One fundamental tenet of the Dow Theory holds that the movement of one index, when not confirmed by another, should be disregarded. This principle underscores that a Buy or Sell signal originating from one index, such as surpassing a prior high or breaking down below a previous low, carries no significance if it lacks validation from another index.

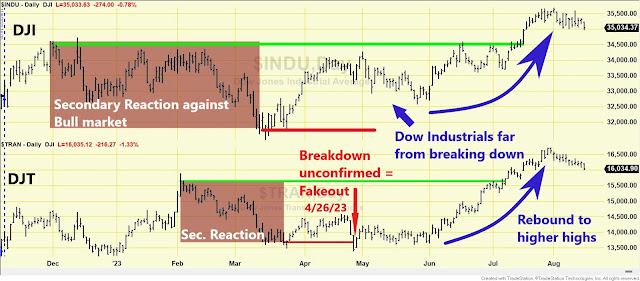

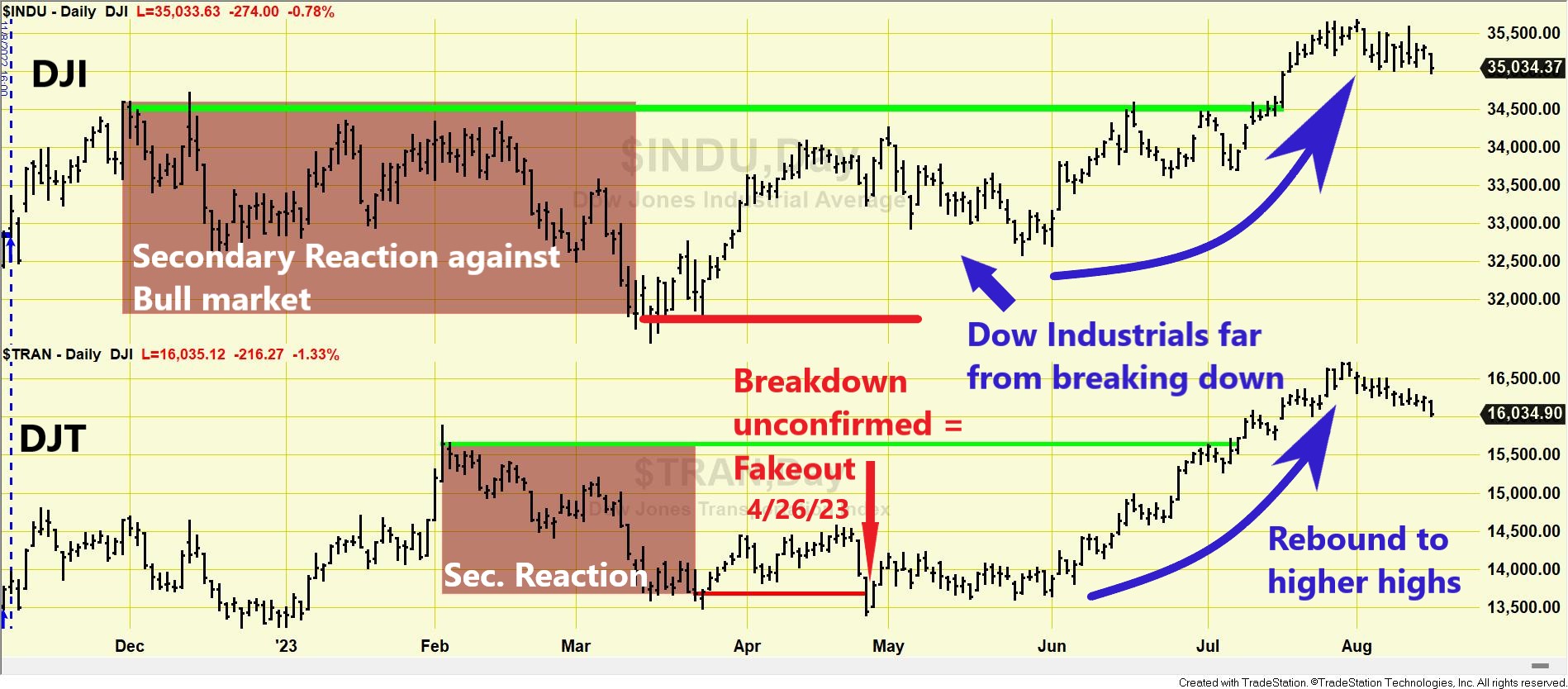

A recent instance illustrating the significance of this principle involves the Dow Transportation (DJT) index. The trend has been bullish since 11/8/22. On 4/26/23, the DJT broke below the last recorded secondary reaction lows. However, the DJI (or the S&P500, for that matter) did not confirm. Such a breakdown was bearish, but unconfirmed did not have the power to reverse the trend. Hence, no Sell signal was given, and we continued being long stock indexes. The breakdown was a fake out, and thereafter all Indexes rallied higher until the last recorded bull market highs (green horizontal lines) were jointly bettered, and our 11/8/22 Buy signal was confirmed. All in all, the principle of confirmation helped us avoid a false sell signal and a nasty whipsaw.

The accompanying charts visually represent the price movements in question.

It’s worth noting that the principle of confirmation extends beyond the confines of the Dow Theory. As I expounded upon HERE, it finds application in other trend-following techniques, including moving averages. Additionally, there are indications that it holds relevance in the realm of cryptocurrencies. It’s important to note that my assessment is preliminary, as I would prefer a more extensive dataset, given that cryptos have a relatively short history. However, thus far, the principle seems to hold true.

Sincerely,

Manuel Blay

Editor of thedowtheory.com