Overview: The gold and silver miners ETF reached a make-or-break moment on 11/10/25. The setup for a potential bear market is complete, and the line in the sand has been drawn. Please mind the word “potential”. Only if the two read lines I show in the chart below are jointly pierced, the trend will shift to bearish.

Gold and silver are showing such strength that they have not even entered a secondary reaction. Therefore, their primary and secondary trends remain bullish.

General Remarks:

In this post, I extensively elaborate on the rationale behind employing two alternative definitions to evaluate secondary reactions.

SIL refers to the Silver Miners ETF. More information about SIL can be found HERE.

GDX refers to the Gold Miners ETF. More information about GDX can be found HERE.

A) Market situation if one appraises secondary reactions not bound by the three weeks and 1/3 retracement dogma.

As I explained in this post, the primary trend was signaled as bullish on 6/2/25.

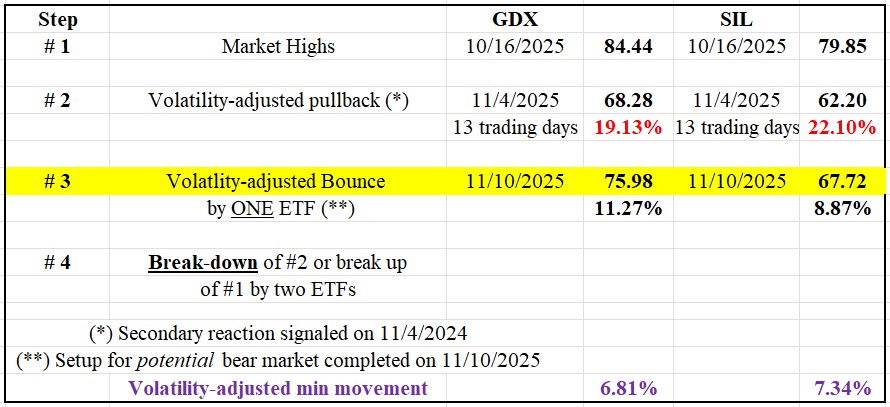

Following the 10/16/25 highs for both SIL and GDX, there has been a pullback until 11/04/25. Such a pullback meets the time and extent requirement for a secondary (bearish) reaction against the still-existing primary bull market.

The rally that started at the 11/04/25 (SIL) lows and lasted until 11/10/25 set up both ETFs for a potential primary bear-market signal.

Thus, a confirmed breakdown of the 11/4/25 closing lows (SIL at 62.2 and GDX at 68.28) would signal a new primary bear market.

The table below gives you the most relevant information:

The chart below illustrates the latest price movements. The brown rectangles mark the secondary reaction against the primary bull market (Step #2). The blue rectangles indicate the rally (Step #3), positioning GDX and SIL for a potential bear market signal. The red horizontal lines show the secondary reaction lows (Step #2), where a confirmed break would signal a new primary bear market. The blue lines highlight the bull market highs (Step #1) whose confirmed breakup would re-confirm the still-existing primary bull market.

So, now we have two options:

- If GDX and SIL jointly break down their 11/4/25 lows (SIL at 62.20 and GDX at 68.28), a new primary bear market would be signaled.

- If GDX and SIL jointly surpass their 10/16/25 highs (SIL at 79.85 & GDX at 84.44), the primary bull market would be reconfirmed, and the secondary reaction and bearish setup would be canceled.

So, now, the primary trend is bullish, and the secondary one is bearish.

B) Market situation if one sticks to the traditional interpretation demanding more than three weeks and 1/3 confirmed retracement to declare a secondary reaction.

I explained in this post that the primary trend was signaled as bullish on 6/2/25.

The current pullback has not reached 15 confirmed days by both ETFs, so there is no secondary reaction against the bull market.

So, the primary and secondary trends are bullish under the “slower” appraisal of the Dow Theory.

Sincerely,

Manuel Blay

Editor of thedowtheory.com