Overview: Gold and Silver are in a new bull market of their own, as I explained HERE.

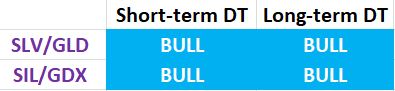

Now, the miners have joined the rally, and as of 4/3/24, a new bull market has been confirmed. Therefore, regardless of how we analyze it, the trend in the precious metals sector is bullish, as illustrated in the table below:

If gold consolidates its gains, the miners should play catch up.

General Remarks:

In this post, I extensively elaborate on the rationale behind employing two alternative definitions to evaluate secondary reactions.

SIL refers to the Silver Miners ETF. More information about SIL can be found HERE.

GDX refers to the Gold Miners ETF. More information about GDX can be found HERE.

Clarification: All references below to days and prices refer to trading days and closing prices.

GOLD AND SILVER MINERS ETFs

- A) Market situation if one appraises secondary reactions not bound by the three weeks dogma.

As I explained here, the primary trend was signaled as bearish on 2/28/24.

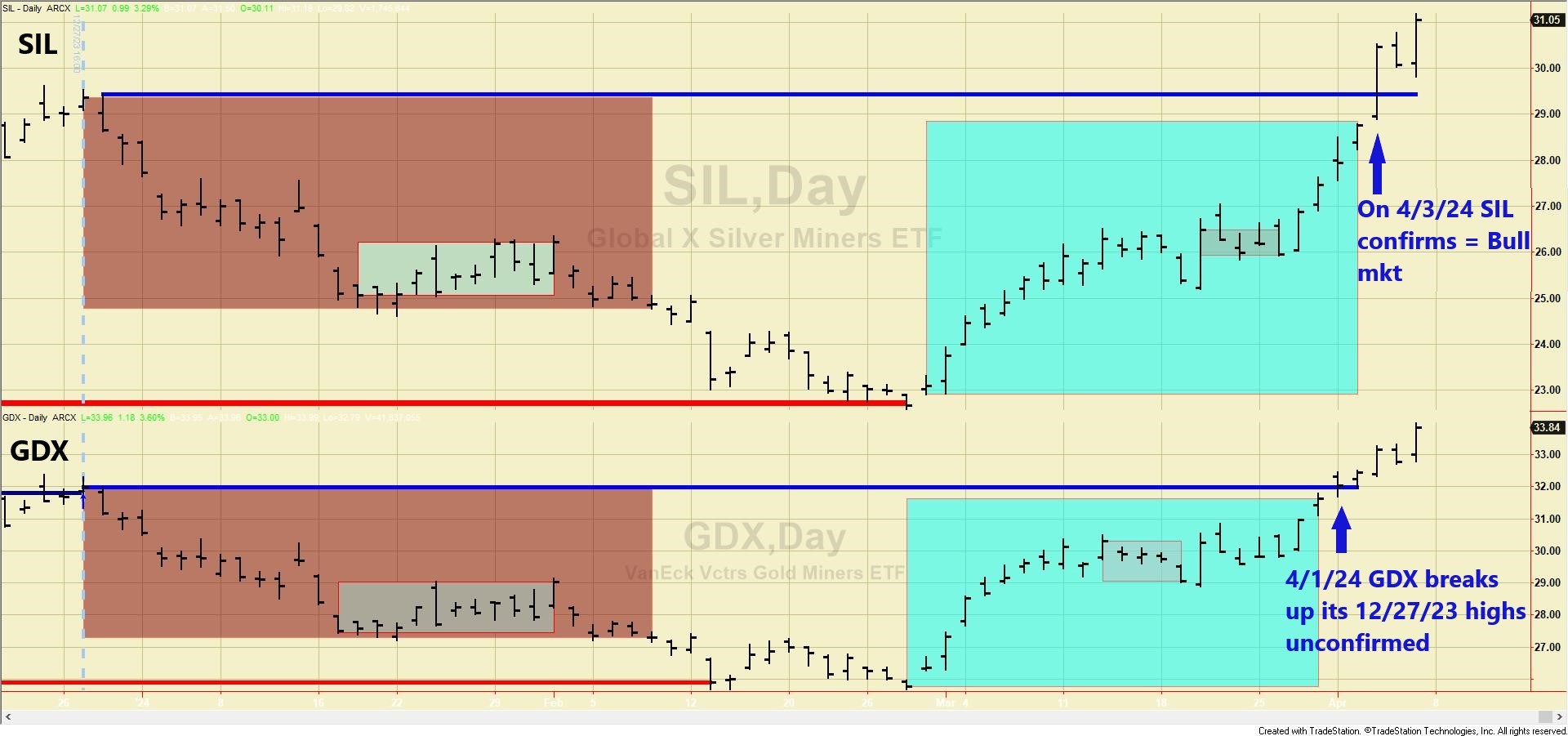

Following the 2/28/24 lows, a strong rally ensued with no meaningful pullback. Accordingly, the relevant highs to be surpassed were the 12/27/23 closing highs for SIL and GDX at 29.37 and 31.98. On 4/1/24, GDX broke above such highs without SIL confirming. On 4/3/24, SIL confirmed signaling a primary bull market.

Check out the chart below for a visual walkthrough of the recent price action. The blue rectangles indicate the rally that began after the lows on 2/28/24. The small grey rectangles represent a pullback that failed to meet the criteria for triggering an ordinary buy signal in both ETFs. In the absence of this setup, the highs of the previous bull market become the relevant highs to surpass.

Thus, both the primary and secondary trends are currently bullish.

B) Market situation if one sticks to the traditional interpretation demanding more than three weeks and 1/3 confirmed retracement to declare a secondary reaction.

As I explained here, the primary trend was signaled as bearish on 2/28/24.

In this specific instance, the trend appraisal using the “long-term” version of the Dow Theory yields the same results as the “short-term” one. So, what I explained above applies fully to this section. The primary and secondary trends are bullish.

Sincerely,

Manuel Blay

Editor of thedowtheory.com