The primary trend remains bearish

Overview: All markets are sensing that a new wave of liquidity will be released. Gold, stocks, bonds, and crypto are edging higher. The gold and silver miners’ ETFs, mired in a bear market, have experienced a rally. However, this rally is not enough to change the trend from bearish to bullish yet.

General Remarks:

In this post, I extensively elaborate on the rationale behind employing two alternative definitions to evaluate secondary reactions.

SIL refers to the Silver Miners ETF. More information about SIL can be found HERE.

GDX refers to the Gold Miners ETF. More information about GDX can be found HERE.

A) Market situation if one appraises secondary reactions not bound by the three weeks and 1/3 retracement dogma

As I explained in this post, the trend was signaled as bearish on 12/18/24.

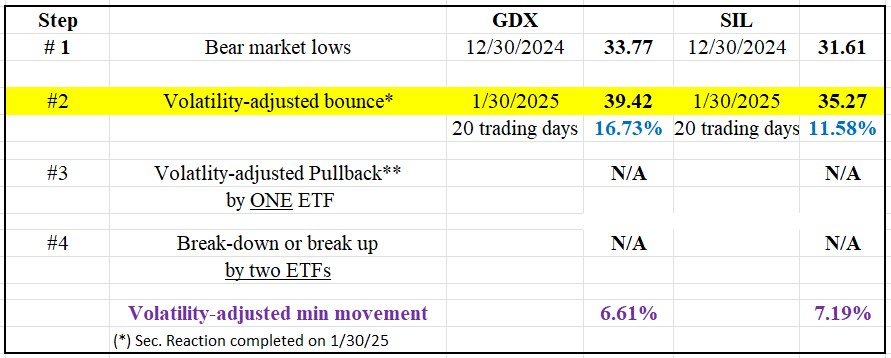

The drop continued until SIL & GDX made their last closing lows on 12/30/24.

Following such lows a rally ensued. On 1/30/25, the rally met the time requirement for a secondary reaction. The rally also exceeded the Volatility-Adjusted Minimum Movement (VAMM, more about it here), so the extent requirement for a secondary reaction was also met.

The Table below shows all the information you need:

Now, we are waiting for a >=2 pullback that exceeds the VAMM in at least one ETF to complete the setup for a potential primary bear market signal. We must wait.

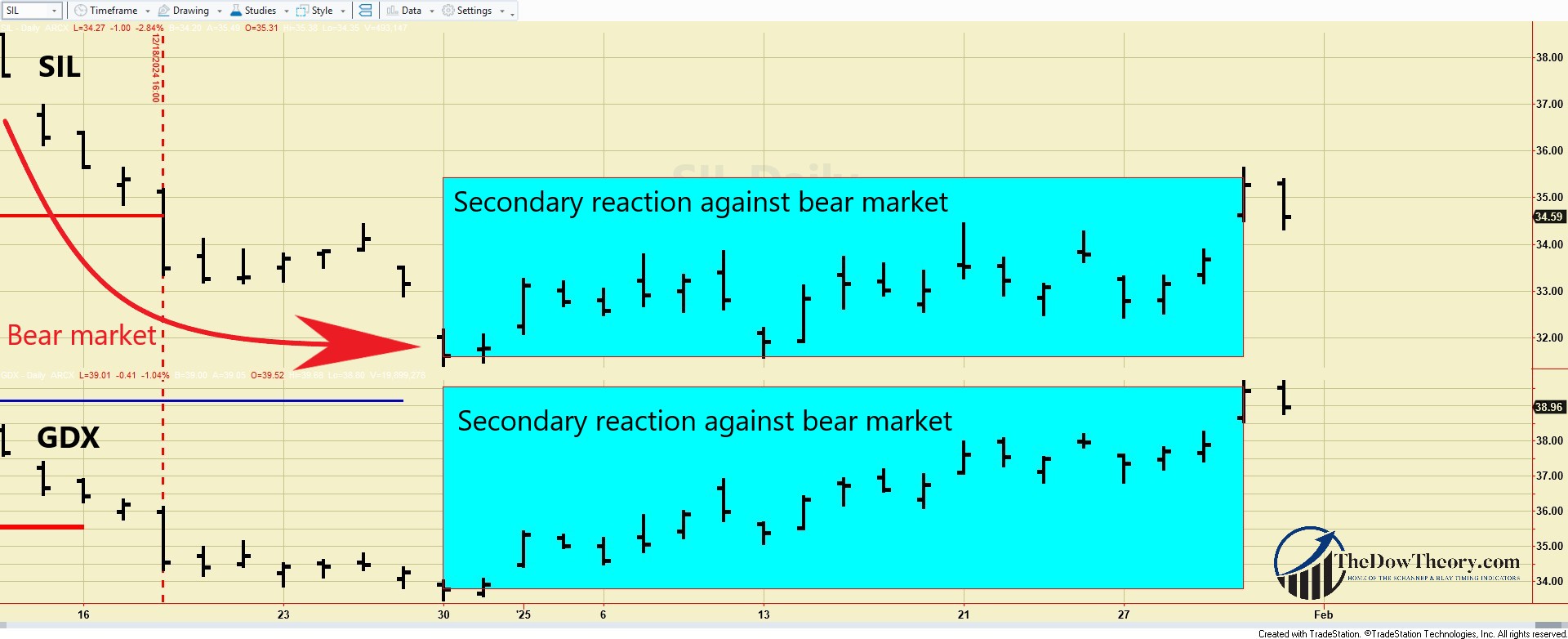

The following charts depict the latest price movements. The blue rectangles display the secondary (bullish) reaction against the still-existing bear market.

Therefore, the primary trend is bearish, and the secondary one is bullish.

Therefore, the primary trend is bearish, and the secondary one is bullish.

B) Market situation if one sticks to the traditional interpretation demanding more than three weeks and 1/3 confirmed retracement to declare a secondary reaction.

As I explained in this post, the trend was signaled as bearish on 12/18/24.

The current rally has met the time and extent requirements for a secondary reaction.

Therefore, the primary trend is bearish, and the secondary one is bullish.

Sincerely,

Manuel Blay

Editor of thedowtheory.com