Does the classical Dow Theory yield positive risk-adjusted returns?

The answer is: YES. The article linked below penned by William Goetzmann proves that the market calls made by Dow Theorist Hamilton from 1902 to 1929 beat buy and hold on a risk-adjusted basis.

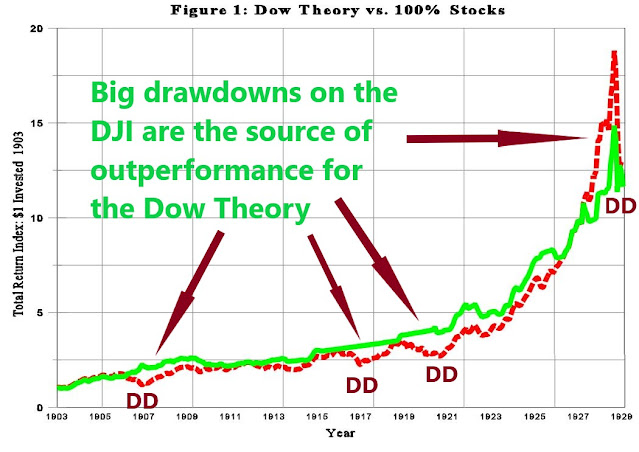

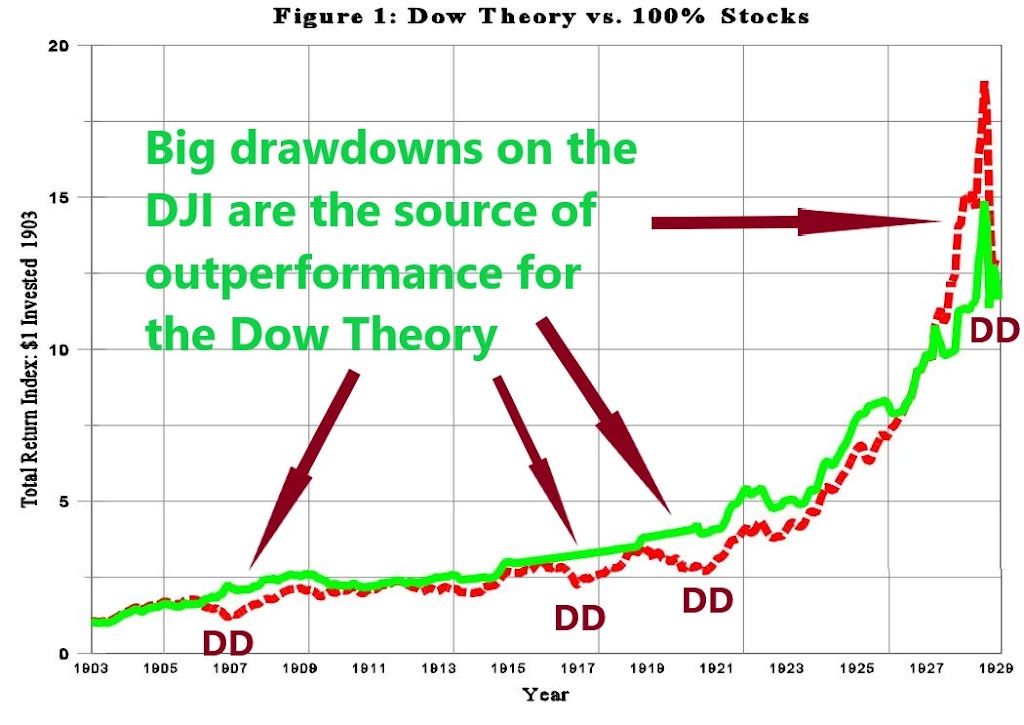

The edited chart below extracted from the linked article shows that the source of outperformance (green line above the red line) are bear markets for Buy and Hold. By avoiding drawdowns (DD), the Dow Theory has lower volatility and, over time, builds up outperformance.

If the chart had included 1929-1932, the DT would have outperformed not only risk-adjusted by also on a very absolute basis. Regrettably, Hamilton died shortly after the October 1929 crash. On our website, we keep the updated record for the classical DT. As a reminder, our own rendition of the DT, namely, the Dow Theory for the 21st Century, is even more reactive than the “classical” one, as you can read here.

Sincerely,

Manuel Blay

Editor of thedowtheory.com