| DOW THEORY PRIMARY TREND MONITOR SILVER (SLV) | |||

| SLV | |||

| Bull market started | 06/28/2012 | 25.63 | |

| Bull market signaled | 08/22/2012 | 28.92 | |

| Last close | 10/12/2012 | 32.47 | |

| Current stop level: Bear mkt low | 25.63 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 12.28% | 26.69% | 12.84% | |

| DOW THEORY PRIMARY TREND MONITOR ETF SIL | |||

| SIL | |||

| Bull market started | 07/24/2012 | 17.08 | |

| Bull market signaled | 09/04/2012 | 21.83 | |

| Last close | 10/12/2012 | 24.37 | |

| Current stop level: Bear mkt low | 17.08 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 11.64% | 42.68% | 27.81% | |

| DOW THEORY PRIMARY TREND MONITOR ETF GDX | |||

| GDX | |||

| Bull market started | 05/16/2012 | 39.56 | |

| Bull market signaled | 09/04/2012 | 47.77 | |

| Last close | 10/12/2012 | 51.66 | |

| Current stop level: Bear mkt low | 39.56 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 8.14% | 30.59% | 20.75% | |

Sincerely,

The Dow Theorist