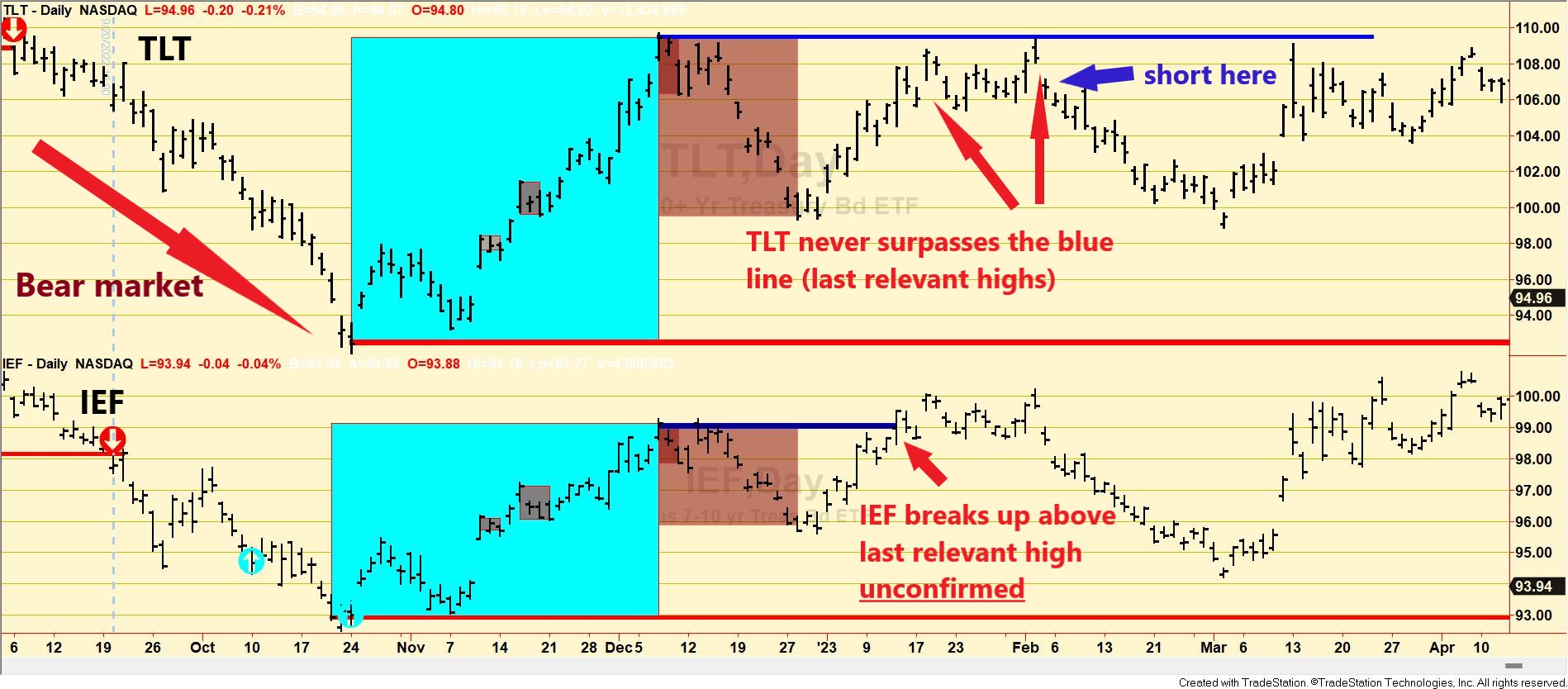

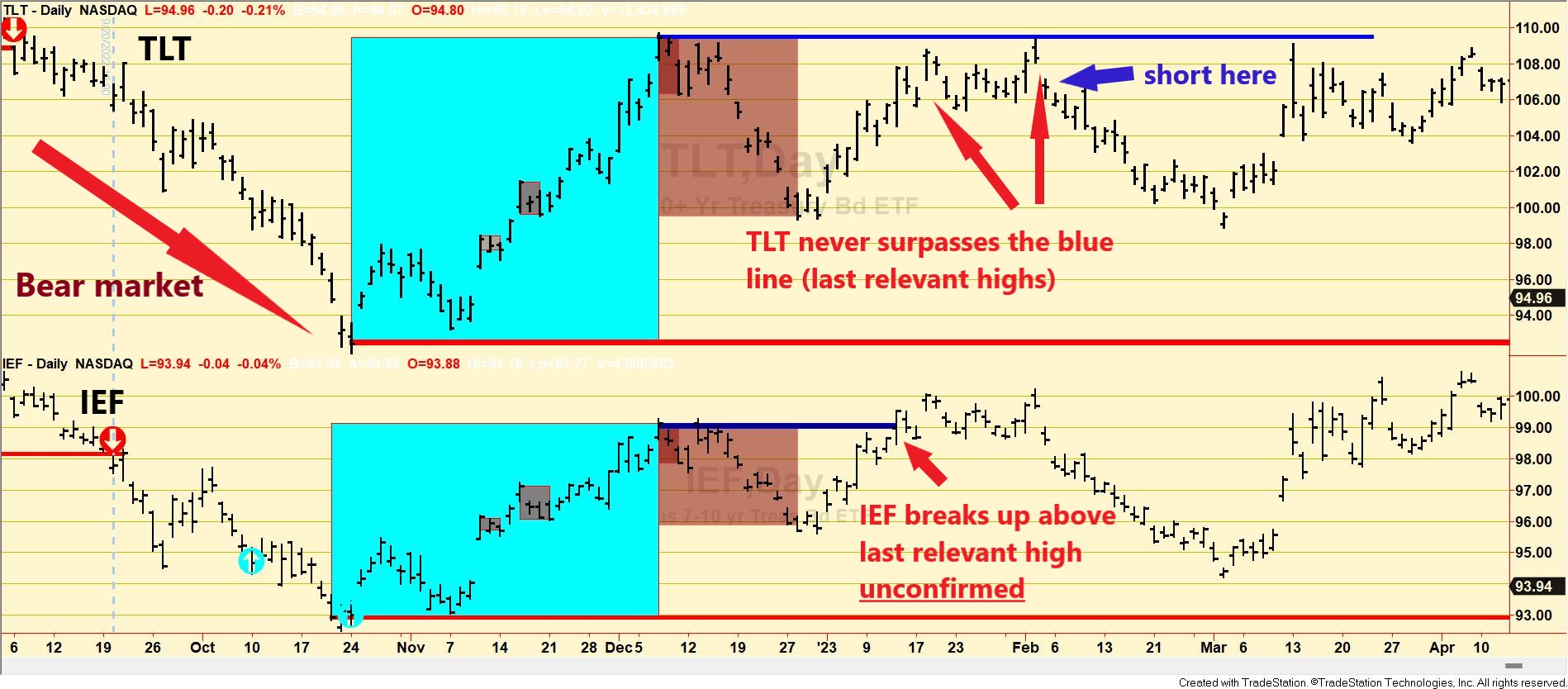

In my previous post, I explained the principle of confirmation in action when applied to U.S. stock indexes. In this post, we will see its application to bonds.

The starting point is the primary bear market that was signaled on 9/20/22 (as explained HERE). Following the 10/24/22 bear market lows, a rally followed that qualified as a secondary reaction. On 1/12/23, IEF surpassed its 12/7/22 secondary reaction highs, but TLT did not confirm. In light of this lack of confirmation, the trend remained unaltered and did not transition to bullish, thereby refraining from triggering a Buy signal. Subsequent price movements distinctly leaned toward the bearish, effectively categorizing the earlier breakout as a bull trap. Fortunately, TLT’s refusal to confirm proved to be our shield.

Incidentally, this situation also presented an excellent opportunity for shorting. The primary trend, which was bearish, invariably guides our actions under the assumption that the primary trend will ultimately dictate outcomes. In this context, the absence of confirmation following a bullish breakout indicated a higher probability of bonds trending downward. Around February 3rd, a prime shorting opportunity materialized: both TLT and IEF resumed their downward trajectory, while our stop-loss in case of a newly confirmed rebound was very near our shorting price (some ticks above the 2/2/22 highs). So, the risk-reward of that trade was huge.

To capitalize on this situation, I personally employed an inverse leveraged ETF (TBT) to leverage the tight stop-loss. I opted to exit the trade several days later, securing a significant reward relative to the risk undertaken.

The accompanying charts visually represent the price movements in question.

Sincerely,

Manuel Blay

Editor of thedowtheory.com