The primary trend remains bullish

Overview: SLV and GLD (silver and gold) are in a secondary reaction, and on 6/20/24, the setup for a potential primary bear market has been completed.

The gold and silver miners ETFs (GDX and SIL) are also in a secondary reaction, but no setup for a potential primary bear market has been completed. In a future post, I will deal with the miners.

General Remarks:

In this post, I extensively elaborate on the rationale behind employing two alternative definitions to evaluate secondary reactions.

GLD refers to the SPDR® Gold Shares (NYSEArca: GLD®). More information about GLD can be found HERE.

SLV refers to the iShares Silver Trust (NYSEArca: SLV®). More information about SLV can be found HEREA)

A) Market situation if one appraises secondary reactions not bound by the three weeks and 1/3 retracement dogma.

I explained in this post that the primary trend was signaled as bullish on 4/2/24.

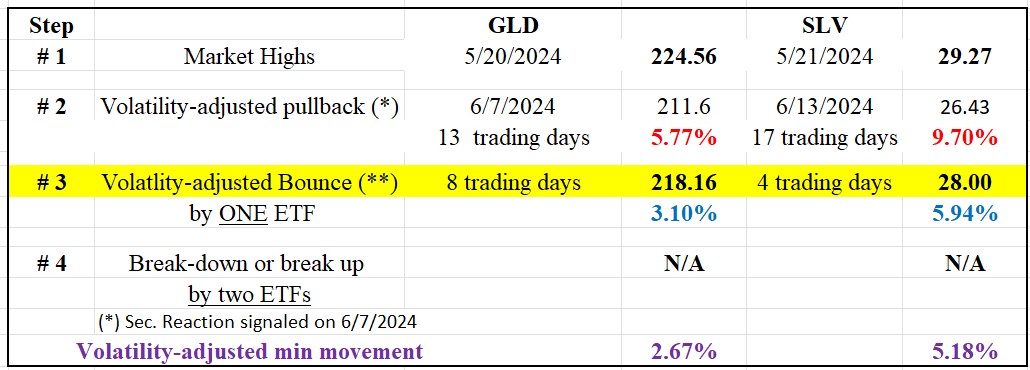

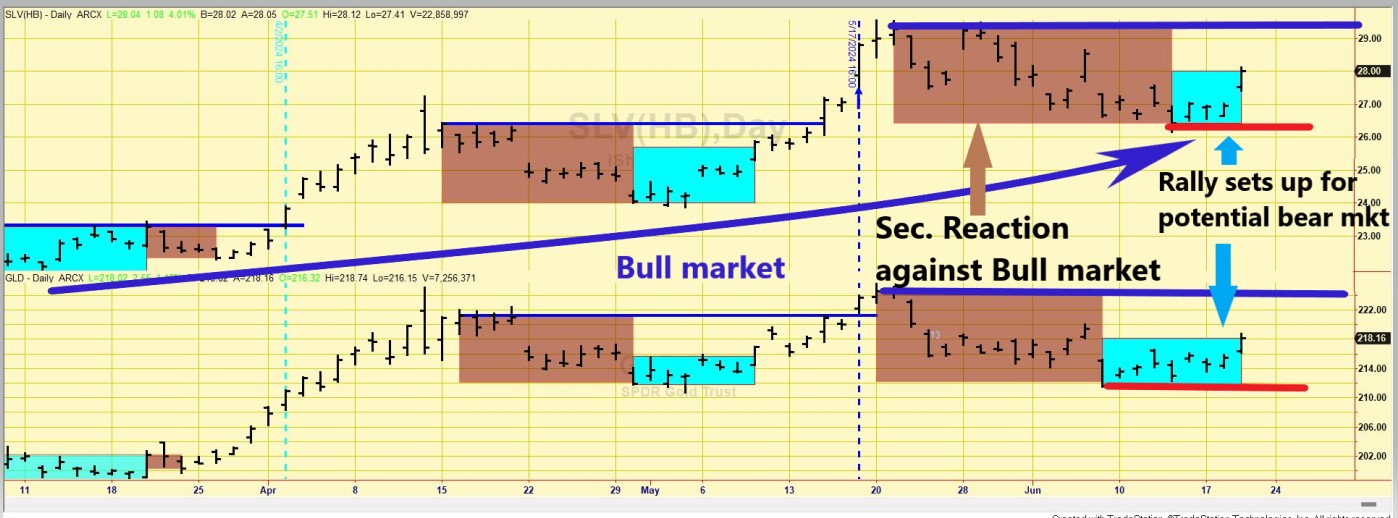

Following the 5/20/24 (GLD) and 5/21/24 (SLV) highs, there was a pullback until 6/7/24 (GLD) and 6/13/24 (SLV), which met the time and extent requirement for a secondary reaction. Following, the secondary reaction lows, a rally ensued until 6/20/24 that completed the setup for a potential primary bear market signal.

The table below shows the relevant data:

So, now there are two possible outcomes:

1) A primary bear market would be signaled if GLD and SLV head south and jointly break below their pullback closing lows (Step #2 in the table above).

2) If GLD and SLV extend the present rally and jointly surpass their most recent highs (Step #1), the current primary bull market would be confirmed, and the secondary reaction and the setup would be canceled.

The chart below shows the secondary reaction (Step #2, brown rectangles) and the rally starting off the 6/7/24 (GLD) and 6/13/24 (SLV) lows (Step #3, blue rectangles). The blue horizontal lines highlight the most recent highs (Step #1), whose breakup reaffirmed the primary bull market, and the red lines show the pullback lows (Step #2), whose violation would entail a new primary bull market.

Therefore, the primary trend is bullish, and the secondary one is bearish.

B) Market situation if one sticks to the traditional interpretation demanding more than three weeks and 1/3 confirmed retracement to declare a secondary reaction.

I explained in this post that the primary trend was signaled as bullish on 4/2/24.

The most recent pullback did not last at least 15 trading days, so it did not qualify as a secondary reaction.

So, now the primary and secondary trends are bullish.

Sincerely,

Manuel Blay

Editor of thedowtheory.com