This post was challenging to compose. Occasionally, trends don’t conform to a textbook pattern, requiring additional interpretation grounded in sound principles. It won’t be an easy read, but sometimes, sound analysis cannot be compressed into a couple of lines.

General Remarks:

In this post, I thoroughly explained the rationale behind using two alternative definitions to appraise secondary reactions.

TLT is the iShares 20 years + Treasury bond ETF. More about it here

IEF is the iShares 7-10 years Treasury bond ETF. More about it here.

Thus, TLT tracks longer-term US bonds, whereas IEF tracks middle-term US bonds. A bull market in bonds entails lower interest rates. A bear market in bonds represents higher interest rates.

A) Market situation if one appraises secondary reactions not bound by the three weeks and 1/3 retracement dogma.

As I explained HERE, the primary trend was signaled as bearish on 9/20/22.

Following the 10/19/23 bear market lows, a powerful rally ensued, which qualifies as a secondary (bullish) reaction against the primary bear market, as I explained HERE.

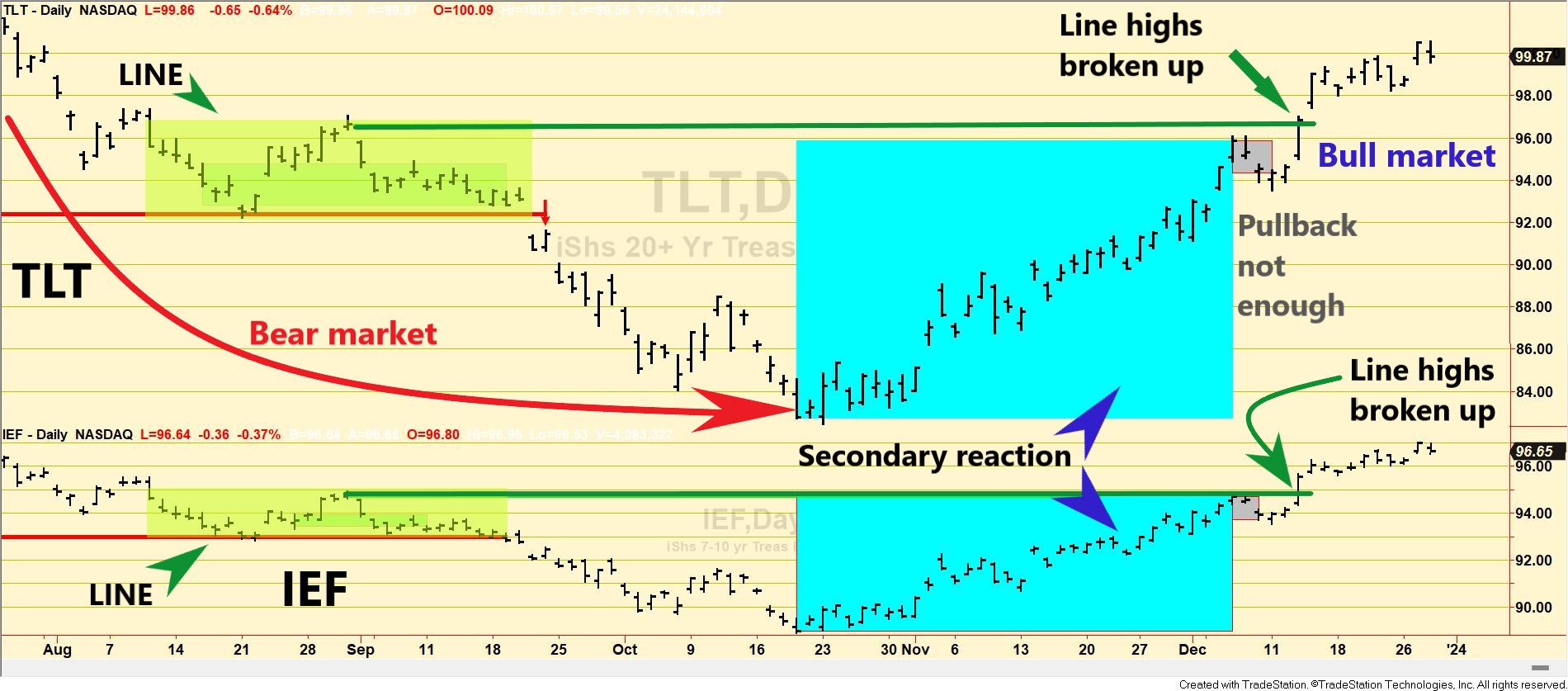

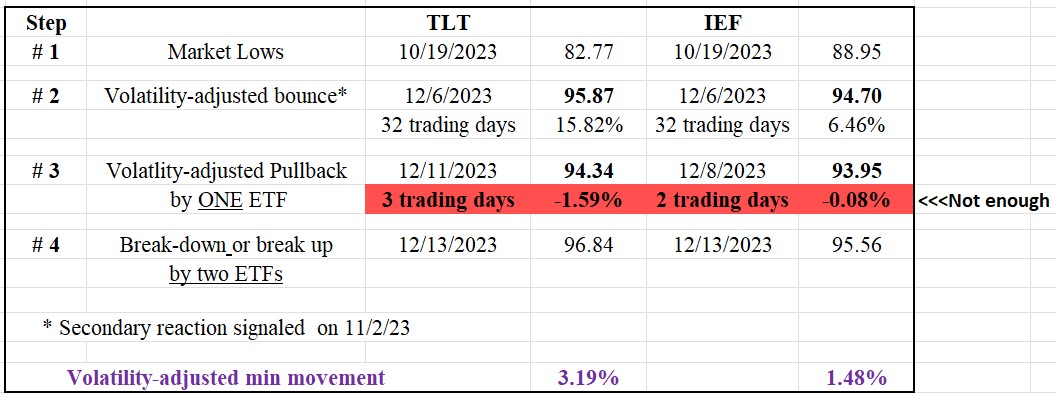

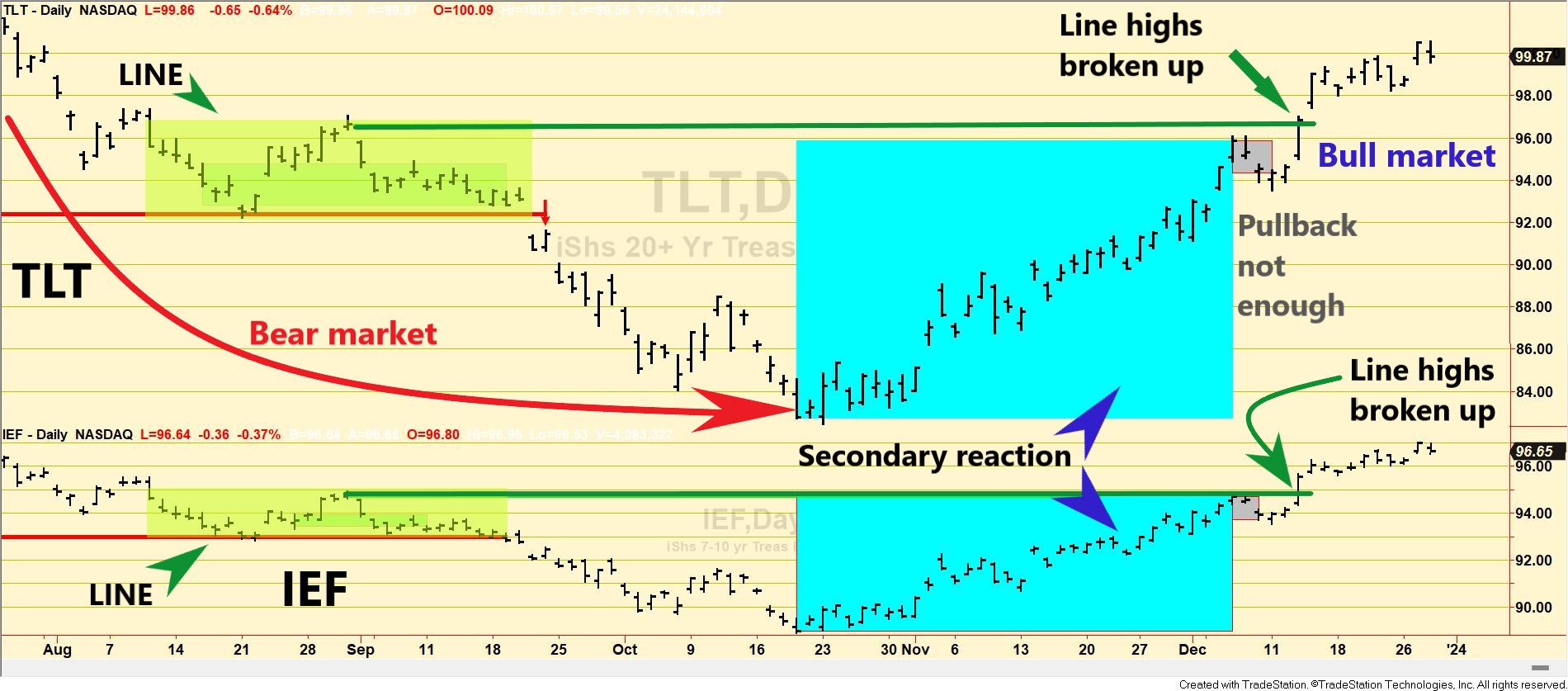

The rally has been so strong that we did not get a >= 2-day pullback with a Volatility-Adjusted Minimum Movement (more explanations about VAMM here). As the table below shows, the pullback that started after the 12/6/23 closing highs amounted to a meager -1.59% for TLT and 0.08% for IEF, which is well below the VAMM. In other words, such a pullback does not suffice to set up bonds for a bull market, implying that a breakup of the 12/6/23 highs (Step #2 in the Table below) which occured on 12/13/23 (Step #4) does not result in a new primary bull market. At least not without further analysis.

According to the Dow Theory (Rhea’s book “The Dow Theory”, page 77), the breakup of the highs of the last completed secondary reaction serves as an alternative way to signal a new bull market (and alternatively, the lows of the last completed secondary reaction serve as the relevant price to monitor for a new bear market). You can get more information about this alternative signal HERE, HERE, and HERE.

In this particular instance, there wasn’t a previously completed secondary reaction, as preceding rallies didn’t reach the VAMM. Consequently, the extent requirement for a secondary reaction was not fulfilled. Without any “highs of the last completed secondary reaction” to surpass, we needed to explore alternative ways to signal a new primary bull market.

Enter the Dow Theory concept of “lines” to help us out. According to Rhea, a line for stocks is a narrow range where stocks fluctuate less than 5% (from top to bottom) for at least 10-15 trading days (the number of days is not carved in stone). As Rhea noted, the breakout of a line implies a change in the trend of secondary proportions and occasionally even a new primary bull market. The charts below show that a line formed on TLT and IEF from 8/10/23 to 9/18/23 meets the criteria. The green rectangle highlights the line, with the green horizontal line emphasizing its highs.

If we observe the charts below, we see that from 8/10/23 to 9/18/23, a line formed on both TLT and IEF. The width of the line was below the equivalent of 5% in VAMM terms for both. I highlighted the line with a green rectangle, and the green horizontal line highlighted the line highs.

Considering that the breakout of a “line” suggests a trend of secondary proportions, it’s reasonable to view these line highs as if they were the highs of a secondary reaction. Both signify a change in the secondary trend, making it plausible to consider the breakup of “the last completed/finalized” line as a signal for a new primary bull market.

Furthermore, an alternative way of analysing the current market renders the same result. Now follow me. Following the 10/19/23 lows, a secondary bullish reaction began, establishing an unequivocally bullish secondary trend. Combining this with the breakup of a line, which also implies a bullish secondary trend, provides two independent secondary bullish inferences. Could we not consider this as indicative of a shift to a bullish primary trend? The first bullish signal is the secondary reaction, and the second is the breakup of a previously existing line. 1+1=2.

Lastly, the robust and sustained bullish momentum for both TLT and IEF suggests that we’re dealing with more than just a correction.

Therefore, my conclusion is that the primary trend has turned bullish too. More exactly, it shifted to bullish on 12/13/23 when TLT and IEF jointly surpassed the 8/31/23 “line” highs.

The Dow Theory has been tracking accurately the now recently terminated bear market (and avoiding losses or making profits for those shorting) as explained HERE and HERE.

B) Market situation if one sticks to the traditional interpretation demanding more than three weeks and 1/3 confirmed retracement to declare a secondary reaction.

The primary trend was signaled as bearish on 9/28/21. A more aggressive and legitimate interpretation would have signaled the bear market on 9/24/21. The explanations here.

In this specific instance, the price action that was explained above fully applies to the “longer-term” rendering of the Dow Theory. In other words, look at the table and charts above, as they fully explain what happened when we take a longer view. Therefore, the primary and secondary trends are bullish.

Sincerely,

Manuel Blay

Editor of thedowtheory.com