Transports finally confirm under Dow Theory.

The good thing of the Dow Theory is that it doesn’t provide us with “news” every day.

However, today is one of those rare days that are vital to understand future market action. Today is an important day.

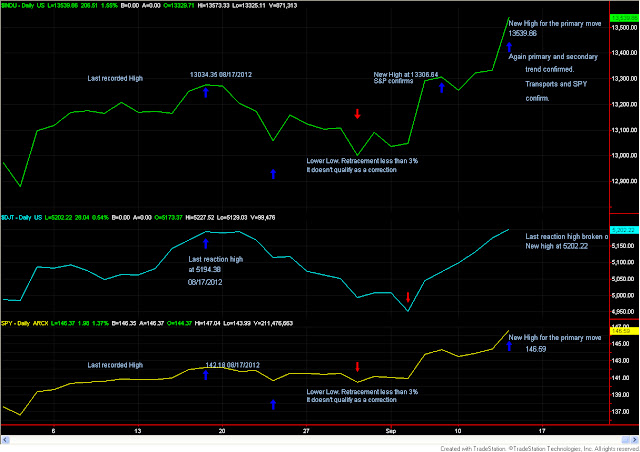

The three stock indices I follow under Dow Theory: The Industrial, The S&P (SPY) and the Transports have broken out to new absolute highs since the primary bull movement started on June 4th (signaled by Dow Theory on June 29th). You can find more details as to the “guts” of the primary bull market signal in my posts “Where is the Bull market now as per Dow Theory” which you can find hereand here.

Higher highs always have a bullish indication and confirm the underlying trend. In our case, it confirms that the secondary movement continues in its bullish mode and by the same token, the primary bull movement displays its good health.

Volume as been again bullish exceeding yesterday’s volume which was bullish as well.

Here you have the charts of the three indices:

|

| The market has had another bullish breakout under Dow Theory |

However, the most bullish implication under Dow Theory is the fact that the Transports have finally deigned to confirm the primary bull market previously signaled by the SPY and the Industrials.

In my Dow Theory update for September 11, I wrote:

“we have to keep an eye on the Transports which are getting closer and closer to the previous secondary highs and are making higher lows since 07/25/2012. We will watch it like a hawk”

Like a hawk I monitored the Transports and today we find that the transports exceeded their previous reaction high made on 08/17/2012 at 5194.38. Today’s close at 5202.22 puts the Transport in bullish territory (namely a primary bull trend and thereby provides further confirmation to the Industrials and Transports).

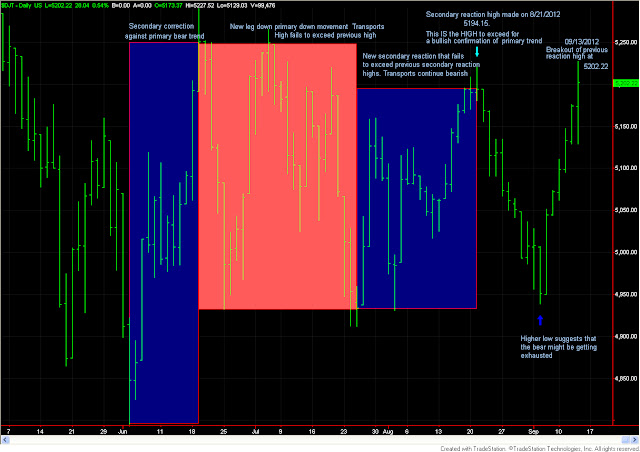

Here you have a detailed chart explaining the thorny issue of determining the relevant highs to be exceeded . The “highs” to be exceeded are not carved in stone (as many say “May highs” or “June Lows”. While such “monthly” highs and lows may be important, much more relevant are the last secondary reaction highs or lows made. In our case, the last secondary reaction highs were not those made on earlier dates (in which case we should still be waiting for the breakout) but the most recent reaction ones. Take a careful look at the chart and you will judge for yourself.

|

| The Transports have finally joined the bullish parade thus providing a bullish confirmation under Dow Theory |

Gold and Silver and their miners also reached higher absolute highs since the primary movement started. It is a primary bull market. SLV made a monstrous day-to-day gain of 7.49% while GDX made 5.01%.

All markets are severely overbought and the market structure makes them vulnerable to a sharp and swift correction. So now is definitely not the best moment to get into these markets.

Below you can find the latest figures as you can see the unrealized gain made by the early Dow Theory birds continue to grow. Will the market deliver a secondary reaction to allow a sweet entry point for late comers? What do I mean by this? Maybe you should read this post.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sincerely, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Dow Theorist | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||