Gold and silver down.

Let’s get started with our Dow Theory commentary in this blog.

Stocks

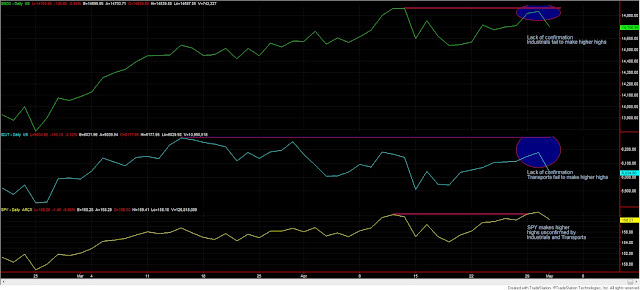

The SPY, Industrials and Transports closed down. The higher high made by the SPY two and three days ago, remain unconfirmed, which suggests weakness and increases the odds for a secondary reaction, unless either the SPY or the Industrials make higher highs soon.

The chart below shows the highest high recently made (red horizontal lines) and the failure of both the Industrials and Transports to break above such highs.

|

| SPY (bottom of the chart) made higher highs unconfirmed by the Industrials (top) and Transports (middle) |

The primary and secondary trend remains bullish.

Today’s volume was lower than yesterday’s. Since it was a down day, this has a bullish connotation, as declining prices were not joined by volume.

Gold and silver

Guess! GLD lost inventory once again…is it being drained into extinction?

GLD and SLV closed down. The primary trend is bearish, and the secondary trend is bullish. If this pullback persists further, we could get the set up for a primary bull market signal. To this end, gold or silver should decline ca. 3% and 6% respectively.

As to the gold and silver miners ETFs, GDX and SIL, both closed down. The primary and secondary trend remains bearish.

Here you have the figures of the markets I monitor for today:

| Data for May 1, 2013 | |||

| DOW THEORY PRIMARY TREND MONITOR SPY | |||

| SPY | |||

| Bull market started | 11/15/2012 | 135.7 | |

| Bull market signaled | 01/02/2013 | 146.06 | |

| Last close | 05/01/2013 | 158.28 | |

| Current stop level: Bear mkt low | 135.7 | ||

| Unrlzd gain % | Tot advance since start bull mkt | Max Pot Loss % | |

| 8.37% | 16.64% | 7.63% | |

| DOW THEORY PRIMARY TREND MONITOR GOLD (GLD) | |||

| GLD | |||

| Bull market started | 05/16/2012 | 149.46 | |

| Bull market signaled | 08/22/2012 | 160.54 | |

| Exit December 20 | 12/20/2012 | 161.16 | |

| Current stop level: Sec React low | 11/02/2012 | 162.6 | |

| Realized Loss % | Tot advance since start bull mkt | ||

| 0.39% | 7.83% | ||

| DOW THEORY PRIMARY TREND MONITOR SILVER (SLV) | |||

| SLV | |||

| Bull market started | 06/28/2012 | 25.63 | |

| Bull market signaled | 08/22/2012 | 28.92 | |

| Exit December 20 | 12/20/2012 | 29 | |

| Current stop level: Sec React low | 11/02/2012 | 29.95 | |

| Realized gain % | Tot advance since start bull mkt | ||

| 0.28% | 13.15% | ||

| DOW THEORY PRIMARY TREND MONITOR ETF SIL | |||

| SIL | |||

| Bull market started | 07/24/2012 | 17.08 | |

| Bull market signaled | 09/04/2012 | 21.83 | |

| Exit January 23 | 01/24/2013 | 21.69 | |

| Current stop level: Sec React low | 11/15/2012 | 21.87 | |

| Realized Loss % | Tot advance since start bull mkt | Max Pot Loss % | |

| -0.64% | 26.99% | 27.81% | |

| DOW THEORY PRIMARY TREND MONITOR ETF GDX | |||

| GDX | |||

| Bull market started | 05/16/2012 | 39.56 | |

| Bull market signaled | 09/04/2012 | 47.77 | |

| Exit January 23 | 01/24/2013 | 44.56 | |

| Current stop level: Sec React low | 12/05/2012 | 45.35 | |

| Realized Loss % | Tot advance since start bull mkt | Max Pot Loss % | |

| -6.72% | 12.64% | 20.75% | |

Sincerely,

The Dow Theorist