How world-class quant research and timing filters slash drawdowns and boost returns.

What happens when you combine a strong stock-picking strategy with first-class trend following?

Something remarkable happens: returns surge, drawdowns shrink, and consistency improves dramatically. That’s exactly what the two charts below reveal.

This article was originally a brief social media post, but the conclusions drawn from the data were so compelling that I expanded it into a full blog entry.

The test covers the period from January 1, 2005, to July 25, 2025, with a 0.25% slippage applied to each side of every trade.

The stock-picking component focuses on identifying true value stocks — companies that are attractively priced and supported by solid earnings profiles.

When blending stock selection and market timing, everything must begin with a solid stock-picking foundation. The strategy should already outperform the benchmark (in this case, the S&P 500) and show a respectable Sharpe ratio on its own. Market timing can enhance results, but it can also disguise flaws — making a weak stock-picking system appear better than it really is. That’s why the underlying strategy must be robust by itself before adding any timing overlay. Once that’s in place, the combination of both becomes truly powerful: higher returns, smaller drawdowns, and far better risk-adjusted performance.

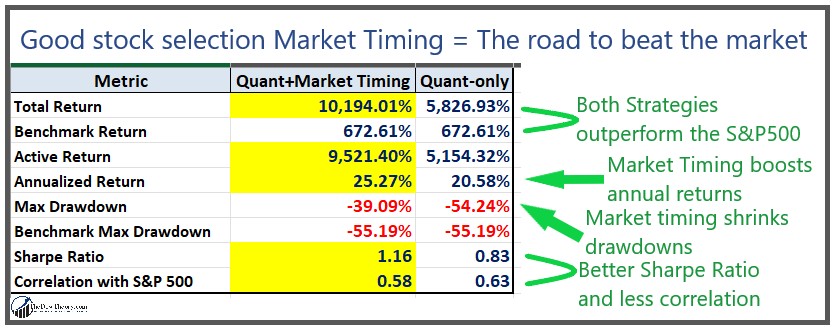

The table below summarizes the key performance metrics for the Quant + Market Timing strategy compared with the Quant-only version.

Even though the Quant-only strategy already beats the market, introducing a trend filter — a refined version of our Timing Indicators tailored to stocks — transforms the results. Performance takes off, drawdowns contract sharply, correlation with the S&P 500 falls (a welcome outcome), and the Sharpe ratio leaps higher.

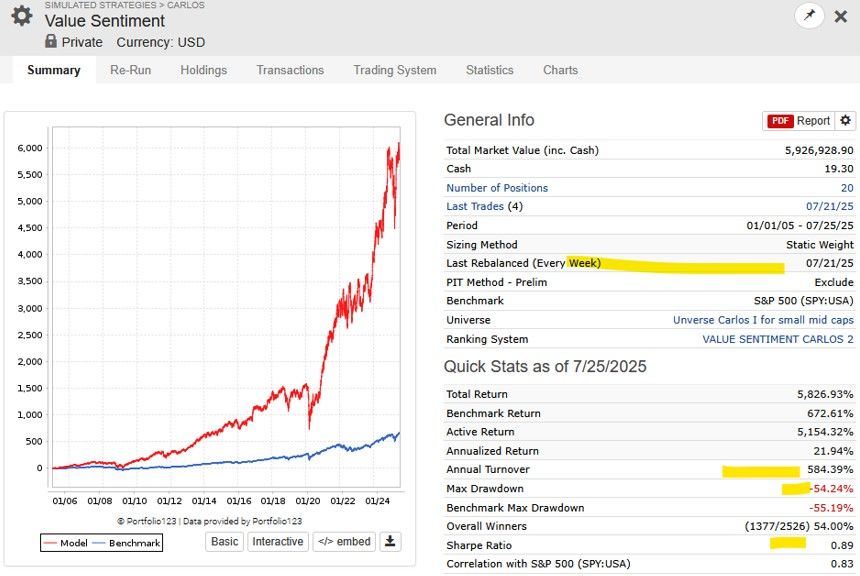

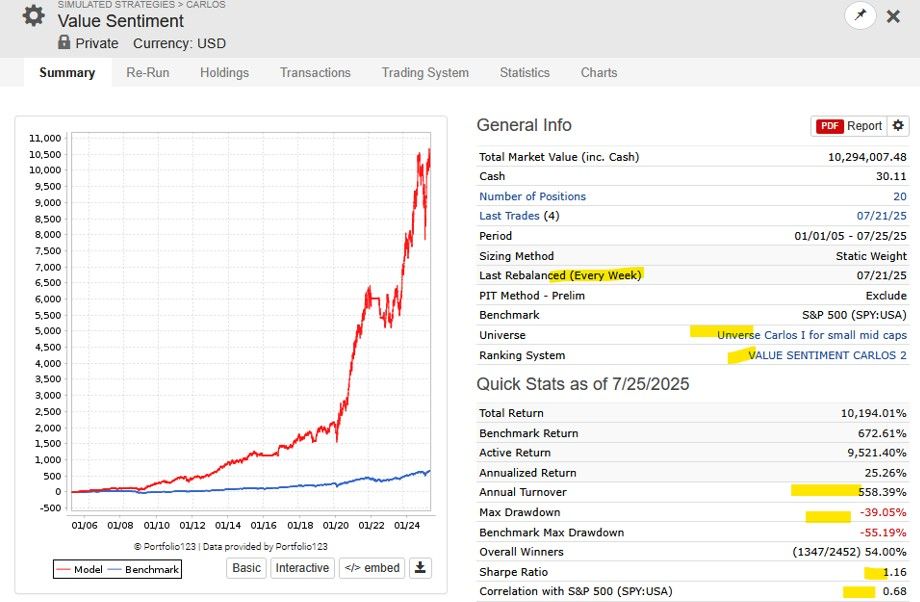

The charts below display the Quant-only Strategy, and the Quant+ Market Timing Strategy. The red line showcases the stock picking strategy, and the blue one is Buy and Hold for the S&P500. The results speak for themselves:

So, when some still claim that market timing doesn’t work — or that those who practice it are misguided — the evidence tells a different story. The combination of disciplined quantitative research and systematic timing produces results that are too strong to dismiss.

Sincerely,

Manuel Blay

Editor of thedowtheory.com