Overview: Higher confirmed highs by SLV and GLD (silver and gold) have reaffirmed the primary bull market. The secondary reaction is over.

The most recent pullback in the gold and silver miners’ ETFs (GDX and SIL) was so modest that it did not qualify as a secondary reaction. So, a bull in full gear.

General Remarks:

In this post, I extensively elaborate on the rationale behind employing two alternative definitions to evaluate secondary reactions.

GLD refers to the SPDR® Gold Shares (NYSEArca: GLD®). More information about GLD can be found HERE.

SLV refers to the iShares Silver Trust (NYSEArca: SLV®). More information about SLV can be found HERE.

A) Market situation if one appraises secondary reactions not bound by the three weeks and 1/3 retracement dogma.

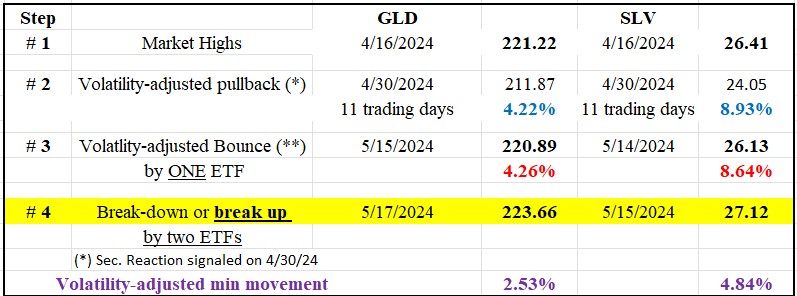

I explained in this post that the primary trend was signaled as bullish on 4/2/24.

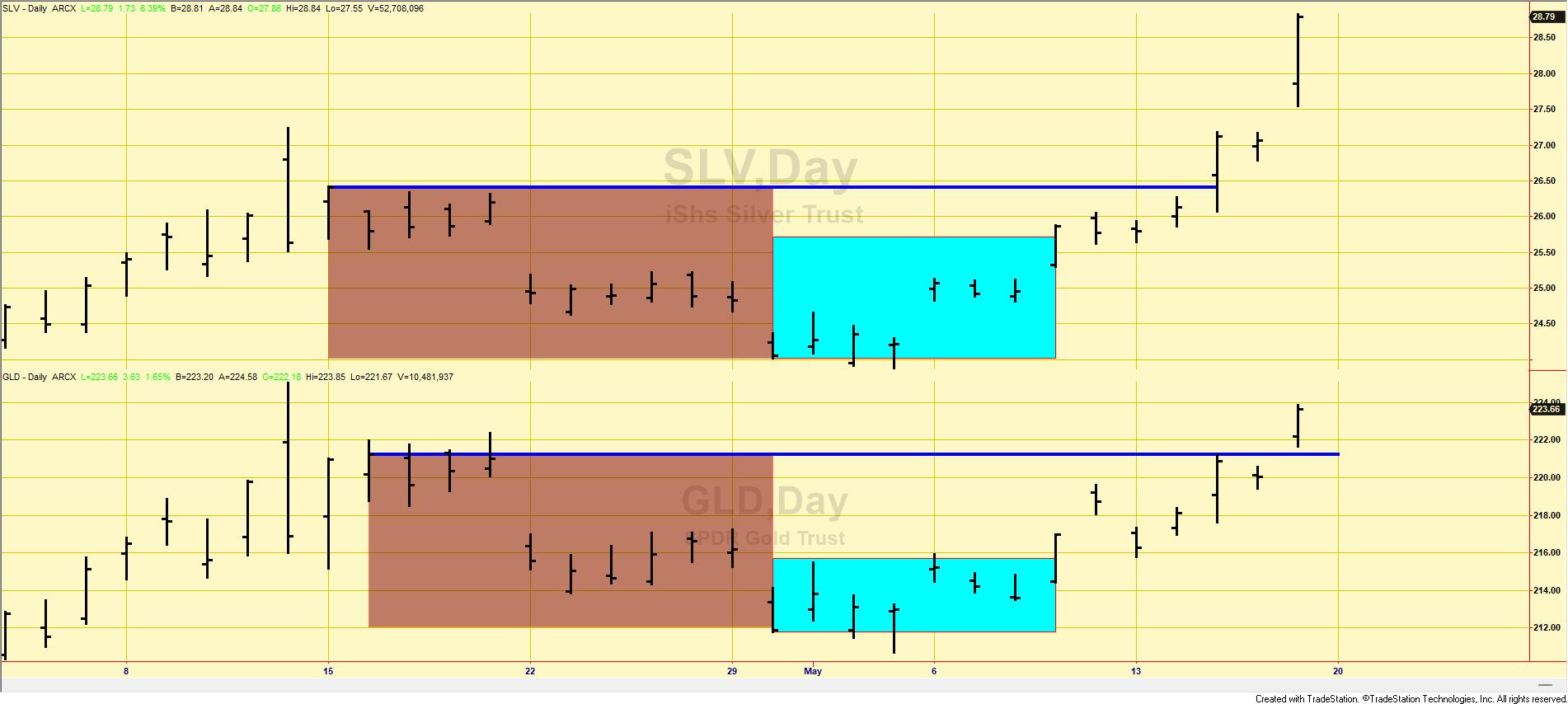

Following the 4/16/24 highs, there was a pullback until 4/30/24 that lasted 11 trading days. Such a pullback met the time and extent requirement for a secondary (bearish) reaction against the primary bullish trend. After the 4/30/24 lows, a powerful rally emerged that surpassed the 4/16/24 highs. SLV broke topside its 4/16/24 high on 5/15/24, while GLD did so on 4/17/24.

The Table below shows the relevant data summarizing the most recent price action.

The chart below shows the secondary reaction (Step #2, brown rectangles) and the rally starting the 4/30/24 lows (Step #3, blue rectangles). The blue horizontal lines highlight the 4/16/24 highs (Step #1), whose breakup reaffirmed the primary bull market.

Therefore, the primary and secondary trends are now bullish, and the secondary reaction has been canceled.

Therefore, the primary and secondary trends are now bullish, and the secondary reaction has been canceled.

B) Market situation if one sticks to the traditional interpretation demanding more than three weeks and 1/3 confirmed retracement to declare a secondary reaction.

I explained in this post that the primary trend was signaled as bullish on 4/2/24.

The most recent pullback did not last at least 15 trading days, so it did not qualify as a secondary reaction.

So, now the primary and secondary trends are bullish.

Sincerely,

Manuel Blay

Editor of thedowtheory.com