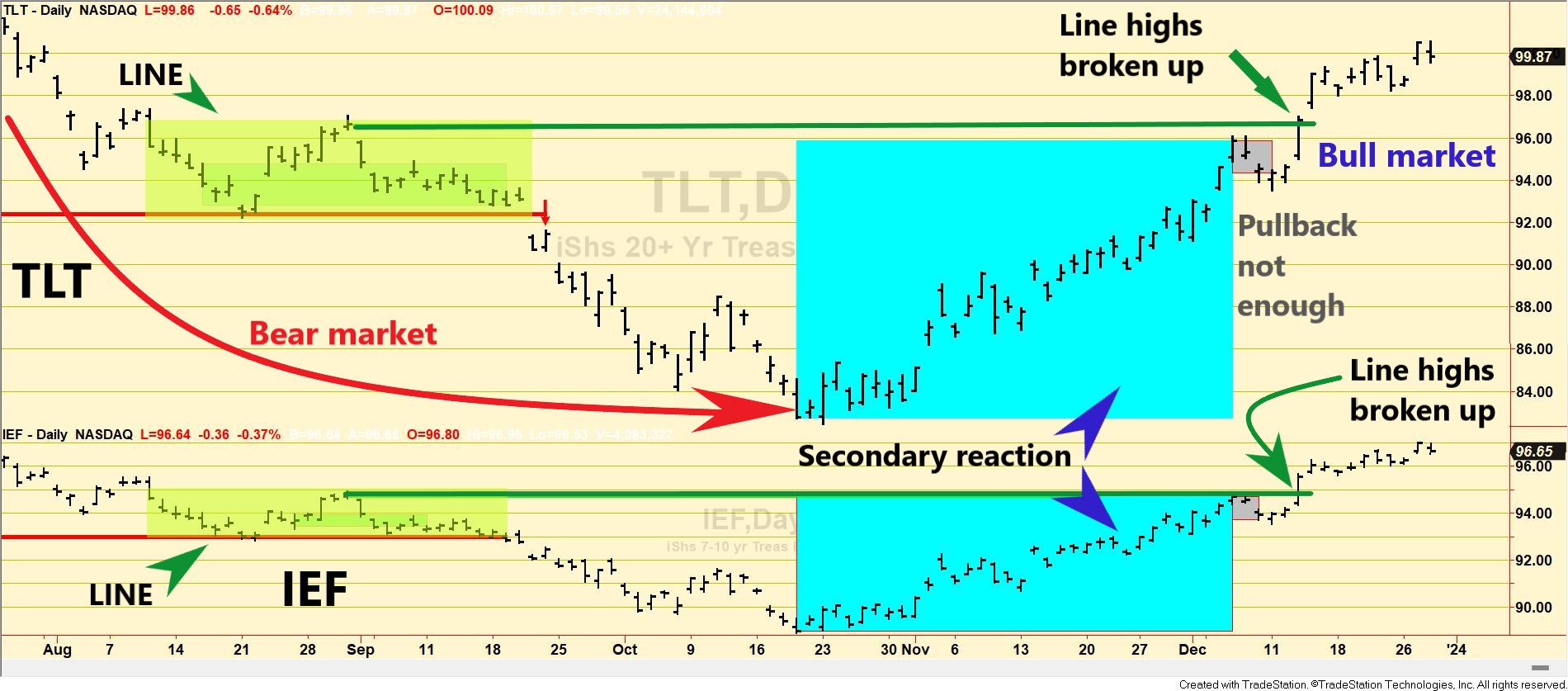

Unforseen CPI Jump Rattles Markets: A Deep Dive into U.S.Treasuries and their new Bear market signaled on 2/13/24

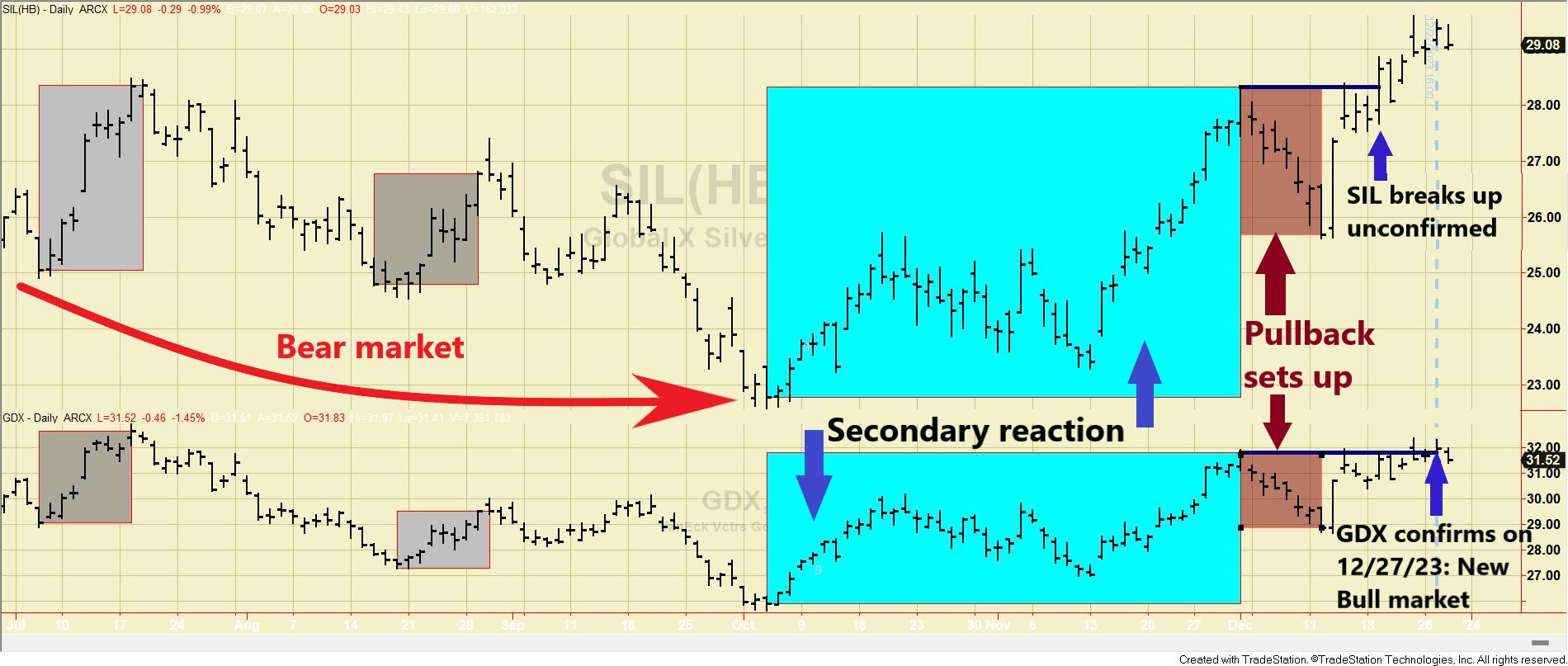

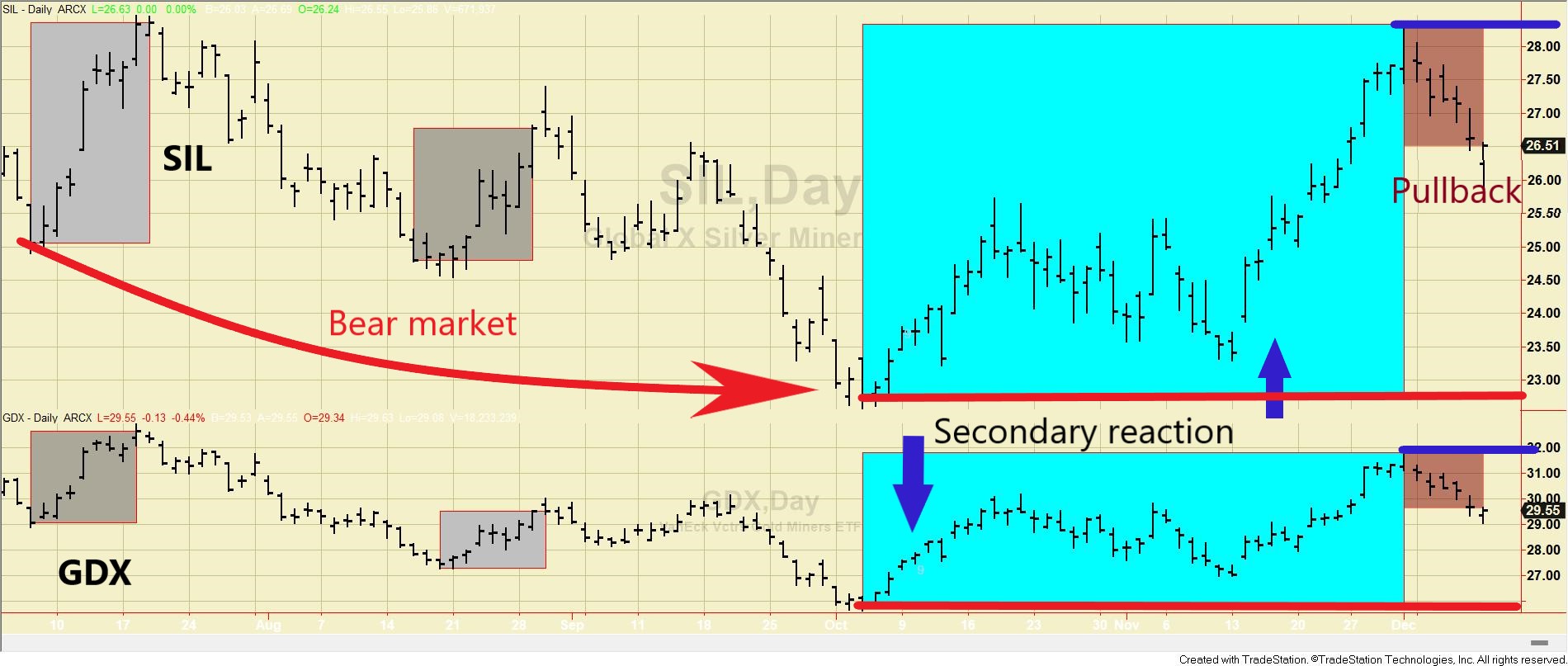

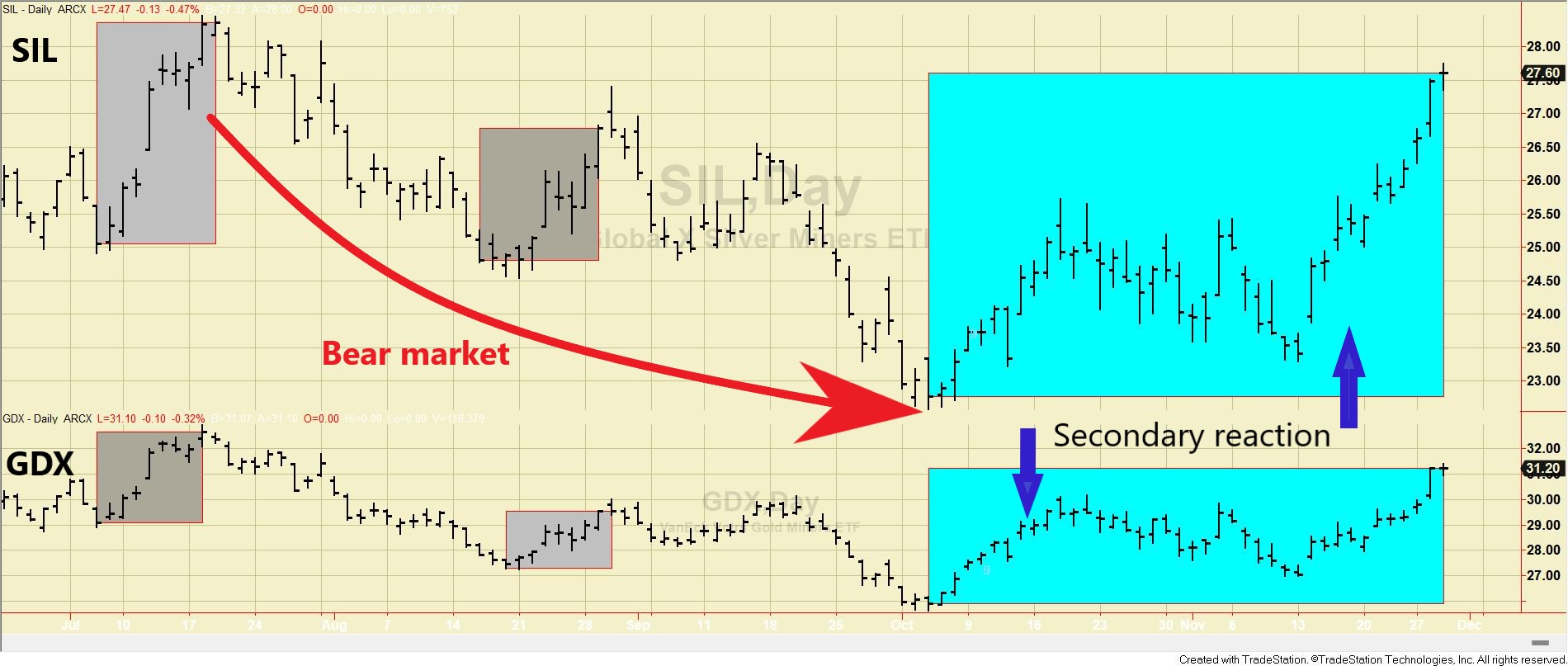

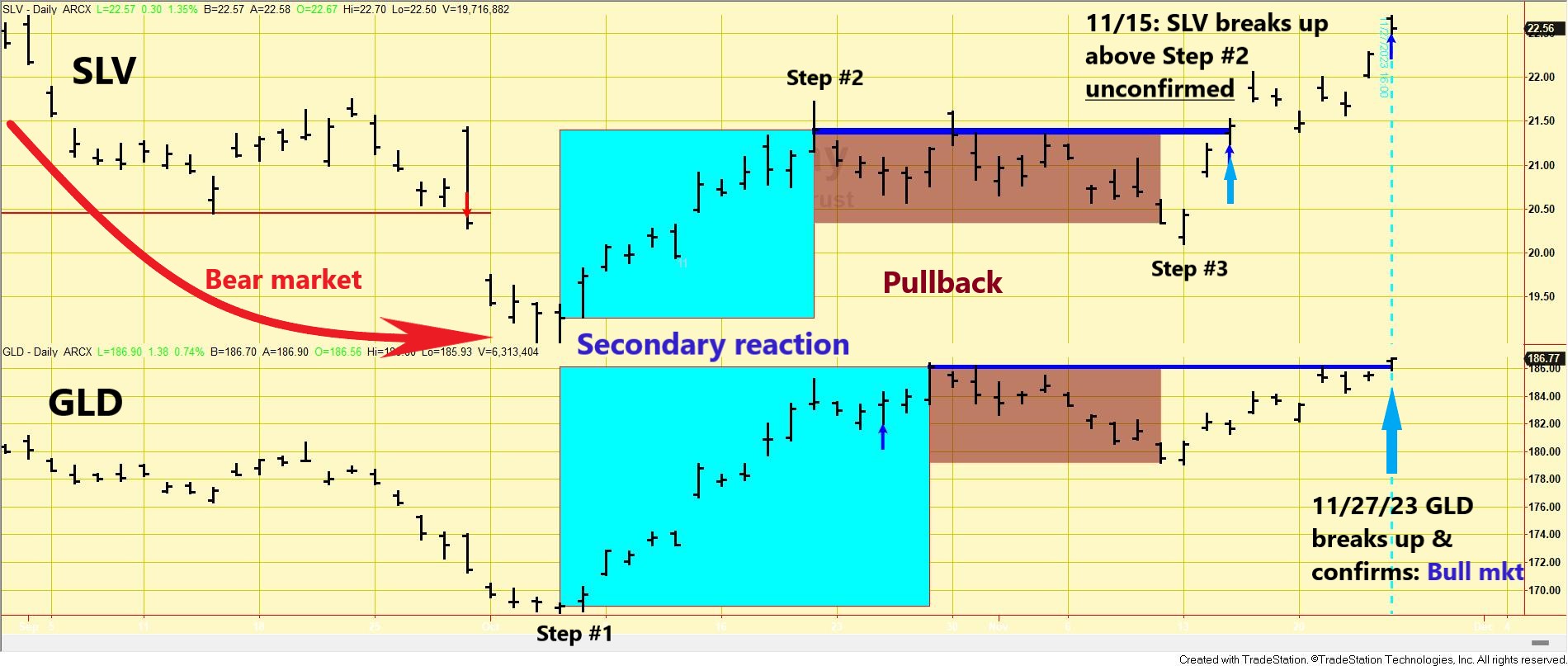

Stocks Plunge but bull market unchanged, and precious metals in a Bear market now: Market Reactions to CPI Surprise Overview: Yesterday (2/13/24) morning’s Consumer Price Index (CPI) inflation report surpassed expectations, triggering significant market upheaval. The Headline CPI saw a 0.3% month-over-month increase compared to the previous month’s 0.2% rise. This unexpected development led to […]